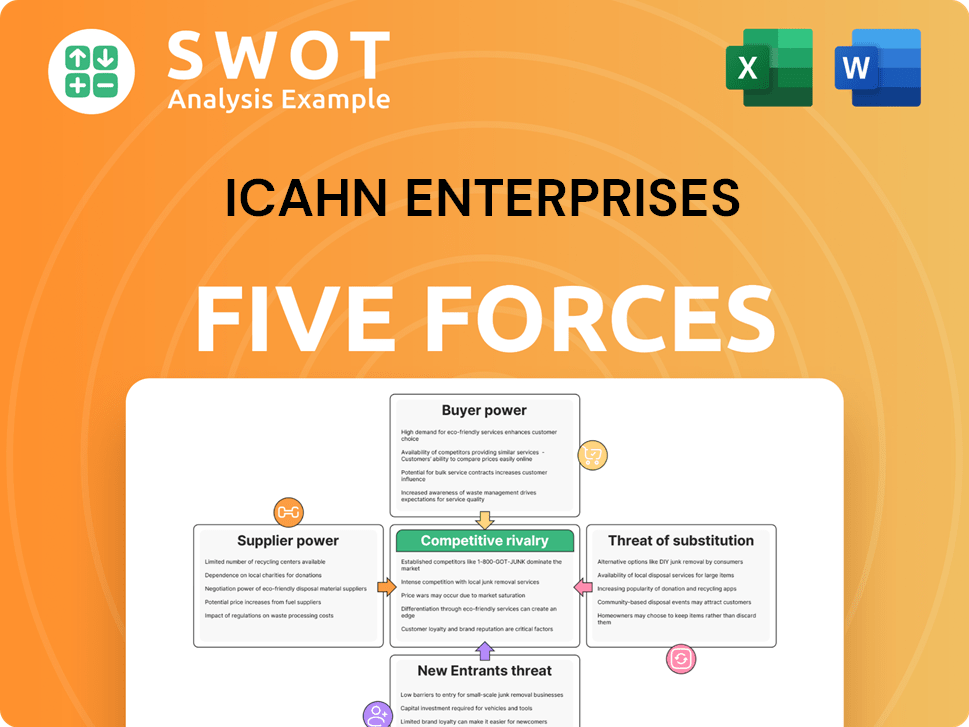

Icahn Enterprises Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

What is included in the product

Analyzes Icahn Enterprises' competitive landscape, examining its position amidst market forces.

Customize pressure levels with real-time market data and track strategic shifts.

Full Version Awaits

Icahn Enterprises Porter's Five Forces Analysis

You’re previewing the final version—precisely the same document that will be available to you instantly after buying. This Icahn Enterprises Porter's Five Forces analysis details industry rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. The analysis provides a comprehensive overview of competitive forces affecting Icahn Enterprises. The document offers valuable insights and is ready for immediate use. The complete analysis file is exactly what you’ll receive.

Porter's Five Forces Analysis Template

Icahn Enterprises faces complex industry pressures. Its profitability is influenced by supplier power & competitive rivalry. The threat of new entrants and substitutes, coupled with buyer power, shape its strategic landscape. Understanding these forces is crucial. This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Icahn Enterprises’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Icahn Enterprises' presence in multiple sectors, including automotive and energy, means it isn't overly reliant on any one supplier. This diversification strategy allows them to source from various vendors, which helps to lessen the influence suppliers have. By spreading out their sourcing, Icahn Enterprises can negotiate better prices and switch suppliers if needed. For instance, in 2024, the company's diverse portfolio helped it navigate supply chain challenges more effectively.

Industries like energy and automotive are vulnerable to commodity price swings. Supplier power strengthens as raw material costs increase, squeezing profits. For example, in 2024, crude oil prices fluctuated significantly. Icahn Enterprises needs smart strategies such as hedging or long-term contracts to lessen its vulnerability to these shifts. In 2024, West Texas Intermediate (WTI) crude oil prices ranged from around $70 to over $90 per barrel.

In industries like food packaging, specialized equipment suppliers hold significant power due to their limited numbers. These suppliers of unique machinery or proprietary tech can heavily influence costs and operations. For instance, in 2024, the packaging industry faced a 5% increase in equipment costs. Investing in alternative technologies or developing internal capabilities could help reduce this dependency.

