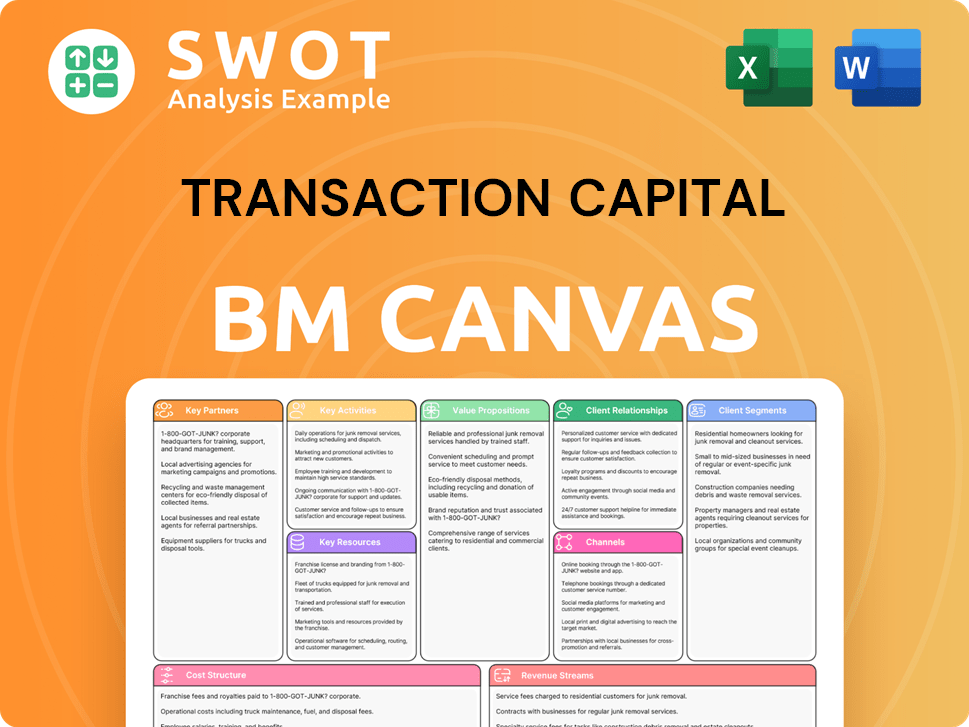

Transaction Capital Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Transaction Capital Bundle

What is included in the product

Transaction Capital's BMC details segments, channels, and value. Reflects operations and plans for presentation and funding.

Condenses company strategy into a digestible format for quick review.

Delivered as Displayed

Business Model Canvas

This preview is the real Transaction Capital Business Model Canvas. It’s a direct look at the actual document you'll receive after purchase. You’ll get full access to this same professional, ready-to-use document. No hidden layouts or surprises. What you see is what you'll own, ready for use.

Business Model Canvas Template

See how the pieces fit together in Transaction Capital’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Vehicle suppliers are pivotal for Transaction Capital. The company partners with vehicle manufacturers and dealerships to secure a consistent supply of vehicles for SA Taxi. These relationships are essential for fleet management and offer taxi operators various options, boosting Transaction Capital's competitive financing and procurement solutions. In 2024, SA Taxi financed approximately 3,500 new and used minibus taxis monthly.

Transaction Capital's collaboration with insurance providers is crucial for the minibus taxi industry. These partnerships enable the provision of tailored insurance products, addressing the sector's specific risks. This approach provides financial security and makes their services more appealing to clients. In 2024, the minibus taxi industry insured around 80% of vehicles.

Transaction Capital's partnerships with financial institutions are crucial for funding. This includes relationships with banks to support SA Taxi and Risk Services. In 2024, Transaction Capital aimed to diversify its funding sources. The company's ability to extend credit and acquire portfolios depends on these partnerships, as seen in its lending activities. These partnerships are critical for financial stability and expansion, as demonstrated by their 2023 financial results.

