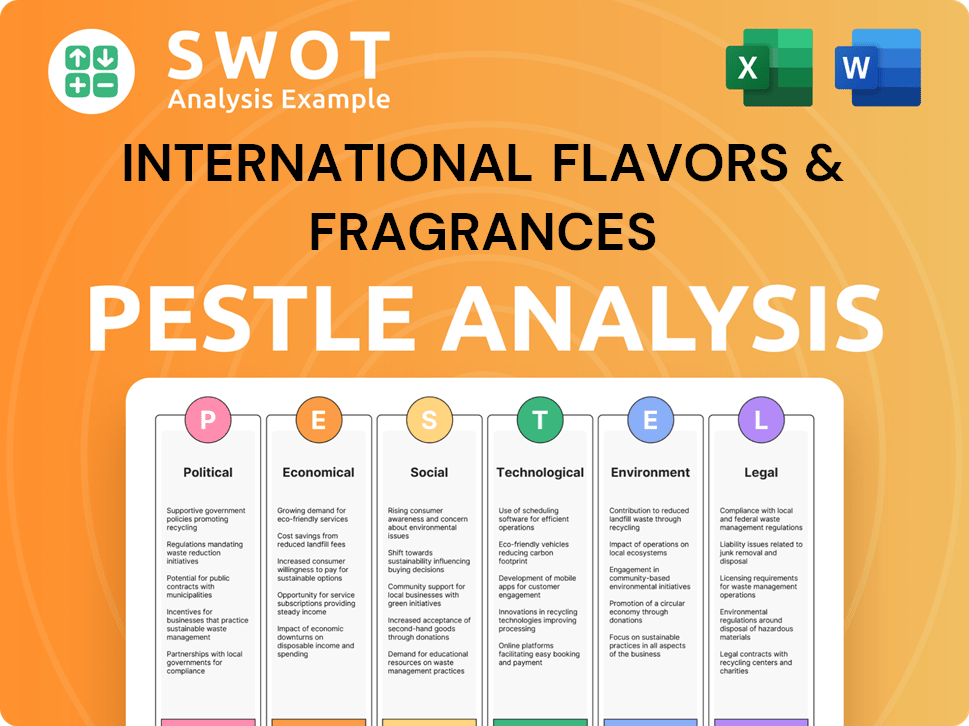

International Flavors & Fragrances PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Flavors & Fragrances Bundle

What is included in the product

Offers a detailed PESTLE analysis for International Flavors & Fragrances, examining external factors and their impacts.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

International Flavors & Fragrances PESTLE Analysis

Preview this IFF PESTLE analysis—the actual file you'll receive after purchase. It's fully formatted and ready for your immediate use.

PESTLE Analysis Template

Navigate the complex world of International Flavors & Fragrances with our PESTLE analysis. Uncover how political landscapes, economic shifts, and social trends influence their operations. Learn about the impact of new technologies and evolving environmental regulations. This concise overview provides key insights, but there's more! Download the complete analysis for a comprehensive view and strategic advantage.

Political factors

International Flavors & Fragrances (IFF) faces geopolitical risks due to its global operations. Trade policies, like those from the US-China tensions, disrupt supply chains. These disruptions can increase costs through tariffs and import restrictions. In 2024, IFF's global revenue was $12.1 billion, highlighting its exposure.

International Flavors & Fragrances (IFF) faces a complex regulatory compliance landscape across various countries. This includes adhering to chemical safety regulations such as REACH in the EU and EPA rules in the US. IFF also navigates environmental regulations in China, impacting sourcing and formulation. Recent data shows that in 2024, IFF allocated approximately $150 million for regulatory compliance globally.

Governments globally are pushing sustainability and green chemistry initiatives. These policies impact International Flavors & Fragrances (IFF), as seen in the EU's Green Deal. IFF must adapt its product development to meet these standards. In 2024, IFF invested heavily in R&D for eco-friendly solutions, allocating $250 million.

