Marsh McLennan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marsh McLennan Bundle

What is included in the product

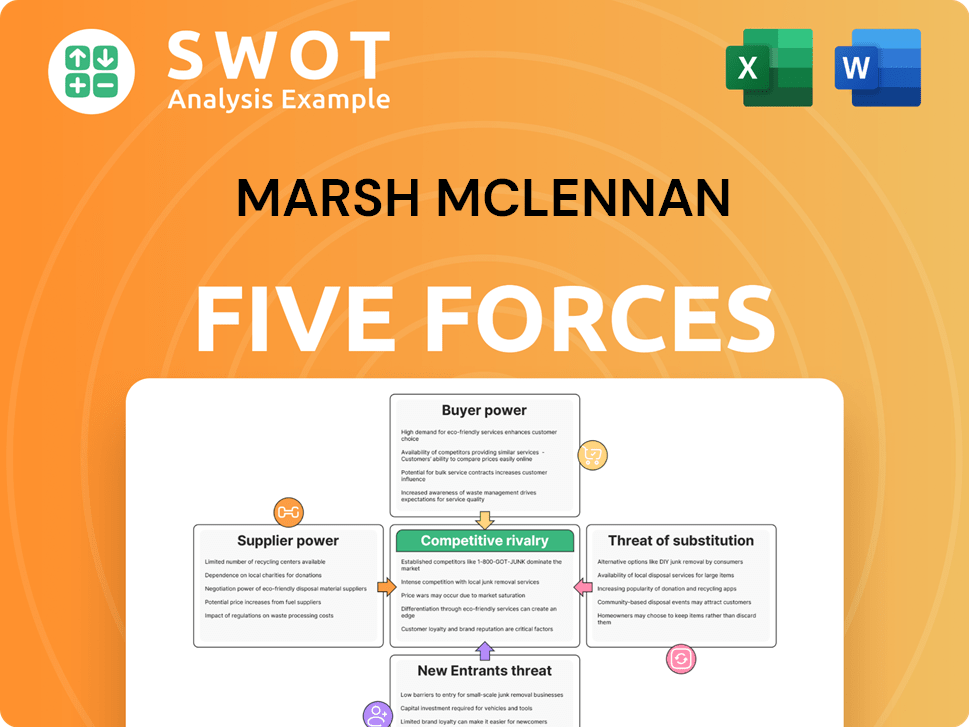

Marsh McLennan's competitive landscape examined through Porter's Five Forces. Analyzes threats, influence, and market dynamics.

Understand competitive pressure with an intuitive, data-driven visual chart.

What You See Is What You Get

Marsh McLennan Porter's Five Forces Analysis

You are viewing the complete Porter's Five Forces analysis of Marsh McLennan. This preview showcases the full document; there are no hidden sections.

The analysis provided is the same in its entirety as the one you’ll receive immediately after your purchase.

Get instant access to the in-depth, ready-to-use report—no changes are needed.

The document seen here is the deliverable, complete and formatted for your needs.

Porter's Five Forces Analysis Template

Marsh McLennan faces a complex competitive landscape, shaped by powerful industry forces. The threat of new entrants is moderate due to high capital requirements. Supplier power is relatively low, while buyer power is somewhat concentrated. Substitute products pose a limited threat. Competitive rivalry within the industry is intense.

Ready to move beyond the basics? Get a full strategic breakdown of Marsh McLennan’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Suppliers with unique expertise, such as data analytics firms, wield considerable power. Demand for specialized skills is high; over 70% of projects depend on it. Limited supply amplifies their bargaining position. For instance, in 2024, the demand for AI specialists surged, influencing project costs significantly.

The risk management sector has a concentration of specialized providers. In 2023, the top five firms, including Marsh & McLennan, held about 39% of the global market share. This concentration gives these suppliers increased bargaining power. They can influence pricing and terms due to their significant market presence.

Marsh McLennan's suppliers, especially those offering specialized risk management solutions, benefit from high switching costs, boosting their bargaining power. Switching analytics providers, for example, can cause a 15% to 30% dip in operational efficiency during transition. Furthermore, firms often face contractual obligations lasting 3 to 5 years. These factors limit clients' flexibility and strengthen supplier leverage.

