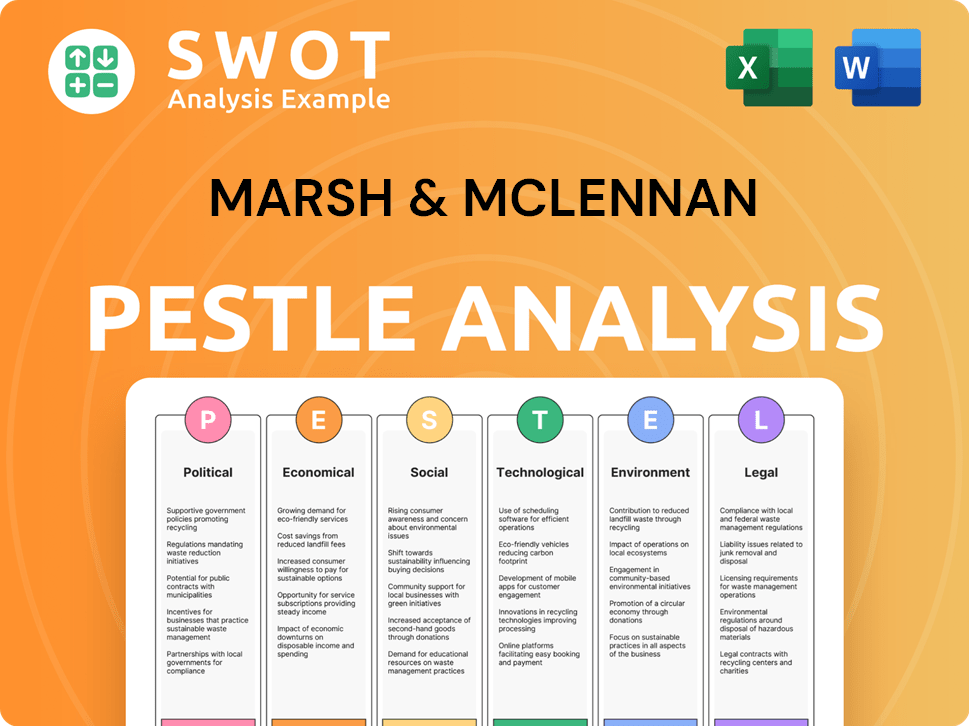

Marsh & McLennan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marsh & McLennan Bundle

What is included in the product

Analyzes Marsh & McLennan's macro-environment via six PESTLE factors: Political, Economic, etc.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview Before You Purchase

Marsh & McLennan PESTLE Analysis

This Marsh & McLennan PESTLE Analysis preview displays the complete report you'll receive. The layout, insights, and data are identical to the final purchased version. No hidden extras, just the fully-realized document ready for immediate download. What you see here is the finished product.

PESTLE Analysis Template

Uncover Marsh & McLennan's strategic landscape with our PESTLE Analysis. Explore how political factors, economic shifts, and more impact their operations. This detailed analysis delivers valuable insights for informed decisions. Grasp key trends and leverage our data for smarter planning and strategy. Ready to gain an edge? Download the full version now!

Political factors

Marsh & McLennan faces diverse global regulations. Compliance includes US disclosure rules & EU data protection. The company manages varied regulatory frameworks worldwide. In 2024, regulatory fines in the financial sector reached $4.2 billion globally. This impacts operational costs.

Geopolitical instability poses risks to Marsh & McLennan's global operations. Conflicts can disrupt international business and trade. Sanctions and restrictions can limit services, affecting clients. In 2024, geopolitical events influenced market volatility, impacting financial strategies.

Governments globally are stepping up cybersecurity and data protection measures, increasing regulations and investments. Marsh & McLennan, handling sensitive data, must comply with these changes to ensure security and retain client trust. In 2024, global spending on cybersecurity reached $214 billion, reflecting the growing emphasis. Compliance with GDPR and NIST frameworks is crucial.

