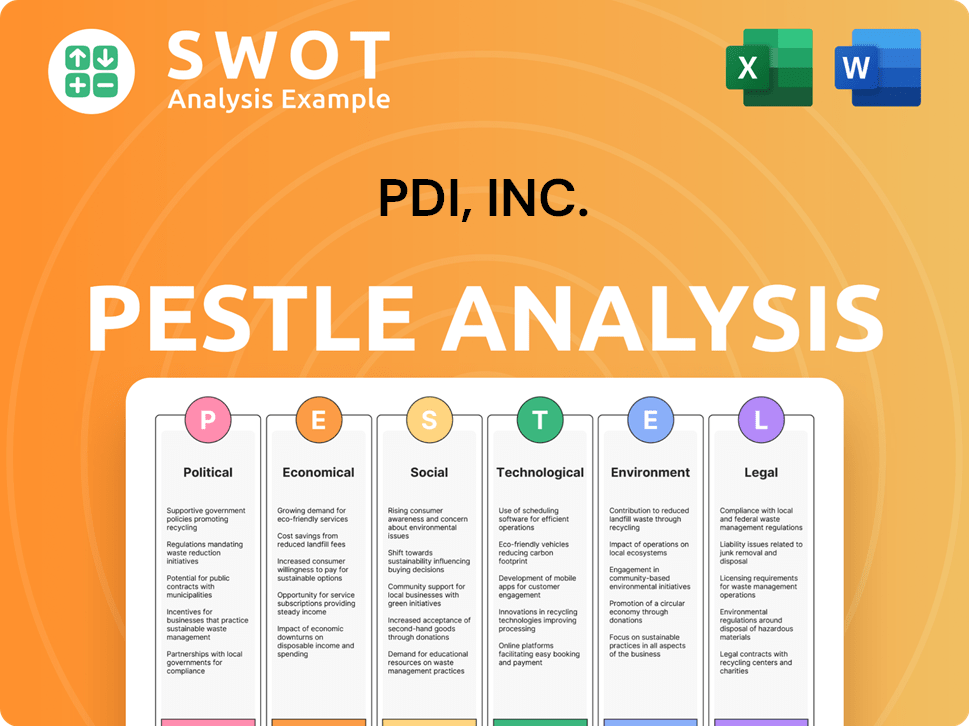

PDI, Inc. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PDI, Inc. Bundle

What is included in the product

Investigates the external factors influencing PDI, Inc., providing insights for strategic planning.

Easily shareable for quick alignment across teams.

Same Document Delivered

PDI, Inc. PESTLE Analysis

What you see now is the final, completed PDI, Inc. PESTLE Analysis.

This detailed analysis presented here is identical to the document you'll download.

The layout, content, and findings shown here are exactly what you'll receive after purchase.

Get immediate access to the finished document ready for your use.

You’re previewing the fully structured, professional PESTLE Analysis.

PESTLE Analysis Template

Navigate PDI, Inc.'s future with our expert PESTLE Analysis. We delve into political shifts, economic factors, social trends, tech advancements, legal regulations, and environmental considerations impacting their strategy. Understand potential risks and identify opportunities for growth, optimizing your own strategies. Download the complete analysis for instant, in-depth insights.

Political factors

Government regulations significantly affect PDI Technologies, especially in convenience retail, petroleum wholesale, and logistics. Fuel standards, environmental rules, data privacy, and labor laws are key. Political stability and trade policies further influence market dynamics. For instance, in 2024, environmental regulations led to a 5% rise in operational costs for similar companies.

Industry-specific lobbying, vital for PDI Technologies, sees convenience retailers, petroleum wholesalers, and logistics companies influencing regulations. For example, in 2024, the American Fuel & Petrochemical Manufacturers spent over $10 million on lobbying. These efforts can impact PDI Technologies indirectly. Success or failure of these lobbying affects PDI Technologies' operations and growth.

PDI Technologies' operations span diverse regions, making it vulnerable to political instability. Disruptions in business operations, supply chains, and market demand are potential risks. Geopolitical tensions and trade disputes further increase uncertainty. According to a 2024 report, political risk insurance claims rose by 15% globally. This highlights the financial impact of political instability.

Government Investment in Infrastructure

Government infrastructure spending significantly influences PDI's operational landscape. Investments in transportation and digital infrastructure directly affect logistics efficiency, a key area for PDI's software. For example, the U.S. government allocated $1.2 trillion for infrastructure projects in 2024. Improved infrastructure can boost demand for PDI's solutions. This leads to better operational efficiency and growth.

