Marsh McLennan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marsh McLennan Bundle

What is included in the product

Highlights competitive advantages and threats per quadrant

Easily switch color palettes for brand alignment for presenting the BCG matrix

Preview = Final Product

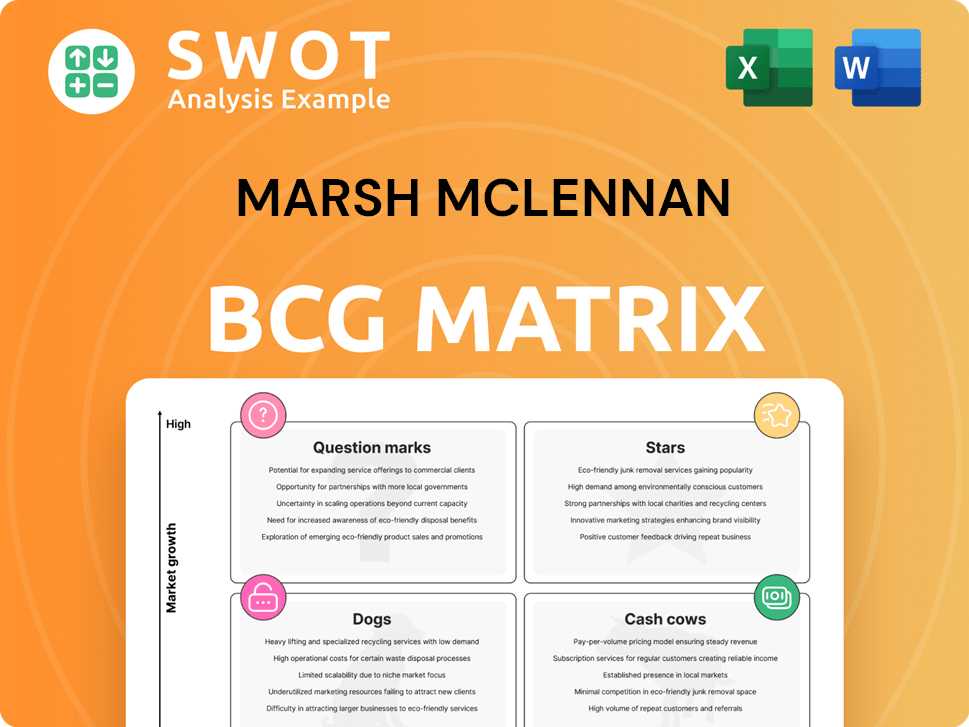

Marsh McLennan BCG Matrix

The Marsh McLennan BCG Matrix preview is the same document you'll obtain after purchasing. It's a fully functional report, ready for strategic planning and analysis, just as you see it now.

BCG Matrix Template

The Marsh McLennan BCG Matrix offers a snapshot of the company's diverse portfolio. This strategic tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks. Understanding these positions is key to informed investment decisions. This preview is just a taste. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Marsh, a key player in Marsh McLennan's portfolio, excels as a "Star." It leads globally in insurance broking and risk management. In 2024, Marsh's revenue grew, reflecting its strong market position. Its focus on complex risks, such as cyber and climate, fuels its growth. Marsh's innovation keeps it ahead, serving clients worldwide.

Guy Carpenter, a key part of Marsh McLennan, is a significant player in the reinsurance market. This sector is growing, driven by the need for risk management. Guy Carpenter excels in analytics and capital markets. This helps clients handle market swings and find capital. For example, in 2024, the reinsurance market saw a 9% increase in premiums.

Oliver Wyman, a Marsh McLennan subsidiary, excels as a "Star" in the BCG matrix. It thrives in high-growth markets, fueled by digital transformation. Oliver Wyman's strong market share stems from its broad industry expertise and digital analytics capabilities. In 2024, consulting revenue is projected to reach $21.4 billion. Recent acquisitions, like Innopay, have expanded its advisory services.

MMA (Marsh McLennan Agency)

MMA, a key component of Marsh McLennan, is a "Star" in its BCG Matrix, indicating high growth and market share. The firm's strategic focus on the middle market has driven rapid expansion, supported by acquisitions. In 2024, MMA's workforce reached 15,000 colleagues and generated approximately $5 billion in revenue. This revenue represents about one-third of Marsh McLennan's total global revenue.

- High Growth: MMA experiences significant growth within the middle market.

- Market Share: MMA holds a substantial market share within its target sector.

- Strategic Focus: The firm prioritizes the middle market for expansion.

- Revenue Contribution: MMA contributes roughly a third of Marsh's global revenue.

