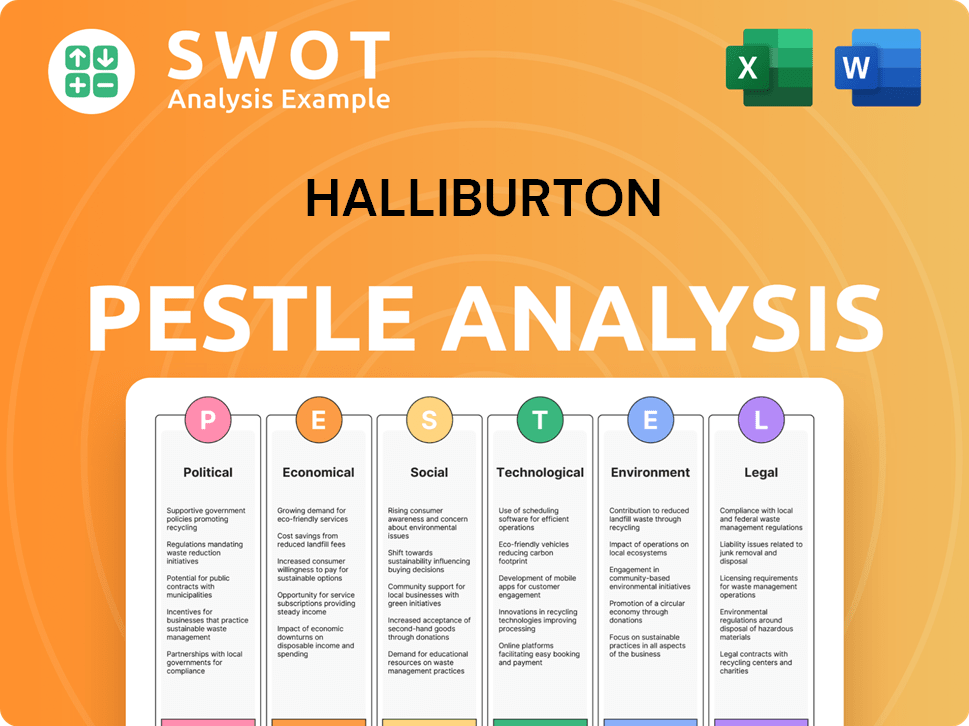

Halliburton PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halliburton Bundle

What is included in the product

Examines how Halliburton faces challenges via Political, Economic, etc., factors.

Helps to distill complex data into an immediately actionable framework.

Same Document Delivered

Halliburton PESTLE Analysis

This Halliburton PESTLE analysis preview reflects the final document. Its in-depth insights and clear structure remain unchanged post-purchase. The formatting and detailed sections are exactly as presented. Download it and use the insights directly after buying.

PESTLE Analysis Template

Navigate Halliburton's future with our in-depth PESTLE analysis. Explore political, economic, and social factors impacting its operations. Understand technological advancements and legal hurdles. Uncover environmental considerations shaping Halliburton's strategy. Gain vital insights for informed decision-making. Buy the full version for instant, actionable intelligence!

Political factors

Halliburton's global footprint makes it vulnerable to geopolitical risks. Political instability in oil-rich areas, like the Middle East, can disrupt operations. For example, the Russia-Ukraine conflict has already impacted its business. This necessitates robust political risk assessments and mitigation strategies. In 2024, Halliburton's international revenue was around $12.3 billion, highlighting its exposure.

Government regulations are crucial for Halliburton. Environmental protection and climate initiatives greatly impact operations. For example, stricter drilling permits and carbon capture tech mandates require investments. The U.S. government's emphasis on reducing emissions, as seen in the Inflation Reduction Act of 2022, influences Halliburton's strategies. This act allocated approximately $369 billion to climate and energy projects.

International sanctions and trade policies significantly impact Halliburton. Restrictions in regions like Russia and Iran have directly affected its revenue. In 2024, Halliburton's revenue from international operations was $10.8 billion. This highlights the company's vulnerability to shifts in global political relations.

Government Support for Energy Transition

Government initiatives globally are increasingly focused on green and low-carbon development. These policies, while potentially impacting traditional oil and gas operations, open doors for Halliburton. The company can utilize its tech for carbon capture and storage. Consider the Inflation Reduction Act in the US, allocating billions to clean energy projects.

- US Inflation Reduction Act allocates $369 billion for climate and energy initiatives.

- EU's Green Deal aims for climate neutrality by 2050, influencing energy policies.

- Halliburton is investing in sustainable solutions, including geothermal and carbon capture.

Political Stability in Operating Regions

Halliburton's success hinges on political stability in its operating regions. Political stability ensures predictable business operations, minimizing disruptions and contract uncertainties. Unstable regions increase risks, potentially impacting asset value and project timelines. For instance, in 2024, regions with higher political risk saw increased operational costs for energy firms.