Influence of Sponsors

Marsh McLennan's bargaining power with suppliers, including sponsors and industrial partners, is generally low. The company's strong global brand and extensive customer base limit supplier influence. Suppliers are keen to maintain relationships with Marsh McLennan, securing steady revenue streams and benefiting from the brand's reputation. This dynamic results in a relatively weak position for suppliers in negotiations.

- Marsh McLennan's 2024 revenue was around $23 billion, showcasing its financial strength.

- The company's market capitalization exceeds $80 billion, demonstrating its substantial size.

- Marsh McLennan's global presence and diverse client base reduce supplier leverage.

Technology Providers

Technology providers are increasingly influential in the insurance sector. These suppliers, especially those offering AI and data analytics, hold significant bargaining power. Marsh McLennan must invest in these technologies to stay competitive and deliver advanced solutions. For example, the global AI market in insurance was valued at $4.1 billion in 2023.

- Reliance on specialized tech increases supplier influence.

- Investment in AI and data analytics is crucial.

- Keeping pace with tech is essential for client solutions.

Suppliers, particularly those with specialized expertise, have considerable bargaining power. Limited supply and high demand, like for AI specialists in 2024, amplify their influence. Switching costs and contractual obligations further strengthen suppliers' leverage in negotiations.

| Factor | Impact | Data |

|---|---|---|

| Specialized Expertise | High Bargaining Power | AI market in insurance: $4.1B in 2023 |

| Switching Costs | Limits Client Flexibility | 15-30% efficiency dip during transition |

| Contractual Obligations | Boosts Supplier Leverage | Contracts often last 3-5 years |

Customers Bargaining Power

Marsh McLennan's (MMC) revenue heavily relies on large corporate clients, with over 30% from Fortune 500 firms. In 2022, MMC's revenue was $19.2 billion, highlighting the impact of these clients. These clients, often with $50B+ annual revenues, wield significant bargaining power. They can demand tailored services and competitive pricing, pressuring MMC.

Marsh McLennan's clients increasingly demand personalized financial services. This shift requires the firm to adapt its client interactions and service offerings. Customized solutions, like tailored investment strategies, are highly valued. For example, in 2024, the demand for personalized financial planning increased by 15% among high-net-worth individuals.

Customers, particularly large corporations, wield considerable influence over pricing due to their substantial business volume. These clients, some with revenues exceeding $50 billion in 2024, can demand tailored services and competitive rates. This exerts significant price pressure on Marsh McLennan Companies (MMC), impacting its profitability. The company's ability to retain these large clients and adapt to their demands is crucial.

Availability of Alternatives

Customers of Marsh McLennan, such as businesses seeking risk management services, have considerable bargaining power due to the availability of alternatives. They can easily switch to competitors like Aon or Willis Towers Watson for similar services. This competitive landscape puts pressure on Marsh McLennan to offer competitive pricing and value. The insurance brokerage market is highly competitive, with the top five brokers, including Marsh & McLennan, controlling a significant market share, but competition remains fierce.

- Aon's 2024 revenue was approximately $13.4 billion, highlighting its market presence.

- Willis Towers Watson's 2024 revenue was around $9.7 billion, also providing strong competition.

- Marsh & McLennan's 2024 revenue was approximately $23 billion, indicating its leading position in the market.

Demand for Flexible Engagement

Marsh McLennan's clients are increasingly demanding flexible engagement models. Project-based work is rising, alongside traditional retainers, as clients seek tailored solutions. Technology impacts the industry, offering consultants powerful tools but also risking commoditization of some services. The future hinges on consultancies leveraging tech to boost human expertise.

- Project-based consulting grew, representing a significant portion of overall consulting revenue in 2024.

- The market for AI-driven consulting solutions is projected to reach $100 billion by 2027.

- Clients are now using more sophisticated procurement processes.

- Companies are actively seeking consultants who can prove ROI.

Large corporate clients of Marsh McLennan, especially Fortune 500 firms, wield considerable bargaining power, impacting pricing and service demands. These clients, generating over 30% of MMC's revenue, can negotiate favorable terms. The availability of alternatives, like Aon and Willis Towers Watson, intensifies price pressure.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue Reliance | Percentage of revenue from large clients | Over 30% |

| Client Revenue | Avg. annual revenue of key clients | >$50B |

| Competitive Landscape | Key competitors and their 2024 revenue | Aon ($13.4B), Willis Towers Watson ($9.7B) |

Rivalry Among Competitors

Marsh McLennan faces fierce competition. Competitors include Aon and Willis Towers Watson, plus smaller firms. In 2024, Aon's revenue was about $13.4 billion. To succeed, Marsh McLennan must stand out.

