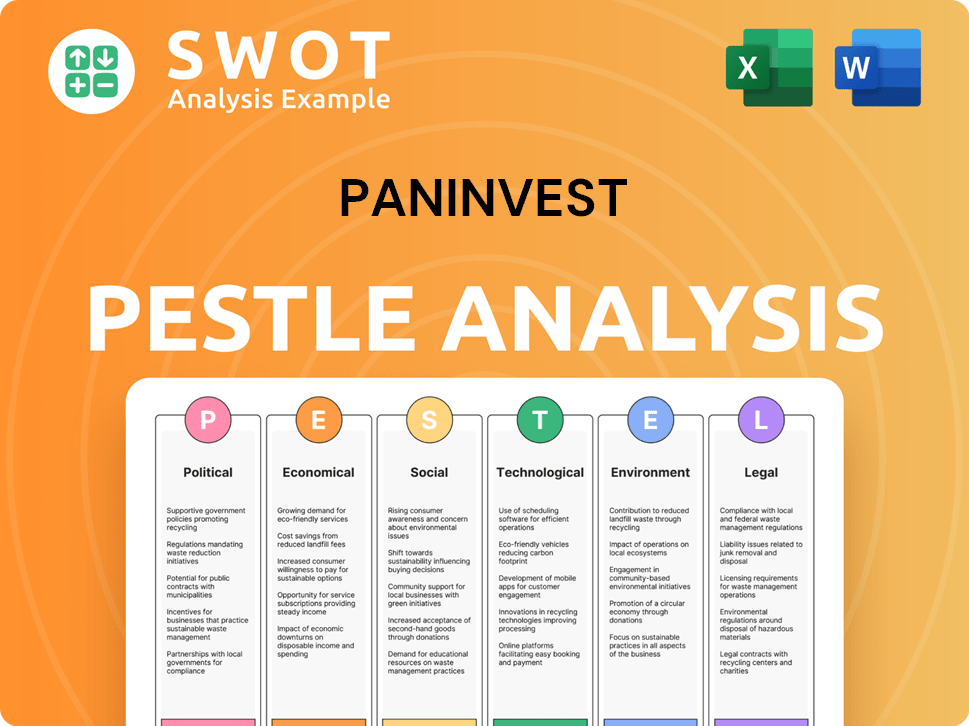

Paninvest PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paninvest Bundle

What is included in the product

Provides a structured examination of Paninvest's macro-environment. Analyzes Political, Economic, Social, Technological, Environmental, and Legal influences.

Supports focused discussions on crucial external factors during strategy meetings. Quick and easy format aids in risk assessment.

Same Document Delivered

Paninvest PESTLE Analysis

The file you're seeing now is the final version—ready to download right after purchase. This Paninvest PESTLE analysis offers a comprehensive market overview. You'll get detailed political, economic, social, tech, legal & environmental factors. Analyze them for insightful business strategy. Purchase, download, and start planning today.

PESTLE Analysis Template

Uncover the forces shaping Paninvest's future with our PESTLE analysis. Explore political, economic, social, technological, legal, and environmental factors. Our analysis delivers key insights to strengthen your strategy and make informed decisions. Download the full report and gain a competitive edge today!

Political factors

Indonesia's political environment is stable post-2024 elections. The new government, in power since October 2024, is a broad coalition. This influences policy changes and their execution. This stability is attracting global investment; for example, foreign direct investment in Q1 2024 reached $12.8 billion.

Policy synergy is crucial for Indonesia's economic health. The government and Bank Indonesia are working together to align fiscal and monetary policies. This coordinated approach aims to ensure stability amid global uncertainties. For example, in 2024, Indonesia's GDP growth was around 5%, supported by these efforts. This collaboration is vital for sustainable growth.

The OJK's new regulations, effective December 2024, significantly impact financial conglomerates. These rules mandate that controlling shareholders of financial institutions with assets exceeding specific thresholds must establish a financial holding company by June 2025. This initiative, part of broader efforts to strengthen financial sector oversight, aims to improve control and consolidation. For instance, compliance costs are expected to increase by 10-15% for affected institutions.

Government Initiatives for Economic Development

The Indonesian government actively promotes economic growth through strategic initiatives. Key programs include the 'Making Indonesia 4.0' roadmap and the 'Digital Indonesia Roadmap 2021-2024', focusing on technological advancements. These initiatives aim to boost digital infrastructure and enhance digital skills across the workforce. The government's commitment supports business technology adoption. These efforts are designed to foster sustainable economic development.

