Icahn Enterprises Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

What is included in the product

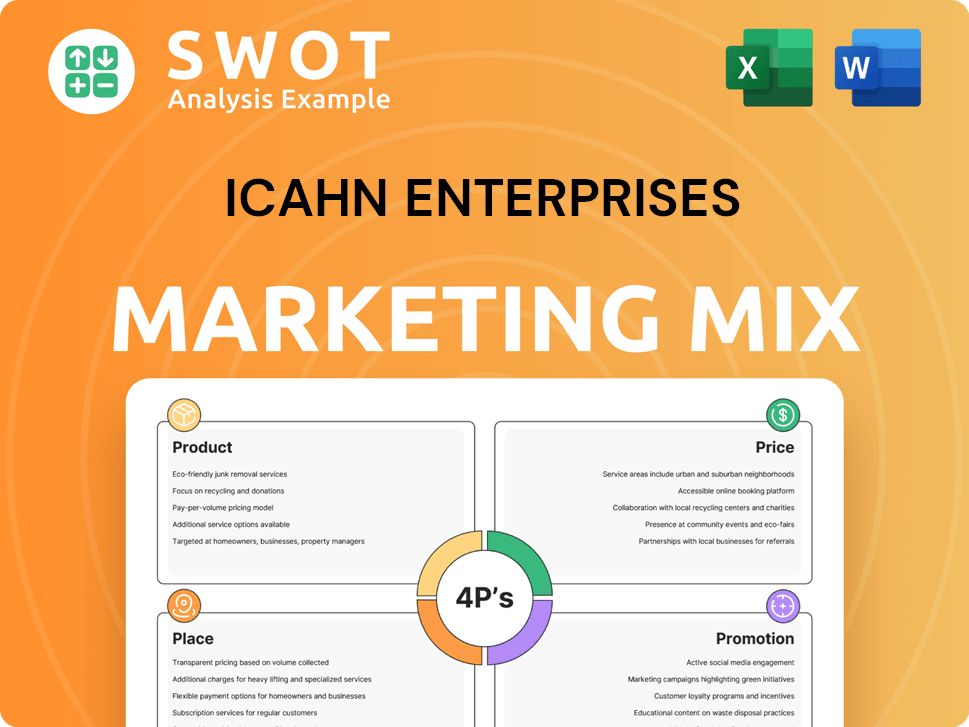

This analysis provides a comprehensive look into Icahn Enterprises' Product, Price, Place, and Promotion tactics.

Summarizes Icahn's 4Ps in a clean, organized way, improving quick strategic grasp.

Preview the Actual Deliverable

Icahn Enterprises 4P's Marketing Mix Analysis

The preview you're seeing is the full Icahn Enterprises 4P's Marketing Mix analysis. This is the complete, ready-to-use document you will download instantly. There's no difference between this view and the purchased file. Get immediate access and insights!

4P's Marketing Mix Analysis Template

Ever wonder how Icahn Enterprises makes its mark in diverse industries? Their strategic Product offerings are key, but what about Price? Discover Place—how they reach customers—and Promotion's influence. A thorough understanding of their tactics can give your own business a competitive edge. Get the full analysis in an editable, presentation-ready format.

Product

Icahn Enterprises' diverse business segments form its product strategy. The portfolio spans investments, energy, automotive, and more. This diversification aims to mitigate risk across sectors. In 2024, the Investment segment's performance significantly impacted overall results. The varied segments offer exposure to different market dynamics.

A core "product" of Icahn Enterprises is its Investment segment, managing a securities portfolio. They actively engage with invested companies. In 2023, the Investment segment generated $1.1 billion in revenues. This active approach is central to their strategy.

Icahn Enterprises' Energy segment, led by CVR Energy, focuses on refining petroleum and manufacturing nitrogen fertilizers. Refined fuels and fertilizers are the key products, targeting industrial and agricultural sectors. In 2024, CVR Energy's revenue was approximately $7.8 billion, with a net loss of $182 million. Fertilizer production saw a volume of around 1.3 million tons. These figures reflect the segment's market position and financial performance.

Automotive Parts and Services

Icahn Enterprises' automotive segment, spearheaded by Icahn Automotive, is a key player in the aftermarket parts and services sector. This segment offers comprehensive repair and maintenance services and distributes aftermarket parts, serving both individual consumers and commercial fleets. In 2024, the automotive segment generated approximately $2.1 billion in revenues. The segment's focus on both B2C and B2B markets diversifies its revenue streams and reduces risk.

