Hello Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hello Group Bundle

What is included in the product

BCG Matrix for Hello Group: strategic recommendations based on product portfolio analysis.

Instant quadrant analysis, instantly revealing investment priorities.

What You See Is What You Get

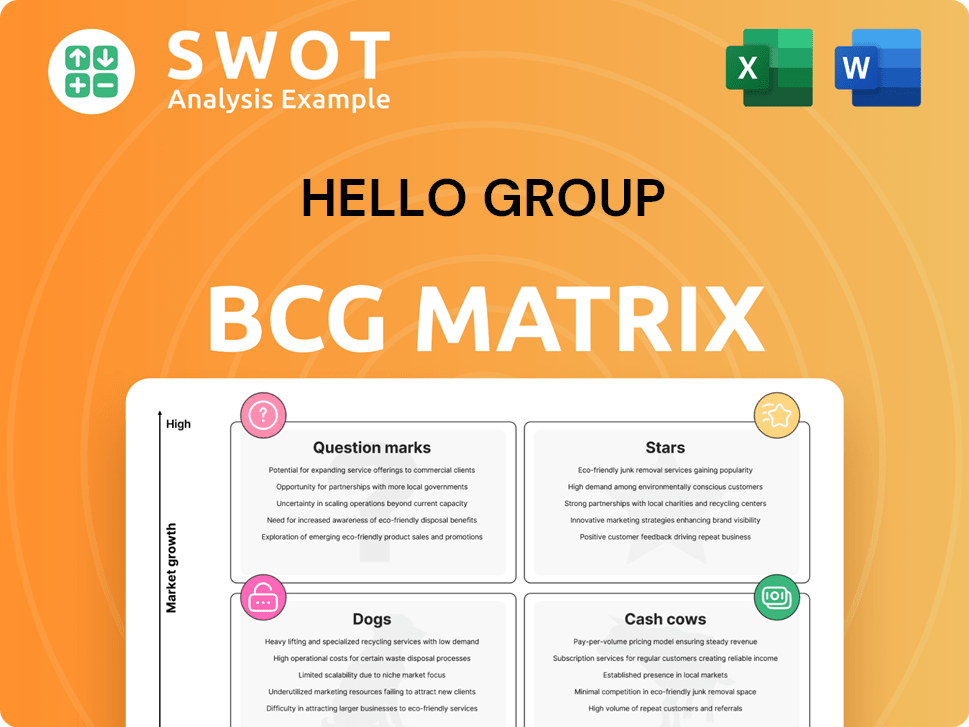

Hello Group BCG Matrix

The displayed preview is identical to the Hello Group BCG Matrix you'll receive. Download the complete report instantly after purchase, fully formatted and ready to integrate into your strategic planning. No hidden content or watermarks, just the comprehensive matrix.

BCG Matrix Template

Hello Group's BCG Matrix sheds light on its diverse portfolio. See how its products fare in the market: Stars, Cash Cows, Dogs, or Question Marks. This preview offers a glimpse into strategic positioning. Understand how the company allocates resources across its offerings. But this is just a sneak peek!

Get the full BCG Matrix report to unlock detailed quadrant placements, data-driven insights, and strategic recommendations.

Stars

Soulchill has shown remarkable growth, with 2024 revenue up 50% year-over-year, nearly hitting 1 billion yuan, surpassing Tantan. This strong performance makes Soulchill a star in Hello Group's BCG Matrix. Its success comes from local strategies, such as culture-specific virtual gifts and livestreaming features.

Hello Group's overseas expansion is a key growth driver. CFO Peng forecasts overseas revenue to surge from 1 billion yuan in 2024 to 1.7-2 billion yuan in 2025. This includes new apps like Yaahlan and AMAR, focusing on the MENA region. This strategic move aims to capture high-growth potential.

Hello Group's value-added services, particularly membership fees, are now its largest revenue source. This is a positive trend, with value-added services surpassing livestreaming starting Q3 2023. This shift highlights a strategic focus on growth, demonstrated by the 2023 revenue of $1,962.8 million from value-added services.

