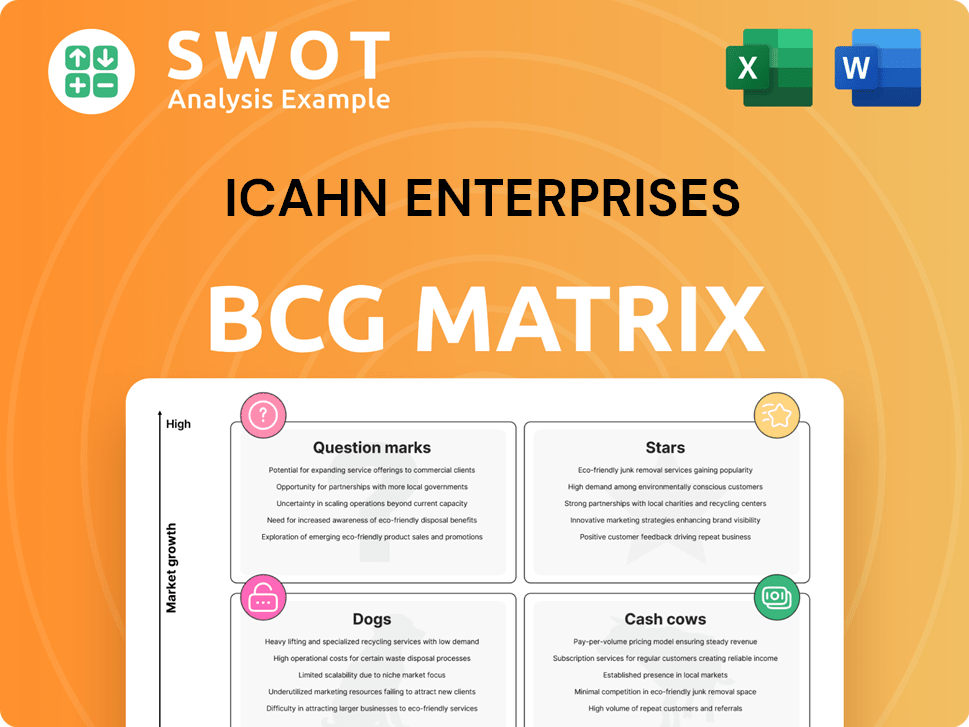

Icahn Enterprises Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

What is included in the product

Icahn Enterprises' BCG Matrix analysis reveals investment priorities by evaluating diverse business units.

Printable summary optimized for A4 and mobile PDFs, giving key stakeholders a clear overview.

What You See Is What You Get

Icahn Enterprises BCG Matrix

The preview showcases the identical Icahn Enterprises BCG Matrix report you'll receive after purchase. It’s a complete, ready-to-implement strategic tool, free of watermarks and demo content, prepared for immediate application.

BCG Matrix Template

Icahn Enterprises' BCG Matrix reveals a dynamic portfolio, with diverse businesses across multiple sectors. Understanding its Stars, Cash Cows, Question Marks, and Dogs is crucial for investment decisions. This preview highlights key product positions and strategic implications. Strategic insights await those looking for a deeper dive. Uncover detailed quadrant placements, data-backed recommendations, and actionable insights. Purchase the full version for a complete strategic analysis.

Stars

CVR Energy, within Icahn Enterprises, is a "Star" due to its refining and fertilizer businesses. Recent strategic investments and operational efficiency initiatives highlight its growth potential. Despite refining margin volatility, its market role remains crucial. In 2024, CVR Energy reported revenues of $8.1 billion.

The real estate segment of Icahn Enterprises is performing well, with value increases due to strategic sales and valuation adjustments. Growth potential is high, particularly with property sales anticipated in early 2025. Continued investments in key properties and development could strengthen its position. In 2024, the real estate segment contributed significantly to overall revenue.

Icahn Enterprises' activist investment funds operate with a high-risk, high-reward approach, positioning them as stars in its BCG matrix. These funds actively influence companies, aiming for substantial financial gains. In 2024, the firm's investment portfolio, including activist stakes, was valued at approximately $4.5 billion. Success hinges on identifying undervalued assets and implementing effective value-creation strategies.

Pharma Segment

The Pharma segment within Icahn Enterprises represents a potential "Star" in the BCG matrix, hinting at high growth prospects. Strategic moves like acquisitions and partnerships are key for boosting this segment. Investing in innovative pharmaceutical products and expanding market reach could transform this sector. Continued focus on R&D and market expansion could elevate its position.

- Icahn Enterprises' market capitalization as of late 2024 was approximately $5 billion.

- The pharmaceutical industry's global market size was estimated at around $1.48 trillion in 2022, with continued growth.