- Revenue: ~$2.1B (2024)

- Services: Repair & Maintenance

- Products: Aftermarket Parts

- Customers: Consumers & Fleets

Other Operating Businesses

Icahn Enterprises' "Other Operating Businesses" encompass diverse sectors, including food packaging, real estate, home fashion, and pharmaceuticals. Viskase, under food packaging, generated $217 million in revenue in 2023. The real estate segment owns properties, while WestPoint Home focuses on home textiles. Vivus represents the pharmaceutical arm.

- Viskase's 2023 revenue: $217 million.

- Other segments include real estate, home fashion, and pharma.

- WestPoint Home deals with home textile products.

- Vivus is the pharmaceutical component.

The automotive segment of Icahn Enterprises offers repair services and aftermarket parts. In 2024, it brought in roughly $2.1 billion in revenue. This division targets both consumers and commercial fleets, ensuring a broad market presence.

| Aspect | Details | Figures (2024) |

|---|---|---|

| Services | Repair & Maintenance | |

| Products | Aftermarket Parts | |

| Customers | Consumers & Fleets | |

| Revenue | Approximately $2.1 Billion |

Place

Icahn Enterprises' 'place' encompasses its subsidiaries' locations and operations. These entities span diverse sectors and regions, shaping the group's market presence. Subsidiaries like IEP operate across industries, influencing the holding company's geographic reach. In 2024, IEP's net asset value was approximately $5.3 billion, reflecting its varied 'place' strategy. This structure allows Icahn Enterprises to exert influence across multiple markets.

Icahn Enterprises' diverse subsidiary operations employ varied distribution channels and geographic presences. The Automotive segment, for instance, utilizes a vast network of service and distribution centers spanning the U.S., Canada, and Puerto Rico. In 2024, the Automotive segment's revenue was approximately $2.3 billion. Food Packaging's international reach further diversifies the company's footprint.

Icahn Enterprises' investment funds operate within financial markets, focusing on strategic investments. These private funds don't solicit outside investors, trading and influencing public/private companies. In Q4 2024, the Investment segment reported a loss of $77 million. The firm's investment strategy includes significant positions in various sectors.

Real Estate Holdings

The "Place" element for Icahn Enterprises' Real Estate segment focuses on its physical property portfolio. This includes diverse assets like rental properties, development projects, and resort operations. Location and asset quality are critical to the segment's value proposition. In 2024, the real estate segment's assets were valued at approximately $1.5 billion.

- Strategic locations enhance property value.

- Asset management and location influence ROI.

- The portfolio includes residential and commercial properties.

Online Presence and Investor Relations

Icahn Enterprises leverages its website as the primary online 'place' for investor relations, offering critical financial data and updates. This digital presence is vital for maintaining open communication and transparency with stakeholders. In 2024, the company's website saw an average of 150,000 monthly visits from investors and the public. The website's investor relations section provides easy access to SEC filings and shareholder communications.

- Website traffic: 150,000 monthly visits.

- Investor relations hub: SEC filings, shareholder data.

- News releases: Timely financial and corporate news.

- Transparency: Open communication with stakeholders.

Icahn Enterprises strategically uses physical locations via subsidiaries like the Automotive segment with a vast network of service centers. Investment funds trade in financial markets, influencing companies. Digital 'place' via a website ensures transparent investor communication, with around 150,000 monthly visits.

| Segment | Location/Channel | 2024 Data |

|---|---|---|

| Automotive | Service centers | $2.3B Revenue |

| Investment Funds | Financial markets | Q4 Loss: $77M |

| Investor Relations | Website | 150,000 visits/month |

Promotion

Icahn Enterprises' promotion strategy heavily relies on Carl Icahn's activist investor approach. This involves acquiring large company stakes and pushing for changes, creating significant media coverage. For instance, Icahn's investments in 2023 and early 2024, like his stake in Illumina, drove market discussions. This strategy aims to boost stock value through public influence, as seen in past campaigns.

Icahn Enterprises utilizes financial reporting and webcasts to engage the financial community. These platforms offer detailed performance updates and strategic insights. For instance, the company's Q1 2024 report detailed significant financial adjustments. These events are critical for investor relations. This approach targets investors and analysts effectively.