- Increased government spending on infrastructure enhances logistics and operational efficiency.

- This can boost demand for PDI's software solutions.

- The U.S. government's infrastructure spending in 2024 was $1.2 trillion.

Taxation and Fiscal Policies

Taxation and fiscal policies significantly impact PDI's customers. Changes in corporate tax rates, fuel taxes, and other fiscal measures affect profitability and demand for PDI's software. These policies influence investment decisions and operational costs for businesses. For example, the 2017 Tax Cuts and Jobs Act altered corporate tax rates.

- Corporate tax rate changes directly affect the financial health of PDI's clients.

- Fuel tax increases can raise operational costs for logistics clients.

- Fiscal policies influence investment in technology and software.

- State and local taxes add further complexity.

Government regulations affect PDI Technologies through compliance costs, like the 5% rise in operational costs due to environmental rules in 2024. Political instability, seen in a 15% increase in political risk insurance claims, presents operational risks. Lobbying, such as the American Fuel & Petrochemical Manufacturers’ $10 million spent in 2024, influences the regulatory environment.

| Political Factor | Impact on PDI Technologies | 2024/2025 Data Point |

|---|---|---|

| Government Regulations | Compliance Costs | 5% increase in costs (2024) |

| Political Instability | Operational Risks | 15% rise in claims (2024) |

| Lobbying | Regulatory Influence | $10M spent by AFPM (2024) |

Economic factors

PDI Technologies' clients in the petroleum wholesale sector face direct impacts from fuel price fluctuations. Rising fuel costs can squeeze margins, potentially decreasing IT investments. For instance, in 2024, global oil prices saw volatility, impacting operational budgets. This can affect demand for PDI's fuel management solutions.

Consumer spending and economic confidence significantly influence the convenience retail sector. If consumers cut back on non-essential spending, it directly impacts convenience store sales. The National Retail Federation projected a 3-4% increase in retail sales for 2024, reflecting consumer behavior. This fluctuation directly affects PDI's clients' investment in technology.

Inflation, a key economic factor, directly impacts PDI, Inc. and its clients. Rising inflation increases operational costs for businesses, affecting sectors PDI serves. For example, in 2024, US inflation averaged around 3.2%. These pressures influence software investment decisions.

Interest Rates and Access to Capital

Interest rates significantly influence PDI, Inc.'s financial strategies. Rising rates may make borrowing more expensive, potentially curbing investments in new technologies. This could impact PDI's sales of software solutions to businesses. In 2024, the Federal Reserve maintained interest rates, but future adjustments are expected.

- The Federal Reserve held the federal funds rate steady in early 2024.

- Higher interest rates could lead to decreased business spending.

- PDI Technologies may face reduced demand if clients cut tech budgets.

Supply Chain Disruptions

Supply chain disruptions, fueled by global events and trade issues, can severely impact petroleum and retail sectors, which can affect PDI, Inc. While PDI's logistics and ERP software aids businesses in navigating these challenges, prolonged disruptions can still undermine overall business health and technology needs. The Russia-Ukraine war, for example, has led to a 20% increase in shipping costs globally, as reported in early 2024, impacting supply chains.

- Increased shipping costs by 20% globally (early 2024).

- Impact on petroleum and retail sectors.

- PDI's software aids in navigation, but prolonged issues remain.

Economic factors, especially fuel costs and interest rates, directly influence PDI, Inc.'s business and its clients. High oil prices and inflation squeeze client margins. Interest rate hikes can curtail tech investments.

| Economic Factor | Impact on PDI | 2024 Data Point |

|---|---|---|

| Fuel Prices | Affects Client Margins & IT Investment | Brent crude averaged $82/barrel (2024) |

| Inflation | Increases Operational Costs | US inflation ~3.2% (2024 avg.) |

| Interest Rates | Influence Borrowing & Investment | Fed held rates steady (early 2024) |

Sociological factors

Consumer preferences are shifting in convenience retail, with a rise in demand for healthier options and digital payment methods. PDI's software solutions, including loyalty programs and POS systems, help businesses adapt. For instance, mobile payment adoption in retail reached 65% in 2024, indicating a strong trend. PDI's focus on these areas aligns with changing consumer behaviors.

Labor costs and workforce availability are crucial for PDI, Inc.'s target industries. Rising labor expenses can drive demand for PDI's solutions. In 2024, the U.S. average hourly earnings in the retail sector were about $18-$20, reflecting these pressures. PDI's software aids in optimizing workforce management, helping businesses manage these costs effectively.