- Successful acquisitions and R&D can significantly improve the segment's performance.

- Market expansion and strategic partnerships are vital for growth.

Home Fashion Segment (WestPoint Home LLC)

WestPoint Home LLC, under Icahn Enterprises, is in the home fashion segment, aiming for growth through new products and partnerships. Efforts to boost supply chain efficiency and expand its market are crucial for its success. Investments in product development and market expansion could solidify its position. In 2024, the home textiles market saw a revenue of $8.7 billion.

- Focus on innovation and partnerships to drive growth.

- Enhance supply chain and market presence.

- Invest in product development and expand market reach.

- The home textiles market in 2024 had $8.7B revenue.

The Automotive segment's "Star" status is due to significant revenue and strategic investments. Revenue and profit growth are indicators of a strong future. New product development and market expansion could further solidify its position. In 2024, the Automotive segment's revenue was $1.2 billion.

| Segment | Status | 2024 Revenue/Value |

|---|---|---|

| CVR Energy | Star | $8.1B |

| Real Estate | Star | Significant Contribution |

| Activist Investment Funds | Star | $4.5B (Portfolio Value) |

| Pharma | Star | Growing through acquisitions |

| WestPoint Home LLC | Star | $8.7B (Home Textiles Market) |

| Automotive | Star | $1.2B |

Cash Cows

Viskase, a key player in food packaging, faces volume and pricing pressures. Despite these challenges, its market presence ensures consistent cash flow generation. Strategic improvements in plant efficiency and product mix optimization can boost profitability. In 2024, the food packaging market is valued at $380 billion.

Icahn Automotive Group, operating numerous repair shops, caters to retail and fleet clients. This division consistently generates strong cash flow due to its established presence. In 2024, this segment's revenue reached approximately $2.5 billion. Strategic moves, like better shop locations, boost efficiency and profits, solidifying its "cash cow" status.

Icahn Enterprises' holding company demonstrates robust liquidity. In Q3 2024, it held over $1.5 billion in cash and investments. This significant cash reserve supports ongoing operations. It also covers administrative expenses, aligning with its cash cow status.

Declared Dividends

Icahn Enterprises is known for its consistent dividend payouts to depositary unitholders. The company's recent financial moves include a declared fourth-quarter distribution of $0.50 per depositary unit. This is scheduled to be paid around April 16, 2025. These steady dividends show Icahn Enterprises' capacity to generate and distribute cash effectively, aligning with the characteristics of a cash cow.

- Q4 2024 dividend declared: $0.50 per unit.

- Payment date: Around April 16, 2025.

- Consistent dividend history reflects strong cash flow.

Strategic Asset Management

Icahn Enterprises strategically manages its diverse assets, focusing on operational enhancements and valuation adjustments. This approach aims to boost shareholder value and ensure a consistent cash flow, categorizing it as a cash cow within the BCG matrix. In 2023, Icahn Enterprises reported revenues of $5.4 billion, indicating its asset management's financial impact. The company's strategy includes actively managing its investments to maximize returns. This active management helps generate steady cash flow.

- Strategic asset management is a core focus.

- Operational improvements are key.

- Aims to enhance shareholder value.

- Generates steady cash flow.

Icahn Enterprises’ cash cows, like Viskase and Icahn Automotive Group, consistently generate cash flow. Their established market presence and operational improvements support profitability. These divisions contribute significantly to the company's robust financial health.

| Category | Details |

|---|---|

| Viskase | Food packaging with $380B market value in 2024. |

| Icahn Automotive | $2.5B revenue in 2024; retail & fleet services. |

| Holding Company | $1.5B+ cash/investments in Q3 2024. |

Dogs

If Icahn Enterprises' Pharma segment underperforms, it could become a dog. This is especially true if it fails to grow market share. Recent financial reports show the segment's revenue growth has been stagnant. Without innovation, it may generate minimal cash flow, potentially leading to divestiture.

If WestPoint Home LLC, Icahn Enterprises' home fashion segment, fails to evolve with market trends, it risks becoming a dog. This segment might struggle to maintain market share without innovation. Poor performance and low growth could lead to divestiture consideration. In 2024, the home textiles market saw shifts in consumer preferences, impacting companies that lagged.

Real estate holdings within Icahn Enterprises that underperform are classified as dogs. These properties, failing to deliver adequate returns or appreciation, consume capital. In Q3 2023, Icahn Enterprises reported a net loss, potentially impacted by underperforming real estate. Reevaluating and divesting these assets could improve overall financial health.