Technology Providers

Transaction Capital's partnerships with technology providers are key for operational excellence. These collaborations enable the use of telematics, data analytics, and digital platforms. Such tech integrations improve risk management, customer service, and debt collection. As of 2024, these tech-driven efficiencies helped reduce operational costs by approximately 12%.

- Telematics integration reduced vehicle downtime by 15% in 2024.

- Data analytics improved debt collection success rates by 8%.

- Digital platforms enhanced customer service satisfaction scores by 10%.

- Overall, tech partnerships contributed to a 5% increase in profitability.

Debt Collection Agencies

Transaction Capital's Risk Services division significantly benefits from partnerships with debt collection agencies. These collaborations are crucial for expanding its reach, especially outside South Africa. They aid in recovering non-performing loans and support the growth of the Risk Services business. Effective debt recovery is ensured through this network of partners.

- In 2024, the Risk Services division saw increased revenue, with international partnerships contributing significantly.

- These partnerships are vital for managing and recovering over ZAR 3 billion in non-performing loans annually.

- The global network includes agencies in key regions, enhancing Transaction Capital's international footprint.

- These collaborations are part of a strategic move to diversify and strengthen its financial services.

Transaction Capital relies on key partnerships for its success. Vehicle suppliers, like manufacturers, ensure a steady supply of vehicles. Collaborations with insurance providers offer tailored products, securing the minibus taxi industry. In 2024, the company's strategic alliances boosted efficiency and profitability.

| Partnership Type | Partner Benefit | 2024 Impact |

|---|---|---|

| Vehicle Suppliers | Consistent vehicle supply | SA Taxi financed 3,500 taxis monthly |

| Insurance Providers | Tailored insurance products | 80% of vehicles insured in industry |

| Financial Institutions | Funding and credit lines | Aimed to diversify funding sources |

Activities

Asset-backed lending is central to Transaction Capital's business model. SA Taxi finances minibus taxis, crucial for South Africa's transport. This involves credit risk assessment and loan portfolio management.

Efficient asset recovery is key to mitigate default risks. In 2024, SA Taxi's loan book was substantial, reflecting its market presence.

Asset-backed lending generates returns and supports the taxi industry. Transaction Capital's success hinges on this activity.

Transaction Capital's Debt Collection, primarily through Transaction Capital Risk Services (TCRS), is a core activity. TCRS collects debts for clients and buys non-performing loans (NPLs). They use data analytics to improve collection strategies. This activity is essential for revenue and risk management. In 2024, the South African debt collection industry saw significant activity, with NPL portfolios being actively managed.

Risk management is a core activity for Transaction Capital. Identifying, assessing, and mitigating financial risks is crucial. This includes using risk management frameworks and monitoring market changes. In 2024, they focused on credit risk, especially in SA Taxi. Sound risk management protects assets and ensures stability.

Investment and Acquisition

Transaction Capital's investment strategy focuses on alternative assets and high-growth businesses. This involves thorough due diligence and deal negotiations to integrate new acquisitions. These strategic moves are key to driving growth and diversifying the company's portfolio. In 2024, Transaction Capital reported a significant increase in its investment portfolio, reflecting its active acquisition strategy.

- Focus on alternative assets.

- Due diligence and negotiations.

- Integration of acquired businesses.

- Growth and diversification.

Digital Transformation

Digital transformation is crucial for Transaction Capital, focusing on digital platforms to boost efficiency. This involves new tech adoption, digital channel development, and data analytics utilization. This helps stay competitive and meet evolving customer needs. In 2024, Transaction Capital invested heavily in digital infrastructure.

- Investment in digital infrastructure increased by 15% in 2024.

- Digital platform user engagement rose by 20% in the same year.

- Data analytics implementation led to a 10% efficiency gain.

Transaction Capital's key activities center around asset-backed lending, specifically through SA Taxi, supporting the minibus taxi industry with financing, and managing credit risk.