Political Instability

Political instability poses a significant risk to IFF's operations, particularly in regions crucial for raw material sourcing or manufacturing. Civil unrest or conflict can halt production, damage facilities, and disrupt supply chains. For instance, the ongoing geopolitical tensions in various parts of the world have increased the volatility of raw material prices. This can lead to higher operational costs and potential revenue losses for IFF.

- Supply chain disruptions can lead to a decrease in revenue.

- Geopolitical issues have increased the volatility of raw material prices.

- Political instability can lead to higher operational costs.

Competition Law Enforcement

Regulatory scrutiny is intensifying. Competition law enforcement bodies like the European Commission are actively investigating the flavors and fragrances market. This includes probes into potential anti-competitive practices, such as agreements on hiring and recruitment. These investigations could lead to significant fines and operational changes. The focus is on ensuring fair market practices and preventing monopolies.

- In 2024, the European Commission fined several companies for anti-competitive practices.

- The UK's CMA is also increasing its investigations into the sector.

- These actions are part of a broader global trend towards stricter competition laws.

- IFF's legal and compliance costs are expected to rise in 2024/2025.

IFF navigates political risks from global trade policies and geopolitical instability. Competition law scrutiny, like EU investigations, could impact IFF financially, with fines and operational shifts expected. Adapting to changing global dynamics and stricter competition regulations is essential. Regulatory compliance is projected to cost more in 2024/2025.

| Political Factor | Impact | Financial Implication |

|---|---|---|

| Trade Policy | Supply Chain Disruptions | Increased Costs, Revenue Loss |

| Geopolitical Instability | Raw Material Price Volatility | Higher Operational Costs |

| Regulatory Scrutiny | Anti-Competitive Practices Probes | Fines, Operational Changes |

Economic factors

Raw material costs are crucial for IFF, significantly impacting its financials. Essential oils and synthetic ingredients price volatility directly affects profitability.

In 2024, IFF's cost of goods sold was approximately $5.5 billion. The company expects continued pricing pressure on key materials.

For example, the price of citrus oils has fluctuated by up to 20% in the last year. This volatility necessitates careful hedging strategies.

IFF uses long-term contracts and hedging to manage these risks. These strategies aim to stabilize margins despite market fluctuations.

Monitoring these costs and the effectiveness of risk mitigation is critical for assessing IFF's financial health.

Global economic conditions and uncertainties, such as inflation and interest rates, significantly influence consumer spending habits. Premium fragrances and flavors, often considered discretionary purchases, are particularly susceptible to economic downturns. Data from early 2024 indicates fluctuating consumer confidence levels globally. Recessions can lead to decreased demand, impacting IFF's sales.

IFF faces currency risks due to its global operations. Exchange rate swings, especially with Euro and emerging market currencies, affect reported financials. For example, in Q1 2024, currency fluctuations negatively impacted IFF's revenue by approximately 2%. This is a consistent challenge for the company.

Mergers and Acquisitions

Strategic mergers and acquisitions (M&A) significantly shape IFF's economic landscape. The merger with DuPont's Nutrition & Biosciences in 2021 illustrates this, expanding IFF's market reach. Planned divestitures, like the Pharma Solutions business, redirect resources. These actions drive synergy savings and focused investment.

- IFF's revenue in 2024 was approximately $11.5 billion.

- The Nutrition & Biosciences merger aimed for $300 million in cost synergies.

- Divestitures help streamline operations and boost profitability.

Market Growth in Flavors and Fragrances

The flavors and fragrances market is expected to grow steadily despite economic uncertainties. This growth is fueled by consumer demand for enhanced sensory experiences. Data from 2024 shows the global market valued at $32.7 billion. Projections estimate it will reach $41.3 billion by 2029. This growth is attributed to rising disposable incomes and product innovation.

- Market value in 2024: $32.7 billion.

