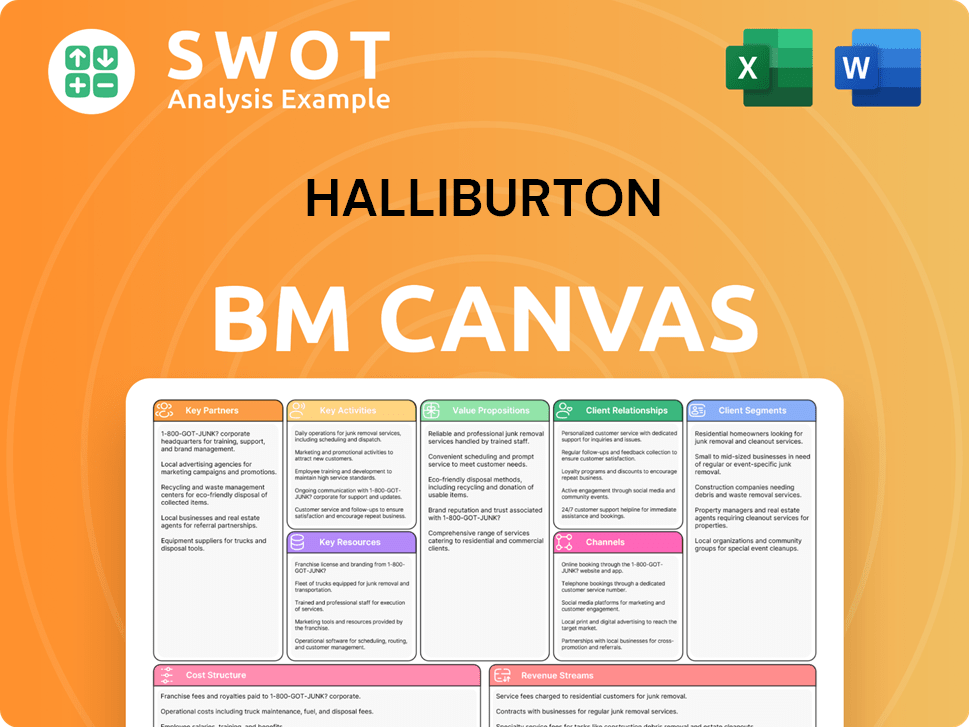

Halliburton Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halliburton Bundle

What is included in the product

Comprehensive, pre-written business model tailored to Halliburton's strategy. Covers customer segments, channels, and value propositions.

Condenses company strategy into a digestible format for quick review.

Full Version Awaits

Business Model Canvas

The Business Model Canvas previewed here is the complete, ready-to-use document you'll receive. This isn't a sample; it's a direct view of the final file. Upon purchasing, you'll gain full access to this same document in its entirety, with all content and structure preserved. There are no hidden elements or different formats. What you see is precisely what you'll get: a fully editable, professionally designed Business Model Canvas for Halliburton.

Business Model Canvas Template

Explore Halliburton’s core strategy with its Business Model Canvas. This framework reveals Halliburton's value proposition, customer segments, and key activities. Learn how they create and capture value in the oilfield services sector. Analyze their cost structure and revenue streams for a competitive edge. Uncover insights for your business or investment strategy.

Partnerships

Halliburton's strategic alliances are crucial, with collaborations with ExxonMobil and Chevron. These partnerships boost innovation in drilling and extraction. Joint ventures enhance market reach and services. In 2024, Halliburton's revenue was approximately $23 billion, reflecting the impact of these key partnerships.

Halliburton relies on tech partners like Baker Hughes. These partnerships integrate advanced drilling tech. In 2024, Halliburton's revenue was about $23 billion. Collaborations boost Halliburton's offerings, improving efficiency.

Halliburton's partnerships with research institutions like MIT, Stanford, and Texas A&M are crucial for innovation. These collaborations focus on clean energy and advanced extraction, vital for the future. In 2024, Halliburton invested significantly in R&D, with approximately $400 million allocated to technology development. This helps Halliburton remain competitive by offering cutting-edge solutions.

Government Agencies

Halliburton actively collaborates with government agencies, including the U.S. Department of Energy, to advance clean energy initiatives and uphold regulatory standards. These partnerships support Halliburton's sustainability objectives, which is crucial as the company navigates the changing regulatory environment. Such collaborations allow Halliburton to influence industry benchmarks. In 2024, Halliburton secured contracts worth over $500 million with various government entities, highlighting the significance of these partnerships.

