SAP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SAP Bundle

What is included in the product

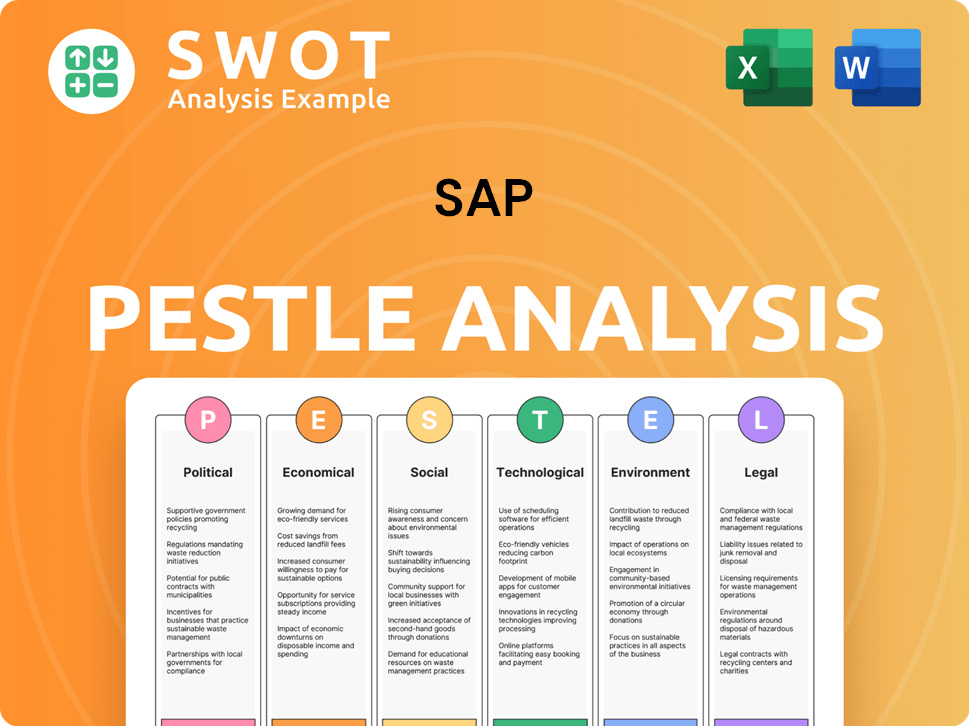

Investigates macro-environmental forces impacting SAP through Political, Economic, etc. factors.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

SAP PESTLE Analysis

Explore this SAP PESTLE Analysis preview! The information provided here mirrors the complete document.

What you're viewing now is the final, polished file.

It is formatted and ready for immediate use post-purchase.

Enjoy all the in-depth analysis presented, the moment you get it.

This preview shows exactly what you'll receive upon purchase.

PESTLE Analysis Template

Navigate SAP's future with a strategic edge. Our SAP PESTLE Analysis dissects crucial external factors. Uncover how political, economic, social, technological, legal, and environmental forces shape SAP. Gain insights into market risks and growth opportunities. Download the full analysis for in-depth understanding and data-driven decisions. Perfect for strategic planning and investment analysis!

Political factors

Governments globally are enacting stringent data privacy, cybersecurity, and technology regulations. SAP must adapt its software to comply with frameworks like GDPR. Non-compliance risks significant fines; for example, in 2024, Google faced a $57 million GDPR fine. Compliance costs increase operational expenses.

International trade policies and geopolitical tensions significantly influence SAP. Trade restrictions, such as those from the US-China trade war, can affect SAP's market access; for example, in 2024, the US imposed further restrictions on technology exports to China. Political instability in key regions also affects IT spending; in 2024, IT spending decreased in several unstable regions, impacting SAP's customer base. These factors necessitate SAP's diversified strategies.

Government investments in digital transformation are surging, creating opportunities for SAP. Public sector spending on IT is projected to reach $684 billion in 2024. SAP can capitalize on this by offering solutions to modernize government infrastructure.

Political stability in key markets

Political stability is paramount for SAP's global operations. Instability can disrupt supply chains and affect market access. In 2024, political risks, including elections, impacted business confidence in several regions. SAP closely monitors political climates to mitigate risks and ensure business continuity.

- SAP operates in over 180 countries, making it vulnerable to varied political climates.

- Political instability can lead to currency fluctuations, affecting SAP's financial performance.

- Changes in government policies can directly influence SAP's market access.

Public policy on sustainability and environmental issues

Governments worldwide are intensifying sustainability and environmental regulations. Policies like the EU's Green Deal and similar initiatives in the US and China drive demand for SAP's sustainability solutions. These policies encourage circular economy models and mandate carbon emission reporting, affecting SAP's market positioning and operational strategies. In 2024, the global green technology and sustainability market is valued at $366.6 billion.