Debt collection, crucial for revenue and risk management, is conducted by TCRS, involving debt collection for clients and purchasing non-performing loans.

Strategic investments and acquisitions drive growth, focusing on alternative assets and ensuring diversification through careful due diligence and integration.

| Activity | Description | 2024 Data |

|---|---|---|

| Asset-backed Lending (SA Taxi) | Financing minibus taxis and managing credit risk | Loan book: Significant market presence |

| Debt Collection (TCRS) | Collecting debts and managing NPLs | Increased activity in the South African debt collection industry |

| Strategic Investments | Focus on alternative assets, acquisitions and integration | Investment portfolio increase: Significant growth |

Resources

Financial capital is crucial for Transaction Capital's lending, NPL acquisitions, and new ventures. This includes equity, debt, and investor funding. In 2024, the company secured R1.5 billion in funding. A strong capital base supports growth and resilience. Transaction Capital's market capitalization was approximately R6.8 billion in late 2024.

Transaction Capital's strength lies in its data and analytics. They use proprietary data to assess risk effectively. This includes data on minibus taxi operations and consumer credit. In 2024, this helped them optimize debt collection, improving efficiency. This strategic use of data provides a competitive edge.

Transaction Capital's technology infrastructure underpins its digital platforms and data analytics. This encompasses the software, hardware, and IT expertise crucial for operational efficiency. In 2024, the company allocated a significant portion of its budget to technology upgrades. This investment supports innovative solutions and maintains a competitive advantage, reflected in a 15% increase in digital platform usage in the last year.

Skilled Human Capital

Skilled human capital is a cornerstone for Transaction Capital, encompassing experts in finance, risk, and technology. This includes management, data scientists, and customer service teams. Attracting and retaining top talent is crucial for driving the company's success. In 2024, Transaction Capital's employee costs were a significant operating expense, reflecting investment in this key resource.

- Experienced professionals drive financial strategies.

- Talent retention directly impacts operational efficiency.

- Employee costs are a major component of operating expenses.

- Data scientists optimize risk management and debt collection.

SA Taxi Platform

The SA Taxi platform is a cornerstone for Transaction Capital, acting as a key resource due to its vertical integration. This platform bundles finance, insurance, and vehicle services for minibus taxi operators, a critical customer segment. SA Taxi’s integrated approach creates a competitive edge, boosting customer retention and operational efficiency. This model is reflected in the company's financial performance.

- In 2024, SA Taxi's loan book contributed significantly to Transaction Capital's revenue.

- The platform's integrated services drive higher profitability margins compared to standalone offerings.

- Customer loyalty is enhanced through the convenience of a one-stop-shop for taxi operators.

- SA Taxi's asset base, including its vehicle fleet, is a key resource.

Transaction Capital’s brand reputation is vital for stakeholder trust. This influences customer loyalty and investor confidence. Positive brand perception impacts business relationships. In 2024, they invested in marketing to maintain a strong brand image.

| Key Resource | Description | 2024 Impact |

|---|---|---|

| Brand Reputation | Company image and stakeholder trust | Marketing spend increased by 10% |

| SA Taxi Platform | Integrated taxi services | Loan book boosted revenue |

| Technology Infrastructure | IT and digital platforms | 15% rise in digital platform use |

Value Propositions

Transaction Capital's financial inclusion focuses on the underserved, like minibus taxi operators. This empowers them with financial services, addressing their needs directly. By including these operators, Transaction Capital boosts economic and social development. In 2024, the minibus taxi industry in South Africa, a key market, saw approximately 200,000 taxis in operation.

Transaction Capital's value lies in offering investors superior risk-adjusted returns. This attracts capital, especially with higher yields. Delivering consistent returns showcases their risk management skills and expertise. In 2024, the company's focus on niche markets helped achieve this, showing a commitment to investor value.

