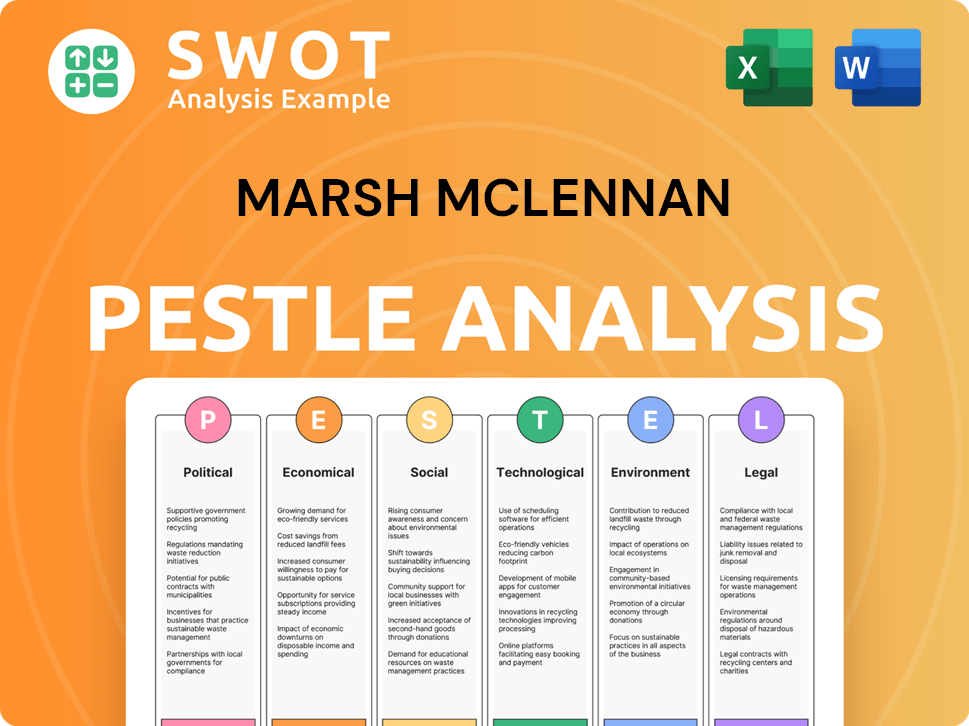

Marsh McLennan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marsh McLennan Bundle

What is included in the product

Analyzes the macro-environmental factors affecting Marsh McLennan using Political, Economic, Social, etc. factors.

Facilitates proactive identification of opportunities and threats to help the business make sound, strategic decisions.

Preview Before You Purchase

Marsh McLennan PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured.

This Marsh McLennan PESTLE Analysis contains a thorough examination. The preview showcases its complete layout. It's organized and easily accessible.

Upon purchase, expect immediate access to this same, high-quality analysis.

Ready to download, analyze, and use—instantly!

PESTLE Analysis Template

Navigate the complexities shaping Marsh McLennan with our insightful PESTLE Analysis. Uncover how political, economic, social, technological, legal, and environmental factors impact their strategy. This analysis offers a clear understanding of the external forces at play.

Gain a competitive edge by understanding the key drivers influencing the insurance brokerage and risk management landscape. Use our PESTLE to assess risks, opportunities, and market dynamics effectively.

Our fully researched report delivers concise, actionable intelligence ready for strategic planning. Make informed decisions faster with a comprehensive overview.

Download the full PESTLE Analysis now and equip yourself with essential insights. Access expert-level analysis for business growth!

Political factors

Geopolitical instability poses major risks for Marsh McLennan. Conflict and trade disputes can disrupt supply chains and increase business risks. For example, the Ukraine war continues to affect global markets. This boosts demand for risk management services, as businesses navigate uncertain environments.

Increased government intervention and policy uncertainty are significant challenges. In 2024, with numerous elections globally, regulatory shifts in healthcare, taxation, and insurance could impact Marsh McLennan. For instance, changes in the Affordable Care Act or tax reforms could directly affect their financial services. Furthermore, policy instability can hinder long-term strategic planning.

