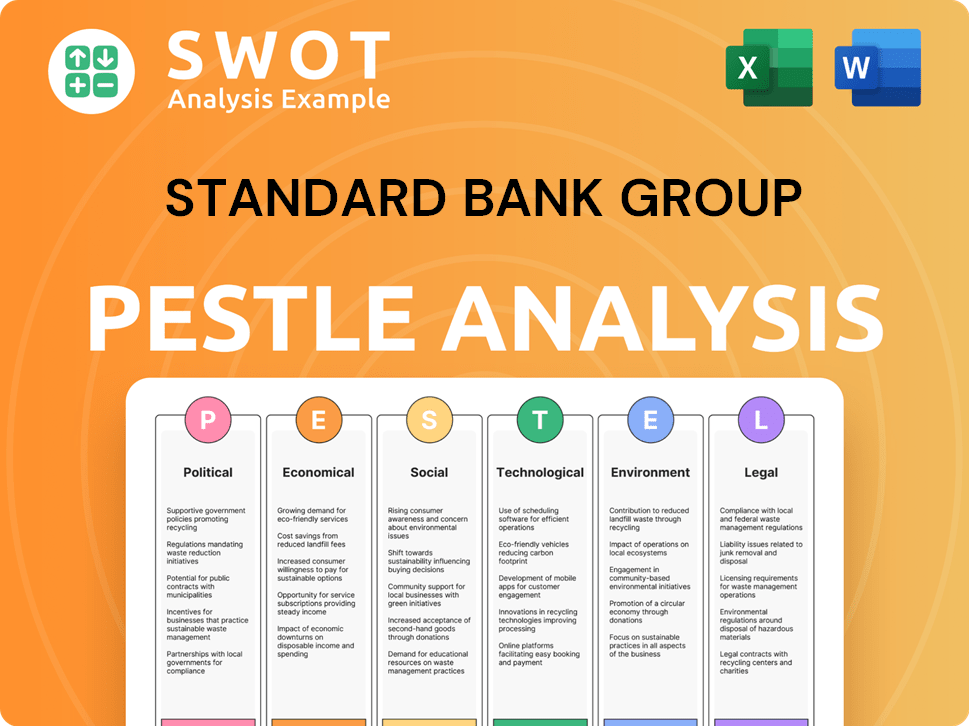

Standard Bank Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Standard Bank Group Bundle

What is included in the product

A comprehensive overview of external factors impacting Standard Bank Group across political, economic, social, tech, environmental & legal areas.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Standard Bank Group PESTLE Analysis

This Standard Bank Group PESTLE Analysis preview mirrors the final product. The format and all content visible is identical to your purchase. No hidden changes! This is the full analysis you'll download. Enjoy the immediate access to this complete report. Everything here is yours to utilize.

PESTLE Analysis Template

Gain a crucial advantage with our specialized PESTLE Analysis of Standard Bank Group. Uncover how political shifts, economic fluctuations, social trends, technological advancements, legal factors, and environmental concerns impact their operations. Our expertly crafted analysis offers insights for strategic decision-making and risk assessment. Improve your investment understanding or competitive intelligence. Don't miss out on the comprehensive, instantly downloadable, full report.

Political factors

Standard Bank Group's operations across Africa hinge on political stability. Political instability creates economic uncertainty, directly affecting banking operations. Policy shifts from elections and government changes alter the regulatory environment. In 2024, several African nations faced election-related disruptions, potentially impacting Standard Bank's performance. For instance, political risks in South Africa, a key market, remain a concern.

Government policies, fiscal strategies, tax regulations, and trade restrictions significantly shape the banking sector. These policies can reshape the competitive dynamics, affecting bank operations and revenue. Standard Bank must adeptly manage these shifting regulatory environments across its operational regions. In 2024, South Africa's tax revenue increased, impacting banks' profitability.

Political interference and corruption pose risks to banking sector stability in certain regions. Such instability can deter foreign investment, impacting banks like Standard Bank. Standard Bank must uphold strong governance and compliance to counter these challenges. For example, in 2024, Transparency International reported high corruption perception indices in several African nations where Standard Bank operates.

Government Support and Recapitalization

Governments can offer support, including recapitalization, to maintain financial stability and confidence within the banking system. This is a crucial political consideration for the banking sector, particularly during times of financial stress. Standard Bank's robust capital position offers a significant buffer against such interventions. In 2024, several African nations saw increased government focus on financial sector stability.

- South Africa's government, for example, has ongoing initiatives to ensure banking sector resilience.

- Kenya's regulatory environment is also subject to political influences impacting financial institutions.

International Relations and Trade Disputes

Geopolitical tensions and trade disputes pose risks to Standard Bank's international operations, especially trade finance and investment banking. Shifts in global trade patterns and restrictions can impact cross-border activities. Standard Bank's African presence offers potential benefits from regional trade expansion. For instance, in 2024, trade finance revenue rose by 12% amid global uncertainties.