Cyber Risk Solutions

Cyber Risk Solutions, a key area for Marsh McLennan, is a high-growth segment within the BCG matrix. The company leverages its expertise to provide advisory services and solutions addressing the rising frequency of cyberattacks. Marsh McLennan's commitment to responsible AI use is evident through its comprehensive framework. In 2024, cyber insurance premiums increased, reflecting the growing risk.

- Cyber insurance premiums saw a significant increase in 2024.

- Marsh McLennan's advisory services help clients manage cyber threats.

- The company emphasizes ethical and compliant AI practices.

- The cyber risk market is expanding due to increased attacks.

These "Stars" demonstrate high growth and significant market share. They are key drivers within Marsh McLennan's portfolio. The firms such as Marsh, Guy Carpenter, Oliver Wyman, and MMA generate substantial revenue.

| Business Unit | 2024 Revenue (Projected) | Market Position |

|---|---|---|

| Marsh | Growing | Global Leader |

| Guy Carpenter | Increased Premiums (9%) | Reinsurance Market |

| Oliver Wyman | $21.4B (Consulting) | High Growth |

| MMA | $5B (Revenue) | Middle Market Leader |

Cash Cows

The Risk and Insurance Services segment, including Marsh and Guy Carpenter, is a cash cow due to its strong market position. This segment enjoys consistent cash flow from long-term client relationships.

It benefits from recurring revenue streams, which support its stability. In 2024, this segment had $4.8 billion in revenue, an 11% increase year-over-year.

Traditional insurance broking, a steady cash cow for Marsh McLennan, provides consistent revenue. These services benefit from established client relationships. Marsh introduced client representation through brokerage. In 2024, Marsh McLennan's revenue was over $23 billion. This sector remains crucial.

Reinsurance brokerage, like traditional insurance, generates consistent revenue and cash flow. Guy Carpenter, a key player, benefits from insurers' continuous risk management needs. In 2024, Guy Carpenter's revenue reached $1.2 billion, reflecting its strong market position. This steady performance solidifies its status as a cash cow within Marsh McLennan's portfolio.

Employee Health & Benefits Consulting (Mercer)

Mercer's employee health and benefits consulting is a cash cow for Marsh McLennan. This segment thrives in a stable market, providing consistent revenue. The demand for these services is steady, as companies always need to attract and retain employees. Mercer, a leading firm, generated $5.7 billion in revenue.

- Steady demand from employers.

- Essential services for talent management.

- Consistent cash flow generation.

- Mercer's strong market position.

Investment Consulting (Mercer)

Mercer's investment consulting arm, a key part of Marsh McLennan, is a cash cow. This is fueled by the consistent demand from institutional investors for asset management. The outsourced CIO (OCIO) services provided by Mercer, similar to Vanguard and Cardano, ensure steady, recurring revenue streams. This stability is supported by long-term client relationships.

- Mercer's OCIO assets under management (AUM) significantly contribute to its revenue.

- The OCIO market is growing, creating more opportunities for Mercer.

- Recurring fee structures provide predictable cash flow.

- Long-term client relationships increase revenue stability.

Cash cows at Marsh McLennan, including Risk and Insurance Services, consistently generate revenue. Traditional and reinsurance brokerage services benefit from long-term client relationships. Mercer's employee health and benefits consulting and investment consulting arms provide consistent revenue. The demand ensures steady cash flow.

| Segment | 2024 Revenue (USD Billions) | Key Drivers |

|---|---|---|

| Risk & Insurance Services | 4.8 | Long-term client relationships, recurring revenue |

| Guy Carpenter | 1.2 | Continuous risk management needs, market position |

| Mercer | 5.7 | Employee health and benefits, investment consulting, OCIO |

Dogs

In the Marsh McLennan BCG matrix, underperforming geographies are considered "dogs." These are regions where the company's presence is weak or competition is tough. Such areas might need substantial investment for improvement. For example, in 2024, Marsh McLennan's revenue from Asia-Pacific was $4.2 billion, a smaller share compared to North America's $12.6 billion.

Within Marsh McLennan, certain niche consulting areas, like those within Oliver Wyman or Mercer, might be considered "dogs" if they have low market share and limited growth. These areas might not align with the company's core focus on risk, strategy, and people. For example, if a specific, highly specialized consulting service within Mercer doesn't see significant demand, it could be classified as a dog. Marsh McLennan's revenue in 2024 was $23 billion.

Mercer's Career consulting arm, part of Marsh McLennan, experienced a minor 1% downturn. This segment's challenges might stem from changing workforce dynamics or rivalry from niche firms. In 2024, the global HR consulting market, where Mercer plays a significant role, is valued at approximately $70 billion, indicating the scale of the competitive landscape.