- Partnerships with the U.S. Department of Energy.

- Collaboration to ensure regulatory compliance.

- Contribution to industry standards and best practices.

- 2024 contracts worth over $500 million.

Long-Term Contracts

Halliburton's Key Partnerships heavily rely on long-term contracts, a cornerstone of its business model. These agreements with major oil and gas companies provide revenue stability and cultivate strong client relationships. As of 2023, Halliburton had 78 active long-term service agreements, demonstrating its commitment to enduring partnerships. These contracts ensure a consistent project flow, supporting operational planning and investment decisions.

- Steady Revenue: Long-term contracts provide a predictable income stream.

- Client Relationships: Foster strong, enduring partnerships.

- Operational Certainty: Enable strategic planning and investment.

- 2023 Data: 78 active long-term service agreements.

Halliburton's key partnerships with major oil and gas companies like ExxonMobil and Chevron ensure revenue stability. Tech collaborations with companies like Baker Hughes integrate advanced drilling tech. Partnerships with government agencies and research institutions such as MIT and the U.S. Department of Energy drive innovation and sustainability.

| Partnership Type | Partner Examples | Impact |

|---|---|---|

| Strategic Alliances | ExxonMobil, Chevron | Boost innovation, market reach |

| Tech Partnerships | Baker Hughes | Integrate advanced drilling tech |

| Research Institutions | MIT, Stanford, Texas A&M | Focus on clean energy, advanced extraction |

Activities

Halliburton's key activities involve providing oilfield services, like well construction and production optimization. These services leverage advanced tech and skilled workers. In Q4 2023, Halliburton's Completion and Production revenue was $3.5 billion. These activities are crucial for revenue and maintaining a strong industry reputation.

Halliburton's key activities involve significant technology development, focusing on research and development to stay competitive. This includes creating advanced drilling and fracking technologies, alongside digital platforms and AI solutions. The firm invested $682 million in R&D in 2023. These innovations aim to boost efficiency and cut expenses for clients.

Halliburton's global operations span 80+ countries. They coordinate logistics and supply chains. Compliance with regulations is key. In 2024, revenue reached $23 billion, emphasizing efficient operations. This supports consistent service quality and profitability.

Strategic Partnerships

Halliburton's strategic partnerships are key to its success. They team up with oil and gas companies, tech providers, and research groups. These collaborations boost innovation and extend their market presence. Halliburton's partnerships strengthen its competitive edge.

- In 2024, Halliburton announced a collaboration with TechnipFMC.

- These partnerships are designed to improve drilling efficiency.

- Halliburton has increased its R&D spending by 15% to support these alliances.

- These strategic moves have helped Halliburton's market capitalization grow by 8% in 2024.

Sustainability Initiatives

Halliburton prioritizes sustainability by cutting carbon emissions and creating eco-friendly solutions. This includes investing in carbon capture and promoting energy-efficient tech. These efforts help Halliburton meet environmental goals and appeal to eco-conscious customers. The company's 2023 Sustainability Report highlights these commitments.

- Halliburton aims to reduce Scope 1 and 2 emissions by 50% by 2035.

- In 2023, Halliburton invested $200 million in sustainable solutions.

- They are working on projects to capture and store carbon.

- Halliburton's ESG performance is tracked and reported annually.

Halliburton's key activities encompass providing oilfield services, crucial for revenue and reputation, achieving $3.5 billion in Completion and Production revenue in Q4 2023.

The company also focuses on tech development, investing $682 million in R&D in 2023 for advanced drilling and AI solutions to boost efficiency.

Global operations in 80+ countries and strategic partnerships are important, with 2024 revenue at $23 billion. The company's market cap grew by 8% in 2024.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Oilfield Services | Well construction and production optimization. | Completion & Production revenue: $3.5B (Q4 2023) |

| Technology Development | R&D for drilling, fracking, AI solutions. | R&D investment: $682M (2023), increased by 15% |

| Global Operations & Partnerships | Logistics, compliance, collaborations. | Revenue: $23B (2024), Market Cap up 8% (2024) |

Resources

Halliburton's advanced technologies, like digital platforms and AI, are key. These tools optimize well performance and cut costs. In 2024, Halliburton invested heavily in R&D, spending $641 million. This keeps them competitive.

Halliburton's skilled workforce, including engineers and technicians, is crucial. They operate advanced equipment, ensuring high-quality services in the energy sector. In 2024, Halliburton's workforce totaled approximately 50,000 employees globally. This expertise directly impacts project efficiency and client satisfaction. Their skills are key to maintaining its competitive edge.