Changes in Mining Law

Amendments to the Mining Law, expected in 2025, target better access for smaller firms and religious entities while boosting domestic mineral use. These changes aim to spur sector growth and investment. However, worries persist about environmental effects and governance, potentially impacting project approvals and operational costs. For instance, in 2024, the mining sector contributed approximately 10% to the national GDP.

- Expected law changes in 2025.

- Focus on access for small companies and religious groups.

- Goal to increase domestic resource use.

- Concerns about environment and governance.

Indonesia's political scene is stable, with policy changes anticipated post-2024 elections. The government and Bank Indonesia work to align fiscal and monetary policies. These initiatives supported 5% GDP growth in 2024.

| Political Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Government Stability | Attracts investment | FDI in Q1 2024: $12.8B |

| Policy Synergy | Ensures Stability | GDP Growth (2024): ~5% |

| Mining Law | Sector Boost, Concerns | Mining's GDP Share (2024): ~10% |

Economic factors

Indonesia's GDP growth remained robust, approximately 5% in 2024. Projections for 2025 anticipate a similar growth rate, largely fueled by domestic consumption. This consistent growth, while positive, poses hurdles for achieving higher economic goals. The Indonesian economy's growth rate in Q1 2024 was 5.11%.

Indonesia's inflation remained within the 2-4% target in 2024, influenced by global commodity prices and domestic demand. The VAT rate increase in 2025 could slightly elevate inflation. Bank Indonesia (BI) has managed the policy rate to support economic growth and Rupiah stability. In 2024, BI's policy rate was around 6.25%, potentially adjusting further in 2025.

Consumer spending is projected to stay robust in 2025, supporting economic expansion. Investment is increasing, fueled by public infrastructure spending, even if the rate softens. Household affluence is boosting spending, with a strong emphasis on value. In 2024, consumer spending accounted for about 68% of GDP in the U.S. and is expected to remain high in 2025.

External Factors and Trade

Indonesia's economy faces external risks like China's slowdown and potential US tariff changes. These factors could affect exports, even though trade surpluses and foreign investment currently help. A projected current account deficit in 2025 might worsen vulnerability to capital outflows. The trade surplus in 2024 was around $36.3 billion.

- China's economic slowdown could decrease demand for Indonesian exports.

- US tariff adjustments might impact specific Indonesian goods.

- The current account deficit, possibly emerging in 2025, could lead to capital flight.

- Foreign direct investment is crucial to offset these risks.

Digital Economy Growth

Indonesia's digital economy is booming. It's on track to surpass $130 billion by 2025, fueled by high internet use and a young population. E-commerce and fintech are leading the way, with digital payments and lending seeing rapid expansion. This growth presents many opportunities and challenges for businesses and investors alike.

- Projected digital economy value for 2025: Over $130 billion.

- Key drivers: Rising internet penetration and a young demographic.

- Major sectors: E-commerce and financial technology (fintech).

Indonesia's economy grew roughly 5% in 2024, expected to stay stable in 2025, mainly due to consumer spending, as in 2024, it reached 68% of the U.S. GDP. Inflation is in check but could be slightly up due to the 2025 VAT hike, with BI managing interest rates at about 6.25%. Challenges include external risks, like China's slowdown, with digital economy reaching over $130 billion by 2025.

| Metric | 2024 | 2025 (Projected) |

|---|---|---|

| GDP Growth | 5% | ~5% |

| Inflation | 2-4% | May see a slight rise |

| Digital Economy Value | Not specified | Over $130 billion |

Sociological factors

Indonesia boasts a youthful demographic with high digital literacy, fueling the digital economy. This segment, active on social media, is reshaping consumer habits. Over 60% of Indonesia's population is under 40, driving e-commerce. Mobile internet penetration reached 77% in 2024.

Urbanization fuels new consumption trends in Indonesia. Data from 2024 shows urban areas' rising demand for modern goods. The middle class's income growth affects spending habits. In 2024, middle-class spending increased by 8%, impacting market trends significantly.

Indonesia sees growing digital tech adoption. Internet penetration reached 79.5% in early 2024. Social media use is widespread, affecting consumer behavior, information access, and service delivery. Digital platforms are key for business in Indonesia. E-commerce sales in Indonesia were projected to reach $68.5 billion in 2024.

Social Media Trends and Influence

Social media significantly shapes Indonesian society, impacting how businesses market and communicate. Platforms such as Instagram, Facebook, TikTok, and X (formerly Twitter) are integral for entertainment, e-commerce, and news consumption. The widespread use of social media necessitates that businesses adapt their strategies to connect with consumers effectively in the digital space. In 2024, Indonesia's social media users exceeded 200 million, highlighting the platforms' reach.