- Projected market value by 2029: $41.3 billion.

- Growth drivers: Increased disposable incomes and innovation.

IFF faces economic risks from volatile raw material costs and currency fluctuations, which directly impact profitability. Inflation and interest rates influence consumer spending, affecting demand for premium products. Strategic M&A activities reshape the company's market position.

| Economic Factor | Impact on IFF | 2024 Data/Projections |

|---|---|---|

| Raw Material Costs | Affects COGS and margins | COGS ~$5.5B, citrus oil volatility up to 20% |

| Currency Risks | Impacts reported revenue | Q1 2024 revenue down ~2% due to FX |

| Market Growth | Drives demand for flavors & fragrances | 2024 market ~$32.7B; proj. to $41.3B by 2029 |

Sociological factors

Consumer demand for natural and organic ingredients is surging, influencing the flavors and fragrances industry. This shift pushes companies like International Flavors & Fragrances to innovate with natural alternatives. The global organic food market is projected to reach $390 billion by 2025, reflecting this trend. This impacts sourcing strategies and product development.

Consumers prioritize health and wellness, boosting demand for beneficial products. This shifts preferences toward flavors and fragrances with natural components. The global health and wellness market is projected to reach $7 trillion by 2025. IFF responds by developing natural and sustainable ingredients. Increased wellness focus affects product formulation and market trends.

Consumers increasingly favor sustainable and ethical products. This trend boosts demand for responsibly sourced ingredients. In 2024, the global green packaging market was valued at $280 billion. IFF is adapting to meet these evolving consumer preferences. The company is investing in sustainable practices and transparent supply chains.

Demand for Personalization and Unique Sensory Experiences

Consumers increasingly desire personalized products and unique sensory experiences, driving demand for customized flavor and fragrance profiles. This trend compels companies like IFF to innovate with product formulations. The global fragrance market is projected to reach $70.9 billion by 2025. IFF's focus on tailored solutions aligns with this market growth.

- Personalization drives demand for customized flavor and fragrance.

- IFF responds by developing innovative product formulations.

- The fragrance market is predicted to reach $70.9 billion by 2025.

Influence of Social Media and Digital Trends

Social media significantly shapes consumer choices in beauty and personal care, directly affecting fragrance preferences. Digital platforms amplify trends, influencing demand for specific scents and product features. IFF must adapt to these rapid shifts to stay relevant. In 2024, social media's impact on beauty sales reached $15 billion.

- Digital marketing spending in the beauty sector is projected to reach $8 billion by 2025.

- Influencer marketing campaigns can boost product visibility by 40%.

- Consumers increasingly seek personalized and digitally-driven experiences.

Sociological trends highlight rising demand for natural, sustainable products and personalized experiences. Consumers increasingly favor brands prioritizing health, wellness, and ethical sourcing. Social media significantly shapes these choices, especially in the beauty sector.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Health & Wellness | Demand for natural ingredients | Market at $7T by 2025 |

| Sustainability | Ethical sourcing, packaging | Green packaging market $280B in 2024 |

| Social Media | Influencing purchase decisions | Beauty sales impact: $15B (2024), $8B digital marketing by 2025 |

Technological factors

Biotechnology advancements drive sustainable flavor/fragrance production. Precision fermentation, synthetic biology, and enzymatic conversion create new molecules. IFF invests heavily; research spending in 2024 was $300 million. This boosts product innovation. The market for sustainable ingredients is projected to reach $20 billion by 2025.

International Flavors & Fragrances (IFF) leverages AI and machine learning to swiftly develop customized flavor and fragrance profiles. These profiles are tailored to specific regions, using consumer behavior data for precision. This approach allows IFF to meet evolving consumer preferences effectively. Notably, the global flavors and fragrances market, valued at $30.2 billion in 2024, is projected to reach $38.8 billion by 2029.

