Nissan Motor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nissan Motor Bundle

What is included in the product

Analysis of Nissan's BCG Matrix reveals investment, hold, or divest strategies for each quadrant.

Printable summary optimized for A4 and mobile PDFs, allowing concise insights for on-the-go stakeholders.

What You’re Viewing Is Included

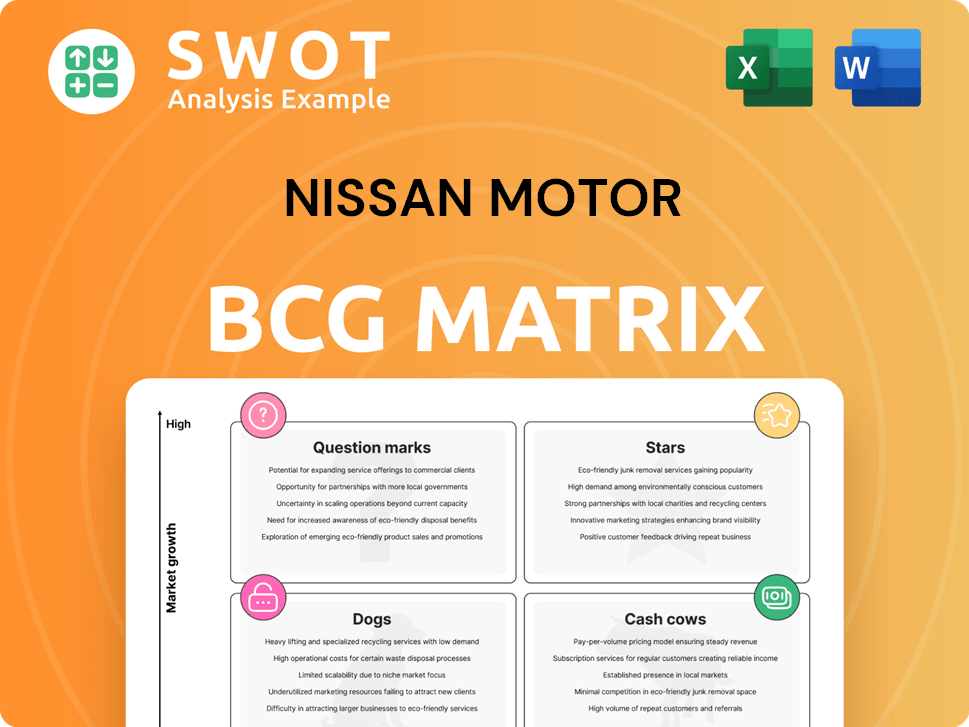

Nissan Motor BCG Matrix

The preview shows the complete Nissan BCG Matrix you'll receive. It’s a fully realized, editable report, devoid of watermarks, and ready for your strategic initiatives.

BCG Matrix Template

Nissan's BCG Matrix showcases its diverse product portfolio across four key quadrants. Understanding the strategic implications of each product group—Stars, Cash Cows, Dogs, and Question Marks—is crucial. This framework reveals where Nissan excels, where it needs to invest, and where it might need to re-evaluate.

This preview offers a glimpse, but the full BCG Matrix reveals detailed quadrant placements, data-backed recommendations, and a roadmap to smart product decisions.

Stars

The Nissan Ariya and Leaf EVs are gaining traction, with the Ariya's sales up 47% and the Leaf's up 57% in 2024, especially in the US. This growth highlights their role in the EV market and Nissan's sustainability drive. Despite this, Nissan delayed its EV investment until 2028. These models are categorized as Stars due to their sales growth.

The Nissan Kicks shines as a Star in Nissan's BCG Matrix. Sales surged by 51.1% year-over-year in Q4 2024, hitting record highs monthly. Its appeal stems from affordability, modern design, and tech. The Kicks excels in urban settings, a key market focus. This success strengthens Nissan's portfolio.

The Nissan Pathfinder shines as a "Star" in Nissan's BCG matrix, fueled by strong growth. Sales soared, with a 44.2% jump in Q4 2024, and a 95% surge in the Middle East. This SUV is hitting the mark with families and adventurers. The fresh 2025 model is now at dealerships.

Nissan Frontier

The Nissan Frontier, classified as a Star in Nissan's BCG matrix, demonstrates strong performance. Sales for the Frontier increased by 17.2% in 2024, signaling its growing popularity. The truck's robust V6 engine and versatile configurations contribute to its appeal. It effectively competes in the midsize truck market, offering a balance of capability and affordability.

- Sales Growth: 17.2% increase in 2024.

- Engine: Features a powerful V6 engine.

- Market Position: Competes effectively in the midsize truck segment.