Marsh McLennan faces intense rivalry, primarily from Aon, Willis Towers Watson, and Arthur J. Gallagher. In 2024, these competitors vie for market share in risk management and consulting. Aon's 2024 revenue reached $13.4 billion, highlighting the competitive landscape. This rivalry impacts pricing and service offerings within the industry.

Marsh McLennan's global footprint, spanning over 130 countries, intensifies competitive rivalry. This broad reach enables direct competition with global players, heightening market pressures. The company's localized expertise across these regions is a key differentiator. In 2024, Marsh McLennan generated $23 billion in revenue, showcasing its substantial global presence and the scale of its competitive arena.

Strategic Moves

Competitive rivalry intensifies as companies like Marsh McLennan make strategic moves to gain an edge. Acquisitions, such as Marsh McLennan's 2019 purchase of Jardine Lloyd Thompson Group (JLT), reshape the competitive landscape. These moves often involve significant investments in technology and talent to enhance service offerings and market reach. Such actions directly impact market share and profitability, driving ongoing competition within the industry.

- Marsh McLennan's revenue in 2023 was $23 billion, up from $20.7 billion in 2022.

- The JLT acquisition expanded Marsh McLennan's global footprint.

- Investments in digital platforms are a key strategic focus.

- The insurance brokerage industry is highly competitive.

Differentiation

Marsh McLennan, like other firms, battles intense rivalry, pushing for service differentiation. Innovation is crucial, with firms constantly needing to update their offerings to stay ahead. Technology, especially AI and data analytics, is reshaping the industry. This drives firms to adapt and invest in tech. Competition is fierce, leading to strategic moves.

- Marsh McLennan's revenue in 2023 was $20.7 billion, showing its market presence amid rivalry.

- Investments in digital platforms are increasing, with the global market for AI in financial services projected to reach $22.4 billion by 2025.

- The professional services industry sees high M&A activity, reflecting the need for firms to acquire new capabilities.

Marsh McLennan faces intense competition from Aon, Willis Towers Watson, and others, striving for market share in risk management and consulting. Strategic moves, like Marsh McLennan's acquisition of Jardine Lloyd Thompson Group, reshape the competitive landscape. In 2023, Marsh McLennan's revenue was $20.7 billion, highlighting its strong market presence.

| Metric | Value |

|---|---|

| Marsh McLennan Revenue (2023) | $20.7B |

| Aon Revenue (2024) | $13.4B |

| AI in Fin. Services Market (2025 Proj.) | $22.4B |

SSubstitutes Threaten

Companies might opt for in-house solutions, acting as substitutes for Marsh McLennan's services. This could impact the growth of external consulting. Rising costs, shrinking margins, and AI advancements pose threats. For example, the global management consulting market was valued at $181.3 billion in 2022, yet faces these challenges.

The threat of technological disruption looms large for Marsh McLennan. Digital platforms and AI can automate services, challenging traditional offerings. This rapid tech advancement is a key concern. Staying current with AI, blockchain, and data analytics is essential. In 2024, digital transformation spending in financial services reached $275 billion, emphasizing the urgency.

Smaller, niche consulting firms pose a threat as substitutes by offering specialized services, potentially at lower costs. In 2023, the consulting market saw a rise in specialized firms, increasing competition for broader service providers like Marsh McLennan. This fragmentation intensifies price pressures. For example, boutique firms increased their market share by 7% in specific areas.

Software and Automation

Software and automation pose a notable threat to Marsh McLennan. Solutions automating risk assessment and management are emerging substitutes. This includes AI and ML in talent management, a growing area. The market for AI in risk management is projected to reach $20 billion by 2024.

- AI in risk management market is projected to reach $20 billion by 2024.

- Automated solutions can replace some traditional services.

- Talent management software integrates AI and ML.

- Partnerships between hiring firms and services are increasing.

