Marsh & McLennan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marsh & McLennan Bundle

What is included in the product

Marsh & McLennan BCG Matrix analysis: strategic guidance on resource allocation, growth, and divestiture decisions.

Clean, distraction-free view optimized for C-level presentation of Marsh & McLennan's business units.

What You See Is What You Get

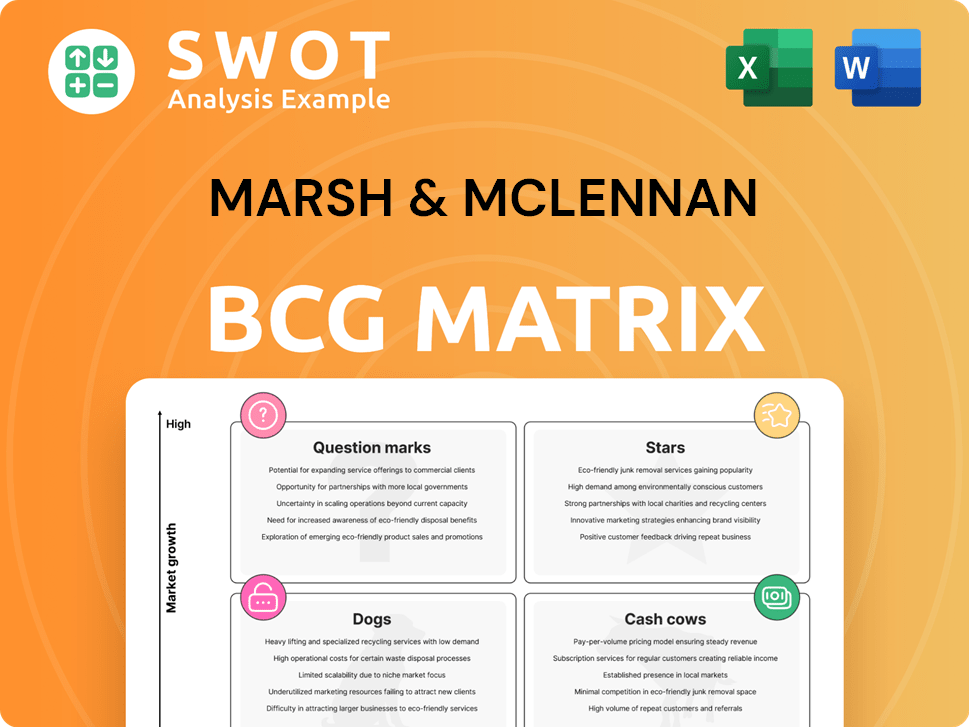

Marsh & McLennan BCG Matrix

The BCG Matrix preview is identical to the purchased version. This means no extra content, just the complete, fully editable document delivered instantly after purchase.

BCG Matrix Template

Marsh & McLennan's BCG Matrix analyzes its diverse business lines, placing them into Stars, Cash Cows, Dogs, or Question Marks. This snapshot helps identify growth opportunities and resource allocation strategies. Understanding these quadrant positions is key to smart investment. However, this is just a simplified view.

Get instant access to the full BCG Matrix and discover which products are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool.

Stars

Marsh's insurance broking arm is a Star within the BCG Matrix. It shows robust growth, especially internationally. In Q4 2024, revenue hit $3.3B, up 15% overall and 8% underlying, solidifying its market leadership. This performance reflects strong demand and effective strategies.

Oliver Wyman Group, part of Marsh & McLennan, saw its revenue grow by 9% to $3.4 billion in 2024. This growth highlights its strong performance in the consulting industry. The firm's expertise in strategy and economic consulting is a key driver of this success.

The Risk and Insurance Services segment is a "Star" in Marsh & McLennan's BCG matrix. In 2024, this segment saw revenue of $15.4 billion, a 9% increase. Adjusted operating income surged 13% to $4.6 billion, highlighting its strong performance.

Strategic Acquisitions

Marsh & McLennan's strategic acquisitions, such as the $7.75 billion purchase of McGriff Insurance Services in 2021, have significantly bolstered its market presence and fueled revenue expansion. These acquisitions are central to Marsh & McLennan's growth strategy, enabling it to provide a broader array of services and capture a larger market share. The integration of these acquired entities is a key driver of the company's overall success, expanding its capabilities.

- Acquisition of McGriff Insurance Services for $7.75 billion in 2021.