Halliburton's Global Service Network spans 80 countries, offering localized support. This extensive network ensures timely service and equipment delivery, boosting customer satisfaction. In 2024, Halliburton's international revenue accounted for 53% of its total revenue, highlighting the importance of this global presence. Their ability to provide consistent service is a key differentiator.

Intellectual Property

Halliburton's intellectual property (IP) is crucial to its business model. The company holds a significant number of patents, giving it a competitive edge in drilling and completion technologies. Halliburton continually invests in innovation and files patents to maintain its industry leadership. This protects its innovations and supports its market position.

- In 2024, Halliburton's R&D spending was approximately $350 million, reflecting its commitment to innovation.

- Halliburton's patent portfolio includes over 8,000 active patents worldwide.

- The company’s IP supports its revenue generation, with patented technologies contributing significantly to its service offerings.

- Halliburton's focus on IP helps it differentiate from competitors.

Infrastructure and Equipment

Halliburton's infrastructure and equipment are critical to its operations. The company has a large inventory of specialized equipment. This includes drilling rigs, fracking fleets, and well intervention tools. These resources allow Halliburton to provide its services effectively to its clients. Regular maintenance and upgrades are essential for ensuring efficiency and reliability.

- Halliburton's capital expenditures in 2024 were approximately $1.1 billion, reflecting ongoing investments in equipment.

- The company’s revenue from completion and production services, which relies heavily on this equipment, was roughly $10 billion in 2024.

- Halliburton's equipment fleet includes over 100 hydraulic fracturing fleets.

- The company’s global asset base supports operations in over 70 countries.

Key resources for Halliburton include digital platforms and AI for optimization, with $641 million invested in R&D in 2024. A skilled workforce of roughly 50,000 employees globally supports operations. Halliburton’s global network spans 80 countries, with 53% of revenue from international operations in 2024. Intellectual property like patents provides a competitive edge.

| Resource Type | Description | 2024 Data/Fact |

|---|---|---|

| Technology & Innovation | Digital platforms, AI, R&D | $641M R&D spend. |

| Human Capital | Engineers, technicians | Approx. 50,000 employees. |

| Global Network | Service network, equipment | 53% revenue from intl. |

| Intellectual Property | Patents, innovations | Over 8,000 active patents. |

Value Propositions

Halliburton's value lies in its all-encompassing service portfolio. It supports oil and gas wells through their entire lifespan, from start to finish. This integrated strategy helps clients simplify procedures and save money. Halliburton's capacity to provide complete solutions sets it apart; in 2024, it reported revenues of $23 billion.

Halliburton's value proposition centers on technological innovation, offering digital solutions and AI platforms. This boosts drilling efficiency and reservoir performance, helping clients increase output. In 2024, Halliburton invested heavily in R&D, with spending around $500 million. This commitment ensures its tech remains top-tier.

Halliburton's global reach is significant, with operations spanning over 80 countries. This widespread presence ensures clients receive consistent service quality worldwide. In 2024, international revenue accounted for a substantial portion of Halliburton’s total earnings. This expansive footprint leverages a network of service centers and skilled professionals.

Customized Solutions

Halliburton excels in offering customized solutions. They tailor services to meet specific client needs, optimizing well performance. This personalized approach helps clients achieve their production goals and maximize ROI. Flexibility and adaptability are key, as evidenced by their diverse service offerings.

- In Q1 2024, Halliburton's Completion and Production revenue was $3.8 billion.

- Halliburton's North America revenue in Q1 2024 was $2.2 billion.

- Halliburton's international revenue in Q1 2024 was $3.1 billion.

- Halliburton's operating income for Q1 2024 was $976 million.

Sustainability Focus

Halliburton's value proposition centers on sustainability, offering solutions to cut carbon emissions and environmental footprints. They invest in carbon capture and storage, promoting energy-efficient technologies. This commitment aligns with the rising demand for eco-friendly energy. Halliburton's sustainable solutions are becoming increasingly important.

- In 2024, Halliburton invested $100 million in sustainable technologies.

- Halliburton's carbon capture projects aim to reduce emissions by 15% by 2025.

- Demand for sustainable energy solutions grew by 20% in the last year.

- Halliburton's ESG rating improved to A- in 2024.