Labor market influence

Labor market dynamics significantly affect supplier power, particularly in sectors like automotive where unionized labor is prevalent. Labor unions can exert considerable influence, potentially leading to increased operational costs through wage demands or labor disputes. For example, in 2024, the United Auto Workers (UAW) strike against major automakers resulted in billions of dollars in losses and highlighted labor's impact. To mitigate these risks, companies must foster positive labor relations and consider automation strategies.

- Unionized labor can act as a powerful supplier, especially in automotive.

- Labor disputes and rising wages can increase operational costs.

- The 2024 UAW strike cost automakers billions, showing labor’s impact.

- Positive labor relations and automation are key risk management strategies.

Energy sector dynamics

Icahn Enterprises' energy segment encounters supplier power from oil and gas producers. Geopolitical events and supply disruptions substantially influence input costs. For example, in 2024, crude oil prices saw volatility due to conflicts and production cuts. Diversifying energy sources and boosting energy efficiency can lessen this vulnerability.

- Oil prices fluctuated in 2024, influenced by geopolitical events.

- Supply disruptions can cause significant cost increases.

- Diversification is key to reducing supplier power impact.

- Energy efficiency improvements can mitigate risks.

Icahn Enterprises manages supplier power through diversification and strategic sourcing across various sectors. Commodity price fluctuations, like the 2024 crude oil volatility, impact costs, necessitating hedging. Industries with specialized suppliers, such as food packaging, face concentrated power.

| Factor | Impact | 2024 Data |

|---|---|---|

| Commodity Prices | Affect profitability | WTI crude oil: $70-$90/barrel |

| Specialized Suppliers | Influence costs | Packaging equipment cost increase: 5% |

| Labor Dynamics | Increase operational costs | UAW strike losses: Billions |

Customers Bargaining Power

Icahn Enterprises benefits from a diverse customer base across various sectors, mitigating the risk of customer concentration. This diversification strategy shields against sector-specific economic downturns, enhancing stability. In 2024, the company's diverse holdings, including automotive and real estate, served numerous customers, lessening reliance on any single entity. This broad base is crucial, particularly when considering that in 2023, one of its segments saw a 10% fluctuation due to market shifts.

In the home fashion segment, Icahn Enterprises encounters price-sensitive consumers. Consumers can easily switch to competitors based on price; this intensifies competition. To retain customers, Icahn Enterprises must emphasize its value proposition and brand loyalty. Retail sales in the US were $7.1 trillion in 2023, showing the importance of price.

The automotive industry, a key customer segment for Icahn Enterprises, wields substantial bargaining power. Auto manufacturers, representing large-volume buyers, can pressure suppliers for price reductions and customized features. This dynamic necessitates strong supplier-customer relationships and differentiated product offerings to protect profitability. In 2024, automotive sales in the US reached approximately 15.5 million units, highlighting the sector's significant influence.

Investment fund clients

Icahn Enterprises' investment arm faces strong customer bargaining power. Its clients, including institutional investors, are discerning and demand high returns. These clients can easily shift their substantial capital to competing funds. Maintaining top-tier performance and investor trust is vital to retain these clients.

- In 2024, the hedge fund industry saw significant outflows, highlighting investor mobility.

- Icahn Enterprises' investment performance is closely scrutinized, with even small underperformances potentially leading to large withdrawals.

- Client due diligence processes are rigorous, focusing on past performance and risk management.

- The ability to attract and retain capital is crucial for the fund's survival.

Food packaging consolidation

The food packaging sector is seeing customer consolidation, which boosts their bargaining power. Major food corporations can secure better deals due to their size. This trend pressures companies like Icahn Enterprises to innovate and provide unique solutions. For instance, in 2024, the top 10 food and beverage companies controlled over 40% of the market share.

- Consolidation leads to stronger customer negotiation.

- Larger buyers demand lower prices and better terms.

- Icahn Enterprises needs to add value to stay competitive.

- Innovation and unique offerings are crucial.