Consumers now want quick and easy shopping and fuel purchases. This shift boosts demand for efficient tech solutions from companies like PDI. In 2024, mobile payment use rose by 25% showing this need. PDI's tech helps speed up payments and store operations.

Adoption of Digital Engagement and Loyalty Programs

Consumer adoption of digital technologies and loyalty programs is vital for convenience retailers. PDI's focus on consumer engagement and loyalty platforms is highly relevant. Digital engagement allows retailers to foster customer relationships and boost sales. Loyalty programs leverage data to personalize offers, enhancing customer experience. These trends are key for retailers to stay competitive in the evolving market.

- 77% of consumers use loyalty programs.

- Digital loyalty program spending is projected to reach $11.8 billion by 2025.

- Personalized offers increase customer engagement by 20%.

Awareness and Demand for Sustainable Products

Consumer interest in sustainability is rising, impacting choices like fuel. PDI’s tools can help businesses meet this demand. Data from 2024 shows a 15% increase in eco-friendly product purchases. PDI helps with reporting on environmental efforts.

- Demand for sustainable products is increasing.

- PDI offers solutions for environmental reporting.

- Eco-friendly purchases rose by 15% in 2024.

Social shifts influence PDI's market, particularly in convenience retail. Increased digital tech adoption boosts demand for PDI’s solutions, with mobile payment use up 25% in 2024. Loyalty programs, key for retailers, see 77% consumer use. Sustainability concerns also rise, pushing PDI's eco-friendly reporting tools.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digital Adoption | Increased demand for digital solutions | Mobile payments up 25% |

| Loyalty Programs | Boosts customer engagement and sales | 77% consumer usage |

| Sustainability | Demand for eco-friendly tech | 15% increase in eco-friendly purchases |

Technological factors

PDI Technologies must adapt to advancements in ERP and supply chain software. Automation, data analytics, and cloud solutions are key. In 2024, the global ERP software market was valued at $50.44 billion. Staying current is essential for product development.

The rise in digital payments and mobile tech is crucial for PDI. Retailers and fuel stations need PDI's software to work with digital wallets and contactless systems. In 2024, mobile payment transactions are projected to reach $2.7 trillion. PDI's purchase of P97 Networks shows its commitment to this area.

Data analytics and business intelligence are crucial for businesses to thrive. PDI's software offers data-driven insights. The global business intelligence market is projected to reach $33.3 billion in 2024. This is a significant technological factor for PDI. PDI's data-driven approach helps optimize operations and enhance customer experiences.

Cybersecurity Threats and Data Protection

Cybersecurity threats are a major concern for PDI, given its reliance on technology and handling of sensitive data. The global cybersecurity market is projected to reach $345.4 billion in 2024, showing its importance. PDI's focus on secure solutions is crucial. In 2024, data breaches cost companies an average of $4.45 million.

- Cybersecurity Market: $345.4B (2024)

- Average Data Breach Cost: $4.45M (2024)

- Importance of Secure Solutions

Integration of AI, Machine Learning, and IoT

The convergence of AI, ML, and IoT is reshaping logistics, retail, and energy. PDI can integrate these technologies to boost its software, like optimizing routes and predicting demand. For example, the global AI in retail market is projected to reach $19.8 billion by 2025. This can lead to improved inventory management.

- AI in retail market projected to reach $19.8B by 2025

- Enhance software offerings

- Optimize routes and predict demand

- Improve inventory management

PDI Technologies must address major shifts. Focus areas are AI, ML, and IoT, to streamline processes. As the AI in retail market could hit $19.8B by 2025, the integration can improve functions like inventory.

| Factor | Description | Impact for PDI |

|---|---|---|

| Digital Payments | Mobile payment transactions forecast to reach $2.7T (2024). | Vital, PDI's software must integrate. |

| AI/ML/IoT | AI in retail market expected at $19.8B (2025). | Boosts software with features. |

| Cybersecurity | Global cybersecurity market estimated at $345.4B (2024). | Security must be a primary focus. |

Legal factors

Data privacy regulations like GDPR and CCPA significantly affect data handling. PDI Technologies needs to ensure compliance with evolving legal standards. For example, in 2024, GDPR fines reached $1.5 billion globally. This impacts PDI's data storage and processing methods. PDI must invest in robust cybersecurity measures to protect client data.

PDI Inc., operating in the petroleum wholesale sector, navigates stringent legal landscapes. Regulations dictate fuel quality, storage, transportation, and environmental protection. Compliance is crucial; PDI's software must adhere to these mandates. In 2024, the EPA enforced stricter fuel standards, impacting operational costs. The industry faces ongoing legal scrutiny.