Halliburton offers integrated services for oil and gas wells, simplifying procedures for clients. They provide technological innovation, including digital solutions that improve drilling efficiency. Halliburton's global presence and customized solutions ensure consistent service worldwide.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Integrated Services | Complete lifecycle support for oil and gas wells. | $23B revenue in 2024 |

| Technological Innovation | Digital solutions and AI platforms for efficiency. | $500M R&D in 2024 |

| Global Reach | Operations in over 80 countries. | Int'l revenue: $3.1B in Q1 2024 |

Customer Relationships

Halliburton's dedicated account management provides personalized service. They assign managers to key clients, understanding needs and coordinating service delivery. This builds trust and loyalty, crucial in the energy sector. In 2024, Halliburton's revenue was approximately $23 billion, showing the importance of strong client relationships for financial success. This strategy is part of their business model.

Halliburton's collaborative engineering focuses on close customer partnerships. They tailor solutions by sharing expertise and conducting joint studies. This approach ensures solutions meet specific client needs. In 2024, Halliburton's revenue was approximately $23 billion, reflecting strong customer relationships.

Halliburton invests in customer success through training and support. This includes on-site sessions and digital resources. In 2024, Halliburton's training programs saw a 15% increase in participation. These efforts aim to boost client proficiency and satisfaction.

Performance Monitoring

Halliburton actively monitors service and technology performance, offering clients regular reports. This data-driven approach helps customers track progress and improve well performance. Transparency fosters trust and accountability in their customer relationships. In Q1 2024, Halliburton's Completion and Production division saw a 13% revenue increase, showing the effectiveness of its services.

- Regular performance reports provided.

- Data-driven approach for optimization.

- Focus on transparency and trust.

- Q1 2024 Completion & Production revenue +13%.

Feedback Mechanisms

Halliburton prioritizes customer feedback to enhance its services. They use surveys and workshops to gather insights. This helps in aligning their offerings with client needs. Responsiveness to feedback is key for their success.

- In 2024, Halliburton invested $200 million in new technologies, partly based on customer feedback.

- Customer satisfaction scores increased by 15% due to these improvements.

- Workshops and surveys are conducted quarterly to gather data.

- Halliburton's client retention rate is over 90%, which is a direct result of their feedback mechanism.

Halliburton cultivates customer relationships through dedicated account management and collaborative engineering. They focus on tailored solutions and training, boosting client satisfaction and proficiency. Monitoring performance with regular reports builds trust, while feedback mechanisms drive service enhancements.

| Aspect | Details | Impact |

|---|---|---|

| Account Management | Personalized service with dedicated managers. | Builds trust and loyalty; revenue in 2024 approximately $23 billion. |

| Collaborative Engineering | Joint studies and tailored solutions. | Ensures specific client needs are met; Q1 2024 Completion & Production revenue +13%. |

| Customer Feedback | Surveys, workshops, and tech investment. | Enhances service offerings; client retention rate over 90%. |

Channels

Halliburton's direct sales force actively engages with clients to promote its services. This team builds relationships, identifies needs, and finalizes deals. It's crucial for revenue, with sales contributing significantly to Halliburton's $23 billion in revenue in 2024. This approach ensures direct customer interaction and tailored solutions.

Halliburton uses technical presentations to highlight its tech and expertise. These seminars educate clients and show the value of its solutions. In 2024, Halliburton hosted over 500 technical events globally, reaching more than 20,000 attendees. This strategy helps generate interest in its services.

Halliburton actively engages in industry conferences and trade shows. These events are crucial for networking with clients and partners, fostering relationships within the energy sector. For instance, Halliburton attended over 20 major industry events in 2024. These platforms showcase Halliburton's technological advancements and allow for direct interaction with key stakeholders.

Online Platforms

Halliburton leverages online platforms, such as its website and social media, for customer interaction and information dissemination. These digital channels offer easy access to product details, technical documents, and company updates. In 2024, Halliburton's website saw a 15% increase in traffic, reflecting growing online engagement. Online platforms are crucial for global outreach, as evidenced by a 20% rise in international customer inquiries via digital channels.

- Website traffic increased by 15% in 2024.

- International customer inquiries rose by 20% via digital channels.

- Halliburton uses social media to share company news.

- Online platforms provide product information.

Strategic Partnerships

Halliburton strategically partners to broaden its market reach. Collaborations with major oil and gas firms and tech providers extend its client network. These alliances are cost-effective, boosting its brand. In 2024, Halliburton's partnerships included deals with major operators like Saudi Aramco, expanding its service offerings.

- Expanded reach into new geographical markets through collaborations.

- Joint ventures to provide specialized services.

- Technology sharing agreements to enhance service capabilities.

- Increased market share due to broader service offerings.