Marsh McLennan faces significant regulatory oversight globally. Changes in insurance regulations, particularly in the US, EU, and Asia-Pacific, directly affect the company. For example, the EU's Solvency II directive and similar US state-level rules mandate strict capital adequacy and risk management. In 2024, the company spent $1.2 billion on regulatory compliance.

Shifting Government Policies on Cybersecurity and Data Protection

Governments worldwide are intensifying their focus on cybersecurity and data protection, introducing new regulations and frameworks that Marsh McLennan must adapt to. These policy shifts necessitate that Marsh McLennan ensures compliance and supports its clients in navigating evolving cyber risks. The global cybersecurity market is projected to reach $345.7 billion in 2024, highlighting the growing importance of these areas.

- The EU's GDPR continues to influence global data protection standards.

- The US is implementing stricter cybersecurity mandates for critical infrastructure.

- Increased government spending on cybersecurity is driving market growth.

Trade Restrictions and Economic Sanctions

Trade restrictions and economic sanctions significantly influence international business. These measures directly affect cross-border operations and the need for risk management. For example, in 2024, sanctions on Russia impacted various sectors, increasing demand for specialized insurance. This includes political risk and trade credit insurance.

- Political risk insurance market was valued at $6.5 billion in 2024.

- Trade credit insurance covered $3.8 trillion of global trade in 2024.

- The Russia-Ukraine conflict increased demand for these services by 15% in 2024.

Political factors profoundly impact Marsh McLennan, with geopolitical instability creating supply chain and market risks. Increased government intervention and policy shifts across healthcare, taxation, and insurance pose challenges. Regulatory oversight, particularly in cybersecurity and data protection, necessitates significant adaptation, with global cybersecurity spending reaching $345.7 billion in 2024.

Trade restrictions and economic sanctions further influence international operations and the demand for specialized insurance services. The political risk insurance market was valued at $6.5 billion, while trade credit insurance covered $3.8 trillion of global trade in 2024. The Russia-Ukraine conflict drove a 15% increase in demand for such services in 2024.

| Political Factor | Impact | Financial Data (2024) |

|---|---|---|

| Geopolitical Instability | Disrupted Supply Chains, Increased Business Risks | N/A |

| Government Intervention | Policy Uncertainty, Regulatory Shifts | Marsh McLennan's compliance cost: $1.2 billion |

| Trade Restrictions & Sanctions | Cross-border Operations, Risk Management | Political Risk Ins. Market: $6.5B; Trade Credit: $3.8T |

Economic factors

Marsh McLennan's performance is sensitive to macroeconomic shifts. GDP growth, inflation, and interest rates directly affect their business. Economic downturns can reduce client activity, impacting demand for services. For instance, in Q4 2023, Marsh McLennan reported a 7% underlying revenue growth.

Interest rate volatility significantly affects investment portfolios and underwriting practices. In 2024, the Federal Reserve maintained a target range of 5.25% to 5.50%, impacting insurance pricing. Fluctuations influence Marsh McLennan's financial services, particularly investment returns. Changes in rates necessitate adjustments to pricing strategies and product offerings.

Inflation significantly impacts the cost structure of insurance products and services. Rising inflation can erode clients' ability to absorb higher insurance premiums. This may force Marsh McLennan to adjust pricing strategies, potentially affecting profitability. The U.S. inflation rate was 3.5% in March 2024, indicating persistent cost pressures.

Fragile Macroeconomic Conditions and Debt Levels

Fragile macroeconomic conditions, possibly worsened by high debt, can impact government investments. This situation elevates credit, supply chain, and business interruption risks, influencing demand for Marsh McLennan's services. Global debt reached $313 trillion in Q3 2024, according to the Institute of International Finance. This environment poses challenges.

- Global debt hit $313T in Q3 2024.

- High debt can disrupt government spending.

- Increased risk affects business operations.

- Demand for risk management services fluctuates.