- Strategic acquisitions enhance market position and boost revenue.

- Integration of acquisitions expands service offerings.

- These moves are key to Marsh & McLennan's growth.

Digital Transformation Initiatives

Marsh & McLennan's "Stars" category includes digital transformation initiatives that significantly boost client experiences. Platforms like LINQ and Blue[i][i][i] further enhance performance.

| Category | 2024 Revenue | Growth |

|---|---|---|

| Marsh | $3.3B (Q4) | 15% (Overall) |

| Oliver Wyman | $3.4B (2024) | 9% |

| Risk & Insurance Services | $15.4B (2024) | 9% |

Cash Cows

Marsh McLennan Agency (MMA) is a key "Cash Cow" for Marsh & McLennan. In 2024, MMA generated approximately $3.5 billion in revenue. MMA provides insurance solutions in the US and Canada. Its consistent profitability and strong cash flow make it a reliable revenue source.

Guy Carpenter, Marsh & McLennan's reinsurance arm, showed solid performance in 2024. They reported a 5% revenue increase, with 8% underlying growth. This indicates stable profitability. Guy Carpenter's global presence solidifies its status as a dependable cash cow.

Mercer's health consulting is a cash cow, showing steady growth and contributing significantly to Marsh & McLennan's consulting revenue. This consistent performance makes it a dependable source of funds for the company. In 2024, Marsh & McLennan saw strong revenue growth in its consulting segment, with Mercer playing a key role. This indicates a reliable cash flow generator.

Global Presence and Diversification

Marsh & McLennan's extensive global presence, spanning over 130 countries, is a key characteristic of its "Cash Cow" status within the BCG Matrix. This wide geographic reach diversifies its revenue streams, mitigating risks associated with economic downturns in any single region. The consistent cash flow generated by this global footprint provides stability and allows for sustained investments. In 2023, the company reported revenues of $23 billion, showcasing the financial strength from diverse markets.

- Operations in over 130 countries provide diversified revenue.

- Global footprint ensures consistent cash flow.

- Financial stability makes it a cash cow.

- 2023 revenue was $23 billion.

Strong Client Retention

Marsh & McLennan's robust client retention is a key characteristic of its cash cow status. This strong client base generates consistent revenue and cash flow. In 2024, the company reported client retention rates consistently above 90%. This high rate provides a stable financial foundation.

- High client retention rates above 90% in 2024.

- Recurring revenue streams.

- Stable cash flow.

Marsh & McLennan's "Cash Cows" offer stable, predictable revenues, fueling the company's financial strength. These businesses, like MMA, Guy Carpenter, and Mercer's health consulting, consistently generate strong cash flow, supporting further investments. High client retention, exceeding 90% in 2024, and a global presence enhance their dependability.

| Cash Cow Characteristic | Example | Financial Impact (2024) |

|---|---|---|

| Consistent Revenue | MMA | Approx. $3.5B in revenue |

| Stable Growth | Guy Carpenter | 5% revenue increase |

| High Retention | Overall | Client retention >90% |

Dogs

Underperforming consulting segments within Oliver Wyman, a Marsh & McLennan subsidiary, could be categorized as "dogs." These segments might struggle to meet financial targets, potentially impacting overall firm performance. For instance, if a specific practice area consistently shows lower-than-average revenue growth compared to industry benchmarks, it might be considered underperforming. Restructuring or divestiture could be considered if the situation persists. For example, in 2023, Marsh & McLennan's Consulting revenue was $6.4 billion, with some segments possibly lagging.

Regions like the UK and Pacific face declining insurance rates, classifying them as "Dogs" in the Marsh & McLennan BCG Matrix. These areas need strategic changes for better profitability and market share. For example, the UK saw a decrease in commercial insurance rates in 2024. To improve, they might need to cut costs or find new revenue streams.

In Marsh & McLennan's BCG Matrix, "dogs" represent segments with low growth and market share. These segments often drag down overall financial performance. For example, a specific division with stagnant revenue growth and minimal profitability might be considered a dog. Strategic options include divestiture or restructuring, as seen with some underperforming units in 2024.

Services with Limited Innovation

Some of Marsh & McLennan's services could be classified as "dogs" if they show limited innovation and can't keep up with market changes. These services might need significant changes or even be discontinued to use resources efficiently. For instance, in 2024, the risk and insurance services sector experienced shifts due to technological advancements. A report from Deloitte indicated that companies in the sector are investing heavily in digital transformation. If certain services are not updated, they may struggle to compete.