- 2024: Trade finance revenue increased by 12%.

- Geopolitical risks affect cross-border transactions.

- African presence benefits from regional trade.

Political instability is a key concern affecting Standard Bank Group's operations across Africa, creating economic uncertainty that directly impacts banking activities. Government policies, tax regulations, and fiscal strategies significantly shape the banking sector's competitive dynamics, requiring careful management of regulatory shifts.

Political interference and corruption pose further risks to banking stability, potentially deterring foreign investment and requiring strong governance. Support from governments, including recapitalization efforts, is essential for maintaining financial stability and confidence.

Geopolitical tensions and trade disputes impact Standard Bank's international operations, particularly trade finance; trade finance revenue grew by 12% in 2024 despite uncertainties. South Africa's and Kenya's regulatory environments are constantly shaped by political influences.

| Political Factor | Impact on Standard Bank | 2024/2025 Data Points |

|---|---|---|

| Political Instability | Economic Uncertainty | Election-related disruptions in several African nations. |

| Government Policies | Regulatory Changes | South Africa’s tax revenue impact on bank profitability. |

| Corruption & Interference | Deterrence of Foreign Investment | High corruption perception indices in several African nations. |

Economic factors

Standard Bank's success is significantly linked to Africa's economic growth. Robust GDP expansion boosts demand for its financial services, enhancing profitability. For instance, several African nations experienced varied growth in 2024. Countries like Rwanda saw growth, while others faced challenges. Economic downturns can negatively affect loan demand and asset quality for the bank.

Inflation and interest rates are crucial for Standard Bank. High inflation, like the 5.2% in South Africa in March 2024, can erode consumer purchasing power. Interest rate policies, such as the South African Reserve Bank's decisions, directly affect lending and saving rates. Standard Bank's profits are sensitive to these interest rate fluctuations across its markets. For instance, a 0.25% rate hike can significantly impact loan margins.

Standard Bank, with its global footprint, faces currency risks. Depreciation of local currencies against the USD can increase tech costs. In 2024, the South African Rand's volatility impacted financial results. Currency fluctuations necessitate hedging strategies for financial stability. This influences reported earnings when consolidating global financials.

Credit Quality and Impairments

The economic climate significantly impacts borrower creditworthiness, influencing Standard Bank's loan portfolio quality. Economic downturns can lead to higher credit impairments as clients struggle with loan repayments. For instance, in 2024, Standard Bank's credit impairments were closely monitored due to economic volatility. These trends directly affect Standard Bank's financial results, requiring proactive risk management.

- Credit impairments are a key indicator of the bank's asset quality.

- Economic stability is crucial for maintaining low impairment levels.

- Standard Bank actively manages its credit risk to mitigate potential losses.

Employment Levels and Consumer Confidence

High unemployment and low consumer confidence can significantly curb client spending and borrowing, which directly affects the demand for Standard Bank's products and services. For example, South Africa's unemployment rate in Q4 2023 was 32.1%, indicating a challenging environment. Conversely, rising employment and confidence levels can boost economic activity, benefiting the bank through increased transactions and loan uptake. Improving consumer sentiment is crucial.

- South Africa's Q4 2023 unemployment rate: 32.1%

- Impact: Reduced demand for banking services

- Positive: Increased economic activity with rising employment

Economic factors critically influence Standard Bank's performance. GDP growth in Africa boosts demand for financial services and profitability. Inflation, such as South Africa's 5.2% in March 2024, affects consumer spending and interest rates, impacting lending margins. Currency fluctuations also create risks, and credit impairments rise during downturns.

| Factor | Impact | Data Point (2024/2025) |

|---|---|---|

| GDP Growth | Drives service demand | African GDP: varied, Rwanda (2024): growth |

| Inflation | Erodes purchasing power | South Africa (Mar 2024): 5.2% |

| Interest Rates | Affect lending/saving | SARB rate decisions impact margins |

Sociological factors

Customers now prioritize digital banking for efficiency. Standard Bank must invest in digital platforms to stay competitive. In 2024, 80% of Standard Bank's transactions were digital. This shift demands continuous tech upgrades. The bank allocated $500 million for digital transformation in 2024-2025.

Population growth and urbanization in Africa are key. The continent's population is projected to reach 1.7 billion by 2030. These trends impact Standard Bank's customer base.

Changes in age demographics affect product demand. For instance, the youth population is growing, which influences the need for mobile banking. Standard Bank must adapt.

Understanding these shifts is vital. In 2024, mobile money transactions in Africa surged. This creates opportunities for the bank. Standard Bank's success depends on it.