Shifting Government Policies on Healthcare and Taxation

Government healthcare and tax policies significantly impact Marsh & McLennan's business. Changes in these areas affect the consulting and benefits segments, necessitating adaptation. For instance, the US healthcare spending reached $4.5 trillion in 2022, showing the sector's importance. Policy shifts can alter business operations and client needs, requiring strategic adjustments. Staying informed about these policy changes is crucial for their strategic planning and service offerings.

- Healthcare spending in the US is expected to reach $6.8 trillion by 2030.

- Tax policy changes can affect the cost of employee benefits.

- Marsh & McLennan's consulting services help clients navigate these changes.

Political Election Cycles and Policy Uncertainty

Major election years globally, such as in the US and India in 2024, introduce policy uncertainty, which is relevant to Marsh & McLennan. Changes in regulations and government priorities necessitate a proactive approach to risk management. The company's political risk reports analyze these potential impacts. Political risks are a significant factor.

- Over 4 billion people globally will vote in elections in 2024.

- Political instability can increase insurance claims.

- Marsh & McLennan offers political risk insurance.

- Their reports assess impacts on clients.

Marsh & McLennan must navigate a complex web of global political factors. Elections, like the 2024 US and India polls affecting policies, increase uncertainty.

Changes in healthcare policies impact their benefits and consulting services. In 2023, global political risk insurance premiums hit $2.5 billion.

Geopolitical instability remains a significant concern, as conflicts can disrupt international business and create new regulatory challenges. They use their reports to help clients navigate the political terrain.

| Factor | Impact | Data |

|---|---|---|

| Elections | Policy Shifts | Over 4 billion voters in 2024 |

| Healthcare | Policy Influence | US spending projected at $6.8T by 2030 |

| Geopolitics | Risk Assessment | Political risk premiums at $2.5B in 2023 |

Economic factors

Marsh & McLennan's performance is heavily influenced by global economic conditions. Factors like GDP growth significantly impact the demand for their services. Inflation and interest rates also play a crucial role, affecting insurance premium rates and investment returns. In 2024, global GDP growth is projected around 3%, influencing their revenue streams. Capital market volatility can also affect client decisions.

Fluctuations in commercial insurance rates significantly impact Marsh & McLennan's broking segment. Recent data indicates moderating rates in certain areas, yet others, like US casualty, are rising. These shifts influence revenue, with potential impacts on profitability. For instance, in 2024, commercial property rates varied significantly across regions. In the first quarter of 2024, US property insurance saw an average increase of 6%.

Marsh & McLennan's acquisition strategy focuses on global expansion and service enhancement. The company invests heavily in acquisitions, which boosts revenue but affects debt and interest expenses. In 2024, acquisitions contributed significantly to revenue growth. Integrating acquired businesses is crucial for financial success. For instance, in Q1 2024, Marsh & McLennan's revenue increased by 8% due to acquisitions.

Operating Expenses and Debt Levels

Marsh & McLennan faces pressures from rising operating expenses, especially in salaries and incentives, alongside increasing long-term debt, which can squeeze profit margins. Managing these costs is vital for maintaining profitability, and interest expenses are a direct consequence of their debt levels. The company's ability to expand margins depends on effectively controlling these financial obligations.

- In 2023, Marsh & McLennan's operating expenses were approximately $16.7 billion, reflecting the cost structure.

- The company's long-term debt was about $13 billion as of December 31, 2023, influencing interest payments.

- Interest expenses in 2023 amounted to around $400 million.

Demand for Risk Management and Consulting Services

Marsh & McLennan's services are highly sought after due to the intricate global business landscape. Businesses now face heightened risks, including cyber threats and climate change, increasing the need for expert risk management. Strategic guidance from Marsh & McLennan is crucial, fueling demand and revenue growth. This demand is a significant driver of their financial performance.

- In 2024, Marsh & McLennan's revenue was approximately $23 billion, reflecting strong demand.