- Areas with low growth potential may be considered dogs.

- Limited innovation can lead to a decline in market share.

- Services may need to be restructured or phased out.

- Resource reallocation is key for overall performance.

Businesses Facing Intense Competition

In Marsh & McLennan's BCG Matrix, businesses in intense competition without clear differentiation are "dogs." These firms, often up against online platforms or direct insurers, struggle. For instance, in 2024, the insurance industry saw a 15% increase in direct sales. They might need innovation to survive or face being sold off.

- Intense competition erodes market share and profitability.

- Lack of differentiation makes it hard to attract and retain customers.

- Divestiture becomes a viable option if the business can't adapt.

- Innovation or strategic partnerships are vital for survival.

In Marsh & McLennan's BCG Matrix, "dogs" face low growth and market share. These segments often need restructuring or divestiture. For example, some underperforming units showed stagnant revenue in 2024. Resource reallocation is critical for improving financial performance.

| Characteristics | Impact | Examples (2024) |

|---|---|---|

| Low Market Share, Slow Growth | Financial Drag, Resource Drain | Underperforming consulting practices |

| Intense Competition, Low Differentiation | Erosion of Profitability | Areas with direct sales competition, facing 15% increase in 2024. |

| Limited Innovation, Inability to Adapt | Decline in Market Share | Services struggling with tech advancements. |

Question Marks

Marsh & McLennan's cyber risk solutions are positioned as a Question Mark in the BCG Matrix. This reflects their high-growth potential within the expanding cybersecurity market. In 2024, global cybersecurity spending is projected to exceed $200 billion. Investments in this area aim for market leadership and substantial returns. Cyberattacks increased by 38% globally in 2023, highlighting the critical need for these solutions.

Transactional risk insurance experienced substantial expansion in 2024, with deal volumes hitting record highs. This surge in activity positions it as a promising segment for Marsh & McLennan. Continued strategic investment and focus on this area have the potential to elevate it to a star performer within the company's portfolio. For example, in Q3 2024, global M&A activity saw a 20% increase, driving demand for such insurance products.

Marsh & McLennan's AI platform is a high-growth venture, potentially reshaping its services. This could draw in new clients, boosting market share. However, it necessitates substantial investment for development. In 2024, the AI market is projected to reach $300 billion, showing its growth potential.

Sustainability and Climate Change Consulting

Marsh & McLennan's sustainability consulting, a potential "Question Mark," targets high-growth areas. This sector is driven by increasing corporate focus on climate change. Investment could yield significant market share, as businesses seek expert advice. In 2024, the global sustainability consulting market was valued at $15.2 billion.

- Market growth is projected at 12% annually.

- Demand is rising for ESG (Environmental, Social, and Governance) advisory.

- Marsh & McLennan can leverage its risk management expertise.

- Success depends on effective market positioning.

Middle Market Expansion

Marsh & McLennan's (MMC) strategic move into the middle market through the acquisition of McGriff Insurance Services highlights a significant growth opportunity. However, the success of this expansion hinges on effective integration and targeted investments to fully leverage McGriff's capabilities. This strategic focus is crucial for MMC to capture a larger share of the middle market segment. The company's 2024 financial results, including an 8% revenue growth, underscore the potential impact of such strategic initiatives [1].

- McGriff acquisition strengthens MMC's middle market presence.

- Successful integration and investment are key to maximizing growth.

- Middle market expansion could drive significant market leadership.

- MMC achieved 8% revenue growth in 2024.

Cyber risk solutions, AI platforms, and sustainability consulting, are considered "Question Marks." These segments require strategic investments to capitalize on high growth. Success depends on market positioning within their respective markets. They are viewed as potential high-growth areas, with significant market share potential.

| Area | Strategic Focus | 2024 Data Highlights |

|---|---|---|

| Cyber Risk | Market Leadership | Cybersecurity spending exceeded $200B. Global cyberattacks increased by 38%. |

| AI Platform | Market Share Growth | AI market projected at $300B. |

| Sustainability | Market Share Growth | Global market valued at $15.2B, with a 12% annual growth. |

BCG Matrix Data Sources

The BCG Matrix uses robust market data, incorporating industry reports, competitor financials, and expert market analyses for precise strategic assessments.