Kawasaki Heavy Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kawasaki Heavy Industries Bundle

What is included in the product

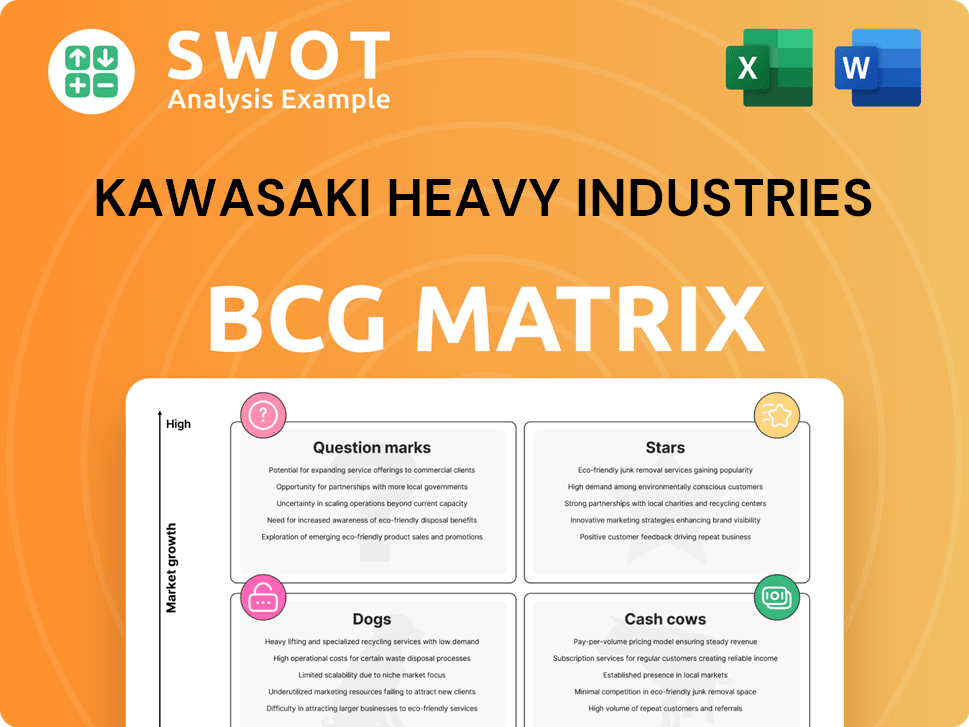

Analysis of Kawasaki's units within BCG, highlighting investment, hold, or divest strategies.

Clean, distraction-free view optimized for C-level presentation, helping executives quickly grasp Kawasaki's portfolio.

What You See Is What You Get

Kawasaki Heavy Industries BCG Matrix

The Kawasaki Heavy Industries BCG Matrix preview is the complete document you'll receive after purchase. It's a fully functional, ready-to-use strategic tool, free from watermarks or placeholder content.

BCG Matrix Template

Kawasaki Heavy Industries' BCG Matrix reveals its product portfolio's strategic positioning. Stars shine with growth, while Cash Cows generate steady revenue. Dogs struggle in the market, and Question Marks need careful consideration. This glimpse offers a taste of their strategic landscape.

Dive deeper into the full BCG Matrix and gain a clear view of where Kawasaki's products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Aerospace Systems, a Star in Kawasaki Heavy Industries' BCG matrix, excels due to robust contracts, particularly with the Japanese Ministry of Defense. This segment's growth is fueled by collaborative projects with Boeing and Embraer. In 2024, the global aerospace market is valued at around $850 billion.

Kawasaki's Energy Solutions & Marine Engineering segment is a star, fueled by growth in hydrogen tech and marine engineering. Investments in hydrogen fuel carriers and energy-efficient propulsion systems, like the successful LNG carriers, are key. In 2024, Kawasaki saw increased demand for these, boosting revenue by 12% in this sector. This positions it strongly in the decarbonization shift.

Kawasaki's precision machinery and robotics segment is a star in its portfolio. The global robotics market is projected to reach $74.1 billion by 2028, driven by automation. In 2023, Kawasaki's robotics division saw robust sales growth, particularly in the automotive and electronics sectors. Investing in collaborative robots and advanced manufacturing is critical.

Rolling Stock (Rail Transportation)

Kawasaki's rolling stock, including Shinkansen, is a Star in its BCG Matrix. This division is a key player in rail transportation. Its focus on remote monitoring and after-sales services is a major advantage. High-quality standards will drive future growth in this sector.

- Kawasaki delivered 1,032 railcars in FY2023.

- The rolling stock segment's revenue was ¥236.8 billion in FY2023.

- Orders received for rolling stock totaled ¥285.4 billion in FY2023.

