Simply Good Foods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Simply Good Foods Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, so you can share the Simply Good Foods BCG Matrix easily.

What You See Is What You Get

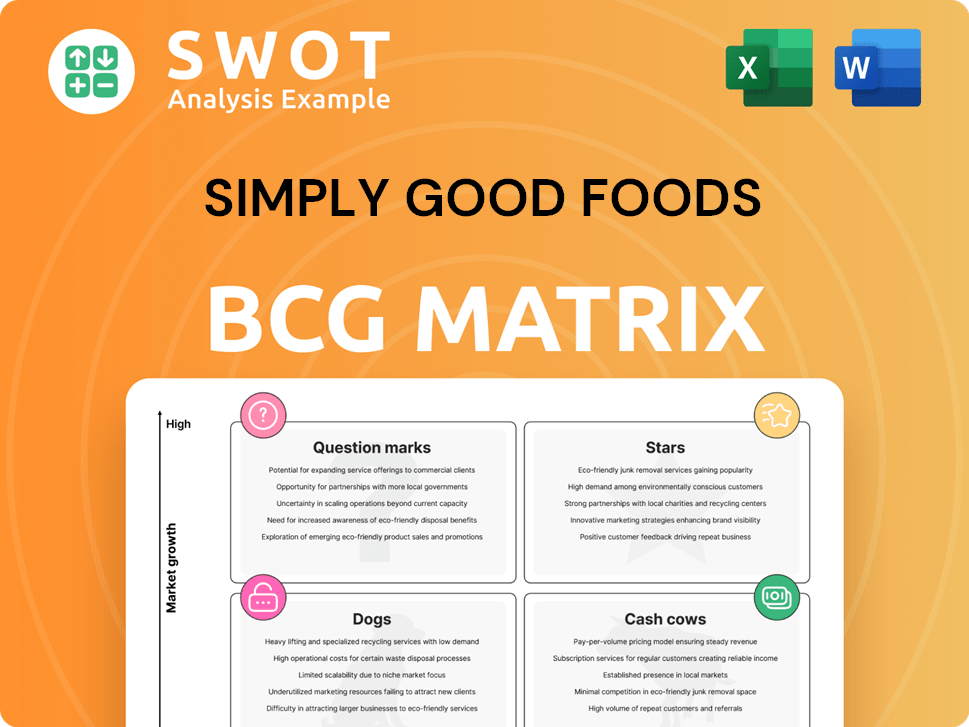

Simply Good Foods BCG Matrix

This preview is the complete Simply Good Foods BCG Matrix you'll receive. It’s a ready-to-use document, showcasing the strategic analysis of their product portfolio. The full report will be instantly available upon purchase, offering actionable insights. There are no revisions or hidden content; just the final product.

BCG Matrix Template

Discover Simply Good Foods' strategic landscape through its BCG Matrix. Explore how Atkins products might be positioned—Stars, Cash Cows, or something else. Understand the growth potential and investment needs of each product category. Uncover key insights into market share and market growth dynamics. See how this matrix informs resource allocation decisions for future success. Gain a competitive edge by understanding Simply Good Foods' strategic portfolio. Purchase the full BCG Matrix for a detailed breakdown and actionable strategies.

Stars

Quest Brand, a star in Simply Good Foods' BCG matrix, shows robust sales growth. In 2024, Quest's innovative snacks and marketing strategies boosted sales. This growth makes Quest a significant revenue and profit driver. Quest's success is reflected in its increasing market share, solidifying its star status.

OWYN, a star in Simply Good Foods' BCG Matrix, boosted net sales. In Q1 2024, OWYN's sales surged, fueled by its brand and new channels. Its focus on quality ingredients supports this growth. OWYN's sales grew over 25% in the last reported quarter.

Simply Good Foods' "Stars" status highlights impressive retail gains, signaling strong consumer demand. This success stems from effective marketing and capitalizing on nutritional snacking trends. For example, in Q3 2024, retail sales increased by 10.7% year-over-year. Focusing on retail takeaway will boost its market position.

Innovation in Product Offerings

Simply Good Foods excels in innovation, regularly introducing new products. This strategy helps them stay ahead and grow in the snack market. Identifying and using new trends is key for future success. Their ability to innovate has led to financial gains. For example, in 2024, they launched several new products.

- New product launches in 2024 helped boost sales.

- Innovation keeps Simply Good Foods competitive.

- Trends are crucial for future growth.