- EU's Green Deal targets a 55% reduction in emissions by 2030.

- The US Inflation Reduction Act includes significant climate-related investments.

- China's 14th Five-Year Plan emphasizes environmental protection.

SAP faces evolving political factors impacting global operations. Government regulations like GDPR influence compliance costs; Google faced a $57M fine in 2024. Trade policies, geopolitical tensions, and IT spending shifts, significantly affect market access.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Regulations | Compliance Costs, Market Access | $57M GDPR fine for Google |

| Trade Policies | Market Access | US Tech Export Restrictions to China |

| Government Investments | IT Spending | $684B projected public sector IT |

Economic factors

Global economic growth profoundly influences enterprise software spending. Uncertainty, inflation, and higher interest rates can cause businesses to reduce expenses. For example, in 2023, global IT spending grew by only 3.2%, impacting SAP's revenue. SAP's 2023 revenue was €30.87 billion, reflecting economic pressures.

SAP, operating globally, faces currency exchange rate risks. Fluctuations affect reported revenue when converting foreign earnings to Euros. For example, a weaker USD against the EUR could lower reported revenue. In Q1 2024, SAP's revenue was €8.04 billion, and currency impacts were closely monitored.

The surge in cloud computing fuels SAP's economic growth. Cloud services offer flexibility and cost efficiency, boosting SAP S/4HANA Cloud adoption. SAP's cloud revenue grew by 23% in Q1 2024, reaching EUR 3.96 billion. The shift to cloud solutions drives SAP's financial performance and market valuation.

Enterprise software market growth

The enterprise software market is experiencing robust growth, creating favorable conditions for SAP. This expansion is fueled by ongoing digital transformation initiatives across various industries. SAP, with its broad suite of solutions, is well-positioned to capitalize on this trend. The market is projected to reach $797.9 billion by 2024, according to Gartner.

- Market growth is expected to continue through 2025.

- SAP's solutions are key for digital transformation.

- Businesses are increasing their IT spending.

- The market's compound annual growth rate is strong.

Inflation and operational costs

Inflation significantly influences SAP's operational expenses, particularly labor and technology costs. These rising costs can strain SAP's pricing strategies, potentially impacting profitability if expenses escalate quicker than revenue growth. For instance, the U.S. inflation rate was 3.5% in March 2024, affecting operational budgets. SAP must carefully manage these costs to maintain financial health. This involves strategic pricing and efficiency improvements.

- March 2024 U.S. inflation: 3.5%

- Impact on labor and tech costs

- Potential pressure on pricing

- Need for cost management

Economic factors strongly shape SAP's financial outcomes. Global economic growth, inflation, and currency fluctuations impact SAP's revenues and operational expenses. SAP benefits from cloud computing growth, with Q1 2024 cloud revenue at EUR 3.96 billion, but faces cost pressures from inflation.

| Economic Factor | Impact on SAP | Data Point (2024) |

|---|---|---|

| Global Growth | Influences IT spending | IT spending growth: 3.2% (2023) |

| Inflation | Affects operational costs | U.S. inflation: 3.5% (March) |

| Cloud Adoption | Drives revenue | Cloud revenue growth: 23% (Q1) |

Sociological factors

The workforce is changing, with younger generations becoming a larger part. This shift affects what people expect from software. SAP must create easy-to-use programs for a diverse workforce. Consider that in 2024, millennials and Gen Z make up over 60% of the global workforce.

Public concern about data privacy is growing, pushing demand for software focused on confidentiality and security. SAP must boost its data protection features to retain customer trust. In 2024, data breaches cost businesses globally an average of $4.45 million. By 2025, the global cybersecurity market is projected to reach $300 billion.

Remote and hybrid work models are booming, boosting demand for digital collaboration platforms. SAP must support these evolving work setups. According to a 2024 study, 60% of companies use remote work. This shift impacts SAP's need for cloud-based solutions.

Customer expectations for user experience

Customer expectations for user experience are evolving rapidly. Users now demand seamless, intuitive interfaces across all devices. SAP must prioritize user interface (UI) design and invest in innovation to stay ahead. Failure to meet these rising standards could lead to customer churn and market share loss. Recent data shows that companies with superior UX see a 20% increase in customer retention.

- User-friendly interfaces are crucial for customer satisfaction.

- Investment in UX design is vital for competitiveness.

- Poor UX can lead to customer dissatisfaction and churn.

- Superior UX correlates with higher customer retention rates.

Social responsibility and sustainability expectations

Societal expectations are pushing companies like SAP toward greater social responsibility and sustainability. SAP's commitment to these areas is vital. This includes its internal sustainability targets and tools assisting customers. SAP's brand image and relationships benefit from these efforts.

- SAP aims for net-zero emissions by 2030.