Ongoing advancements in extraction and formulation tech enable IFF to produce superior flavors and fragrances. This includes using bio-sourced and biodegradable solvents, aligning with sustainability goals. IFF invested $237 million in R&D in 2023, driving innovation. This focus on technology helps IFF stay competitive and meet evolving consumer demands.

Digital Transformation and Operational Efficiency

Digital transformation is key for International Flavors & Fragrances (IFF) to boost efficiency. Advanced IT systems optimize supply chains and business functions. IFF's tech investments are projected to increase operational effectiveness. For instance, in 2024, IFF invested $150 million in digital initiatives. This led to a 5% reduction in supply chain costs.

- Digital transformation investments are crucial for IFF's operational improvements.

- Advanced IT systems enhance supply chain and business effectiveness.

- IFF's 2024 digital investments totaled $150 million.

- These investments resulted in a 5% reduction in supply chain expenses.

Development of Sustainable Product Solutions

Technology is crucial for International Flavors & Fragrances (IFF) to create sustainable products. This includes using biodegradable ingredients and materials to minimize environmental impact throughout the product's life. IFF invests heavily in R&D, with spending of $315 million in 2023, showing their commitment to innovation. Such innovations are vital for meeting consumer demand for eco-friendly products.

- IFF aims to reduce its environmental footprint.

- R&D spending is a key driver for sustainable solutions.

- Consumers increasingly prefer sustainable products.

- Technology enables the creation of eco-friendly ingredients.

Technology significantly influences International Flavors & Fragrances (IFF). R&D investment in 2024 was $300 million, boosting innovation. Sustainable ingredient market is expected to reach $20 billion by 2025. Digital initiatives in 2024 amounted to $150 million.

| Technological Factor | Impact on IFF | Financial Data (2024) |

|---|---|---|

| Biotechnology Advancements | Drives sustainable flavor/fragrance production; new molecule creation | R&D spending: $300M |

| AI and Machine Learning | Develops customized profiles; meets consumer preferences | Global F&F market value: $30.2B |

| Extraction and Formulation Tech | Enables superior product quality, sustainability focus | Investment in R&D $237 million (2023) |

| Digital Transformation | Optimizes supply chains, boosts efficiency | Digital investment: $150M; supply chain cost reduction: 5% |

Legal factors

Intellectual property (IP) protection is paramount for International Flavors & Fragrances (IFF). IFF secures its unique formulations via patents and trademarks. The company's global patent portfolio is continuously updated. In 2024, IFF spent $200 million on R&D and IP.

IFF faces stringent compliance with global chemical regulations. These laws dictate ingredient safety, labeling, and usage across different regions. The European Union's REACH regulation is a key example, impacting IFF's product development and market access. In 2024, IFF spent $150 million on regulatory compliance, reflecting the costs.

Labor law shifts globally affect IFF's operations. Regulations influence hiring, staffing, and expenses. For instance, minimum wage changes in Europe, potentially 2024-2025, could raise labor costs. Compliance with evolving employment standards, like those in the EU's updated directives, demands adjustments. IFF must adapt to maintain competitiveness and manage costs effectively.

Anti-Bribery and Anti-Corruption Laws

International Flavors & Fragrances (IFF) must strictly adhere to anti-bribery and anti-corruption laws, particularly the U.S. Foreign Corrupt Practices Act (FCPA), to maintain ethical conduct. These regulations are vital for its global operations, ensuring fair business practices across diverse markets. Non-compliance can lead to severe penalties, including substantial fines and reputational damage, which can negatively impact its financial performance. IFF's commitment to these laws is crucial for its long-term sustainability and investor trust.

- In 2023, the DOJ and SEC collectively obtained over $5.2 billion in penalties for FCPA violations.

- IFF's revenue for 2024 is projected to be around $12.5 billion.