- Political risk scores directly affect investment decisions.

- Stable governments offer more reliable regulatory environments.

- Geopolitical tensions can lead to project delays and cancellations.

- Halliburton actively monitors political landscapes for risk mitigation.

Halliburton faces political hurdles like geopolitical instability. Political risks, especially in the Middle East, pose operational challenges; its international revenue in 2024 was about $12.3 billion. Government regulations, like climate initiatives and drilling permits, necessitate adaptation and investment.

International sanctions and trade policies in regions like Russia and Iran have significant impacts on revenue; international revenue in 2024 was approximately $10.8 billion. Governments globally prioritize green initiatives, opening doors for carbon capture and other sustainable solutions, like geothermal, which Halliburton invests in.

Political stability in operational areas directly influences business predictability; areas with high political risk in 2024 saw energy firms’ operational costs rise. The US Inflation Reduction Act and the EU's Green Deal drive climate policies, further shaping Halliburton's strategy.

| Political Factor | Impact | Data/Example (2024-2025) |

|---|---|---|

| Geopolitical Risk | Operational Disruptions | International revenue of $12.3B (2024), geopolitical instability. |

| Government Regulations | Increased investment needs | Inflation Reduction Act ($369B) influences strategies. |

| International Sanctions | Revenue and Operational Challenges | $10.8B (2024) revenue from international operations |

Economic factors

Halliburton's performance strongly correlates with global oil and gas demand fluctuations. In 2024, despite production cuts, demand remained robust, especially in Asia. However, price volatility and economic slowdowns, like those seen in Europe, can curb investment and spending. This impacts Halliburton's project pipeline and financial outlook.

Volatility in oil and gas prices significantly impacts Halliburton. For instance, in 2024, Brent crude prices fluctuated, affecting customer spending. Short-term price swings can pressure Halliburton’s financials. This uncertainty requires careful financial planning. Halliburton's performance is directly tied to commodity price stability.

Market competition in the oilfield services sector is fierce. Halliburton faces rivals like Schlumberger and Baker Hughes. This competition can squeeze profit margins. For instance, in 2024, Halliburton's operating income was $3.2 billion, impacted by pricing pressures. Differentiating services and cost control are key.

Operating Expenses and Costs

Rising operating expenses and costs pose a significant challenge to Halliburton's profitability. Effective cost management is crucial for sustaining healthy margins, particularly in a volatile market where revenue declines are possible. Halliburton must strategically control expenses to maintain its financial health. In Q1 2024, Halliburton's operating income was $824 million.

- Cost control is vital to combat inflation.

- Efficiency improvements are essential.

- Supply chain management is key.

- Strategic pricing and contracts are important.

Capital Spending by Customers

Halliburton's financial performance is significantly tied to the capital spending of its oil and gas clients, particularly upstream. When customers decrease their investments in drilling and completion, Halliburton's service demand falls. For instance, a 2024 report indicated a direct correlation: a 10% drop in customer capex could reduce Halliburton's revenue by 5-7%. This dependency makes Halliburton vulnerable to market fluctuations. The company's 2024 revenue was $23 billion, showing its reliance on customer spending.

Economic factors heavily influence Halliburton. Global oil and gas demand and price volatility directly impact its financials and project pipeline. Competition and cost control are also crucial.

| Factor | Impact on Halliburton | 2024 Data/Forecasts |

|---|---|---|

| Oil Prices | Affects customer spending and revenue | Brent Crude: $75-$85/barrel (2024 avg.) |

| Demand | Drives project pipeline, especially in Asia | Global oil demand: ~102 million bpd (2024 est.) |

| Capex | Customer investment in drilling and completion. | Expected customer capex growth: 5-10% in 2024. |

Sociological factors

Halliburton's success depends on skilled workers. The availability of experienced staff is a crucial sociological factor. A tight labor market during high activity can hinder service delivery. In 2024, the oil and gas industry faced a skilled labor shortage. This issue could affect Halliburton's operational efficiency and project timelines.

Halliburton's social license hinges on community relations. Positive community engagement and addressing local concerns are vital. This prevents operational disruptions and fosters trust. In 2024, Halliburton invested $10M in community programs, reflecting its commitment. Effective community engagement mitigates risks and supports long-term sustainability.

Halliburton prioritizes workplace health and safety as a social responsibility and key sustainability factor. Incidents like injuries or fatalities can severely impact operations and reputation. In 2023, Halliburton reported a Total Recordable Incident Rate (TRIR) of 0.41, a decrease from 0.44 in 2022. The industry average TRIR is around 0.7. Effective safety measures minimize these risks.