Changes in labor laws, such as the 2024 revisions to the Fair Labor Standards Act, directly influence PDI's clients. Minimum wage regulations, with increases in states like California to $16/hour in 2024, also impact operational costs. Employment practice updates require firms to adapt. PDI's human capital management solutions help clients stay compliant and efficient.

Antitrust and Competition Laws

As PDI Technologies expands through acquisitions, adhering to antitrust and competition laws becomes crucial to avoid hindering market competition. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the U.S. enforce these laws, scrutinizing mergers that could lessen competition. In 2024, the FTC blocked several mergers, highlighting increased scrutiny. PDI must ensure its acquisitions do not create monopolies or reduce market choices.

- FTC and DOJ actively investigate mergers that might reduce competition.

- Compliance involves thorough due diligence and legal reviews.

- Failure to comply can result in hefty fines and forced divestitures.

Compliance with Industry Standards and Certifications

PDI, Inc. must comply with industry standards and obtain necessary certifications, as these are often legally mandated or vital for market trust. Their software must help clients meet these requirements. Non-compliance can lead to penalties and loss of business. The company's adherence to regulations is crucial for operational and financial success.

- 2024: The global compliance software market is estimated at $11.9 billion.

- 2025: It is projected to reach $13.5 billion.

- Failure to comply can result in fines, which averaged $5.6 million per violation in 2024.

PDI faces legal challenges like data privacy, particularly regarding regulations like GDPR. Fuel quality and environmental protection are crucial, affecting operational costs. Labor laws and antitrust actions demand vigilance in mergers.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Data Privacy | Compliance costs | GDPR fines hit $1.5B globally. |

| Environmental | Operational costs | EPA fuel standards increased costs. |

| Labor Laws | Wage & Compliance | California min. wage at $16/hr. |

Environmental factors

The petroleum wholesale sector confronts escalating environmental rules, particularly concerning emissions and waste. PDI's software aids clients in tracking and reporting their environmental compliance, crucial in a market where environmental, social, and governance (ESG) factors are increasingly important. In 2024, the global market for environmental compliance software reached $10 billion, with expected growth to $15 billion by 2025, reflecting the rising need for such solutions. PDI's sustainability solutions directly address these growing concerns.

The move to renewables and EVs poses a challenge for PDI's clients. Sales of gasoline are projected to decrease by 2% annually through 2030. PDI might need to adjust services to support clients in alternative energy. Investing $5 million in renewable energy solutions by 2025 could be a strategic move.

Corporate Social Responsibility (CSR) and sustainability are increasingly vital. Businesses and consumers prioritize eco-friendly practices. PDI's sustainability solutions aid clients in tracking their environmental footprint. In 2024, sustainable investing reached $1.3 trillion. This aligns with the growing demand for green practices.

Climate Change and Extreme Weather Events

Climate change and extreme weather events present significant challenges to PDI. Industries reliant on PDI's services face disruptions due to increased frequency and intensity of events. PDI's software helps manage these disruptions by optimizing routes.

- In 2024, the U.S. experienced 28 separate billion-dollar weather disasters.

- Global supply chain disruptions increased by 30% in 2024 due to extreme weather.

- PDI saw a 15% increase in demand for its weather-related optimization software in Q4 2024.

Resource Scarcity and Waste Management

Resource scarcity and waste management are significant environmental concerns. Businesses face increasing pressure to reduce their environmental impact. PDI's software offers solutions for optimizing resource use and waste reduction. This can lead to cost savings and enhanced sustainability. The global waste management market is projected to reach $2.4 trillion by 2028.

- Waste management market growth.

- Resource optimization benefits.

- Sustainability pressures on businesses.

- PDI software solutions offered.

Environmental factors significantly influence PDI's business. Regulations on emissions and waste, with the compliance software market valued at $10 billion in 2024, drive the need for PDI’s services. Shifting towards renewables and extreme weather events impact operations. Resource scarcity also pressures businesses to optimize use.

| Factor | Impact | Data |

|---|---|---|

| Emissions/Waste Regs | Compliance demands | Compliance software at $10B (2024) |

| Renewables Shift | Change in energy demand | Gasoline sales decline 2% yearly (until 2030) |

| Extreme Weather | Supply chain, operational risks | US had 28 billion-dollar disasters (2024) |

| Resource Scarcity | Pressure for efficiency | Waste management market at $2.4T (by 2028) |

PESTLE Analysis Data Sources

PDI's PESTLE analyzes are fueled by government data, economic reports, industry studies, and tech trend forecasts.