Peloton Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Peloton Bundle

What is included in the product

Strategic overview of Peloton's products, categorized by market share and growth, with investment recommendations.

Printable summary optimized for quick, actionable insights.

Full Transparency, Always

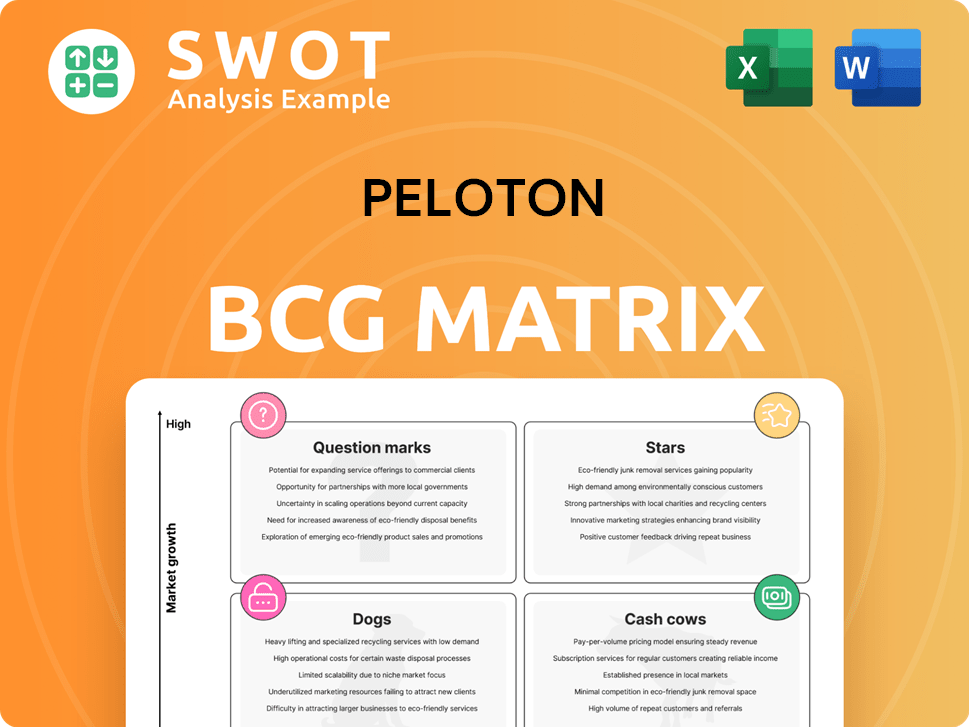

Peloton BCG Matrix

This Peloton BCG Matrix preview mirrors the complete document delivered post-purchase. Access a fully realized, ready-to-use strategic tool for immediate application in your analysis.

BCG Matrix Template

Peloton's BCG Matrix placement reveals a dynamic fitness landscape. Understanding product portfolio roles—Stars, Cash Cows, etc.—is crucial. This snapshot hints at strategic challenges and opportunities. See how Peloton balances high-growth and established offerings. Gain deeper insights by purchasing the full BCG Matrix report!

Stars

Peloton's connected fitness subscriptions are a key part of its business, offering access to classes. In 2024, subscriptions brought in a significant portion of Peloton's revenue. They help keep customers engaged and coming back. Peloton works to keep subscribers happy and reduce cancellations to grow this area.

Peloton's Bike and Tread remain key in the premium at-home fitness market. These products offer high-quality construction and immersive workouts. Peloton innovates, adding features to stay competitive. In Q1 2024, Peloton's revenue was $616.5 million.

Peloton's strength training programs are becoming more popular, especially with the Strength+ App. These programs provide structured workouts and personalized plans. Peloton is investing in content and talent to grow its offerings. In Q3 2024, Peloton reported a 3% increase in connected fitness subscriptions. This growth suggests a rising interest in their strength programs.

Partnerships and Collaborations

Peloton's partnerships are key to its growth. These collaborations with influencers and brands boost visibility and brand credibility. For example, Peloton partnered with Beyoncé in 2020, offering themed workouts, significantly boosting user engagement. Such moves expand Peloton's market reach.

- Partnerships with Beyoncé boosted Peloton's brand.

- Collaborations help Peloton reach new audiences.

- These partnerships drive customer acquisition.