Delay or Cancellation

The threat of substitutes for Marsh McLennan includes clients potentially delaying or canceling projects amid economic downturns. This action effectively substitutes external services with internal cost-saving strategies. In times of uncertainty, clients seek trusted advisors and sector specialists. Marsh McLennan's expertise in tech, cybersecurity, cost efficiencies, and productivity becomes crucial.

- Economic uncertainty can lead to a reduction in consulting spending.

- Clients may opt for in-house solutions to manage costs.

- Marsh McLennan's specialized services become essential during crises.

- Focus on tech and cybersecurity remains vital for clients.

The threat of substitutes for Marsh McLennan stems from various sources. Companies choosing in-house solutions, smaller firms, and tech automation are key. Economic downturns also drive clients to cut external spending. The market for AI in risk management is projected to reach $20 billion by 2024.

| Substitute Type | Impact | Market Data |

|---|---|---|

| In-house Solutions | Reduces demand for external consulting | Global management consulting market: $181.3B (2022) |

| Tech Automation | Challenges traditional service offerings | Digital transformation spending in financial services: $275B (2024) |

| Specialized Firms | Increases competition | Boutique firms' market share increased by 7% (specific areas) |

Entrants Threaten

Newcomers to the insurance brokerage industry encounter substantial obstacles, especially with the high initial costs. Establishing an office can cost between $25 and $100 per square foot, depending on the location. Moreover, technology infrastructure demands over $100,000 in initial investments. Recruiting and training staff, particularly management consultants, adds significant expenses, with average U.S. salaries ranging from $90,000 to $150,000 annually, posing a major financial barrier.

Marsh McLennan's established brand and client loyalty create a formidable barrier for new entrants. Their global presence and reputation for expertise are significant advantages. In 2024, Marsh McLennan's revenue reached $23 billion, highlighting its market dominance. New competitors face the challenge of building trust and recognition to rival this established position.

New entrants in insurance and consulting face significant regulatory hurdles. The risk management industry is heavily regulated, demanding adherence to complex rules. Compliance costs are substantial, with evolving laws impacting operations. Marsh & McLennan Companies must stay updated on these changes. In 2024, the insurance industry faced increased scrutiny.

Expertise and Talent

Attracting and keeping top talent is crucial for Marsh McLennan, especially in competitive fields like insurance and risk management. The company invests significantly in its workforce. The challenge lies in recruiting and retaining skilled professionals amidst competition from new market players and other sectors. This directly impacts Marsh McLennan's ability to deliver services and maintain its market position.

- Talent Acquisition: Marsh McLennan spends a lot on recruiting, training, and developing its employees.

- Retention Rates: High turnover can hurt service quality and increase costs.

- Industry Competition: The insurance and consulting industries are very competitive for talent.

- Specialized Skills: Expertise in areas like data analytics and cyber risk is in high demand.

Technological Advancements

Technological advancements pose a significant threat to Marsh McLennan by requiring continuous adaptation. New entrants must invest heavily in technology and digital platforms to compete effectively. The insurance and risk management industry is seeing increased use of AI and data analytics. To stay competitive, Marsh McLennan needs to embrace digital transformation.

- In 2024, the global Insurtech market is valued at over $10.5 billion, showing the importance of tech.

- Companies are investing in AI-driven risk assessment tools to stay ahead.

- Developing proprietary technology is crucial to maintaining a competitive edge.

- Digital platforms enhance client service and operational efficiency.

New entrants in the insurance brokerage industry face high initial costs, including significant office space and technology investments. Brand recognition and client loyalty, especially with established firms like Marsh McLennan, pose a significant barrier. Regulatory hurdles and the need to attract skilled talent further challenge new competitors.

| Factor | Impact on New Entrants | 2024 Data Points |

|---|---|---|

| Startup Costs | High initial investments needed. | Office space: $25-$100/sq ft; Tech: >$100K; Salaries: $90K-$150K (U.S.) |

| Brand & Loyalty | Established firms have advantages. | Marsh McLennan revenue in 2024: $23 billion. |

| Regulations | Complex compliance requirements. | Increased scrutiny in the insurance sector. |

Porter's Five Forces Analysis Data Sources

The analysis utilizes Marsh & McLennan's public filings, industry reports, and market research for comprehensive competitive analysis.