Automotive Aftermarket Parts (Divested)

Icahn Enterprises is wrapping up the sale of its automotive aftermarket parts business by early 2025. This segment probably landed in the "dog" category within the BCG matrix. It likely struggled with growth and profitability, based on market trends. This move to divest shows a strategic shift away from underperforming areas.

- Divestiture expected to conclude in Q1 2025.

- Market analysis suggests the sector faced margin pressures in 2024.

- Icahn Enterprises aims to streamline its portfolio.

- Focus shifted towards potentially higher-growth sectors.

Metals (Divested PSC Metals in 2021)

In 2021, Icahn Enterprises divested PSC Metals for $323 million, reflecting a strategic shift. This move likely aimed at shedding underperforming assets and reallocating capital. The sale signals a reduction in exposure to potentially low-growth areas within the metals sector. It aligns with a broader strategy of focusing on higher-return investments.

- Sale of PSC Metals in 2021 for $323 million.

- Strategic divestiture to reallocate capital.

- Reduced exposure to low-growth segments.

- Focus on higher-return investments.

Dogs within Icahn Enterprises represent underperforming segments. These businesses, like those facing stagnant growth or low returns, consume capital. Divestiture, such as the planned sale of the automotive aftermarket parts business by early 2025, is a common strategy. The goal is to streamline the portfolio, focusing on potentially higher-growth sectors.

| Segment | Status | Action |

|---|---|---|

| Pharma | Underperforming | Monitor |

| Home Fashion | Potential Dog | Re-evaluate |

| Real Estate | Underperforming | Divest |

| Auto Parts | Dog | Divested (Q1 2025) |

Question Marks

The automotive segment at Icahn Enterprises faces restructuring, signaling an uncertain outlook. Expectations point towards stabilization by late 2025, but it currently operates as a question mark. Strategic investments and operational enhancements are crucial for fostering high growth and market share. In 2024, the automotive industry saw shifts; for example, demand for used vehicles has changed.

Icahn Enterprises frequently identifies new investment prospects, fitting the question mark profile. These ventures possess significant growth potential, yet their market share is unconfirmed. For example, in 2024, Icahn Enterprises' investments in renewable energy reflect this. Strategic investment is essential to assess if these initiatives can evolve into stars or decline.

The shift to fair-market value for Real Estate and Automotive Services segments marks a question mark in Icahn Enterprises' BCG matrix. This change aims for a more market-accurate financial representation. However, its impact on performance is currently uncertain. For example, in 2024, real estate values fluctuated, influencing segment valuation. Monitoring these adjustments is vital to understand their long-term effect.

Potential Acquisitions

Icahn Enterprises' question marks include potential acquisitions, which are high-growth, high-market-share ventures. The company's liquidity allows it to pursue opportunities, both within and outside its current sectors. However, their success is uncertain, hinging on integration, market dynamics, and strategic fit. Careful due diligence and skillful management are crucial to transform these question marks into successful investments.

- Icahn Enterprises reported $1.4 billion in cash and equivalents as of September 30, 2023, showcasing its liquidity.

- Acquisition integration challenges often lead to initial losses; the success rate of acquisitions varies significantly based on industry and market conditions.

- Strategic alignment is key; acquisitions that match the company's core competencies tend to perform better.

Home Fashion (Strategic Partnerships)

If Icahn Enterprises forms strategic partnerships in its Home Fashion segment, it aligns with a question mark status. The success hinges on the partners' abilities and market synergy. Effective collaboration is key to boosting growth and market share. Careful partnership management is crucial for a positive outcome.

- In 2024, the home fashion market saw varied growth rates depending on the product category, with some segments experiencing declines while others showed modest gains.

- Strategic partnerships can help Icahn Enterprises navigate market challenges and leverage external expertise.

- The selection of partners must consider their financial stability and market presence.

- Collaboration effectiveness is measured by increased sales and brand recognition.

Icahn Enterprises' question marks involve segments with high potential but uncertain outcomes. These ventures, like those in renewable energy and home fashion, require strategic investment and effective management to succeed. In 2024, such segments faced market fluctuations, emphasizing the need for careful assessment. Partnerships and acquisitions, if well-executed, could turn these question marks into stars.

| Segment | Status | 2024 Key Considerations |

|---|---|---|

| Automotive | Question Mark | Restructuring; used car demand. |

| New Investments | Question Mark | Growth potential; market share. |

| Real Estate/Auto Services | Question Mark | Fair-market value impact. |

| Acquisitions | Question Mark | Integration, market dynamics. |

| Home Fashion | Question Mark | Partnerships; market synergy. |

BCG Matrix Data Sources

Our BCG Matrix is fueled by diverse data: SEC filings, market research reports, competitor analyses, and expert evaluations for strategic insights.