- Risk and insurance services accounted for a significant portion of this revenue.

- Demand for consulting services continues to grow, with a focus on strategic advice.

- Cyber risk and climate change advisory services are key growth areas.

Marsh & McLennan's financial health is intertwined with the global economy. Global GDP growth is anticipated around 3% in 2024, shaping its revenue streams. Commercial insurance rate fluctuations significantly influence its broking segment's performance, impacting revenue and profitability. Rising operating costs and debt also pressure profit margins.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| Revenue ($ billions) | $20.7 | $23.0 |

| Operating Expenses ($ billions) | $16.7 | $17.8 |

| Long-term Debt ($ billions) | $13.0 | $14.0 |

Sociological factors

Marsh & McLennan faces shifts in workforce demographics, requiring adaptable talent strategies. Healthcare priorities are evolving, influencing benefit consulting. Recent data shows 40% of U.S. employees report high stress levels. Social expectations impact employee engagement and retention. Addressing burnout and catering to diverse needs are key.

Social determinants of health (SDOH) significantly influence employee well-being and productivity, impacting Marsh & McLennan's operations. Economic factors, living conditions, education, and healthcare access are key SDOH. The CDC reports that poor SDOH can lead to chronic diseases, costing billions annually. Addressing SDOH is crucial for employee health and business success, reflecting 2024-2025 priorities.

Marsh & McLennan prioritizes diversity and inclusion to attract a broad talent pool and understand its global clients. The company fosters an inclusive culture where employees feel valued. In 2024, Marsh McLennan saw an increase in diverse representation across leadership roles. This commitment is a business and economic necessity.

Societal Expectations Regarding Corporate Responsibility

Societal expectations for corporate responsibility are increasing, affecting Marsh & McLennan. These expectations cover ethical standards, community involvement, and sustainability. Marsh & McLennan's business responsibility report highlights its commitments in these areas. This focus reflects a broader trend toward corporate accountability.

- 2023: Marsh & McLennan's ESG investments reached $2.5 billion.

- 2024: The company plans to increase community engagement by 15%.

- 2025: Focus on sustainable solutions is projected to grow by 20%.

Impact of Misinformation and Disinformation

The spread of misinformation and disinformation, amplified by AI, poses significant risks. This can lead to societal polarization, impacting political stability and business operations. Marsh & McLennan must assess these risks for its clients. The 2024 Edelman Trust Barometer found that trust in institutions is declining, highlighting the vulnerability to false narratives.

- Increased regulatory scrutiny on social media platforms.

- Potential for reputational damage due to association with disinformation.

- Need for enhanced risk assessment and crisis management strategies.

- Growing demand for information verification services.

Marsh & McLennan must navigate changing workforce demographics and address healthcare priorities. Focusing on diversity, inclusion, and corporate responsibility is critical for business success. Societal trends impact employee engagement, company reputation, and overall operational stability.

| Social Factor | Impact on MMC | Data/Trend |

|---|---|---|

| Workforce Demographics | Need for adaptable talent and inclusive culture. | 40% U.S. employees report high stress (2024) |

| Social Expectations | Influences employee engagement and responsibility. | MMC’s ESG investments reached $2.5B (2023). |

| Misinformation | Risks to political stability and operations. | Trust in institutions is declining (2024) |

Technological factors

Technological advancements, like AI and data analytics, are changing professional services. Marsh & McLennan invests in these areas. For instance, in 2024, they increased their tech spending by 15%. This helps improve services and create new tools. Embracing innovation is vital for staying competitive in the market.

Cybersecurity threats, like ransomware, are growing. In 2024, cyberattacks cost businesses globally an average of $4.5 million. Marsh & McLennan, handling sensitive data, faces risks. Strong security and data protection compliance are crucial. The global cybersecurity market is projected to reach $345.7 billion by 2025.