Standard Bank Group actively works on financial inclusion and literacy to tap into underserved markets, which creates opportunities. They can broaden their customer base by offering easy-to-understand financial products. However, this requires investment in financial education programs. In 2024, the bank's initiatives reached over 1 million people with financial literacy programs. This boosted financial inclusion rates by 15% in targeted areas.

Social Media and Public Perception

Social media significantly shapes public perception, directly impacting Standard Bank's reputation and customer trust. Effective management of online presence is crucial, as negative publicity can quickly erode brand value. Recent data shows that 70% of consumers trust online reviews, underscoring social media's influence. Employee conduct on social media also reflects on the bank, necessitating clear guidelines.

- 70% of consumers trust online reviews.

- Standard Bank's social media strategy must include robust reputation management.

- Employee social media guidelines are essential.

Income Inequality and Poverty

High income inequality and poverty in regions where Standard Bank operates can limit financial service affordability and increase credit risk. The bank addresses this through inclusive growth initiatives, like providing housing and finance access across income levels. For example, in South Africa, 55.5% of the population lived below the poverty line in 2024. Standard Bank's focus aims to mitigate these sociological challenges.

- Poverty rates in South Africa were at 55.5% in 2024.

- Standard Bank's strategy includes financial inclusion programs.

Digital banking is key, with 80% of transactions online in 2024. Standard Bank invests in tech upgrades with $500M allocated for digital transformation. Social media shapes public perception; 70% trust online reviews, impacting the bank's reputation.

High income inequality in operational regions impacts service affordability and credit risk. Financial inclusion efforts reached over 1M people with financial literacy programs in 2024, boosting inclusion rates by 15%.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digitalization | Customer preference | 80% transactions online |

| Social Media | Reputation | 70% trust online reviews |

| Financial Inclusion | Accessibility | 1M+ reached by programs |

Technological factors

Digital transformation is vital as tech evolves fast. Standard Bank invests heavily in software, cloud, and AI. In 2024, they allocated $500 million to digital initiatives. This boosts efficiency and customer experience. It helps Standard Bank stay competitive in the market.

Digital channel adoption is rising among clients for transactions. Standard Bank prioritizes mobile banking and online platforms. In 2024, mobile transactions surged, accounting for 65% of all transactions. Online banking users grew by 20%, driven by enhanced digital services. This trend demands continuous digital infrastructure investment.

As of 2024, Standard Bank faces escalating cybersecurity threats. In 2023, global cybercrime costs reached $8.4 trillion, highlighting the urgency for robust defenses. The bank's IT spending in 2024 includes significant allocations for enhanced security protocols.

Artificial Intelligence and Automation

Artificial intelligence (AI) and automation are transforming banking. Standard Bank is integrating AI to improve customer service and streamline operations. This includes AI-driven chatbots and automated processes. The bank's digital transformation strategy focuses on these technologies. In 2024, Standard Bank increased its investment in AI by 15%.

- AI-driven chatbots handle 60% of customer inquiries.

- Automation has reduced operational costs by 10%.

- Investment in AI increased by 15% in 2024.

- Focus on digital transformation is key.

Cloud Computing Adoption

Standard Bank is increasingly adopting cloud computing to streamline operations and improve data management. This transition supports faster service deployment, which is a key goal for 2024/2025. The bank's IT spending is evolving from traditional infrastructure to cloud and subscription models. This shift is expected to reduce capital expenditures while boosting agility and scalability.

- By 2024, the global cloud computing market is projected to reach over $600 billion.

- Standard Bank's cloud migration could reduce IT operational costs by up to 20%.

- The bank aims to have 70% of its applications on the cloud by the end of 2025.

Standard Bank's tech investments focus on efficiency and digital adoption. In 2024, $500 million went to digital initiatives, boosting mobile transactions to 65%. Cybersecurity and AI are key: In 2023, global cybercrime cost $8.4 trillion; AI investments rose 15%.

| Factor | Impact | 2024 Data |

|---|---|---|

| Digital Transformation | Efficiency & Customer Experience | $500M Digital Initiatives |

| Mobile & Online Banking | Transaction Channel Shift | 65% Mobile Transactions |

| Cybersecurity | Risk Mitigation | $8.4T Global Cybercrime (2023) |

| AI & Automation | Operational Efficiency | 15% AI Investment Growth |

Legal factors

Standard Bank Group operates under stringent financial regulations in multiple countries. It must comply with evolving regulatory landscapes, increasing compliance costs. This includes adherence to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. In 2024, compliance expenses rose by 7% due to new global standards.

Basel III, an international regulatory framework, significantly impacts Standard Bank. These reforms dictate capital adequacy, affecting the bank's financial stability. Standard Bank must adapt to evolving capital requirements. In 2024, the bank's CET1 ratio was 13.8%, showing compliance.