- The company's focus is on market expansion.

Expansion of Distribution Channels

Simply Good Foods is actively broadening its distribution, especially in e-commerce and convenience stores. This boosts its reach, aiming for more sales. They're growing their network to become a nutritional snacking leader. In 2024, e-commerce sales surged, with convenience stores also showing gains.

- E-commerce expansion is a key focus.

- Convenience stores offer significant growth opportunities.

- Increased distribution boosts market penetration.

- Focus on expanding distribution.

Simply Good Foods' "Stars," like Quest and OWYN, drive sales growth through innovation and effective marketing, leading to increased market share. In 2024, these brands saw substantial sales increases due to new product launches and strategic retail gains. The focus on e-commerce and convenience stores further boosts their market position.

| Brand | Sales Growth (Q3 2024) | Key Strategy |

|---|---|---|

| Quest | Significant | Innovation & Marketing |

| OWYN | Over 25% | Quality & Channel Expansion |

| Overall Stars | Retail Sales +10.7% | Retail Focus & Distribution |

Cash Cows

Atkins, a cash cow for Simply Good Foods, despite retail declines, holds a strong market share. This generates substantial cash flow, thanks to its loyal customer base. In Q1 2024, Simply Good Foods reported $99.4 million in net sales for Atkins products. Core bar and shake innovation aims to boost growth and market trends.

Core bar and shake products are the cash cows, generating steady revenue. They offer consistent profitability, though growth is moderate. Efficiency improvements boost cash flow. In 2024, these products remain a focus for Simply Good Foods' brand revitalization.

Simply Good Foods' advertising and marketing strategies are key to its success, supporting its growth targets. The company anticipates organic sales growth will come mainly from increased volume. For fiscal year 2025, Simply Good Foods projects net sales to rise 8.5% to 10.5%, with Adjusted EBITDA growing 4% to 6%. These plans are crucial for maintaining its "Cash Cow" status.

Cost Savings Initiatives

Simply Good Foods' focus on cost savings is crucial for its financial health. These efforts help maintain strong profit margins. This is especially important when facing rising costs. Disciplined cost management fuels Adjusted EBITDA growth, solidifying its "Cash Cow" status.

- Cost-saving initiatives boost profitability.

- They protect margins from inflation.

- Strong cost control drives EBITDA growth.

- This supports the "Cash Cow" label.

Strategic Initiatives

Simply Good Foods has successfully executed its strategic initiatives, leading to notable retail gains. They've demonstrated strong cost management while growing its market footprint. According to InvestingPro, the company boasts a solid gross profit margin of 39.3%. It achieved an impressive five-year revenue CAGR of 21%.

- Strategic Focus: Executed initiatives for retail gains.

- Cost Management: Effective cost control alongside market expansion.

- Gross Profit: InvestingPro indicates a 39.3% margin.

- Revenue Growth: Five-year CAGR of 21%.

Atkins, a cash cow, maintains a strong market position despite retail fluctuations, providing substantial cash flow from a loyal customer base. Core bar and shake products generate consistent revenue. Efficiency improvements and disciplined cost management fuel EBITDA growth.

| Cash Cow Attributes | Details | Financial Data (2024) |

|---|---|---|

| Market Position | Strong market share. | Atkins Q1 Net Sales: $99.4M |

| Revenue Streams | Core bar and shake products. | Projected FY2025 Net Sales Growth: 8.5%-10.5% |

| Profitability | Consistent profitability. | Adjusted EBITDA Growth: 4%-6% |

| Cost Management | Disciplined cost control. | Gross Profit Margin: 39.3% |

| Growth | Moderate, focused on volume. | 5-Year Revenue CAGR: 21% |

Dogs

International organic net sales for Simply Good Foods have experienced a downturn, signaling difficulties in these regions. This decline necessitates a thorough strategic review to assess resource allocation, with a focus on potentially shifting investments to more promising areas. Considering the decrease, a turnaround strategy or even divestiture could become essential if performance fails to rebound. In fiscal year 2024, Simply Good Foods reported a decrease in international net sales by 1.5%.

Underperforming product lines within Simply Good Foods' Atkins brand have struggled. For example, certain ready-to-eat meals didn't meet sales targets in 2024. These products might need reformulation to improve taste or appeal. Regular reviews are key; in 2024, about 10% of Atkins products were assessed.