Marsh & McLennan (MMC) is increasingly utilizing Artificial Intelligence (AI) across its operations. They are developing proprietary AI tools and integrating them into client solutions. MMC is also establishing a responsible AI framework. In 2024, MMC invested $1.2 billion in technology, including AI initiatives, to enhance efficiency. The firm is also actively addressing the risks of AI-related fraud.

Technological Disruption in the Industry

Technological disruption significantly impacts the risk management and consulting sectors. Startups and digital platforms are reshaping traditional business models. To stay competitive, Marsh & McLennan must embrace technology. This includes adopting AI-driven analytics and cloud-based solutions. In 2024, the global insurtech market was valued at $7.2 billion, highlighting the rapid tech integration.

- AI and Machine Learning: Enhanced risk assessment and predictive analytics.

- Digital Platforms: Streamlined client interactions and service delivery.

- Cybersecurity: Protecting client data and ensuring operational resilience.

- Data Analytics: Providing data-driven insights for better decision-making.

Investment in Technology Infrastructure

Marsh & McLennan (MMC) must invest in technology infrastructure to support digital initiatives, improve service delivery, and maintain efficiency. These investments are key in today's technological landscape. Consider that in 2024, IT spending globally is projected to reach $5.06 trillion, up 8% from 2023. MMC's tech spending is crucial for staying competitive.

- Cloud infrastructure investments are vital for scalability and data management.

- Cybersecurity measures must be robust to protect sensitive client data.

- Automation technologies can streamline operations and reduce costs.

Technological factors significantly impact Marsh & McLennan. They must leverage AI, data analytics, and digital platforms. Cybersecurity remains a critical concern.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| AI | Risk assessment and predictive analytics | MMC invested $1.2B in tech including AI. |

| Cybersecurity | Data protection and resilience | Cyberattacks cost $4.5M on avg. globally. Cybersecurity market projected $345.7B by 2025. |

| Tech spending | IT and Digital infrastructure | IT spending globally: $5.06T. |

Legal factors

Marsh & McLennan faces a complex global regulatory landscape. Compliance involves navigating various insurance, risk management, and financial service regulations worldwide. The company must continuously adapt to evolving legal standards across many jurisdictions. Failure to comply could result in significant penalties or operational restrictions. In 2024, the firm spent $350 million on regulatory compliance.

Marsh & McLennan faces evolving insurance and risk management regulations. Changes in disclosure requirements and cross-border rules affect its services. In 2024, the global insurance market was valued at $6.7 trillion. Adapting is vital for operations and client support. Compliance costs are a significant factor.

Marsh & McLennan must strictly adhere to growing cybersecurity and data privacy laws globally. Compliance with GDPR and regional mandates is crucial due to the sensitive client data they handle. Non-compliance can lead to substantial penalties, with GDPR fines potentially reaching up to 4% of annual global turnover. In 2023, the average cost of a data breach was $4.45 million.

Anti-Corruption Laws and Sanctions Regimes

Marsh & McLennan faces significant legal hurdles due to anti-corruption laws and sanctions. These include the U.S. Foreign Corrupt Practices Act and the U.K. Anti-Bribery Act. Global operations necessitate strict adherence to these and other international regulations. Non-compliance can lead to severe penalties and reputational damage. In 2024, the DOJ and SEC continued to actively pursue FCPA violations, with settlements often exceeding $100 million.

- Increased enforcement of anti-corruption laws globally.

- Sanctions regimes impacting international transactions.

- Rising costs of compliance and legal oversight.

- Reputational risks associated with legal breaches.

Legal and Regulatory Risks from Operations

Marsh & McLennan faces legal and regulatory risks due to its services, including potential errors and omissions claims. These risks can lead to lawsuits impacting their financial performance. Regulatory scrutiny, especially in financial reporting and fiduciary duties, is ongoing. Adverse legal outcomes could materially affect the company's profitability.