Standard Bank faces stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations globally. Compliance requires sophisticated systems to monitor transactions and verify customer identities, impacting operational costs. In 2024, the bank invested significantly in its compliance infrastructure, with related expenses reaching approximately $250 million. Non-compliance can lead to hefty fines, such as the $11 million penalty the bank received in 2023 for KYC violations.

Consumer Protection Laws

Consumer protection laws are critical for Standard Bank, ensuring fair practices in financial services. Compliance is essential to protect customers and maintain trust. In South Africa, the National Credit Act and the Financial Sector Regulation Act are key. These laws mandate transparency and fair treatment. Standard Bank's adherence to these laws is vital for its operational integrity and customer satisfaction.

- South Africa's Financial Sector Regulation Act aims to enhance financial stability.

- The National Credit Act regulates credit providers and protects consumers.

- Consumer complaints in the banking sector increased by 15% in 2024.

Data Privacy Regulations

Standard Bank Group faces evolving data privacy regulations, including GDPR and local laws, affecting data handling practices. Compliance is crucial to avoid penalties and maintain customer trust. The bank must invest in data security measures and robust compliance programs. In 2024, GDPR fines reached €1.8 billion.

- GDPR fines can significantly impact financial institutions' profitability.

- Data breaches can lead to reputational damage and loss of customers.

- Compliance requires ongoing investment in technology and training.

Standard Bank Group must adhere to evolving legal requirements, particularly those related to finance. The bank encounters escalating compliance costs, experiencing a 7% rise in 2024. Compliance is key with Basel III and AML/KYC regulations, requiring continuous adaptation. Non-compliance can lead to big penalties, as evidenced by a $11 million fine in 2023.

| Regulatory Aspect | Impact | 2024 Data |

|---|---|---|

| Compliance Costs | Increased Operational Expenses | 7% increase |

| AML/KYC Compliance | Operational and Reputational Risks | $250M invested in compliance |

| Data Privacy | Customer Trust & Legal Penalties | GDPR fines of €1.8B |

Environmental factors

Climate change poses significant physical risks to Standard Bank Group. Extreme weather events, such as floods and droughts, can disrupt clients' businesses. This can lead to loan defaults, especially in sectors sensitive to climate impacts, like agriculture, which accounts for a portion of the bank's loan portfolio. Standard Bank needs to enhance its risk assessment to address these climate-related vulnerabilities.

The shift to a lower carbon economy introduces risks and opportunities globally and regionally. Standard Bank finances sustainable projects, especially in renewable energy. In 2024, the bank committed to a net-zero emissions target in its financed portfolio by 2050. They plan to allocate $250 billion to sustainable finance by 2030.

Standard Bank integrates environmental and social risk assessments into lending. This includes evaluating project impacts, aligning with the Equator Principles. In 2024, Standard Bank saw a 15% increase in sustainable finance deals. The bank aims for a 30% reduction in financed emissions by 2030.

Water Scarcity and Management

Water scarcity and inadequate water infrastructure in regions where Standard Bank operates pose risks. This can affect both businesses and communities, potentially increasing credit risk. For instance, water stress is a growing concern in South Africa, where Standard Bank has a significant presence. This environmental factor is increasingly important for the bank's strategic planning and risk assessment.

- In 2024, South Africa faced severe water shortages in several provinces.

- The World Bank estimates that water scarcity could reduce GDP in some regions by up to 6% by 2030.

- Standard Bank's exposure to sectors heavily reliant on water, such as agriculture, is a key consideration.

Biodiversity Loss and Natural Resource Management

Biodiversity loss and unsustainable resource management are critical environmental factors. These issues create risks for sectors reliant on natural resources and can affect economic stability. Standard Bank addresses these concerns through responsible investment strategies. The bank supports sustainable practices to mitigate environmental impacts. In 2024, the World Bank reported that biodiversity loss costs the global economy billions annually, with further impacts expected by 2025.

- 2024: World Bank reported billions in annual economic costs due to biodiversity loss.

- Standard Bank focuses on responsible investment to address environmental risks.

- The bank promotes sustainable practices to minimize negative impacts.

Environmental factors heavily influence Standard Bank Group's operations and risks.

Climate change, including extreme weather, threatens clients and can increase loan defaults. Water scarcity and biodiversity loss present additional challenges, particularly in regions like South Africa. Standard Bank addresses these issues through sustainable finance initiatives and responsible investment strategies.

| Environmental Risk | Impact | 2024/2025 Data |

|---|---|---|

| Climate Change | Loan defaults, operational disruptions | $250B sustainable finance target by 2030; 30% emissions cut by 2030 |

| Water Scarcity | Business disruption, increased credit risk | South Africa water shortages; 6% GDP impact by 2030 (World Bank) |

| Biodiversity Loss | Economic instability | Billions in annual costs; growing impacts expected |

PESTLE Analysis Data Sources

The PESTLE Analysis draws from economic indicators, policy updates, market research, and regulatory documents for comprehensive insights.