Economic Divergence Between Sectors and Economies

Economic divergence presents complex scenarios for Marsh McLennan. Sectoral shifts, like tech's rise versus retail's struggles, impact insurance needs and consulting demands. Global economic disparities, with varying growth rates, require tailored market strategies. For example, the U.S. GDP grew by 3.3% in Q4 2023, while the Eurozone experienced slower growth. This necessitates flexible resource allocation and risk assessments.

- U.S. GDP growth in Q4 2023: 3.3%

- Eurozone economic growth: slower than the U.S.

- Sectoral shifts impacting insurance and consulting demands.

- Requires tailored market strategies.

Economic factors significantly shape Marsh McLennan's performance, with GDP growth, inflation, and interest rates directly impacting its business operations and profitability.

In Q3 2024, global debt reached $313 trillion, influencing government spending and potentially affecting the demand for the company's services, alongside interest rate volatility in 2024 which significantly influenced investment portfolios and underwriting practices, adding complexity.

Economic divergence, like the U.S. Q4 2023 GDP growth of 3.3% versus slower Eurozone growth, highlights the need for flexible strategies in insurance and consulting across various global markets, further requiring customized approaches.

| Metric | Value | Impact |

|---|---|---|

| Global Debt (Q3 2024) | $313 Trillion | Influences demand for services. |

| U.S. GDP Growth (Q4 2023) | 3.3% | Highlights need for flexible strategies. |

| Inflation Rate (March 2024) | 3.5% | Impacts costs, pricing adjustments. |

Sociological factors

Workforce dynamics are shifting, with varied generational priorities. Younger employees prioritize work-life balance and mental health. Addressing these shifts is crucial for Marsh McLennan. A 2024 study shows 70% of employees seek flexible work arrangements. Marsh McLennan must adapt its talent strategies.

Marsh McLennan faces pressure to address social determinants of health. Factors like economic stability and healthcare access significantly impact employee well-being. This affects Mercer's business, as employers prioritize well-being initiatives. For instance, 2024 data shows rising employer spending on mental health benefits, reflecting this trend.

Societal polarization and misinformation erode trust in institutions. This can hinder collective responses to crises, impacting client confidence and market stability. A 2024 study showed a 20% increase in misinformation spread on social media. This can lead to economic instability.

Importance of Diversity and Inclusion

For Marsh McLennan, diversity and inclusion are paramount, especially as a global entity. Attracting and retaining a diverse workforce is essential for serving a broad client base. Diverse teams offer varied perspectives, critical for an advisory business. This approach fosters innovation and better decision-making.

- In 2024, Marsh McLennan's commitment to DEI is reflected in its various programs.

- Globally, diverse teams are proven to enhance problem-solving capabilities.

- The company's initiatives include employee resource groups and inclusive leadership training.

- These efforts align with broader societal trends, enhancing brand reputation.

Evolving Client Needs and Expectations

Client needs and expectations are in constant flux, shaped by societal shifts and emerging issues. Marsh McLennan must adjust its services to address these evolving demands, especially in risk management and consulting. This adaptation is crucial for maintaining relevance and competitiveness. The focus should be on proactive solutions that anticipate client challenges.

- Marsh McLennan's 2024 revenue reached $23 billion, demonstrating its financial strength in a changing market.

- Consulting services saw increased demand, with a 7% revenue growth in 2024, reflecting evolving client needs.

- The company's investments in digital solutions and data analytics, totaling $1.5 billion in 2024, are aimed at meeting future demands.

Societal shifts impact Marsh McLennan, including workforce priorities and institutional trust. The focus on diversity and inclusion remains critical globally. Adjusting services and anticipating client challenges is a must for resilience.

| Sociological Factor | Impact on Marsh McLennan | 2024/2025 Data Point |

|---|---|---|

| Workforce Dynamics | Adapt talent strategies. | 70% seek flexibility |

| Social Determinants of Health | Address employee well-being. | Mental health benefit spending up |

| Societal Polarization | Maintain client trust, stability. | Misinformation rose 20% |

Technological factors

Digital transformation is crucial. Automation, AI, and digital platforms are reshaping service delivery. Marsh McLennan must adopt these technologies to stay competitive. For example, in 2024, the company increased its technology spending by 12%, focusing on AI-driven risk assessments and client platforms. This tech adoption aims to enhance efficiency and offer innovative solutions.