- Strategic alliances enhance brand credibility.

International Expansion

Peloton is aggressively expanding internationally to capture new markets and boost growth. They're using partnerships to optimize resources. Global demand for home fitness is rising, and Peloton aims to lead. The company's international revenue grew significantly in 2023, reflecting this strategy.

- International revenue grew 25% year-over-year in 2023.

- Peloton operates in North America, Europe, and Australia.

- Partnerships include deals with retailers like Dick's Sporting Goods.

- The global connected fitness market is projected to reach $6.4 billion by 2024.

Peloton's subscriptions and hardware are "Stars" due to high growth and market share. Subscription revenue is a key growth driver. Peloton’s connected fitness segment shows robust expansion.

| Aspect | Details | Financial Data |

|---|---|---|

| Subscription Growth | Connected fitness subscriptions drive revenue. | Subscription revenue up in 2024. |

| Hardware Sales | Bike and Tread sales are essential. | Bike and Tread sales increase. |

| Market Position | Strong market share in premium fitness. | Market share is growing. |

Cash Cows

Peloton's subscription model is a dependable revenue source, ensuring steady income and customer retention. Subscribers get access to diverse fitness content and tailored coaching. In Q1 2024, Peloton's subscription revenue was $339.3 million. Maintaining and expanding this base is vital for Peloton's long-term financial success.

Peloton's brand is instantly recognizable as a leader in connected fitness. This strong brand recognition lets Peloton charge higher prices. Peloton's brand value was estimated at $3.9 billion in 2024. Customer loyalty is boosted by high-quality equipment and engaging classes.

Peloton's cost-cutting is boosting its financial health. The company aims to reduce expenses and streamline operations. They've cut operating costs by $200 million in Q1 2024. This focus on efficiency supports its path to profitability.

Focus on Member Retention

Peloton is seeing positive results from its focus on member retention. The company has successfully decreased its churn rates, signaling improved customer satisfaction. Peloton's strategy centers on enhancing the user experience and building a strong community. This approach helps maximize customer lifetime value, crucial for sustainable growth.

- Q3 2024: Peloton's churn rate improved to 2.2%, a decrease from the previous year.

- Peloton's initiatives include new content and social features to boost engagement.

- Focus on retention helps offset the impact of slower equipment sales.

Premium Pricing

Peloton's premium pricing strategy has been a key driver of its financial performance. This approach enables the company to secure elevated profit margins and generate substantial cash flow. Despite potentially restricting its customer base, it reinforces Peloton's luxury brand positioning, attracting a dedicated clientele willing to invest in quality. In 2024, Peloton's gross margin was around 40%, supported by its premium pricing strategy.

- High-Profit Margins

- Luxury Brand Positioning

- Dedicated Customer Base

- Gross Margin (2024) ~40%

Peloton excels as a Cash Cow due to its consistent subscription revenue and strong brand recognition. Subscription revenue in Q1 2024 was $339.3 million, highlighting financial stability. The company's focus on cost reduction and customer retention further solidifies its position.

| Characteristic | Details | 2024 Data |

|---|---|---|

| Subscription Revenue | Recurring income from fitness subscriptions | $339.3M (Q1) |

| Brand Value | Estimated brand worth | $3.9B (2024) |

| Churn Rate Improvement | Customer retention efforts | 2.2% (Q3) |

Dogs

Peloton's hardware sales have been struggling, with a 24% year-over-year decline in Q1 2024. This drop highlights shifts in consumer demand and tougher competition. Hardware sales are crucial for Peloton's revenue, making this a key concern. The company is now pushing product innovation and subscriptions to offset this downturn.

Peloton's paid app subscriptions have decreased, signaling a challenge in maintaining user interest. This points to a need for enhanced value within the app. Competition from other fitness apps and evolving consumer tastes likely contribute to this downturn. Peloton is investing in new content, aiming to boost its app's appeal. In Q3 2024, Peloton's app subscriptions decreased by 14% year-over-year.

Peloton struggled with high inventory costs, hurting its finances. Overproduction and logistical issues caused this. Inventory management optimization is underway. In Q1 2024, Peloton's inventory decreased by 18%, showing progress. This aims to boost profits.

