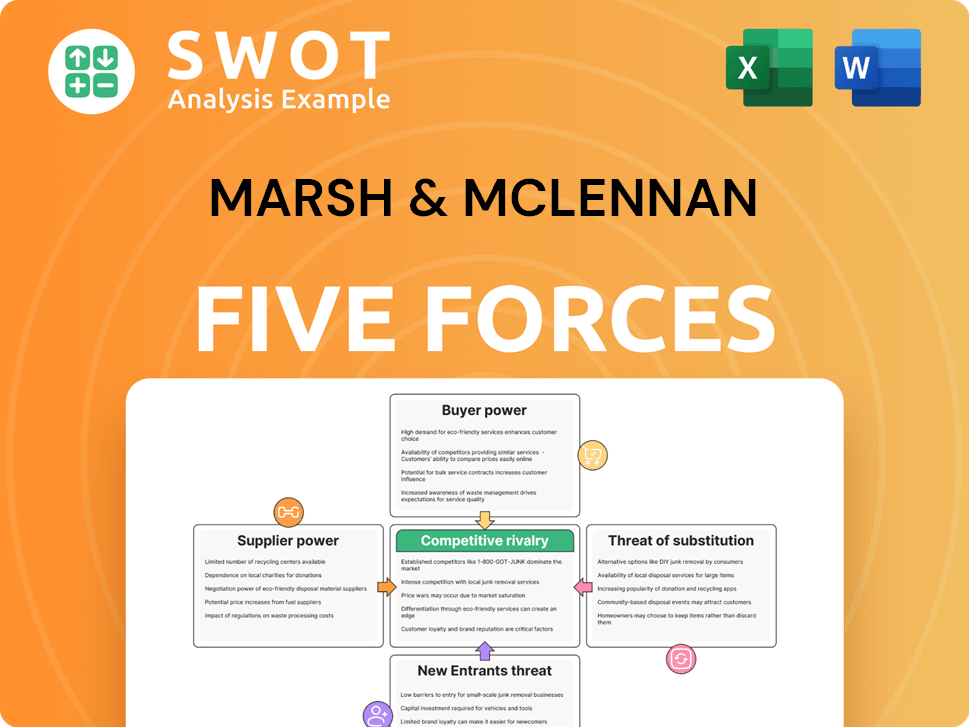

Marsh & McLennan Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marsh & McLennan Bundle

What is included in the product

Analyzes competitive forces, supplier/buyer power, and new entrant barriers specifically for Marsh & McLennan.

Customize pressure levels based on new data, aiding dynamic strategic analysis.

Preview Before You Purchase

Marsh & McLennan Porter's Five Forces Analysis

You're viewing the complete Marsh & McLennan Porter's Five Forces Analysis. This thorough analysis includes an examination of the competitive rivalry, supplier power, buyer power, threat of substitution, and threat of new entrants specific to Marsh & McLennan. The document provides actionable insights for strategic decision-making. This preview is the same document you'll receive immediately after purchase. The file is fully formatted and ready to download.

Porter's Five Forces Analysis Template

Marsh & McLennan faces a complex competitive landscape. Analyzing this through Porter's Five Forces, we see moderate rivalry, strong buyer power. Supplier power is relatively low, while threat of new entrants is moderate. The threat of substitutes poses a limited challenge. Ready to move beyond the basics? Get a full strategic breakdown of Marsh & McLennan’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Marsh & McLennan faces strong supplier power, especially in reinsurance. The reinsurance market has few key players. This concentration allows reinsurers to dictate terms. In 2024, the top 5 global reinsurers controlled a significant market share, enhancing their leverage. Marsh & McLennan's role as an intermediary helps, but supplier influence remains substantial.

Marsh & McLennan relies on technology and consulting partners for specialized services. These partners often possess high expertise and unique capabilities, increasing their bargaining power. Firms invest heavily in R&D and proprietary technologies, which enhances their leverage. This dependence can drive up costs, affecting the company's profitability. In 2024, such partnerships accounted for a significant portion of Marsh & McLennan's operational expenses.

Marsh & McLennan's supplier power is indirectly affected by the dependence on skilled human capital. The professional services industry is highly reliant on its employees, especially their expertise. Competition for top talent drives up labor costs.