- Indonesia's internet penetration rate reached 78% in early 2024.

- TikTok's ad revenue in Indonesia is projected to reach $1.8 billion by the end of 2024.

- E-commerce sales influenced by social media marketing account for 60% of all online transactions.

Income Inequality and Regional Growth Disparities

Income inequality persists in Indonesia, especially in cities, even with economic growth. The government is trying to boost growth in areas outside big cities, with Central and Eastern Indonesia becoming more important. In 2024, the Gini ratio, a measure of inequality, was around 0.38, showing a slight improvement. These areas are seeing increased investment and development.

- The Gini ratio in Indonesia was approximately 0.38 in 2024.

- Central and Eastern Indonesia are key regions for growth.

- Government efforts aim to reduce regional disparities.

- Urban areas still face significant income inequality.

Indonesia's digital and youthful population fuels e-commerce and mobile internet use. Urbanization is driving new consumption trends as the middle class grows. Digital adoption is widespread, significantly shaping consumer behavior via social media. Income inequality remains a challenge. The government promotes development in Central and Eastern Indonesia.

| Factor | Data |

|---|---|

| Internet Penetration (Early 2024) | 78% |

| Social Media Users (2024) | Over 200M |

| Gini Ratio (2024) | 0.38 |

Technological factors

Indonesia's digital transformation accelerates, backed by government tech initiatives. AI and automation adoption is rising among businesses. In 2024, the digital economy grew to $82 billion. Fintech adoption surged, with 85% of Indonesians using digital payment.

Indonesia's ICT sector is set for continued growth, fueled by AI, IoT, and 5G adoption. Digital infrastructure enhancements support this expansion. The Indonesian digital economy is forecasted to reach $330 billion by 2025, with strong ICT sector contributions. Investment in digital infrastructure grew by 20% in 2024, indicating robust sector development.

Indonesia's fintech sector is booming, especially in digital payments, P2P lending, and BNPL. Regulations support this growth, fostering innovation. The digital payment market is projected to reach $130B by 2025. Investments in fintech surged to $1.2B in 2024. This sector's expansion offers diverse investment opportunities.

Adoption of Emerging Technologies

Indonesia's technological landscape is rapidly evolving, driven by emerging technologies. AI, IoT, and blockchain are set to reshape industries. The digital economy's growth supports this transformation, with significant market potential. The government's digital economy roadmap aims for $315 billion by 2030.

- AI adoption is growing, with a 20% increase in usage among businesses.

- IoT spending is projected to reach $15 billion by 2025.

- Blockchain initiatives are gaining traction in supply chain and finance.

Cybersecurity Concerns

Cybersecurity is a significant technological factor, especially as digital transactions and online activities increase. The need for robust cybersecurity solutions has grown substantially. For instance, the global cybersecurity market is projected to reach $345.4 billion by 2024. This includes strengthening payment system frameworks with advanced security measures.

- Demand for cybersecurity solutions is rising.

- Global cybersecurity market expected to reach $345.4B by 2024.

- Cybersecurity is vital for payment systems.

Indonesia's tech sector thrives, with AI use up 20% in businesses, enhancing digital economy which reached $82B in 2024. IoT spending targets $15B by 2025. Cybersecurity market hits $345.4B by 2024.

| Technological Aspect | 2024 Data | 2025 Projection |

|---|---|---|

| AI Adoption | 20% business usage increase | Further growth in various sectors |

| IoT Spending | Data Not Available | $15 billion projected |

| Cybersecurity Market | $345.4 billion | Continued expansion expected |

Legal factors

New regulations, such as POJK 30 of 2024, are reshaping financial conglomerations. These regulations mandate financial holding companies for certain groups. The goal is to enhance the stability and oversight of financial institutions. This could lead to increased compliance costs. It also potentially impacts operational structures.

The fintech sector faces evolving regulations. New rules target peer-to-peer lending and multi-finance, enhancing stability and safeguarding consumers. Regulations are also emerging for alternative credit scoring providers. In 2024, regulatory changes impacted 25% of fintech firms. Compliance costs rose by 15% due to these changes.

Adjustments to VAT provisions, effective January 2025, impact Paninvest. A 12% VAT applies to luxury items, potentially affecting sales. Non-luxury goods face an effective 11% rate. These changes could influence pricing strategies and profitability. Anticipate compliance costs and possible consumer behavior shifts.