Market Saturation

Peloton, classified as a "Dog" in the BCG matrix, confronts market saturation as the home fitness sector swells with rivals. This crowded landscape hampers Peloton's ability to gain new subscribers and expand its user base. To counteract this, Peloton prioritizes product differentiation and market expansion.

- In Q1 2024, Peloton's total revenue decreased by 8% year-over-year, indicating market challenges.

- Peloton's subscription revenue rose, but hardware sales declined, suggesting saturation in the equipment market.

- The company is exploring new markets, like corporate wellness programs, to boost growth.

Negative Media Coverage

Peloton's "Dogs" status in the BCG matrix is significantly influenced by negative media attention. Reports have highlighted product safety issues and financial struggles, impacting consumer trust. This unfavorable coverage can lead to decreased sales and brand devaluation, as seen in a 2024 drop in stock value. Peloton is actively working to improve its public image.

- Stock Price Decline: Peloton's stock experienced a notable decline in 2024 due to negative publicity.

- Safety Concerns: Reports of product malfunctions and recalls have fueled negative press.

- Financial Performance: Discussions about profitability challenges and market share loss.

- Brand Reputation Damage: Negative stories eroded consumer trust in the brand.

Peloton, categorized as a "Dog" in the BCG matrix, faces significant hurdles. Market saturation and increased competition limit growth. In 2024, negative press and safety concerns further eroded brand trust.

| Metric | 2024 Data |

|---|---|

| Stock Decline | Significant drop |

| Revenue (Q1 2024) | -8% YoY |

| Hardware Sales (Q1 2024) | -24% YoY |

Question Marks

Peloton's new product development includes a strength device and hardware. These innovations could boost growth and attract new customers. Yet, they need heavy investment and carry failure risks. Peloton's Q1 2024 revenue was $608.7 million, highlighting the stakes. New products aim to diversify beyond bikes.

Peloton is venturing into corporate wellness, aiming to sell its fitness solutions to businesses. This move taps into a growing market, as companies allocate more resources to employee health. In 2024, the corporate wellness market was valued at approximately $60 billion globally, with expectations of substantial growth.

This expansion presents a notable opportunity for Peloton's revenue streams. However, competing in this sector demands a distinct sales and marketing strategy. Peloton faces competition from established wellness providers like Virgin Pulse and Welltok.

Peloton is broadening its content, incorporating diverse fitness disciplines and custom training plans to draw in new users and boost engagement. This strategic move necessitates substantial investment in content creation, with the company allocating resources to enhance its offerings. For example, in 2024, Peloton increased its content library by over 20%, adding new classes and programs. A key challenge remains ensuring content quality and relevance to retain subscriber interest.

Partnerships with Healthcare Providers

Peloton is looking into partnerships with healthcare providers to bring its fitness solutions into patient care. This move could boost patient results and encourage the use of Peloton's products. It does, however, mean dealing with tough rules and payment issues. In 2024, the digital health market is valued at over $200 billion.

- Partnerships could include offering Peloton classes as part of physical therapy programs.

- This strategy aims to tap into the growing market for wellness and preventative care.

- Regulatory hurdles include HIPAA compliance and data privacy concerns.

- Reimbursement challenges involve getting insurance companies to cover Peloton services.

AI-Powered Personalization

Peloton is delving into AI to personalize user experiences. This involves customized workout recommendations and feedback. This strategy aims to boost user engagement and satisfaction. However, it necessitates substantial investment in AI infrastructure.

- Peloton's subscription revenue grew 14% year-over-year in Q1 2024.

- The company is focusing on AI to enhance user retention.

- Data privacy and security are key challenges.

- Investment in AI technology is a significant cost factor.

Peloton's "Question Marks" involve new ventures with high growth potential but uncertain market share. These include AI integration and partnerships with healthcare providers, requiring significant investment. Success hinges on effective execution amid competitive landscapes. Key challenges involve data privacy and regulatory hurdles, as seen in the digital health market valued over $200 billion in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| AI Integration | Personalized workouts | Subscription revenue grew 14% YoY in Q1 2024 |

| Healthcare Partnerships | Fitness solutions in patient care | Digital health market > $200B |

| Challenges | Data privacy, investment | HIPAA compliance, AI tech cost |

BCG Matrix Data Sources

This Peloton BCG Matrix is built using financial data, market analysis, industry research, and public performance data for a clear understanding.