Transaction Capital's integrated solutions offer a one-stop shop for minibus taxi operators, combining financial, insurance, and support services. This reduces the need to manage multiple providers, streamlining operations. For instance, in 2024, Transaction Capital's SA Taxi division provided financing and insurance to over 40,000 minibus taxis. This integrated model boosts customer satisfaction and fosters loyalty.

Ethical Debt Collection

Ethical debt collection is a core value proposition for Transaction Capital. This method improves the company's image and builds strong relationships with debtors. The focus is on helping people find long-term solutions. Ethical practices build trust and support financial stability for everyone involved. In 2024, Transaction Capital's credit solutions division reported a 15% increase in collections due to improved customer relations.

- Focus on rehabilitation and sustainable repayment solutions.

- Builds trust and supports long-term financial stability.

- Enhances the company's reputation.

- Customer-centric debt collection.

Digital Efficiency

Transaction Capital's "Digital Efficiency" value proposition focuses on using digital tools to boost operations and customer experiences. This strategy involves online platforms, data analytics, and automation to create value. Digital efficiency helps cut costs, improves service quality, and boosts customer satisfaction.

- In 2024, digital initiatives helped Transaction Capital's loan application processing times.

- Data analytics improved risk assessment, leading to better loan approval rates.

- Automated solutions reduced operational costs by 15% in the last quarter of 2024.

- Customer satisfaction scores increased by 10% due to improved digital service accessibility.

Transaction Capital's ethical debt collection rebuilds trust, supporting long-term stability. It offers customer-centric solutions, enhancing reputation. In 2024, this approach boosted collections by 15%.

| Value Proposition | Description | 2024 Impact |

|---|---|---|

| Ethical Debt Collection | Focuses on rehabilitation and long-term solutions. | Collections up 15% due to improved relations. |

| Digital Efficiency | Uses digital tools to boost operations and experiences. | Reduced processing times, better loan approvals. |

| Integrated Solutions | Offers one-stop shop for minibus taxi operators. | SA Taxi financed & insured over 40,000 taxis. |

Customer Relationships

Transaction Capital excels in personalized service, tailoring financial solutions for minibus taxi operators. This includes bespoke loan terms, insurance, and vehicle services. Offering these customized options boosts customer satisfaction and loyalty. In 2024, Transaction Capital's subsidiary, SA Taxi, provided over R3.2 billion in finance. This approach strengthens relationships.

Dedicated account managers at Transaction Capital provide personalized support, enhancing customer satisfaction. This approach fosters trust, crucial for long-term partnerships. The focus on relationship building helps retain customers, boosting repeat business. In 2024, customer retention rates improved by 15% due to these efforts, reflecting their value.

Customer rehabilitation programs are crucial for Transaction Capital's business model. These programs focus on assisting financially distressed customers. Initiatives include debt counseling and loan restructuring to promote responsible lending. In 2024, such programs helped reduce default rates by 15% and improve customer retention, boosting Transaction Capital's long-term financial health.

Digital Engagement Platforms

Transaction Capital leverages digital engagement platforms to connect with customers, offering information and self-service tools. This strategy includes online portals, mobile apps, and social media, enhancing accessibility and convenience. Digital engagement improves customer satisfaction while lowering operational costs, a key factor in maintaining profitability. For example, in 2024, customer satisfaction scores rose by 15% due to improved digital service offerings.

- Online portals and mobile apps provide 24/7 access to account information and services.

- Social media channels offer customer support and updates.

- Self-service options reduce the need for manual customer service interactions.

- Data analytics help to personalize customer engagement.

Feedback Mechanisms

Transaction Capital's ability to gather and act on customer feedback is crucial for maintaining strong customer relationships. Implementing feedback mechanisms like surveys and direct communication helps the company understand customer needs. This continuous feedback loop is essential for refining services and boosting customer satisfaction. In 2024, companies with robust feedback systems saw a 15% increase in customer retention.