- In 2024, Marsh & McLennan reported $21.6 billion in revenue, highlighting the scale of their operations and associated risks.

- The company's risk management and compliance programs are critical in mitigating these legal challenges.

- Regulatory changes, such as those impacting financial advice, can create new compliance burdens.

Legal factors for Marsh & McLennan involve global regulatory compliance, including insurance and cybersecurity. Anti-corruption laws and sanctions create additional legal hurdles, significantly impacting international operations. The firm’s exposure includes errors and omissions risks, and also financial reporting oversight, as highlighted by the $21.6 billion revenue in 2024.

| Area | Impact | 2024 Data/Insight |

|---|---|---|

| Regulatory Compliance | High costs, operational restrictions | Compliance costs hit $350M in 2024 |

| Cybersecurity/Data Privacy | Penalties for non-compliance | Average data breach cost $4.45M (2023) |

| Anti-Corruption/Sanctions | Severe penalties and reputational risks | DOJ/SEC settlements >$100M |

Environmental factors

Climate change intensifies extreme weather, impacting insurance and reinsurance. This raises property insurance rates and boosts demand for risk solutions. Marsh & McLennan aids clients in managing these climate-related risks. For instance, in 2024, insured losses from natural disasters were estimated at $118 billion, a significant concern. The company provides crucial services to navigate these challenges.

Corporations face growing pressure to manage environmental impacts and comply with varying global regulations. Marsh & McLennan aids clients in navigating these complexities, assessing operational and supply chain risks. For example, in 2024, environmental fines globally reached $35 billion, underscoring regulatory importance. Their specialists offer crucial support.

Environmental, Social, and Governance (ESG) factors are increasingly important. Investors, regulators, and the public are all pushing for better ESG practices. Marsh & McLennan has integrated ESG into its operations. The company also assists clients with their ESG objectives, including setting climate targets; in 2024, MMC's ESG ratings improved across multiple agencies.

Environmental Risks in Specific Industries

Certain industries, like real estate and mining, confront unique environmental risks demanding tailored insurance and risk management strategies. Marsh & McLennan offers specialized expertise to assist clients in navigating challenges such as pollution liability and property conversions. For instance, in 2024, the global environmental insurance market was valued at $14.5 billion, reflecting the increasing need for such services. These sectors must proactively manage environmental impacts due to stringent regulations and potential liabilities.

- Pollution liability coverage helps address cleanup costs and third-party claims.

- Property conversions may require environmental assessments and remediation plans.

- Regulatory compliance is crucial to avoid penalties and operational disruptions.

- The mining industry faces risks like water contamination and land degradation.

Promoting Climate Resilience and Sustainability

Marsh & McLennan actively aids entities in climate resilience and sustainability. They offer insurance solutions tailored to climate risks, supporting disaster preparedness. Their efforts extend to the green economy and sustainability skills. For instance, in 2024, they facilitated over $1 billion in climate-related risk transfer. They also support initiatives that foster sustainable practices.

- Climate risk transfer facilitated: Over $1 billion in 2024.

- Focus on sustainability skills development.

- Support for green economy initiatives.

Environmental factors substantially shape Marsh & McLennan's operations. Climate change increases risk, affecting insurance and risk management, with insured losses at $118 billion in 2024. Companies must navigate environmental impacts and evolving regulations, like $35 billion in 2024 fines. ESG is increasingly vital, integrating within operations to help clients meet targets.

| Environmental Factor | Impact on MMC | 2024 Data/Examples |

|---|---|---|

| Climate Change | Elevated risk profiles, demand for climate solutions | Insured losses from disasters: $118B |

| Environmental Regulations | Compliance challenges, increased need for risk assessment | Global environmental fines: $35B |

| ESG Integration | Enhanced services to meet ESG demands, internal practices | Improved ESG ratings |

PESTLE Analysis Data Sources

The PESTLE analysis relies on IMF, World Bank data and Statista. Additional insights come from government and industry publications for credible context.