In 2024, the average salary for a financial analyst was $86,000, reflecting the need for competitive compensation. High employee retention is critical for maintaining service quality. Marsh & McLennan's ability to attract and retain skilled professionals influences its operational costs.

Complex Relationships with Tech and Data Service Providers

Marsh & McLennan heavily depends on tech and data service providers globally. These suppliers, often with strong market positions, wield considerable pricing power. Effective management of these relationships is vital for competitive pricing and service access. This is crucial, as data and tech costs are rising. For instance, in 2024, IT spending rose by 8% across the financial sector, showing dependency.

- High supplier concentration means limited negotiation leverage for Marsh & McLennan.

- Pricing and service terms influence operational costs and service offerings.

- Reliance on specific providers creates potential for service disruptions.

- Strategic partnerships mitigate supplier power, but require investment.

Potential for Supplier Consolidation

Supplier consolidation, particularly in consulting and analytics, poses a threat. Fewer suppliers mean less choice for Marsh & McLennan. This can elevate costs and limit their strategic options.

- Mergers and acquisitions in the consulting industry increased by 15% in 2024, signaling consolidation.

- The top 5 consulting firms control over 60% of the market share.

- Data analytics firms saw a 20% rise in acquisition prices in 2024.

Marsh & McLennan faces substantial supplier power, particularly in reinsurance and tech services. This impacts operational costs and strategic flexibility. Consolidation among key suppliers reduces Marsh & McLennan's negotiating leverage. Effective supplier management is vital for maintaining profitability and competitive service offerings.

| Supplier Category | Impact | 2024 Data |

|---|---|---|

| Reinsurance | High bargaining power | Top 5 reinsurers: 65% market share |

| Technology & Consulting | Rising costs | IT spending up 8% (financial sector) |

| Human Capital | Labor costs | Avg. analyst salary: $86,000 |

Customers Bargaining Power

Marsh & McLennan's diverse client base includes small businesses and large corporations. Larger clients, like those in the Fortune 500, hold more bargaining power due to their substantial purchasing volume. In 2024, Marsh & McLennan reported serving over 60,000 clients globally. Smaller clients have less individual influence, yet their collective impact is significant.

Clients, particularly in competitive insurance brokerage, emphasize cost-effectiveness. They aim for optimal service at the lowest cost, bolstering their bargaining strength. Marsh & McLennan faces this, needing to prove its value. In 2024, the insurance industry saw a 7% increase in premium rates. This underscores the pressure on brokers to justify their fees.

Switching costs vary; some services like specialized consulting have high costs due to expertise and long-term contracts. Clients still wield power, especially those with substantial budgets or numerous options. In 2024, MMC's client retention rate remained high, but market competition increased. Strong client relationships and consistent value delivery are crucial for retaining clients. Effective client retention strategies are vital.

Demand for Customized Solutions

Clients are increasingly demanding customized solutions to address their specific needs, enhancing their bargaining power. This trend pushes Marsh & McLennan to offer tailored services at competitive prices to retain and attract clients. Adapting offerings is crucial, as evidenced by the 2024 shift towards specialized risk management. The company's ability to personalize services directly impacts its profitability and market position.

- Customization is key in the insurance and consulting industries.

- Clients seek tailored risk management strategies.

- Competitive pricing is crucial.

- Marsh & McLennan must adapt to these demands.

Access to Alternative Service Providers

Clients of Marsh & McLennan have several alternatives, including in-house risk management teams and other consulting firms, which boosts their bargaining power. This allows them to switch providers if they are unhappy with services or pricing. The rise of digital insurance platforms further expands these options. The consulting industry's revenue was over $200 billion in 2024, indicating strong competition. This competition makes switching easier.

- Alternative providers include in-house teams and other consulting firms.

- Digital platforms offer additional options.

- The consulting industry's revenue was over $200 billion in 2024.

Marsh & McLennan's clients, including large corporations and small businesses, exert significant bargaining power. Larger clients leverage their purchasing volume, impacting pricing and service terms. In 2024, the insurance industry saw premium rate fluctuations, adding pressure on brokers to justify their fees and customized solutions.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Client Base | Diverse; Fortune 500 to small businesses | Over 60,000 clients globally. |

| Client Power | Cost-conscious; demand for customization. | 7% increase in premium rates. |

| Alternatives | In-house teams, digital platforms. | Consulting industry revenue: $200B+. |

Rivalry Among Competitors

Marsh & McLennan faces fierce competition, including major firms and tech disruptors. The industry's competitive nature, with many offering similar services, impacts pricing. This rivalry can squeeze profit margins. For example, in 2024, the insurance brokerage market saw significant price competition, affecting revenue growth.