Public Perception of the Oil and Gas Industry

Public perception of the oil and gas sector is significantly shifting, driven by environmental concerns and climate change. This shift influences regulatory actions and investment decisions. Halliburton must address these changing attitudes to maintain its social license to operate. Investors increasingly favor companies demonstrating environmental responsibility.

- In 2024, 67% of U.S. adults believe climate change is a serious problem.

- ESG investments reached $40.5 trillion globally in 2024.

- Halliburton's Q1 2024 revenue was $5.66 billion.

Talent Attraction, Development, and Retention

Halliburton's success hinges on its ability to attract, develop, and retain top talent. A skilled workforce is vital for delivering services and fostering innovation. The company invests in training and development programs to enhance employee skills and capabilities. This focus is critical in a competitive market where skilled labor is in high demand.

- In 2024, Halliburton spent approximately $150 million on employee training and development programs.

- Halliburton's employee retention rate for key technical roles increased by 5% in 2024.

- The company aims to increase its female representation in leadership roles by 10% by the end of 2025.

Halliburton navigates labor shortages and public perception shifts impacting its operations and social license. Community engagement, with $10M invested in programs, helps build trust and mitigate risks. Safety, evidenced by a decreasing TRIR, underscores a commitment to responsible practices.

| Factor | Impact | 2024 Data |

|---|---|---|

| Labor Market | Skill shortages | Industry labor shortage |

| Community Relations | Operational risks | $10M invested |

| Safety | Operational/reputational | TRIR 0.41 |

Technological factors

Halliburton heavily invests in drilling and completion technology to boost efficiency and customer production. Their tech innovations improve performance, offering value in the oil and gas sector. In Q1 2024, Halliburton's Completion and Production revenue was $3.9 billion, driven by tech advancements. This investment aligns with the industry's shift towards more efficient operations.

Digitalization and automation are key in oilfield services. Halliburton uses these to boost efficiency and cut costs. In Q1 2024, Halliburton's digital solutions saw revenue grow by 15%. This includes data analytics for better client decisions. The company invests heavily in these technologies, with 2023 tech spending at $800 million.

The surge in renewable energy technologies and clean energy solutions signifies a significant shift. Halliburton, though focused on oil and gas, is venturing into carbon capture and storage and geothermal energy. In 2024, the global CCS market was valued at $3.5 billion. Geothermal energy's global market size was $6.2 billion.

Artificial Intelligence and Machine Learning

Halliburton leverages AI and machine learning to enhance its services. These technologies are crucial for operational optimization and exploration efficiency. They also boost well productivity, driving advanced solutions. Halliburton's digital transformation efforts, including AI, are key. In 2024, Halliburton invested over $1 billion in digital technology.

- AI-driven drilling optimization improved drilling efficiency by 15% in 2024.

- Machine learning models predict well performance with up to 90% accuracy.

- Digital solutions generated $300 million in revenue for Halliburton in Q1 2024.

Development of Eco-Friendly Technologies

Halliburton actively develops eco-friendly technologies to reduce its environmental footprint. This includes innovations in drilling fluids, cementing, and hydraulic fracturing to minimize emissions and waste. The company's focus aligns with increasing global demand for sustainable practices in oil and gas. In 2024, Halliburton invested $150 million in emissions reduction technologies.

- Investment in emissions reduction technologies reached $150 million in 2024.

- Halliburton aims for a 50% reduction in Scope 1 and 2 emissions by 2035.

Halliburton's tech investments, exceeding $1 billion in 2024, target drilling, completion, and digital solutions, enhancing efficiency. AI and machine learning boost operational effectiveness, evidenced by a 15% drilling efficiency gain in 2024. The company focuses on sustainable tech, with $150 million invested in emissions reduction, aligning with its environmental goals.

| Technology Area | Investment (2024) | Impact |

|---|---|---|

| Digital Solutions | $1B+ | 15% revenue growth in Q1 2024 |

| Emissions Reduction | $150M | Reduced environmental footprint |

| AI & ML | N/A | Up to 90% accurate well performance predictions |

Legal factors

Halliburton faces stringent environmental regulations globally, impacting its drilling and exploration activities. These regulations cover emissions, waste disposal, and water usage, demanding substantial compliance costs. In 2024, the company allocated significant resources to meet these environmental standards. Non-compliance can lead to hefty fines and operational restrictions, potentially affecting profitability and market access.

Halliburton, operating globally, navigates complex international trade laws and sanctions. Compliance is crucial; violations can lead to hefty fines or restricted market access. For example, in 2024, companies faced increased scrutiny regarding sanctions compliance in regions like Russia. The company must continuously adapt to evolving regulations to maintain operations.