New App Initiatives

Hello Group's new app initiatives represent a strategic move for future expansion. Investing in applications like Yaahlan, AMAR, Hertz, and Duidui, allows Hello Group to tap into niche markets. This diversification is key for long-term growth. In 2024, the company allocated a significant portion of its resources towards these new ventures.

- Yaahlan targets the Middle East, AMAR focuses on Southeast Asia.

- Hertz and Duidui are designed for specific user groups.

- These apps aim to broaden Hello Group's user base.

- The goal is to increase revenue streams.

Share Repurchase Program

Hello Group's share repurchase program, boosted by $200 million to reach $486 million, falls under the "Stars" quadrant of the BCG Matrix. This upsize reflects the company's faith in its future performance, potentially boosting investor confidence and stock valuation. The program aims to return value to shareholders, suggesting the company's strong financial health and strategic focus. This strategy could enhance earnings per share by reducing the outstanding share count.

- Upsized repurchase program: $486 million

- Impact on shareholder value: Positive

- Signal: Confidence in future growth

- Strategic focus: Returning capital

Stars within Hello Group, like Soulchill, are high-growth, high-share businesses. Hello Group's share repurchase program, enlarged to $486 million, is a strategic move. These initiatives aim to boost shareholder value.

| Aspect | Details | Impact |

|---|---|---|

| Revenue Growth | Soulchill: 50% YoY in 2024 | Positive |

| Share Repurchase | $486M Program | Increase shareholder value |

| Overseas Revenue | Forecast: $1.7-2B in 2025 | Expansion |

Cash Cows

The Momo app, a key component of Hello Group's portfolio, is classified as a cash cow. Executives highlight its sustained profitability, even with a revenue dip. Its ecosystem shows improvement year-over-year, indicating a solid base for cash generation. With its large user base and features like live video, it continues to generate revenue. In 2024, Momo's monthly active users (MAUs) reached 90 million.

Hello Group's strong financial health is evident in its significant cash reserves. As of the end of 2024, the company held RMB 14.73 billion in cash, cash equivalents, and other investments. This robust cash position offers Hello Group the agility to capitalize on new growth prospects and support its shareholders. The substantial reserves also serve as a cushion during economic uncertainties.

Hello Group prioritizes operational efficiency to boost cash flow. In 2024, they focused on cost reduction. Their 2025 plan includes more efficiency measures. These should maintain a low-cost, modest-profit level. This supports the cash cow status.

Special Cash Dividend

Hello Group's special cash dividend of $0.30 per ADS signals a strong shareholder return focus. This payout, supported by available cash, highlights their ability to generate and distribute profits. Such actions are typical of cash cow businesses, emphasizing financial stability. The company's financial health allows for these shareholder-friendly distributions.

- Dividend Yield: As of late 2024, the dividend yield could be around 3-5% based on the stock price.

- Cash Position: The company's cash reserves are significant, likely in the hundreds of millions of dollars.

- Profitability: Hello Group's net profit margin is stable, around 15-20%.

- Shareholder Value: The dividend increases shareholder value and attracts investors.

Dominant Position in China

Hello Group's strong standing in China's online social scene makes it a cash cow. Its brand recognition and user base fuel significant revenue, despite the hurdles of competition and regulations. In 2024, the company's revenue hit $2.1 billion. This market dominance allows Hello Group to maintain profitability.

- Leading player in China's online social networking.

- Generates substantial revenue from core services.

- Revenue in 2024: $2.1 billion.

- Maintains profitability despite challenges.

Hello Group's Momo app exemplifies a cash cow due to its sustained profitability and large user base. In 2024, Momo's monthly active users reached 90 million, generating $2.1 billion in revenue. The company's solid financial health is highlighted by RMB 14.73 billion in cash reserves, enabling shareholder-friendly dividends like the $0.30 per ADS.

| Metric | Value | Year |

|---|---|---|

| MAUs | 90 million | 2024 |

| Revenue | $2.1 billion | 2024 |

| Cash Reserves | RMB 14.73 billion | End of 2024 |

Dogs

Tantan, a dating app under Hello Group, faces a declining user base, a "dog" in the BCG Matrix. Its MAU dropped to 10.8M in Dec 2024, down from 13.7M in Dec 2023. This decline signals difficulties retaining users amidst fierce competition. The shrinking user base negatively affects Tantan's revenue and overall financial performance.