Artificial Intelligence (AI) is a crucial technological factor for Marsh McLennan. The company is actively developing and implementing AI tools, both internally and for its clients, as the AI market is projected to reach $1.81 trillion by 2030. This necessitates a strong emphasis on responsible AI practices, risk management, and ethical considerations, especially given the potential for AI to be used for misinformation. Marsh McLennan's focus on AI is critical for its future.

Cybersecurity threats are escalating, demanding robust defenses. In 2024, global cybercrime costs reached $9.2 trillion. Marsh McLennan must secure its operations. They also help clients with cyber risk management. Investments in data protection tech are crucial for resilience.

Leveraging Data Analytics

Marsh McLennan significantly benefits from advanced data analytics. This technology improves risk assessment accuracy and personalizes client solutions. Data analysis advancements offer substantial opportunities for the company. The global data analytics market is projected to reach $132.9 billion by 2025, growing at a CAGR of 12.7% from 2019.

- Enhanced Risk Modeling: Improved predictive capabilities.

- Personalized Client Solutions: Tailored insurance and consulting offerings.

- Market Expansion: New business opportunities through data insights.

- Operational Efficiency: Streamlined processes and cost reduction.

Technological Disruption and Competition

Technological disruption significantly impacts Marsh McLennan, potentially lowering entry barriers for competitors through data analytics and digital platforms. To stay ahead, the company must prioritize investments in proprietary technology and continuous innovation. Recent reports indicate the global InsurTech market is rapidly growing, with projections estimating it will reach $1.2 trillion by 2030, highlighting the urgency for technological adaptation. This trend underscores the importance of Marsh McLennan's strategic tech investments.

- InsurTech market projected to hit $1.2 trillion by 2030.

- Need for proprietary tech to maintain competitive edge.

Technology drives Marsh McLennan’s evolution. Tech investments grew by 12% in 2024, emphasizing AI, automation, and digital platforms. Cybercrime's $9.2 trillion cost in 2024 highlights data protection importance.

Data analytics enhances risk modeling and custom solutions, essential with the $132.9 billion market by 2025. The InsurTech market, at $1.2 trillion by 2030, stresses continuous tech adaptation.

| Technology Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Tech Investment | Enhances services | 12% tech spend increase in 2024 |

| Cybersecurity | Protect operations | $9.2T global cybercrime cost in 2024 |

| Data Analytics | Improves client solutions | $132.9B market by 2025 |

Legal factors

Marsh McLennan faces evolving insurance and financial regulations globally. Compliance across jurisdictions is crucial for their operations. Stricter rules impact operational costs and strategic decisions. For instance, the EU's Insurance Distribution Directive (IDD) and the SEC's regulations influence their practices. Regulatory changes can affect profitability and market access.

Data protection and privacy laws are getting stricter, influencing Marsh McLennan's operations. GDPR, for example, demands robust data management to protect client data. In 2024, data breaches cost an average of $4.45 million globally, emphasizing the need for compliance. This impacts how Marsh McLennan manages and uses client information. Compliance is crucial to avoid penalties and maintain client trust.

Marsh McLennan must navigate evolving employment and labor laws globally. Recent changes include expanded paid leave policies and modifications to employee benefits. These shifts directly impact Marsh McLennan's internal policies and the consulting advice it offers clients. For example, in 2024, several US states updated minimum wage and paid leave laws. Mercer, a Marsh McLennan business, helps clients adapt to these changes.

Legal Scrutiny of Fiduciary Responsibilities

Marsh McLennan faces heightened legal scrutiny concerning its fiduciary duties. This is especially true in healthcare plan administration and ESG investments within retirement plans. Navigating these complex legal landscapes demands meticulous compliance. Failure to do so could lead to significant financial and reputational damage for the firm.

- 2024: Increased regulatory focus on fiduciary duty compliance.

- 2024: Potential for lawsuits related to ESG investment practices.

- 2024: Growing importance of documented compliance processes.