Competition Law Investigations and Compliance

IFF faces competition law investigations, underscoring the need for compliance. Authorities scrutinize potential anti-competitive practices. Obstruction of investigations can lead to hefty penalties. For example, companies can face fines up to 10% of their global annual turnover.

- Investigations by competition authorities are common in the flavor and fragrance industry.

- Compliance programs are crucial to avoid legal issues.

- Penalties for non-compliance can be substantial.

IFF prioritizes IP protection via patents and trademarks. The company must comply with chemical regulations, like REACH, incurring significant costs. Labor laws influence hiring and expenses; changing minimum wages pose financial challenges. IFF also adheres to anti-corruption laws.

| Legal Factor | Impact | Financial Implication |

|---|---|---|

| IP Protection | Secures unique formulations | $200M R&D and IP in 2024 |

| Chemical Regulations | Dictates ingredient safety and usage | $150M compliance costs in 2024 |

| Labor Laws | Affects hiring, staffing, costs | Potentially higher costs, EU directives. |

Environmental factors

IFF prioritizes sustainability, aiming to cut emissions, eliminate landfill waste, and enhance water management. For example, in 2023, IFF reduced its Scope 1 and 2 emissions by 25% compared to 2019. The company’s environmental efforts include science-based targets and initiatives like RE100.

Responsible sourcing of natural ingredients is crucial for IFF, focusing on sustainability and ethics. This includes regenerative agriculture and biodiversity protection, vital for long-term supply chain resilience. In 2024, IFF invested $50 million in sustainable sourcing programs. They aim to source 100% of key ingredients sustainably by 2030.

International Flavors & Fragrances (IFF) focuses on waste reduction and circular economy practices to lower its environmental impact. This involves optimizing processes to minimize waste generation and reusing materials. For example, IFF has set goals to reduce waste intensity by 15% by 2025, according to its sustainability reports. This approach not only benefits the environment but also improves operational efficiency.

Water Stewardship

International Flavors & Fragrances (IFF) must prioritize water stewardship to address environmental concerns and operational risks. This involves reducing water consumption and wastewater discharge, especially in water-scarce regions. IFF's water management strategies are crucial for sustainable operations and regulatory compliance. In 2024, water stress is a significant issue for many of IFF's manufacturing sites globally.

- Water stress is increasing globally, impacting manufacturing.

- IFF is implementing water reduction and recycling initiatives.

- Compliance with water regulations is a key operational factor.

- Stakeholders increasingly demand sustainable water practices.

Climate Change and Emission Reductions

International Flavors & Fragrances (IFF) faces increasing pressure to address climate change. This involves cutting greenhouse gas emissions, aligning with global climate agreements like the Paris Agreement. The company is also expected to increase its use of renewable energy across its operations. These actions are crucial for sustainability.

- IFF aims to reduce its Scope 1 and 2 emissions by 30% by 2030.

- In 2024, renewable energy accounted for 25% of IFF's global electricity usage.

- IFF is investing in sustainable sourcing of raw materials.

IFF focuses on cutting emissions, aiming for 30% reduction by 2030 and increased renewable energy use. By 2024, renewable energy met 25% of IFF's electricity needs globally, reducing its carbon footprint. They're also sourcing key ingredients sustainably, with $50 million invested in sustainable sourcing programs in 2024.

| Environmental Aspect | IFF's Focus | 2024/2025 Data |

|---|---|---|

| Emissions | Reduce greenhouse gases (GHG) | 25% reduction in Scope 1 & 2 emissions by 2023 (vs. 2019), aiming 30% reduction by 2030. |

| Sourcing | Sustainable & responsible ingredients | $50M investment in sustainable programs (2024). Aiming 100% sustainable sourcing of key ingredients by 2030. |

| Waste | Waste Reduction & Circular Economy | 15% reduction in waste intensity target by 2025. |

PESTLE Analysis Data Sources

The IFF PESTLE analysis uses data from government sources, economic databases, industry reports and market research firms. We incorporate global institutions data too.