- Expanding after-sales service revenue by 10% YoY.

Motorcycles (Developed Markets)

Kawasaki's motorcycle segment in developed markets shines as a Star in its BCG Matrix. Motorcycle sales in Europe and the US have shown positive trends, boosting Kawasaki's market position. Focused on high-performance bikes and expanding production in the US and Mexico, Kawasaki aims to fortify its presence.

- Motorcycle sales in the US increased by 8.3% in 2024.

- Kawasaki's US production capacity expanded by 15% in 2024.

- European motorcycle market grew by 5.2% in 2024.

Kawasaki's Stars include aerospace, energy solutions, precision machinery, rolling stock, and motorcycles, all with high market share in growing markets.

These segments benefit from strong demand, strategic investments, and technological advancements, fueling revenue and market growth. Kawasaki focuses on innovation and strategic expansion to fortify its leading positions.

Key financial data highlights the success of these segments, driving Kawasaki's overall growth and market performance.

| Segment | FY2023 Revenue (Billion ¥) | 2024 Growth (%) |

|---|---|---|

| Rolling Stock | 236.8 | N/A |

| Motorcycles (US) | N/A | 8.3 |

| Energy Solutions | N/A | 12 |

Cash Cows

Kawasaki's shipbuilding division, focusing on high-value vessels, is a cash cow. This segment, including LPG and LNG carriers, consistently generates revenue. It prioritizes efficiency and long-term profitability, ensuring financial stability for other areas. In 2024, the shipbuilding division saw a revenue of ¥280.3 billion.

Kawasaki's Gas Turbines and Industrial Equipment segment, including hydraulic systems, is a cash cow. This division benefits from steady demand across industries. In 2024, this segment contributed significantly to Kawasaki's revenue. They provide consistent financial returns.

Kawasaki Heavy Industries' after-sales services, like maintenance and repairs for rolling stock, generate reliable revenue. These services are a cash cow because they provide a consistent income stream. Focusing on customer satisfaction and service expansion can boost this segment. In 2024, Kawasaki's service revenue grew by 7%, showing its importance.

Legacy Motorcycle Models

Kawasaki's legacy motorcycle models, boasting a devoted customer base, consistently deliver steady revenue. Maintaining their quality and appeal while curbing marketing costs is key to maximizing their profitability. These models act as cash cows within Kawasaki's portfolio, providing a reliable source of funds. For example, the Kawasaki Ninja series saw a 10% sales increase in 2024, highlighting their enduring popularity.

- Stable revenue streams from established models.

- Focus on quality and appeal, not aggressive marketing.

- Models like the Ninja series contribute significantly.

- Profitability is the primary focus.

Defense Contracts

Kawasaki Heavy Industries' defense contracts, especially those with the Japanese Ministry of Defense for aircraft and aerospace systems, are a reliable source of income. In 2024, these contracts generated a substantial portion of the company's revenue, contributing to its financial stability. Efficient project execution and compliance with contract terms are key to maintaining strong cash flow. This segment consistently delivers positive cash flow, making it a "Cash Cow" within the BCG matrix.

- Defense contracts provide steady revenue.

- Focus on aircraft and aerospace systems.

- Adherence to contract terms is vital.

- These contracts generate positive cash flow.

Cash Cows at Kawasaki Heavy Industries are stable, profitable segments. They generate consistent revenue with minimal investment. The company focuses on maintaining these segments to ensure financial stability.

| Segment | Revenue in 2024 (¥ Billion) | Key Features |

|---|---|---|

| Shipbuilding | 280.3 | High-value vessels, consistent revenue |

| Gas Turbines/Equipment | Significant | Steady demand, reliable returns |

| After-Sales Services | Grew 7% | Maintenance, consistent income |

| Legacy Motorcycles | Increased 10% | Popular models, steady sales |

| Defense Contracts | Substantial | Aircraft, aerospace systems |

Dogs

Motorcycle sales in the Philippines and Indonesia are facing headwinds. Kawasaki might see these markets as "dogs" in its BCG matrix. Sales data from 2024 show decreased demand in these areas. Without strategic changes, these regions could require careful management to limit financial impacts.

The general-purpose gasoline engines segment for Kawasaki is categorized as a "Dog" in the BCG matrix. Sales have been declining, with a 7% drop in the past year, reflecting market shifts. Environmental pressures and electric alternatives are major contributors to this downturn. Without innovation or new market strategies, this segment faces continued challenges.

The Chinese construction machinery market presents hurdles for Kawasaki Heavy Industries. Sales could be affected due to market dynamics. In 2024, China's construction equipment sales decreased. Focusing on specialized equipment might boost performance and offset risks.