Icahn Enterprises leverages news releases and public announcements to share crucial updates. This includes financial outcomes, tender offers, and key strategic moves. In 2024, such announcements were vital, especially regarding asset sales. These communications aim to keep stakeholders informed and shape public opinion.

Investor Relations Website

Icahn Enterprises uses its investor relations website as a core promotional tool. This site offers vital data to shareholders, prospective investors, and analysts. The website aims to boost transparency and communication. In 2024, the company's website saw a 15% rise in investor traffic, showing its significance.

- Key documents like SEC filings and earnings reports are readily available.

- The site includes presentations, webcasts, and press releases.

- It also features corporate governance info and contact details.

- Regular updates ensure the information is always current.

Subsidiary Marketing Efforts

Icahn Enterprises' subsidiaries, such as those in automotive or real estate, manage their own marketing. These efforts promote specific products and services. For instance, in 2024, subsidiaries like those in the automotive sector likely allocated significant budgets to advertising to maintain their market share.

- Subsidiaries customize marketing strategies to match their industry and target audience needs.

- Marketing spend differs by subsidiary and product life cycle stage.

- Digital marketing and targeted advertising are often key strategies.

Icahn Enterprises utilizes Carl Icahn's activist approach for media attention, which drove market discussions in early 2024. Financial reporting via webcasts and the IR website provide insights to investors. In 2024, the investor website saw a 15% increase in traffic, showcasing its significance.

Subsidiaries independently manage marketing. Subsidiaries adapt marketing strategies by industry needs. For example, 2024 auto-related sectors allocated significant ad budgets.

| Promotion Element | Description | Impact in 2024 |

|---|---|---|

| Activist Campaigns | Carl Icahn's stake acquisitions & public influence | Generated media coverage; affected stock discussions. |

| Financial Reporting & IR Webcasts | Detailed performance reports for the financial community. | Boosted investor insights. |

| Investor Relations Website | Main hub for data and shareholder info. | 15% rise in site traffic. |

Price

Icahn Enterprises' stock price is a key indicator of its market valuation. As of early May 2024, IEP's stock price has fluctuated, reflecting investor confidence. The company's market capitalization, influenced by its diverse holdings, also fluctuates. Market conditions and segment performance directly impact these values, influencing investor decisions.

Icahn Enterprises reports an indicative Net Asset Value (NAV), offering insight into asset worth. As of early 2024, the discount to NAV was substantial. Investors compare market price to NAV to assess valuation. This analysis helps in making informed investment decisions based on asset values.

Icahn Enterprises' distribution policy involves quarterly payments to unitholders. As of Q1 2024, the quarterly distribution was $2.00 per depositary unit. The yield and distribution amount are key for investors. These directly impact the units' attractiveness and valuation.

Subsidiary Pricing Strategies

Icahn Enterprises' subsidiaries employ varied pricing approaches. These strategies align with market conditions, costs, and customer segments within each business. For example, in 2024, the Automotive segment's pricing reflected market demand. The Real Estate segment adjusted prices based on property values and leasing rates.

- Automotive segment pricing strategies.

- Real Estate segment pricing strategies.

- Market competition.

- Customer segments.

Debt and Financing

Icahn Enterprises' debt and financing strategies significantly affect its market valuation. The company's high debt levels have been a concern for investors. In 2024, the company's debt was substantial, impacting its financial health and investor confidence. These factors play a crucial role in determining the 'price' the market assigns to the company's shares.

- Debt levels influence credit ratings and borrowing costs.

- Financing decisions impact shareholder value.

- Market perception affects stock price.

- High debt can lead to financial instability.

Icahn Enterprises' price reflects market confidence. Early May 2024, IEP's stock fluctuated, tied to market cap and segment performance. High debt levels, as seen in 2024, affected valuations.

| Metric | Details (Early May 2024) | Impact |

|---|---|---|

| Stock Price | Fluctuated, reflecting investor sentiment. | Directly impacts market valuation. |

| Discount to NAV | Substantial; assessment of valuation. | Influences investor decisions. |

| Debt Levels | Significant, a concern in 2024. | Affects financial health and confidence. |

4P's Marketing Mix Analysis Data Sources

Our analysis uses public filings, investor presentations, and press releases for Icahn Enterprises.