- SAP's sustainability solutions saw a 39% increase in cloud revenue in 2024.

- Over 80% of SAP's customer base uses sustainability solutions.

Societal factors heavily influence SAP's strategic direction. These include workforce diversity demands and user experience expectations. A focus on social responsibility, sustainability, and data privacy is now vital. Businesses now demand better UI/UX; poor design lowers customer satisfaction and market share.

| Sociological Factor | Impact on SAP | Relevant Data |

|---|---|---|

| Workforce Demographics | Needs easy-to-use programs | Millennials & Gen Z: 60%+ of global workforce (2024) |

| Data Privacy Concerns | Must boost data protection | Average cost of data breach: $4.45M (2024) |

| User Experience | Prioritize UI/UX design | Superior UX boosts retention 20%+ |

Technological factors

AI and ML are reshaping enterprise software. SAP is leveraging these technologies to automate tasks and boost decision-making. For example, in Q4 2024, SAP saw a 25% increase in cloud revenue, partly due to AI-driven solutions. This includes predictive maintenance tools. SAP's AI investments are expected to reach $2 billion by 2025.

The evolution of cloud computing is crucial for SAP. S/4HANA Cloud adoption is a key trend, offering benefits. In Q1 2024, SAP's cloud revenue grew 24% to EUR 3.93 billion. This shift boosts scalability and real-time insights for clients. Cloud now represents 77% of SAP's total revenue.

SAP is deeply integrating with IoT and RPA. This enhances real-time data analysis and automation capabilities. For example, SAP's S/4HANA supports IoT, with over 1,000 pre-built IoT scenarios. RPA adoption in SAP environments grew by 40% in 2024. This improves operational efficiency significantly.

Need for enhanced cybersecurity measures

The rise in digitalization elevates cybersecurity threats, making robust defenses crucial for SAP. SAP must consistently improve its security features to safeguard customer data and business operations. Cyberattacks are costly; in 2024, the average cost of a data breach hit $4.45 million globally. SAP's commitment to cybersecurity directly impacts its clients' trust and financial stability.

- Data breaches cost businesses millions.

- SAP must invest in security.

- Client trust depends on security.

- Cyber threats evolve rapidly.

Development of industry-specific solutions

SAP's technological strategy emphasizes industry-specific solutions. This trend involves tailoring software to meet unique industry needs. SAP develops offerings for sectors, addressing challenges and optimizing processes. This approach enhances efficiency and provides competitive advantages. For example, SAP's revenue in 2024 was approximately €30.7 billion, reflecting the importance of specialized solutions.

- Focus on sector-specific solutions.

- Addresses unique industry challenges.

- Optimizes processes for various verticals.

- Enhances efficiency.

SAP leverages AI, with investments reaching $2B by 2025, boosting automation. Cloud computing growth is crucial, with Q1 2024 cloud revenue at EUR 3.93B, representing 77% of total revenue. Cybersecurity is key, with data breaches costing businesses millions.

| Technological Factor | Details | Impact |

|---|---|---|

| AI/ML | $2B investment by 2025 | Automation, decision-making |

| Cloud Computing | Q1 2024 cloud revenue EUR 3.93B, 77% of total | Scalability, real-time insights |

| Cybersecurity | Data breaches cost millions, 2024 data breach cost $4.45M | Protecting data, trust |

Legal factors

SAP must adhere to stringent data privacy regulations such as GDPR and CCPA, impacting how it manages user data. Compliance necessitates robust data protection measures, potentially increasing operational expenses. For example, in 2024, GDPR fines reached €1.2 billion, highlighting the significant costs of non-compliance. This includes investments in data security and privacy features within SAP's products.

SAP's software licenses allow audits of customer software usage. These audits are increasingly scrutinizing indirect access, cloud subscriptions, and license management during S/4HANA transitions. In 2024, compliance audits led to significant financial adjustments for some companies. Gartner projected a 15% rise in software audit spending by 2025, highlighting the growing importance of legal compliance. Navigating these complex requirements is essential for both customers and SAP.

SAP must adhere to international trade laws, sanctions, and export controls, vital for its global footprint. These laws dictate permissible business locations and partners, impacting revenue streams. For instance, sanctions against Russia affected SAP's operations, leading to a reported 2023 revenue decrease in the region. Compliance is essential to avoid penalties and maintain market access.

Industry-specific regulations

Industry-specific regulations are critical. Enterprise software must comply with various requirements depending on the industry. SAP must ensure its solutions adhere to these regulations across sectors like healthcare, finance, and manufacturing. This includes data privacy, security, and industry-specific standards. Failing to comply can lead to hefty fines and operational disruptions. Recent reports show a 15% increase in regulatory fines for non-compliance in the financial sector in 2024.

- Data privacy regulations (e.g., GDPR, CCPA) are crucial for all industries.