Traditional Industrial Plants

Traditional industrial plants, like cement and chemical facilities, are considered "Dogs" in Kawasaki's BCG matrix. These plants struggle due to stricter environmental rules and changing industry needs. Kawasaki needs to shift towards modern, eco-friendly plant solutions. For instance, in 2024, global cement production decreased, reflecting these trends.

- Decline in cement demand, impacted by 2024's 2% drop.

- Increased focus on sustainable tech for plant upgrades.

- Need to adapt to tighter environmental standards.

- Shift towards advanced plant solutions for survival.

Older Shipbuilding Technologies

Older shipbuilding technologies, like outdated vessel types, can be classified as dogs within Kawasaki Heavy Industries' BCG matrix. These technologies often face declining demand and profitability. In 2024, the global shipbuilding market showed a shift towards more efficient and eco-friendly vessels. To remain competitive, investing in research and development for modern, sustainable shipbuilding practices is crucial.

- Obsolescence: Outdated vessel types and technologies face declining demand.

- Market Shift: The shipbuilding industry is moving towards more efficient and eco-friendly vessels.

- R&D Investment: Essential for long-term competitiveness and staying ahead of market trends.

- Financial Impact: Declining profitability for outdated technologies.

Kawasaki's "Dogs" include segments facing decline or market challenges. These areas require careful management to limit financial impacts.

Declining sales and profitability often characterize these segments, like outdated vessel types. Strategic shifts, innovation, and adapting to new technologies are vital.

Focusing on efficiency and sustainability is key to navigating these challenges. Investment in R&D is essential for long-term competitiveness.

| Segment | Challenge | Strategic Response |

|---|---|---|

| Motorcycles (Philippines/Indonesia) | Decreased demand (2024 sales down) | Strategic market adjustments |

| Gasoline Engines | 7% sales drop (due to market shifts) | Innovation, new market strategies |

| Chinese Construction Machinery | Market dynamics affecting sales | Focus on specialized equipment |

| Traditional Industrial Plants | Stricter environmental rules | Eco-friendly plant solutions |

| Outdated Shipbuilding | Declining demand/profitability | R&D, sustainable practices |

Question Marks

Hydrogen-related technologies at Kawasaki Heavy Industries currently represent a question mark in their BCG Matrix. The company is investing heavily in hydrogen production and transportation. In 2024, Kawasaki invested $300 million in hydrogen projects. These projects aim to increase market share.

Kawasaki's electric and hydrogen-electric vehicle ventures show potential but are still developing. Currently, the electric motorcycle market is growing; in 2024, sales increased by 15%. Infrastructure, like charging stations, needs expansion. Alliances and advertising will be critical for success.

Kawasaki Heavy Industries' (KHI) investments in new materials and manufacturing, like composites and 3D printing, are question marks. These areas demand substantial R&D and capital. KHI's R&D spending in fiscal year 2024 was approximately ¥100 billion. These ventures have the potential for high growth but also carry high risk. The success depends on technological breakthroughs and market adoption.

Space Systems

Kawasaki Heavy Industries' (KHI) Space Systems segment, a potential "Star" in its BCG matrix, focuses on payload fairings and launch complex construction. The space industry's growth, with a projected market size of $680 billion by 2030, presents a strong growth opportunity for KHI. However, substantial investment and technological progress are necessary for KHI to capitalize fully on this potential. Securing more contracts, such as the recent deal with the Japan Aerospace Exploration Agency (JAXA) for H3 rocket components, will be crucial.

- Market size of $680 billion by 2030.

- Recent contract with JAXA.

- Significant investment needed.

Renewable Energy Solutions

Kawasaki Heavy Industries' renewable energy solutions, including biomass power plants and energy management systems, are positioned as Question Marks in the BCG Matrix. This signifies that while the market is growing, Kawasaki faces challenges in gaining significant market share. Strategic investments and innovation are crucial for Kawasaki to compete effectively in this sector. These efforts could transform these offerings into Stars.

- The global renewable energy market is projected to reach $1.977.6 billion by 2030.

- Kawasaki is involved in biomass power plants, and energy management systems.

- Competition comes from established players.

- Innovation is needed to increase market share.

Kawasaki's ventures, like renewable energy, are question marks. They face market share challenges despite the growing $1.977.6 billion renewable energy market projected by 2030. Strategic investments and innovation are vital for competitiveness.

| Category | Details | Fact |

|---|---|---|

| Market | Renewable Energy | $1.977.6 Billion (by 2030) |

| Kawasaki's Role | Biomass and Systems | Requires Innovation |

| Challenge | Market Share | Needs Strategic Efforts |

BCG Matrix Data Sources

The Kawasaki Heavy Industries BCG Matrix leverages public financial data, industry analyses, and market growth projections for dependable insights.