Icahn Enterprises faces varied customer bargaining power across its sectors. Price sensitivity impacts its home fashion segment, intensifying competition. Automotive clients and large food corporations have significant negotiating leverage. The investment arm relies on top-tier performance to retain discerning institutional investors.

| Segment | Customer Bargaining Power | Impact |

|---|---|---|

| Home Fashion | High | Price wars, margin pressure, need for strong value proposition. |

| Automotive | High | Demands for price reductions and customized features. |

| Investment | High | Demands for high returns, risk of capital outflow. |

| Food Packaging | Moderate to High | Price pressure due to customer consolidation. |

Rivalry Among Competitors

The investment sector is fiercely competitive, with many firms like Blackstone and Apollo competing for deals. To secure capital and deliver returns, Icahn Enterprises needs top-tier performance and risk management. In 2024, the hedge fund industry's assets reached approximately $4 trillion, highlighting the scale of competition. Icahn Enterprises must constantly innovate to stay ahead.

The automotive market is fiercely competitive, with established automakers and electric vehicle startups vying for dominance. This rivalry leads to frequent market share shifts and rapid technological advancements. For example, in 2024, Tesla's market share in the U.S. EV market was around 50%, but competition from Ford, GM, and others is increasing. Icahn Enterprises, to stay competitive, must prioritize innovation and operational efficiency to adapt to these dynamic market conditions.

The energy sector faces volatile commodity prices and geopolitical risks. Competition is intense, with numerous firms battling for market share. For instance, oil prices in 2024 fluctuated significantly. Icahn Enterprises must streamline operations and manage risks to thrive. Natural gas spot prices averaged $2.50/MMBtu in November 2024.

Real estate market cycles

The real estate market is cyclical, experiencing periods of high demand and downturns. Competition for properties and tenants is fierce. Icahn Enterprises must adopt a long-term perspective to navigate these cycles effectively. Strategic portfolio management is critical for success.

- The National Association of Realtors reported a 1.9% decrease in existing home sales in December 2023.

- Vacancy rates in major U.S. office markets rose to 19.6% in Q4 2023, indicating oversupply.

- Interest rate hikes in 2023 impacted real estate affordability and demand.

- Icahn Enterprises' real estate holdings include various properties, requiring diverse strategies.

Home fashion retail competition

The home fashion retail market is highly competitive, featuring many brands vying for customers. Online retailers and discounters intensify the rivalry, squeezing profit margins. To succeed, Icahn Enterprises needs to distinguish its offerings and provide a superior shopping experience. This involves unique products and exceptional customer service. According to IBISWorld, the U.S. Furniture and Home Furnishings Stores industry is worth $134.1 billion in 2024.

- Market value: $134.1 billion in 2024 (IBISWorld).

- Competitive pressure from online retailers.

- Need for differentiation in products and service.

- Focus on compelling shopping experiences is crucial.

In the investment sector, intense competition among hedge funds like Blackstone and Apollo pushes Icahn Enterprises to excel. The automotive market is also fiercely competitive, with Tesla's market share around 50% in 2024, facing rising challenges. The energy sector deals with price volatility and geopolitical risks.

| Sector | Competitive Factor | 2024 Data |

|---|---|---|

| Investment | Asset competition | $4T hedge fund industry |

| Automotive | Market share shifts | Tesla ~50% US EV share |

| Energy | Price volatility | Oil prices fluctuated |

SSubstitutes Threaten

Investors have many choices beyond Icahn Enterprises. These include stocks, bonds, and real estate, with the S&P 500 up 24% in 2023. Icahn Enterprises needs strong returns to compete. In 2024, innovation in investment strategies remains key to attracting and keeping investors.

Electric vehicles (EVs) are a rising threat to traditional automakers. EV sales continue to climb, with EVs accounting for 11% of all new car sales in the U.S. in Q4 2023. Consumers view EVs as viable alternatives to gasoline cars. Icahn Enterprises needs to adapt by potentially investing in EV technologies.

Renewable energy sources like solar and wind pose a growing threat to traditional energy companies. The increasing adoption of renewables directly challenges the demand for fossil fuels, potentially impacting Icahn Enterprises' investments in energy. In 2024, renewable energy's share of global power generation continued to rise, reaching approximately 30%. To counter this, Icahn could diversify into or invest in renewable technologies.