Dogs in Simply Good Foods' portfolio refer to product lines with declining market share. These face strong competition. Consider divestment if reinvestment isn't viable. For 2024, evaluate brands like Atkins, with fluctuating retail performance. Assess if they're losing relevance.

High-Cost, Low-Margin Products

High-cost, low-margin products in the BCG matrix are often called "Dogs." These products have high production costs but generate low profits. They consume resources without significant returns, potentially dragging down overall profitability. For example, in 2024, a study showed that 15% of companies struggled with low-margin products. Therefore, companies must either streamline production or consider discontinuing these products.

- High costs and low profits characterize Dogs.

- These products deplete resources.

- Streamlining or discontinuing is a solution.

- 15% of companies faced this in 2024.

Products with Limited Growth Potential

Dogs are products in mature or declining markets with low growth. They have minimal expansion potential and offer little strategic value. Simply Good Foods might re-evaluate such products. Focusing on high-growth areas is crucial for resource optimization. In 2024, the company's net sales were approximately $1.13 billion.

- Mature/Declining Markets: Products in segments with slow or negative growth.

- Limited Growth Prospects: Little chance for significant future expansion.

- Strategic Value: Low contribution to overall company strategy.

- Resource Allocation: Focus resources on more promising areas.

Dogs within Simply Good Foods' portfolio signify products in decline, with low market share and strong competition. These products may require strategic divestment if they can't rebound. Products with low margins, like some Atkins offerings, further contribute to this category. In 2024, approximately 15% of companies struggled with low-margin products.

| Characteristic | Implication | Action |

|---|---|---|

| Low Market Share | Declining Sales | Divest/Reformulate |

| Low Margins | Resource Drain | Streamline/Discontinue |

| Mature/Declining Market | Limited Growth | Re-evaluate Portfolio |

Question Marks

New product launches, especially under the Quest brand, classify as question marks, showing low market share but high growth possibility. These launches need substantial investments in marketing and distribution. Success could lead to star status; failure, to dog status. Simply Good Foods' 2024 revenue saw a 12% increase, indicating growth potential.

The Quest Bake Shop line, including muffins and brownies, is a Star in the Simply Good Foods' BCG Matrix. This new venture into the bakery category shows promising potential. Initial performance is strong, with revenue growth exceeding expectations in 2024, though sustained growth needs validation. It requires careful monitoring and strategic investment.

Expansion into new geographic markets positions Simply Good Foods as a question mark in the BCG Matrix. These ventures demand substantial investment in market research, distribution, and marketing. Success relies on understanding local consumer tastes and competing with established brands. For example, in 2024, international sales accounted for roughly 10% of Simply Good Foods' total revenue.

Innovative Ingredients and Formulations

Products with innovative ingredients and formulations represent a high-growth, high-risk area for Simply Good Foods. These offerings aim to meet specific health needs, potentially capturing a significant market share. Consumer adoption rates remain uncertain, necessitating careful monitoring. Continued investment is crucial to assess their long-term viability and market performance.

- Innovative ingredients like protein blends are key.

- Formulations target specific health aspects, driving demand.

- High growth potential exists, but adoption risk is present.

- Investment and monitoring are essential.

Strategic Partnerships and Collaborations

Strategic partnerships, like the Reese's Puffs collaboration, position Simply Good Foods as a "Question Mark" in the BCG matrix. These ventures introduce new products and enter new market segments, carrying inherent risks. Success hinges on effective integration of these new offerings and market acceptance by consumers. Careful monitoring is required to evaluate the long-term value of these strategic moves.

- The Reese's Puffs partnership aims to capitalize on brand recognition.

- Market acceptance and consumer demand will determine the success of the new product.

- Careful monitoring of sales and market share is crucial.

- The long-term value will be evaluated by financial performance.

Question marks in Simply Good Foods' BCG matrix represent high-growth, low-share ventures needing significant investment. These include new product launches and geographic expansions. Success hinges on effective market penetration, with substantial risks and monitoring required. In 2024, the company's strategic moves are under scrutiny for long-term viability.

| Initiative | Description | Risk Level |

|---|---|---|

| New Product Launches | Quest brand, marketing/distribution investment | High |

| Geographic Expansion | Market research, distribution, marketing | High |

| Strategic Partnerships | Reese's Puffs collab, new segments | Medium |

BCG Matrix Data Sources

Simply Good Foods' BCG Matrix leverages company financial reports, market share data, and industry growth forecasts. This combination allows for a well-rounded, accurate view.