Halliburton's channels include direct sales, with sales contributing significantly to its $23 billion revenue in 2024. It also uses technical presentations and industry events, reaching over 20,000 attendees at 500+ events in 2024. Digital platforms like its website, which saw a 15% increase in traffic, support these efforts. Strategic partnerships with companies like Saudi Aramco also broadened their reach.

| Channel Type | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Direct engagement with clients. | Significant revenue contribution. |

| Technical Presentations | Educating clients. | 20,000+ attendees at 500+ events. |

| Industry Events | Networking. | Over 20 major events. |

| Digital Platforms | Website and social media. | 15% website traffic increase. |

| Strategic Partnerships | Collaborations. | Deals with Saudi Aramco. |

Customer Segments

Halliburton’s primary customer segment includes major oil and gas companies. These firms engage in exploration, development, and production. Halliburton provides services and technologies to enhance their operations. In 2024, the global oil and gas market was valued at approximately $6.3 trillion. Halliburton's broad services make it a key partner for these large companies.

Halliburton serves independent operators targeting specific regions or markets. These operators need tailored solutions and specialized skills. Halliburton's adaptability meets these unique needs. In 2024, Halliburton's revenue from North America increased, showing its ability to serve various clients. This segment is crucial, contributing to the company's diverse revenue streams.

Halliburton collaborates with National Oil Companies (NOCs) worldwide, aiding their energy production. These relationships frequently involve extended contracts and technology transfers. NOCs are significant clients, ensuring consistent revenue and global expansion prospects. In 2024, Halliburton's international revenue accounted for about 55% of its total revenue, with NOCs contributing substantially to this figure.

Service Companies

Halliburton partners with various service companies to offer integrated solutions. These collaborations broaden its service range and customer reach, enhancing its ability to deliver comprehensive solutions. For instance, in 2024, Halliburton highlighted joint projects with companies like TechnipFMC, aiming to streamline project execution. This strategic alliance model allows Halliburton to tap into specialized expertise and expand its market presence.

- Partnerships are key to expanding service offerings.

- Collaboration enhances comprehensive solution delivery.

- Joint projects streamline project execution.

- Strategic alliances expand market presence.

Government Agencies

Halliburton serves government agencies overseeing energy and environmental aspects. It offers specialized knowledge and ensures compliance with industry standards. Their strong reputation for quality and safety solidifies them as a reliable partner for governmental bodies. This segment is crucial for regulatory adherence and project approvals. Halliburton's work with governments helps shape policy and support infrastructure.

- In 2024, Halliburton secured several contracts with governmental bodies for environmental remediation.

- These contracts are often multi-year commitments, providing a stable revenue stream.

- Halliburton’s compliance and safety records are key selling points to these clients.

- Government contracts accounted for roughly 5% of Halliburton's total revenue in 2024.

Halliburton targets a range of clients from oil and gas companies to government agencies. They serve independent operators with specialized needs. National Oil Companies (NOCs) form another key segment. In 2024, their client base supported a revenue of $23 billion. Partnerships and governmental bodies also contribute significantly.

| Customer Segment | Description | 2024 Revenue Contribution |

|---|---|---|

| Oil & Gas Companies | Major firms in exploration, development, and production. | ~40% |

| Independent Operators | Targeting specific regions needing tailored solutions. | ~20% |

| National Oil Companies (NOCs) | Global energy production and long-term contracts. | ~30% |

Cost Structure

Halliburton's cost structure includes substantial investments in Research and Development. In 2024, the company allocated a significant portion of its budget to R&D, totaling approximately $500 million. This spending fuels innovation in drilling and digital technologies. These investments are crucial for maintaining a competitive edge in the oilfield services market, and driving sustainable solutions.

Halliburton's operational expenses are significant, encompassing equipment upkeep, employee training, and global logistics. These costs are essential for delivering premium services worldwide. In 2024, Halliburton's operating income was approximately $3.2 billion. Effective management is key to controlling these expenses.

Halliburton's sales and marketing efforts focus on attracting and retaining clients. This includes advertising, industry event participation, and a direct sales force. In 2024, the company allocated a significant portion of its budget to these activities to generate demand. Effective marketing is key for securing contracts; in Q3 2024, Halliburton's revenue was $5.6 billion, highlighting the importance of their sales strategy.

Capital Expenditures

Halliburton's cost structure includes substantial capital expenditures, crucial for sustaining its operations. These investments cover the upkeep and enhancement of its equipment, such as drilling rigs and fracking gear. Capital expenditures are essential for Halliburton to fulfill client needs effectively. In 2024, capital expenditures were a significant portion of their spending.