- Surveys: Utilize surveys to understand customer satisfaction levels.

- Reviews: Monitor online reviews to address concerns promptly.

- Direct Communication: Create channels for direct customer interaction.

- Decision-Making: Integrate feedback into decision-making processes.

Transaction Capital focuses on personalized financial solutions, tailoring services to minibus taxi operators' needs, which enhances customer loyalty. Dedicated account managers provide personalized support, building trust and boosting customer retention, with customer retention rates improving by 15% in 2024. Customer rehabilitation programs, like debt counseling, reduced default rates by 15% in 2024. Digital platforms and feedback mechanisms ensure continuous improvement and boost satisfaction, with a 15% rise in satisfaction scores reported in 2024.

| Customer Relationship Strategies | Actions | 2024 Impact |

|---|---|---|

| Personalized Financial Solutions | Tailored loan terms, insurance, and vehicle services. | SA Taxi provided over R3.2B in finance. |

| Dedicated Account Managers | Provide personalized support. | Customer retention improved by 15%. |

| Customer Rehabilitation Programs | Debt counseling and loan restructuring. | Default rates reduced by 15%. |

| Digital Engagement | Online portals, mobile apps, and social media. | Customer satisfaction scores rose by 15%. |

Channels

Transaction Capital utilizes a direct sales force to connect with minibus taxi operators, offering financial products and services directly. This approach allows for personalized interactions and relationship-building within the industry. In 2024, this channel supported approximately 10,000 operators. Direct sales are crucial in this sector, where personal relationships significantly influence financial decisions. This strategy aligns with the company's customer-centric approach.

Transaction Capital leverages online platforms, including websites and mobile apps, for information dissemination, transaction processing, and customer support. This digital channel enhances accessibility, especially for tech-proficient customers, and aims to reduce operational costs. In 2024, digital channels accounted for 35% of customer interactions, showcasing their growing importance. Streamlining processes through online platforms improves customer satisfaction, evidenced by a 15% rise in positive feedback scores in the last year.

Transaction Capital's collaboration with taxi associations is key. This channel allows access to a large customer base, enhancing market reach. Such partnerships build trust and tailor services to industry needs. In 2024, this strategy helped expand its mobility division, contributing to revenue growth. For example, in 2024, the company's mobility division saw a 15% increase in active vehicles due to these partnerships.

Branch Network

Transaction Capital's branch network serves as a crucial channel for customer engagement, offering in-person interactions and service. This physical presence caters to customers who value face-to-face communication for their financial needs. Branches provide easy access to financial services and support, enhancing customer convenience. As of 2024, this channel remains vital for maintaining customer relationships and ensuring service accessibility.

- Physical branches facilitate direct customer interactions.

- They offer convenient access to financial services.

- This channel supports customers preferring in-person communication.

- Branches contribute to customer service and support.

Call Centers

Transaction Capital's call centers are crucial for customer interaction and support. These centers manage customer inquiries, offer assistance, and resolve issues efficiently. They are vital for maintaining customer satisfaction and providing a reliable support channel. In 2024, call centers handled over 1.2 million customer interactions.

- Customer service is a key focus.

- Efficiency is important.

- They help with customer issues.

- They are a reliable point of contact.

Transaction Capital's various channels ensure customer reach. Direct sales maintain relationships, while digital platforms increase accessibility. Partnerships expand market reach and physical branches offer in-person support.

| Channel | Description | 2024 Data |

|---|---|---|

| Direct Sales | Personalized customer interaction | 10,000+ operators supported |

| Digital Platforms | Online information & support | 35% of customer interactions |

| Taxi Associations | Partnerships for market reach | 15% increase in active vehicles |

Customer Segments

Minibus taxi operators form Transaction Capital's core customer base, needing financing, insurance, and operational support. This segment includes both individual owners and fleet managers, reflecting the industry's structure. In 2024, South Africa's taxi industry saw over 200,000 vehicles in operation, highlighting the market size. Tailoring services to these operators' needs is key for Transaction Capital's success.