To navigate intense competition, Marsh & McLennan needs strong differentiation. This means highlighting its unique strengths and industry knowledge. Specialized solutions and tech investments are critical for staying ahead. In 2024, Marsh & McLennan's revenue reached $23 billion, showcasing its market presence.

Marsh & McLennan can shift from price-based to value-based pricing. This strategy highlights the value of its services to justify higher prices. Strong client relationships and exceptional service delivery are key. In 2024, the company's revenue was approximately $23 billion, reflecting its ability to capture value.

Strategic Growth Initiatives

Marsh & McLennan's strategic growth initiatives, including acquisitions and expansion, are key to maintaining its competitive edge. These moves enable the company to capitalize on new opportunities and diversify its revenue. For example, the acquisition of McGriff Insurance Services strengthens Marsh & McLennan's capabilities. In 2024, Marsh & McLennan continued to pursue acquisitions, signaling its commitment to growth.

- Acquisitions of companies like McGriff Insurance Services.

- Expansion into high-growth markets.

- Focus on enhancing capabilities and scale.

- Diversifying revenue streams.

Technological Disruption

Technological disruption is a critical force in Marsh & McLennan's competitive landscape. The company must navigate the rapid evolution of tech to stay ahead. AI, blockchain, and data analytics are key to providing advanced solutions. Digital transformation is essential for maintaining a competitive edge. In 2024, investments in InsurTech reached $16.8 billion globally.

- AI adoption in insurance is projected to grow by 30% annually.

- Blockchain solutions are expected to streamline claims processing by 25%.

- Data analytics can reduce operational costs by 15%.

- Digital transformation initiatives are key to staying competitive.

Marsh & McLennan faces intense competition, impacting pricing and profit margins. To differentiate, it emphasizes unique strengths and invests in tech, key in 2024's $23 billion revenue. Strategic moves like acquisitions and expansion are crucial for growth amid digital disruption.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Competitive Pressure | Pricing & Margins | Intense competition |

| Differentiation | Market Position | $23B Revenue |

| Strategic Growth | Expansion | Acquisitions |

SSubstitutes Threaten

Alternative risk transfer mechanisms, such as self-insurance or captive insurance, pose a threat to Marsh & McLennan's business. These options allow companies to manage risk independently, potentially reducing the need for external brokers. In 2024, the captive insurance market saw premiums reach approximately $70 billion. Marsh & McLennan mitigates this threat by offering value-added services. These include expert risk assessment and efficient claims management, differentiating its offerings.

The threat of in-house expertise impacts Marsh & McLennan. Companies are building their own risk management teams. To counter this, Marsh & McLennan offers specialized solutions. They integrate insurance, consulting, and data analytics. In 2024, this integrated approach saw a 7% increase in client retention.

Consulting services face substitution from competitors and software solutions. Marsh & McLennan competes with firms like Aon and WTW. They must highlight their unique value proposition and industry knowledge to stay competitive. In 2024, the consulting market was valued at over $700 billion. Investing in technology and methods is critical.

Digital Platforms and Automation

The rise of digital platforms poses a threat to Marsh & McLennan. These platforms offer alternative risk management solutions, intensifying competition. Companies like Guidewire and Duck Creek Technologies compete with brokerage services. Emphasizing comprehensive risk management strategies is key to staying competitive.

- Digital insurance sales increased by 20% in 2024.

- Guidewire's market cap reached $8 billion.

- Duck Creek Technologies' revenue grew by 15% in 2024.

- Marsh & McLennan's digital investments totaled $1 billion in 2024.

Peer Benchmarking Networks

Peer benchmarking networks and online risk management platforms pose a threat to Marsh & McLennan's services by offering alternative solutions for risk assessment. These platforms provide clients with cost-effective ways to compare their risk profiles and potentially manage risks independently, reducing the need for traditional consulting. Marsh & McLennan must emphasize its value in delivering tailored, actionable insights to stay competitive. Innovation in AI-driven risk assessment tools is crucial for maintaining a leading market position.