Legacy Technology Platforms

Legacy technology platforms at Marsh McLennan, which are costly to maintain and offer limited client value, fit the "Dogs" quadrant of the BCG matrix. These outdated systems can impede innovation and efficiency, necessitating upgrades or replacements. The professional services industry is undergoing a significant digital transformation, pushing for modernization. In 2024, companies are investing heavily in digital transformation. For example, the global digital transformation market was valued at $760 billion in 2024.

- Outdated tech platforms are costly to maintain.

- They offer limited value to clients.

- Hinder innovation and efficiency.

- Digital transformation is key.

Small, Underperforming Acquisitions

Some acquisitions by Marsh McLennan might underperform, becoming "dogs" in their portfolio if they don't meet financial expectations. These underperforming acquisitions may need restructuring or to be sold off to boost overall performance. In 2024, Marsh McLennan spent $9.4 billion on acquisitions to boost talent and capabilities.

- Acquisitions not meeting financial targets can be classified as "dogs".

- Restructuring or divestiture might be necessary to improve these acquisitions.

- Marsh McLennan invested billions in acquisitions to expand capabilities.

Dogs in the Marsh McLennan BCG matrix include underperforming geographies, niche consulting areas, and legacy tech platforms. These elements often have low market share or limited growth potential, requiring strategic intervention. In 2024, Marsh McLennan's investments in digital transformation and acquisitions highlight the company's focus on improving these areas.

| Category | Example | 2024 Data |

|---|---|---|

| Underperforming Geography | Asia-Pacific | $4.2B Revenue (vs. $12.6B in North America) |

| Niche Consulting Area | Specialized Mercer Services | Mercer Career consulting -1% |

| Legacy Tech Platforms | Outdated Systems | $760B Digital transformation market |

Question Marks

Marsh McLennan's AI platforms, such as Sentrisk and LenAI, fit the question mark category. These platforms, with high growth prospects, currently have an uncertain market share. Sentrisk, an AI supply chain risk platform, needs further market adoption. In 2024, Marsh McLennan invested heavily in AI, aiming for significant returns.

Sustainability and ESG consulting is a question mark for Marsh McLennan. The market is growing rapidly, but further investment is needed. In 2024, the ESG consulting market was valued at approximately $1.2 billion. Leveraging existing expertise is key to establishing a leading position.

Marsh McLennan's digital insurance solutions are a question mark, showing growth potential. Investments in tech and partnerships are key to gaining market share. Digital transformation significantly impacts professional services. In 2024, the global InsurTech market was valued at $10.65 billion.

Specialty Insurance Programs

Specialty insurance programs represent question marks within Marsh McLennan's BCG Matrix, especially new ventures targeting emerging risks or underserved markets. These programs demand thorough market analysis and precise marketing strategies to succeed. Marsh Affinity, a key player, utilizes affinity distribution models, selling insurance through corporate sponsors. In 2024, the global insurance market reached approximately $7 trillion, highlighting significant opportunities.

- Market analysis is crucial for success.

- Targeted marketing is essential.

- Marsh Affinity uses affinity distribution.

- The global insurance market is huge.

Geographic Expansion in Emerging Markets

Expanding into new geographic markets, especially in emerging economies, positions Marsh McLennan as a question mark within the BCG matrix. These markets have substantial growth prospects but also come with significant risks and uncertainties. This strategic move by Marsh & McLennan aligns with the need to diversify revenue streams and capitalize on global growth opportunities. However, the success of this expansion hinges on navigating complex regulatory landscapes and adapting to local market dynamics. In 2024, the company's strategic focus includes enhancing its presence in high-growth regions.

- Emerging markets offer high growth potential, with some regions experiencing double-digit economic expansion.

- Marsh & McLennan's expansion involves significant investments and resource allocation.

- Success depends on effective risk management and adaptability to local market conditions.

- Geographic expansion is a key strategic initiative for Marsh & McLennan in 2024, with a focus on high-growth regions.

Question marks represent areas with high growth potential but uncertain market share. These require strategic investments and market analysis. Digital solutions and geographic expansions are key areas. Marsh & McLennan aims to leverage expertise for growth.

| Category | Characteristics | Examples |

|---|---|---|

| High Growth | Uncertain market share, requires strategic investments | AI Platforms, Digital Insurance |

| Strategic Focus | Market analysis, targeted marketing, geographic expansion | ESG Consulting, Emerging Markets |

| 2024 Data | ESG market at $1.2B, InsurTech at $10.65B, global insurance market at $7T | Investments in tech and partnerships |

BCG Matrix Data Sources

This Marsh McLennan BCG Matrix uses market analysis, financial data, competitor intelligence, and industry trends, all to ensure our positioning is as factual as possible.