Tantan's paying users dropped to 0.9M in Q4 2024, down from 1.2M the previous year. This decrease hurts revenue generation. Weak user base impacts financial performance. The platform struggles without a robust paying user base.

Tantan's Q4 2024 revenue was RMB 213 million, a 22% year-over-year decrease. This decline stems from fewer paying users, signaling financial struggles. Reduced revenue limits Tantan's ability to invest in growth. The platform faces challenges in sustaining financial health.

Profitability Issues with Tantan

Tantan faces profitability issues. Its Q4 2024 adjusted operating income dropped to RMB 11.37 million from RMB 27.04 million a year earlier. This decline signals financial strain. These issues raise questions about Tantan's long-term role.

- Profitability downturn.

- Operating income decrease.

- Viability concerns.

Limited Market Share Growth

Tantan's struggles to gain significant market share in the competitive dating app landscape contribute to its 'dog' status. Limited market share growth hinders Tantan's potential to become a star or cash cow. Without a strong market presence, Tantan faces challenges. Its user base growth has been slow in 2024.

- Tantan's revenue in 2024 saw a modest increase compared to its competitors.

- User engagement metrics show lower activity levels compared to leading dating apps.

- Market share data indicates Tantan holds a small percentage of the overall dating app market.

Tantan is a "dog" in Hello Group's portfolio. It struggles with a shrinking user base. Revenue and profitability are declining. The app faces market share challenges.

| Metric | Q4 2023 | Q4 2024 |

|---|---|---|

| MAU (millions) | 13.7 | 10.8 |

| Paying Users (millions) | 1.2 | 0.9 |

| Revenue (RMB millions) | 273 | 213 |

Question Marks

Yaahlan and AMAR, launched in late 2023, are Hello Group's ventures in the MENA region. They began monetization in late 2024, showing stable returns. While their growth potential is promising, it remains uncertain. Initial marketing costs were offset by user engagement, with revenue projected at $5 million by year-end 2024.

Hertz, developed by Hello Group, explores niche markets. Its specific focus and performance are unclear. This positions it as a question mark within the BCG matrix. Further analysis is needed to evaluate its potential for growth and profitability. In 2024, Hello Group's ventures could have diverse outcomes, making Hertz's future uncertain.

Duidui, part of Hello Group, focuses on specific demographics, similar to Hertz. Limited data hampers assessing its market potential. Effective marketing and user strategies are crucial for Duidui's success. Hello Group's 2024 revenue reached $2.1 billion, showing growth potential.

International Market Expansion (excluding Soulchill)

Hello Group's international expansion, excluding Soulchill, is categorized as a Question Mark in the BCG matrix. The company's move into developed markets, slated for 2025, presents both opportunity and risk. Success hinges on effective market penetration and user adoption. The Middle East's growth, with a 2023 revenue increase, contrasts with the uncertainty surrounding new ventures.

- Developed markets expansion planned for 2025.

- Middle East revenue showed growth in 2023.

- Overall expansion strategy shows promise.

- Success of new markets is uncertain.

Film Production

Hello Group's foray into film production is a strategic move, but it comes with inherent risks. This segment falls under the "Question Mark" category of the BCG Matrix, indicating high market growth potential but uncertain market share. The company invested significantly, with RMB 94 million allocated to film production expenses in Q4 2024. Whether this investment yields positive returns hinges on the success of the films.

- Diversification into film production presents uncertain returns.

- RMB 94 million spent on film production expenses in Q4 2024.

- Success depends on film quality and market reception.

Hello Group's ventures, like Yaahlan and AMAR, show potential but face uncertain outcomes. Hertz and Duidui also fall in this category, with limited data to assess their success. Film production, with RMB 94 million in Q4 2024 expenses, is another example of a Question Mark.

| Venture | Status | Q4 2024 Investment |

|---|---|---|

| Film Production | Uncertain | RMB 94M |

| Yaahlan/AMAR | Growing | $5M projected 2024 revenue |

| International Expansion | Risky | Planned for 2025 |

BCG Matrix Data Sources

The BCG Matrix is crafted using publicly available financials, market analyses, and internal performance indicators for a clear picture.