Alternative food packaging materials

The threat of substitutes in food packaging is rising, primarily due to the increasing adoption of sustainable materials. Consumers are increasingly seeking eco-friendly alternatives, shifting away from traditional plastics. This trend directly impacts companies like Icahn Enterprises that provide food packaging. To stay competitive, investing in biodegradable and sustainable packaging solutions is crucial.

- The global biodegradable packaging market was valued at $97.7 billion in 2023.

- It is projected to reach $164.8 billion by 2028.

- This represents a CAGR of 11.04% between 2023 and 2028.

- Companies that do not adapt risk losing market share.

Generic home fashion products

Generic home fashion products pose a notable threat to Icahn Enterprises. Consumers readily switch to cheaper alternatives, pressuring margins. Defending against this requires robust brand loyalty and distinctive product designs. Focusing on superior quality and value is essential to maintain market share.

- In 2024, the home goods market saw a 5% increase in sales of generic products.

- Icahn Enterprises' home fashion segment must compete with these lower-priced items.

- Offering unique, high-quality products can help mitigate the impact.

- Data from 2024 shows a 7% rise in consumer preference for value.

Icahn Enterprises faces substitute threats in many sectors. Consumers can easily switch to alternative investments like the S&P 500. Renewable energy and EVs are also strong alternatives.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Investment Options | Diversification | S&P 500 up 10% YTD |

| Renewable Energy | Market Shift | Renewables: 32% of power |

| EVs | Changing Demand | EVs: 14% of new car sales |

Entrants Threaten

Icahn Enterprises faces high capital requirements in sectors like energy and automotive. These industries demand substantial upfront investments, creating a barrier for new entrants. This makes it challenging for smaller firms to compete. In 2024, the energy sector saw average capital expenditures exceeding $100 million. A robust financial standing is key to defending against new competition.

Icahn Enterprises benefits from established brands in certain sectors, acting as a barrier against new competitors. These brands reduce the threat of new entrants. New companies face substantial marketing and branding costs to compete. In 2024, brand strength helped Icahn Enterprises to maintain its market position, especially in sectors like automotive and real estate.

Industries like energy and real estate, where Icahn Enterprises operates, face tough regulations. New companies must deal with complex, costly rules. Compliance requires significant resources and expertise. For example, in 2024, energy companies faced changing environmental standards. Regulatory hurdles can deter new competitors.

Technological expertise

The threat of new entrants in sectors like food packaging and automotive, where Icahn Enterprises operates, is significantly influenced by technological expertise. Newcomers face substantial barriers, needing to develop or acquire specialized technologies to compete. For example, in 2024, the automotive industry saw a surge in electric vehicle (EV) technology, demanding massive R&D investments. Staying ahead requires continuous innovation and investments.

- High R&D costs: New entrants must invest heavily in R&D.

- Patent protection: Patents protect existing technologies.

- Specialized equipment: Requires specific machinery to produce.

- Talent acquisition: Skilled workforce is crucial.

Access to distribution channels

Established companies, like Icahn Enterprises (IEP), often have well-established distribution networks, making it difficult for new entrants to compete. IEP's diverse holdings, including automotive, energy, and real estate businesses, all rely on different distribution channels. New entrants face challenges in securing shelf space, building relationships, and matching the efficiency of existing systems. Overcoming this barrier requires significant investment and strategic planning.

- IEP's market capitalization as of May 10, 2024, was approximately $5.3 billion.

- IEP's revenue in 2023 was $7.7 billion, according to its 2023 10-K filing.

- New entrants may need to invest heavily in marketing to build brand awareness.

- Strategic partnerships can help new entrants gain access to distribution channels.

The threat of new entrants to Icahn Enterprises is moderate. High capital demands and established brands create barriers to entry, especially in energy and automotive. However, technological advancements and regulatory changes can reshape these industry dynamics. In 2024, the automotive sector saw significant shifts due to EV technology and stringent environmental standards.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Requirements | High upfront investment needed. | Energy sector capex >$100M on average. |

| Brand Recognition | Established brands reduce threat. | IEP's brand value maintained position. |

| Regulations | Complex, costly compliance. | Changing environmental standards. |

Porter's Five Forces Analysis Data Sources

The analysis synthesizes data from SEC filings, financial reports, market research, and competitor publications.