Amendments to Mining Law

In 2025, amendments to the Law on Mineral and Coal Mining are in progress. These changes could ease access to mining permits for specific groups and boost domestic mineral use. Such moves aim to stimulate the mining sector. However, they also raise environmental and governance questions, which may affect long-term sustainability.

- Revised laws might increase mining activities, potentially impacting ecosystems.

- Easier permit access could benefit some companies more than others.

- Increased domestic mineral use could alter market dynamics.

- Environmental and governance standards are key for sustainable development.

Environmental Approval Processes

Starting January 2025, a new decree shifts environmental approval authority to provincial and regional governments, streamlining compliance for businesses. This reform aims to expedite project approvals and reduce bureaucratic hurdles. The delegation is expected to cut approval times by up to 30%, based on preliminary estimates. This shift also aligns with broader efforts to boost regional economic development.

- Decree effective: January 2025

- Approval time reduction: up to 30%

- Authority shift: to provincial/regional governments

Regulatory shifts demand financial adjustments. New rules like POJK 30 (2024) reshape financial structures, increasing compliance expenses. VAT changes in early 2025, with 12% for luxury items, require pricing strategy updates, affecting sales and profit. Easing mining permit access may change sector dynamics.

| Regulatory Aspect | Effective Date | Impact on Paninvest |

|---|---|---|

| Financial Conglomeration Regulations (POJK 30) | 2024 | Increased compliance costs, structural changes |

| VAT Adjustments | January 2025 | Pricing strategy adjustments, potentially decreased profit |

| Mining Law Amendments | 2025 | Potential changes in market dynamics, altered permit process |

Environmental factors

Indonesia's commitment to environmental sustainability is evident through its comprehensive legal framework. These laws address vital areas like environmental protection and management, hazardous waste, and pollution control. For instance, the Ministry of Environment and Forestry's budget for 2024 was approximately $1.2 billion, reflecting the government's investment in conservation. These initiatives are crucial for sustainable development.

Indonesia is updating its climate targets under the Paris Agreement, with regulations for emissions monitoring. The nation focuses on increasing renewable energy and protecting forests and peatlands. In 2024, Indonesia aims to reduce emissions by 31.89% independently. The government has set a goal of 23% renewable energy by 2025.

Government regulations are tightening on waste management and pollution control. Businesses handling hazardous waste must meet stringent technical storage standards. The global waste management market is projected to reach $2.6 trillion by 2025. Companies face rising costs related to compliance and remediation. Failure to comply may result in significant financial penalties.

Focus on Sustainable Resource Management

Sustainable resource management is gaining prominence, influencing investment decisions. The division of the Ministry of Environment and Forestry aims to enhance focus on forest protection and broader environmental issues. This restructuring could impact various sectors. The Indonesian government allocated Rp 4.68 trillion (approximately $298 million USD) for environmental and forestry programs in 2024.

- Increased government spending on environmental programs reflects the growing importance of sustainability.

- The separation of the ministry suggests a more specialized approach to environmental protection and resource management.

- Companies need to consider the implications of these changes for compliance and operational strategies.

Environmental Risk Management

Environmental risk management is becoming crucial for Indonesian businesses. The rise of environmental insurance showcases a mature approach to these risks. Companies are now actively assessing and mitigating environmental impacts. This includes regulatory compliance and sustainability initiatives. These actions aim to reduce potential liabilities and enhance corporate reputation.

- The Indonesian government has increased environmental regulations in 2024.

- Environmental insurance premiums in Indonesia rose by 15% in 2024.

- Companies with strong ESG performance saw a 10% increase in investor interest.

Indonesia prioritizes environmental sustainability through strong legal frameworks and substantial investments like the $1.2 billion 2024 Ministry of Environment and Forestry budget. Climate targets are being updated, aiming for a 31.89% emissions reduction by 2024 and 23% renewable energy by 2025. Tightening waste management and pollution control, including technical storage standards for hazardous waste, is affecting businesses.

| Environmental Aspect | Data (2024) | Impact |

|---|---|---|

| Govt. Spending | $298M for env. and forestry programs | Supports sustainability |

| Emissions Reduction Target | 31.89% (independently) | Affects all industries |

| Waste Market (Global) | $2.6T projected by 2025 | Influences costs and regulations |

PESTLE Analysis Data Sources

Paninvest PESTLE Analysis relies on governmental datasets, global market reports, and industry insights to provide you with the most relevant data for your report.