- Financial services face regulations like Basel III and AML/KYC.

- Healthcare must comply with HIPAA for data security.

- Manufacturing needs to meet environmental and safety standards.

Intellectual property laws

SAP heavily relies on intellectual property protection, including patents, copyrights, and trademarks, to safeguard its software and technologies. These legal protections are vital for maintaining its competitive edge in the software industry. For instance, in 2024, SAP invested approximately €5.6 billion in research and development, a significant portion of which supports IP creation and protection. The strength and enforcement of IP laws globally directly impact SAP's ability to license its products and generate revenue. Changes in international trade agreements and IP regulations in key markets can significantly affect SAP's market strategies and profitability.

- €5.6 billion R&D investment in 2024.

- IP protection crucial for licensing and revenue.

- Global IP law changes affect SAP's strategy.

SAP must comply with global data privacy laws like GDPR, and CCPA, and data security regulations, influencing operational costs. Software license audits and compliance are ongoing, impacting customer and SAP financial outcomes, with an estimated 15% rise in software audit spending by 2025. International trade laws, sanctions, and industry-specific rules also heavily affect SAP’s operations worldwide.

| Regulation | Impact | Data (2024/2025) |

|---|---|---|

| GDPR Fines | Operational Costs | €1.2 Billion Fines in 2024 |

| Software Audits | Compliance Spending | 15% rise projected in 2025 |

| Sanctions | Market Access | Russian Revenue Decreased in 2023 |

Environmental factors

There's growing pressure from customers and regulators for eco-friendly business operations and environmental impact reports. SAP addresses this by providing solutions that help firms monitor and manage their carbon footprint and other environmental data. For example, in 2024, the global market for sustainability reporting software reached $2.5 billion, with an anticipated rise to $4 billion by 2025. This shows a significant demand for such tools.

Growing climate change awareness stresses resilient, sustainable supply chains. SAP software helps optimize supply chains, reducing environmental impact. For instance, companies using SAP reported a 15% reduction in carbon emissions in 2024. This aids navigation of climate-related disruptions. Businesses are increasingly adopting sustainable practices.

SAP must adhere to environmental rules, including those for emissions, waste, and energy. These regulations impact SAP's operations and its software, which aids clients in environmental management. For example, in 2024, the EU's Corporate Sustainability Reporting Directive (CSRD) increased the demand for SAP's sustainability solutions. Compliance costs can be significant; in 2024, companies globally spent an average of $1.5 million on environmental compliance.

Corporate sustainability goals and reporting

SAP actively pursues corporate sustainability goals, aiming for net-zero emissions. This commitment shapes both internal operations and product development, with a focus on environmental responsibility. SAP's sustainability efforts are increasingly vital for investors. In 2024, SAP's revenue was approximately €31.2 billion, reflecting its commitment to sustainable practices.

- Net-zero emissions target drives internal changes.

- Sustainability-focused products are a growing part of the portfolio.

- Investors increasingly value environmental performance.

- SAP's 2024 revenue demonstrates its commitment.

Customer demand for environmentally friendly solutions

Customer demand for green solutions is on the rise, pushing companies to adopt sustainable practices. This trend fuels the market for SAP's sustainability software. SAP's offerings help businesses track and improve their environmental impact. This presents a significant growth opportunity for SAP.

- In 2024, the global green technology and sustainability market was valued at over $360 billion.

- SAP's sustainability software revenue grew by 35% in Q1 2024.

- A recent survey shows that 70% of consumers prefer brands with strong sustainability credentials.

Environmental factors significantly influence SAP's business landscape. Customers and regulators increasingly demand eco-friendly operations; the sustainability reporting software market reached $2.5B in 2024, growing to $4B by 2025. Climate change awareness also drives resilient supply chains, with SAP helping reduce environmental impact, evidenced by a 15% carbon emissions reduction reported by companies in 2024.

Compliance with environmental regulations like the CSRD, increased demand for SAP's sustainability solutions, despite global compliance costs averaging $1.5M per company in 2024. SAP's corporate sustainability goals, including net-zero emissions targets, shape its internal operations and product development, reflecting its commitment.

Customer demand for green solutions is rising. SAP's sustainability software saw 35% revenue growth in Q1 2024, with a global green technology market valued at over $360B in 2024, driving SAP's growth opportunities.

| Factor | Impact | Data (2024) |

|---|---|---|

| Sustainability Demand | Eco-friendly operations | $2.5B market, growing to $4B (2025) |

| Climate Awareness | Resilient supply chains | 15% carbon emissions reduction |

| Compliance Costs | Regulation impact | $1.5M average compliance cost |

PESTLE Analysis Data Sources

SAP's PESTLE analysis utilizes public financial data, industry-specific publications, and government resources. It merges global market trends with economic indicators for a thorough assessment.