Compliance with Cybersecurity Regulations

Governments worldwide are intensifying cybersecurity regulations, compelling companies to adhere to stringent digital infrastructure and data protection standards. Marsh McLennan, as a global leader, is obligated to maintain its own compliance with these evolving legal mandates. Furthermore, it must provide expert guidance to its clients, assisting them in meeting these critical cybersecurity requirements. The global cybersecurity market is projected to reach $345.4 billion in 2024.

- GDPR and CCPA Compliance: Ensuring adherence to data privacy laws.

- NIST and ISO Standards: Implementing recognized cybersecurity frameworks.

- Cyber Insurance Implications: Addressing legal aspects of cyber risk coverage.

Marsh McLennan must navigate complex global legal frameworks including insurance and financial regulations; these are constantly evolving. Data privacy laws like GDPR, and increasing cyber security regulations impact how they operate. Legal scrutiny regarding fiduciary duties demands meticulous compliance, especially in healthcare plan administration.

| Legal Area | Impact | Example/Data |

|---|---|---|

| Regulatory Compliance | Operational Costs, Market Access | EU IDD, SEC regulations; potential for $millions in fines. |

| Data Privacy | Client Trust, Legal Penalties | Data breach costs avg $4.45M; GDPR compliance crucial. |

| Fiduciary Duty | Reputational and Financial Damage | ESG investments in retirement plans subject to scrutiny |

Environmental factors

Climate change is causing more frequent and severe natural disasters, directly impacting Marsh McLennan's clients. This increases the demand for insurance and risk management solutions, a key area of focus. For example, insured losses from natural catastrophes reached $118 billion in 2023. This trend is expected to continue, impacting Marsh McLennan's services.

Evolving global environmental regulations and policies are pushing companies to actively manage environmental risks. Marsh McLennan assists clients in navigating these complexities, providing risk mitigation strategies. For instance, in 2024, the environmental consulting market was valued at over $40 billion. This market is expected to grow, reflecting the increasing importance of environmental compliance and risk management.

Climate resilience and sustainability are increasingly important for businesses. Marsh McLennan assists clients in managing climate-related financial risks. In 2024, the global market for climate risk management services was estimated at $10 billion. They help develop transition plans. This includes assessing climate impacts and offering sustainability solutions.

Emergence of New Environmental Risks and Contaminants

New environmental risks, including emerging contaminants, are increasing the need for robust environmental risk management. Marsh McLennan must stay updated on these evolving threats to offer effective solutions. The global environmental remediation market is expected to reach $128.5 billion by 2024. This growth highlights the importance of proactive risk management.

- Market size: $128.5 billion (2024)

- Remediation market growth signifies increased risk.

- Marsh McLennan's role: developing solutions.

Demand for Environmental Risk Insurance

Growing environmental awareness boosts demand for environmental risk insurance. Marsh McLennan, through Marsh, offers these crucial solutions. The market is expanding rapidly. In 2024, the global environmental insurance market was valued at $14.5 billion. It’s projected to reach $22.3 billion by 2029.

- Market growth is fueled by stricter regulations and increasing environmental liabilities.

- Marsh McLennan's expertise helps clients manage and mitigate environmental risks effectively.

- This segment is a significant growth area for the company.

- Demand is especially high in sectors like manufacturing and construction.

Environmental factors significantly influence Marsh McLennan, shaping risk management needs. The environmental remediation market, critical for managing new risks, was at $128.5 billion in 2024. Insurance demand also surges with a $14.5 billion environmental insurance market in 2024, expected to hit $22.3 billion by 2029.

| Aspect | Details | Impact on Marsh McLennan |

|---|---|---|

| Climate Change | More frequent disasters: $118B insured losses in 2023 | Increased demand for insurance and risk management |

| Regulations | Environmental consulting market $40B in 2024 | Growth in risk mitigation solutions. |

| Sustainability | Climate risk management market $10B in 2024 | Need for climate-related financial risk management services |

PESTLE Analysis Data Sources

Our PESTLE analysis is constructed using data from financial institutions, government publications, and market research. Insights are sourced from reputable global databases.