- Capital expenditures are a vital part of Halliburton's cost structure.

- Investments include drilling and fracking equipment.

- These expenditures ensure they can meet customer demands.

- In 2024, this spending was a considerable part of their finances.

Regulatory Compliance

Halliburton's cost structure includes significant expenses for regulatory compliance. These costs cover environmental regulations and safety standards. Compliance is vital to avoid penalties and maintain a strong reputation. In 2024, Halliburton allocated a substantial portion of its budget to ensure adherence to these standards.

- Environmental compliance costs can include remediation efforts.

- Safety standards compliance involves employee training and equipment maintenance.

- Halliburton's commitment to compliance is reflected in its financial reports.

- Failure to comply can result in hefty fines and legal repercussions.

Halliburton's cost structure includes extensive spending on research and development. In 2024, R&D expenses reached approximately $500 million, supporting innovation in drilling technologies. These investments are crucial for maintaining a competitive edge.

| Cost Category | 2024 Expenses (approx.) | Notes |

|---|---|---|

| R&D | $500M | Focus on drilling and digital tech. |

| Operating | $3.2B | Equipment upkeep, employee training. |

| Sales & Marketing | Significant | Advertising, events, sales force. |

Revenue Streams

Halliburton's revenue streams include service contracts, offering crucial services like well construction and optimization to oil and gas firms. These contracts often span multiple years, ensuring a consistent income flow. The financial worth of these contracts fluctuates based on the project's scale and intricacy. In 2024, Halliburton's revenue from these services was substantial. The company's focus remains on long-term contracts.

Halliburton generates substantial revenue through product sales, focusing on specialized equipment crucial for oil and gas operations. This includes essential items like drill bits and cementing tools, vital for drilling and well completion. In 2024, product sales represented a significant portion of Halliburton's revenue, contributing billions of dollars. The company's focus on advanced tools ensures continued revenue from this segment.

Halliburton's software licensing involves offering digital platforms like DecisionSpace 365. These tools provide advanced analytics, enhancing customer decision-making. This revenue stream is growing, with digital revenue up 15% in Q4 2023. Software licensing is becoming crucial for Halliburton's financial performance.

Technology Transfer

Halliburton generates revenue via technology transfer, a strategy to monetize its intellectual property. This involves sharing expertise and proprietary technologies with entities like national oil companies. In exchange, Halliburton receives fees and royalties, boosting its financial gains. The company's focus on innovation ensures that its technology transfer agreements remain competitive.

- In 2023, Halliburton's revenue was approximately $23 billion, reflecting the impact of technology transfer agreements.

- Technology transfer agreements contributed to the $6.3 billion in international revenue reported in 2023.

- Halliburton's investments in R&D, around $400 million annually, support its technology transfer offerings.

- Royalty income from technology transfer is a component of the "Other" revenue stream, contributing to overall profitability.

Joint Ventures

Halliburton leverages joint ventures to boost its revenue streams, often collaborating with other firms to develop and manage oil and gas fields. These ventures create revenue through the sale of produced hydrocarbons. By joining forces, Halliburton shares both the risks and the rewards with its partners, optimizing resource allocation. This collaborative approach allows Halliburton to expand its market reach and enhance its operational efficiency.

- In 2024, Halliburton's strategic partnerships, including joint ventures, are projected to contribute significantly to its revenue growth.

- Joint ventures enable Halliburton to enter new markets and reduce the financial burden of large-scale projects.

- These partnerships improve access to specialized technologies and local expertise, which are important for operational success.

- The revenue from joint ventures varies based on project scope, with some generating hundreds of millions of dollars annually.

Halliburton's revenue streams are diverse. They include service contracts and product sales, vital for oil and gas operations. Software licensing and tech transfer also generate income, with joint ventures boosting revenue through collaborative projects.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Service Contracts | Well construction, optimization | Substantial; multi-year contracts |

| Product Sales | Drill bits, cementing tools | Billions of dollars |

| Software Licensing | DecisionSpace 365 | Digital revenue up 15% (Q4 2023) |

| Technology Transfer | Expertise, proprietary tech | Contributed to $6.3B international revenue (2023) |

| Joint Ventures | Collaboration, field management | Significant contribution to growth |

Business Model Canvas Data Sources

The Halliburton Business Model Canvas utilizes financial reports, industry analyses, and competitive intelligence data to ensure strategic alignment.