- Target Audience: Attracts drivers seeking a capable and versatile pickup.

Nissan Patrol (Middle East)

In the Middle East, the Nissan Patrol shines as a star within Nissan's portfolio. This SUV represents a significant portion of Nissan's sales in the region. Its popularity is growing, fueled by its off-road prowess and heritage.

- Sales Contribution: The Nissan Patrol contributes 31% to Nissan's total sales in the Middle East.

- Sales Growth: Patrol sales have increased by 24%.

- Key Market: The Middle East is a crucial market for the Patrol.

- Product Launch: The all-new Nissan Patrol's debut in Abu Dhabi further enhanced its appeal.

Nissan's Stars show strong growth and market appeal. The Ariya and Leaf EVs, despite delayed investments, are gaining traction. Kicks, Pathfinder, Frontier, and Patrol boast significant sales increases. These models drive Nissan's revenue.

| Model | Sales Growth | Key Market/Region |

|---|---|---|

| Ariya/Leaf | Up to 57% (2024) | US, Global |

| Kicks | 51.1% (Q4 2024) | Urban |

| Pathfinder | 44.2% (Q4 2024) | Families |

| Frontier | 17.2% (2024) | Midsize Truck |

| Patrol | 24% (Middle East) | Middle East |

Cash Cows

The Nissan Versa and Sentra stand out as strong cash cows. For the calendar year, Versa sales surged by 71.7%, and Sentra sales rose by 39.8%. These affordable sedans significantly boost Nissan's sales and help maintain market share. Their success is driven by attractive pricing and improved features.

The Nissan Rogue, a bestseller, is a cash cow for Nissan, providing steady revenue. While exact sales aren't always detailed, its popularity is key to Nissan's sales. In 2023, the Rogue was a top-selling SUV in the U.S. market. Nissan plans a PHEV version of the Rogue for North America, aiming to boost sales further.

Nissan's light commercial vehicles (LCVs) are a key part of their business, consistently generating strong revenue. In 2023, Nissan sold over 700,000 LCVs worldwide, demonstrating their broad appeal. These vehicles are profitable and have shown resilience, even during economic downturns. Nissan's goal is to increase LCV sales to over one million units, highlighting their significance as a reliable source of cash.

Strategic Alliance with Renault and Mitsubishi

Nissan's alliances with Renault and Mitsubishi are strategic cash cows, enhancing its competitive edge. These partnerships support cost savings and resource sharing, boosting profitability. The alliances allow Nissan to leverage shared platforms and technologies, optimizing operations. In 2024, the Renault-Nissan-Mitsubishi alliance sold over 8.2 million vehicles globally.

- Shared platform usage reduces development costs.

- Joint purchasing power lowers material expenses.

- Technology sharing accelerates innovation cycles.

- Increased global market presence.

Continued focus on ICE models

Nissan's strategy emphasizes its ICE models, with 14 new launches planned over the next three years. These models support overall sales and market share in regions with slower EV adoption. ICE vehicles cater to varied customer needs, especially in markets where electrification is not yet dominant. Nissan's focus on ICE models is a key aspect of its balanced approach. In 2024, Nissan's global sales reached 3.4 million units.

- ICE models contribute significantly to Nissan's sales volume.

- The strategy addresses diverse market demands.

- Nissan aims for a balanced approach in vehicle offerings.

- This plan is part of Nissan's global strategy.

Nissan's cash cows include the Versa, Sentra, and Rogue, which provide consistent revenue. Light commercial vehicles also contribute significantly to cash flow, with over 700,000 units sold in 2023. Strategic alliances with Renault and Mitsubishi further boost profitability.

| Cash Cow | Key Features | 2023 Performance |

|---|---|---|

| Versa/Sentra | Affordable sedans | Sales increase of 71.7% (Versa) & 39.8% (Sentra) |

| Rogue | Top-selling SUV | High sales volume in the U.S. market. |

| LCVs | Light Commercial Vehicles | Over 700,000 units sold globally. |

Dogs

The Nissan Maxima, now discontinued, serves as a "Dog" in Nissan's BCG matrix. Sales plummeted by 53% in a recent quarter before its discontinuation. This strategic move allows Nissan to concentrate on more lucrative, expanding market segments. The Maxima's phase-out negatively affected Nissan's overall sales performance.

The Nissan Leaf, despite a US resurgence, faces challenges. Global sales plummeted by 57% in a recent quarter, signaling a dog in some markets. This requires a region-specific strategy. Nissan plans to transform the Leaf into a crossover for future models.

The Nissan Murano, an older model, faces challenges in the market. Sales figures indicate a decline, impacting Nissan's overall performance. Its design and tech are aging, hurting competitiveness. In 2023, Murano sales dropped, signaling its potential status as a dog within Nissan's portfolio.