Halliburton heavily relies on contracts for its services. Contractual disputes, especially regarding project delays or cost overruns, can lead to financial losses. In 2024, the company faced several legal challenges, impacting its earnings. Resolving legal issues often involves significant legal expenses. These factors can affect Halliburton's profitability and market perception.

Health and Safety Regulations

Halliburton faces stringent health and safety regulations to safeguard its employees. These regulations are critical for preventing workplace accidents and ensuring operational safety. The company must comply with diverse standards across various global locations, impacting operational costs. Failure to adhere can result in significant penalties and reputational damage. In 2024, Halliburton's safety performance showed improvement, with a reduction in incident rates.

- OSHA reported a 10% decrease in recordable injury rates for Halliburton in 2024.

- Halliburton invested $150 million in safety training and equipment in 2024.

- Compliance failures led to $5 million in fines in specific regions in 2024.

Tax Laws and Policies

Halliburton faces tax implications due to varying global regulations. Changes in tax laws in different regions impact the company's financial strategies. They project a tax rate increase in 2025, which could affect earnings. These changes necessitate careful financial planning and adaptation.

- Halliburton's effective tax rate was approximately 20% in 2023.

- The company anticipates the tax rate will increase in 2025.

Halliburton navigates a complex legal landscape with stringent environmental, trade, and contractual regulations. Environmental compliance costs and international trade sanctions significantly affect operations, increasing legal expenses. Health and safety regulations add further cost pressures, with potential penalties for non-compliance. The legal framework heavily influences financial strategies, necessitating meticulous planning.

| Legal Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Environmental | Compliance Costs, Fines | $200M spent on environmental compliance in 2024 |

| Trade & Sanctions | Market Access, Penalties | Sanctions compliance reviews increased by 15% in 2024 |

| Contracts | Disputes, Legal Fees | Legal fees for contract disputes: $10M in 2024 |

Environmental factors

Climate change is pushing the energy sector to cut emissions. Halliburton focuses on reducing its operational carbon footprint. The company is also creating tech to help clients lower their emissions. In 2024, Halliburton reported a 15% reduction in Scope 1 and 2 emissions since 2019.

Water is crucial for Halliburton's oil and gas operations, especially in fracking. The company actively manages water usage to lessen consumption and improve practices. Halliburton recycles water; in 2023, 36% of water used was recycled. This reduces environmental impact. Their focus is on sustainable water management.

Halliburton's oil and gas operations produce diverse waste streams. The company manages waste throughout its lifecycle, focusing on reducing waste and finding eco-friendly disposal solutions. In 2024, Halliburton reported a decrease in waste generation. They are exploring innovative methods to reduce environmental impact. This includes recycling initiatives and technologies to minimize waste.

Biodiversity Impact

Halliburton actively works to minimize its effects on biodiversity through its environmental management system. This involves environmental assessments and community involvement to safeguard delicate ecosystems. Halliburton's commitment includes initiatives like habitat restoration, aiming to mitigate risks associated with its operations. This approach is crucial for sustainable business practices, particularly in regions rich in biodiversity. In 2024, Halliburton invested $15 million in environmental sustainability programs, including biodiversity protection.

- Environmental impact assessments are a standard practice.

- Community engagement is essential for habitat protection.

- Habitat restoration projects are part of mitigation efforts.

- $15 million investment in 2024 for sustainability.

Chemical Stewardship

Halliburton prioritizes responsible chemical stewardship as a key part of its environmental strategy. They manage risks related to chemicals used in operations, ensuring regulatory compliance. This involves rigorous handling, storage, and disposal protocols. The company's commitment aims to minimize environmental impact and protect worker safety. For 2024, Halliburton's spending on environmental initiatives was approximately $200 million.

- Chemical management programs cover all stages, from sourcing to disposal.

- Compliance with regulations like REACH and TSCA is a priority.

- Halliburton invests in research for safer chemical alternatives.

- Ongoing audits and training programs enhance safety.

Halliburton tackles environmental factors by cutting emissions, managing water and waste, protecting biodiversity, and ensuring chemical safety.

In 2024, Halliburton cut Scope 1 and 2 emissions by 15% since 2019.

They invested $15 million in environmental programs and spent about $200 million on overall environmental initiatives that year.

| Environmental Factor | Halliburton's Approach | 2024 Highlights |

|---|---|---|

| Emissions | Reducing carbon footprint | 15% cut in Scope 1&2 emissions (since 2019) |

| Water Management | Recycling and reducing water use | 36% water recycled (2023 data) |

| Waste | Reducing waste and finding eco-friendly disposal solutions | Decrease in waste generation reported |

PESTLE Analysis Data Sources

Our Halliburton PESTLE is fueled by industry reports, economic indicators, regulatory updates, and reputable government sources to guarantee reliable insights.