- The global risk management services market was valued at $35.6 billion in 2024.

- AI in risk management is projected to reach $12.8 billion by 2027.

- Companies using AI for risk management report a 20% reduction in operational costs.

Marsh & McLennan faces threats from substitutes like self-insurance, in-house teams, and digital platforms, affecting its revenue streams.

Digital solutions and consulting alternatives challenge its market position, demanding innovation and value differentiation. Peer benchmarking networks further intensify competition, requiring tailored client solutions.

To maintain competitiveness, Marsh & McLennan must emphasize its value proposition, invest in technology, and deliver specialized services to retain clients in a dynamic market.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Self-insurance/Captives | Reduced need for brokers | Captive premiums: ~$70B |

| In-house expertise | Competition for services | Integrated approach: +7% client retention |

| Digital platforms | Increased competition | Digital insurance sales: +20% |

Entrants Threaten

Marsh & McLennan faces the threat of new entrants due to high initial investment needs. Entering the professional services industry demands significant capital for technology, infrastructure, and skilled staff. These high upfront costs act as a major deterrent for many potential new competitors. Investing in office space and IT infrastructure creates substantial barriers to entry. In 2024, the average cost to launch a consulting firm was estimated to be between $500,000 and $1 million.

Marsh & McLennan faces the threat of new entrants, particularly due to stringent regulatory requirements. The insurance industry is heavily regulated, demanding adherence to complex and evolving rules. Compliance with insurance regulations and data privacy laws requires substantial resources. New entrants must navigate a challenging regulatory landscape. In 2024, regulatory fines in the financial sector reached $4.5 billion, emphasizing the costs of non-compliance.

Marsh & McLennan's well-established brand is a significant asset. It has a strong global presence that new competitors will find challenging to replicate. This brand recognition fosters trust, which is vital in the financial services sector. In 2024, Marsh & McLennan's brand value contributed significantly to its revenue of $23 billion.

Technological Advancements

Technological advancements present a mixed threat for new entrants in the insurance brokerage industry. While technology can lower certain barriers to entry by reducing operational costs, it also demands consistent investment and innovation. New entrants must adopt technological advancements and create unique solutions to compete, which can be costly. Developing proprietary technology solutions and platforms is essential for differentiating themselves in the market.

- Marsh & McLennan's 2023 revenue from Risk and Insurance Services was $17.8 billion, showing the scale of technological investment needed to compete.

- The insurance technology (InsurTech) market, while growing, still faces challenges in profitability, as seen in 2023, which influences the investment decisions of new entrants.

- The need for cybersecurity and data analytics platforms requires significant upfront investment, with costs potentially reaching millions of dollars annually.

- The complexity of regulatory compliance in data privacy and technology further increases the barriers for new entrants.

Need for Specialized Expertise

The threat of new entrants for Marsh & McLennan is moderate. The industry demands specialized expertise in risk management, insurance, and consulting, creating a barrier to entry. Newcomers must attract and retain talent, which requires significant investment in competitive compensation and benefits packages. Continuous training and upskilling programs are crucial for maintaining a competitive edge.

- Attracting and retaining talent with the right expertise is crucial.

- New entrants must invest in training and upskilling.

- The industry requires deep industry knowledge.

- Specialized skills are needed.

Marsh & McLennan faces a moderate threat from new entrants, primarily due to high initial investment needs, regulatory hurdles, and the need for specialized expertise. Brand recognition and the scale of operations also pose challenges for newcomers. While technology can lower some barriers, it also requires significant investment, as seen in the $17.8 billion revenue of Marsh & McLennan's Risk and Insurance Services in 2023.

| Factor | Impact | Data |

|---|---|---|

| Initial Investment | High Barrier | Consulting firm launch cost in 2024: $500k-$1M. |

| Regulatory Compliance | High Barrier | 2024 Financial Sector Fines: $4.5B. |

| Technology Investment | Moderate Barrier | Cybersecurity/Data Analytics: Millions annually. |

Porter's Five Forces Analysis Data Sources

Marsh & McLennan's analysis uses public financial data, industry reports, and regulatory filings. These sources allow a comprehensive assessment of competitive dynamics.