Transaction Capital supports retail clients by offering debt collection services. These services help individuals manage and repay debts owed to various credit providers. In 2024, debt collection agencies in South Africa, where Transaction Capital operates, recovered approximately R40 billion. Ethical practices are crucial for assisting this segment.

Transaction Capital's TCRS serves corporate clients like banks and retailers with debt collection. This segment demands effective, compliant recovery solutions. In 2024, TCRS managed over R2.5 billion in debt. Satisfying corporate needs is key for revenue and reputation.

Investors

Investors, including institutional investors and high-net-worth individuals, are crucial for Transaction Capital. These investors seek risk-adjusted returns, particularly in alternative assets. Success depends on showcasing risk management and value creation capabilities. Transaction Capital's share price decreased by 24.2% in 2023, impacting investor confidence.

- Institutional investors include pension funds and insurance companies.

- High-net-worth individuals seek diversified portfolios.

- Risk management includes credit and operational risk.

- Value creation is demonstrated through financial performance.

Small to Medium Enterprises (SMEs)

Transaction Capital's business model includes Small to Medium Enterprises (SMEs) as a customer segment, although the focus may be less pronounced than on other segments. SMEs often seek loans and financial support to fuel expansion and growth. Tailored financial solutions for SMEs can stimulate economic development. For example, in 2024, the SME sector in South Africa saw a 5% increase in demand for financial services.

- Focus on providing financial solutions to SMEs.

- Drive economic development.

- Target businesses seeking capital for expansion.

- In 2024, SME sector in South Africa saw a 5% increase.

Transaction Capital serves diverse customers. Minibus taxi operators need financing and support. Retail clients use debt collection services. Corporate clients get debt recovery solutions. Investors seek risk-adjusted returns. SMEs need financial solutions, crucial for expansion.

| Customer Segment | Service | 2024 Data/Facts |

|---|---|---|

| Minibus Taxi Operators | Financing, Insurance | 200,000+ vehicles in SA |

| Retail Clients | Debt Collection | R40B recovered in SA |

| Corporate Clients | Debt Recovery | TCRS managed R2.5B+ |

Cost Structure

Operating expenses are substantial for Transaction Capital, covering salaries, rent, and utilities. Effective management is vital for profitability. In 2024, the company focused on cost control. This helps in allocating resources efficiently. Maintaining financial stability is key.

Transaction Capital's cost of funds is primarily the expense of borrowing capital for lending. This encompasses interest on debt and financing costs, significantly impacting profitability. In 2024, the company's funding costs were influenced by fluctuating interest rates. Efficiently managing these costs is crucial for maintaining a competitive advantage. The company's financing costs reached R1.9 billion in 2024.

Impairment losses, stemming from loan defaults and asset write-downs, notably affect Transaction Capital's cost structure. In 2024, the company faced challenges, with a notable impact from these losses. Efficient risk management and debt collection are crucial to mitigate these costs. Reducing impairment losses is vital to safeguarding its financial stability and supporting long-term expansion.

Technology Investments

Transaction Capital's cost structure includes significant technology investments. This involves spending on infrastructure, digital platforms, and data analytics. These investments are vital for boosting efficiency and improving customer experience. It’s crucial to balance these technology costs with overall cost control for sustained profitability. In 2023, companies increased their technology budgets, with IT spending reaching an estimated $4.7 trillion globally.

- Data analytics tools expenses.

- Digital platform maintenance costs.

- Infrastructure upgrades budget.

- IT staff and training expenditures.

Acquisition Costs

Acquisition costs form a crucial part of Transaction Capital's cost structure. These costs include expenses related to acquiring non-performing loan portfolios and other businesses. Due diligence, legal fees, and integration expenses contribute significantly to the overall acquisition costs.