China Market Performance

Nissan faces significant challenges in China, a crucial market. Sales in China dropped by 12.2% in 2024, signaling underperformance. This downturn reflects the intense competition, particularly from domestic EV makers. Nissan's struggles position some products as dogs in the region.

- 2024 sales decline of 12.2% in China.

- Intense competition from brands like BYD.

- Underperformance indicates challenges in the EV market.

Underperforming European Models

Nissan faces challenges in Europe. The Qashqai and Juke haven't fully compensated for declines elsewhere. The Ariya EV's performance has been disappointing. This indicates some models are underperforming in the region. Nissan's sales volume has been affected by shifting consumer tastes.

- European sales for Nissan have shown fluctuations, with the Qashqai being a key model, but not enough to fully offset declines.

- The Ariya EV has not met sales expectations, contributing to the "dog" status.

- Consumer preferences are evolving, impacting Nissan's ability to maintain sales volume in Europe.

- Nissan's market share in Europe has been under pressure.

Several Nissan models are classified as "Dogs" in the BCG matrix due to declining sales and market challenges.

The Maxima was discontinued after a 53% sales drop, and the Leaf faces headwinds with a 57% global sales decline.

Murano's older design and declining sales also contribute to its "Dog" status, reflecting Nissan's need for strategic portfolio adjustments.

| Model | Status | Sales Change (Recent Quarter/Period) |

|---|---|---|

| Maxima | Dog | -53% (Before Discontinuation) |

| Leaf | Dog (in Some Markets) | -57% (Global) |

| Murano | Dog (Potential) | Declining (2023) |

Question Marks

Nissan's post-2025 EV lineup, including the Leaf and Micra, are question marks. Their success hinges on consumer adoption and market competitiveness. Nissan is investing heavily in EVs, with plans to launch 19 new EV models by 2030. In 2024, Nissan's global EV sales increased, but face tough competition.

Nissan's e-POWER, a petrol-engine-powered generator hybrid, is expanding into models like the Qashqai. This positions e-POWER as a transitional technology between gasoline and full EVs, which is a question mark. The success hinges on consumer preference for hybrid cars. The next-gen e-POWER will launch in Europe on the Qashqai in fiscal year 2025.

Nissan is venturing into the plug-in hybrid market with a PHEV version of its Rogue SUV in North America. This move positions the model as a "Question Mark" in the BCG Matrix. Success hinges on consumer demand for PHEVs and Nissan's competitiveness, especially against rivals like Toyota and Ford. In 2024, PHEV sales in the US accounted for about 3% of total vehicle sales, indicating a growing but still niche market.

Autonomous Driving Technology

Nissan's foray into autonomous driving represents a "Question Mark" in its BCG matrix. The company is actively investing in advanced driver-assistance systems (ADAS) and autonomous capabilities to improve vehicle safety and enhance the driving experience. However, the future success of these technologies hinges on various factors. These include regulatory approvals, consumer adoption rates, and the continuous evolution of technology.

- Nissan aims for 40% of its vehicles to have Level 2 autonomous driving capabilities by fiscal year 2026.

- The global autonomous vehicle market is projected to reach $62.9 billion by 2030.

- Consumer trust in autonomous systems is a key hurdle, with surveys showing varied levels of acceptance.

New Business Ventures

Nissan's "Question Marks" in the BCG Matrix involve new business ventures. The company aims for 2.5 trillion yen in extra revenue by fiscal year 2030 from these ventures. Success hinges on market dynamics, partnerships, and Nissan's execution capabilities. These initiatives are crucial for driving value and enhancing competitiveness.

- Target: 2.5 trillion yen additional revenue by fiscal year 2030.

- Dependence: Market conditions, strategic partnerships, and innovation.

- Objective: Drive value and strengthen competitiveness.

Nissan's new ventures, like autonomous driving and new business ventures, are question marks. Their success is tied to regulatory approvals and consumer acceptance. The autonomous vehicle market is predicted to reach $62.9 billion by 2030. Nissan targets 40% of vehicles with Level 2 autonomy by fiscal year 2026.

| Aspect | Details | Impact |

|---|---|---|

| Autonomous Driving | Level 2 by 2026 | Enhances safety and driving experience. |

| Market Growth | $62.9B by 2030 | Indicates significant future growth potential. |

| Revenue | 2.5 trillion yen by 2030 | Aims to drive value and boost competitiveness. |

BCG Matrix Data Sources

The Nissan BCG Matrix utilizes data from financial reports, market analysis, and industry research, providing actionable strategic insights.