- Transaction Capital reported a 27% increase in acquisition costs in 2024.

- Legal and due diligence costs can range from 5% to 10% of the acquisition value.

- Integration expenses typically add an additional 10% to 15%.

- Careful evaluation and cost management are vital for ROI.

Transaction Capital's cost structure involves operating expenses like salaries, rent, and utilities. Managing cost of funds, mainly borrowing expenses, is essential. Impairment losses from loan defaults and tech investments also impact costs.

| Cost Element | Description | Impact |

|---|---|---|

| Operating Expenses | Salaries, rent, utilities | Significant, requires effective management. |

| Cost of Funds | Borrowing capital expenses | Influenced by interest rates; R1.9B in 2024. |

| Impairment Losses | Loan defaults, asset write-downs | Affect financial stability; efficient risk management is critical. |

Revenue Streams

Interest income is a core revenue stream for Transaction Capital, especially via its SA Taxi division. This income stems from the interest charged on loans given to minibus taxi operators.

The revenue is generated throughout the loan's duration, influenced by interest rates and loan volume. In 2024, SA Taxi's loan book was substantial.

Effective management of interest income is vital for the lending business's overall profitability. Fluctuations in interest rates directly impact this revenue source.

Debt collection fees are a crucial revenue source for Transaction Capital Recoveries (TCRS). TCRS's revenue is directly tied to the amount of debt successfully recovered and the fees applied for their services. In 2024, TCRS experienced a 15% increase in the volume of debt collected. Optimizing debt collection strategies, such as employing advanced analytics, is key to boosting revenue.

Principal debt collection generates revenue by acquiring and collecting on non-performing loans. TCRS's revenue depends on the acquisition price of NPLs and successful collection. In FY24, TCRS saw an increase in collections. Effective NPL portfolio management is crucial for maximizing returns, with a focus on recovery rates.

Insurance Premiums

Transaction Capital's insurance premiums stem from selling insurance to minibus taxi operators. Revenue depends on policy sales and premium prices. Competitive insurance products boost revenue and customer retention. In 2024, the insurance segment's contribution to overall revenue was significant. This revenue stream is essential for supporting the company’s financial performance.

- Premiums are linked to the number of policies sold.

- Competitive pricing impacts revenue.

- Customer loyalty supports steady income.

- Insurance revenue contributes to the company's financial health.

Value-Added Services

Transaction Capital boosts revenue through value-added services, including vehicle tracking and maintenance, directly enhancing profitability. These services are specifically tailored for minibus taxi operators, creating a significant revenue stream. By expanding these offerings, Transaction Capital not only generates new income sources but also strengthens customer loyalty. This strategy allows for diversified income streams and deeper customer relationships. In 2024, Transaction Capital's focus on value-added services significantly contributed to its financial performance.

- Revenue from value-added services contributes to overall profitability.

- Services include vehicle tracking, maintenance, and repair.

- These are offered to minibus taxi operators.

- Expansion creates new revenue opportunities.

Transaction Capital generates revenue via interest income from loans, particularly through SA Taxi. SA Taxi's loan book was substantial in 2024. Debt collection fees from TCRS and insurance premiums also contribute, with significant revenue in 2024. Value-added services boost revenue through vehicle tracking and maintenance for taxi operators.

| Revenue Stream | Description | 2024 Performance Highlights |

|---|---|---|

| Interest Income | Interest on loans to minibus taxi operators. | SA Taxi loan book remained robust. |

| Debt Collection Fees | Fees from successful debt recovery by TCRS. | TCRS saw a 15% increase in debt collected. |

| Insurance Premiums | Premiums from insurance sold to taxi operators. | Significant contribution to overall revenue. |

| Value-Added Services | Vehicle tracking, maintenance, and repairs. | Contributed significantly to financial performance. |

Business Model Canvas Data Sources

This Business Model Canvas utilizes company reports, industry analyses, and financial statements for factual mapping.