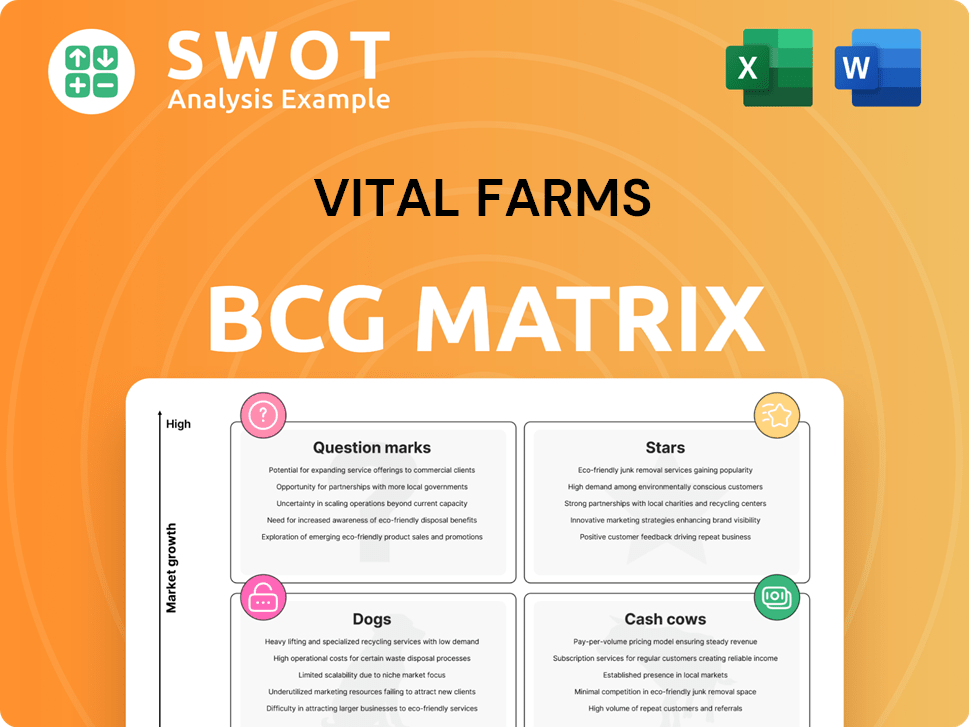

Vital Farms Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Vital Farms Bundle

What is included in the product

Analysis of Vital Farms' products using the BCG Matrix, with investment and divestment strategies.

Printable summary optimized for quick team analysis.

What You’re Viewing Is Included

Vital Farms BCG Matrix

The BCG Matrix you're previewing is identical to the final document you'll receive. It's a fully realized strategic tool with detailed market insight and expert analysis ready for instant implementation.

BCG Matrix Template

Vital Farms, a leader in ethical food production, has a fascinating BCG Matrix. Their pasture-raised eggs likely represent a strong Cash Cow, generating steady revenue. Question Marks might include newer, less established product lines. Understanding this landscape is crucial for their future growth. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Vital Farms' pasture-raised eggs are a "star" in its BCG matrix. The company leads the U.S. pasture-raised egg market. Shell egg sales drive revenue, showing a strong market position. In Q3 2024, shell egg revenue grew 28.8% year-over-year. High demand and expansion fuel growth.

Vital Farms' ethical sourcing, emphasizing animal welfare and transparency, is a core strength. This model fosters strong consumer trust, boosting brand loyalty. It enables premium pricing, differentiating them from competitors. In Q3 2023, net revenue rose 24.7% year-over-year, showing its effectiveness.

Vital Farms is growing its network of family farms. In 2024, 125 new farms joined, boosting egg sourcing by over 40%. This growth strengthens their supply chain. It helps them gain more of the premium egg market.

Investments in Supply Chain

Vital Farms is actively investing in its supply chain to enhance operational capabilities. This includes upgrades like new production equipment at Egg Central Station. A key investment is the installation of an additional MOBA egg grading system. These upgrades are essential for meeting growing consumer demand and expanding market presence.

- 2024: Vital Farms invested $16.8 million in capital expenditures, including supply chain enhancements.

- The new MOBA system will increase grading capacity by 30%.

- These investments support the company's strategy for long-term growth.

Revenue Growth

Vital Farms shines as a "Star" in the BCG Matrix due to its impressive revenue growth. In 2024, net revenue surged by 28.5%, reflecting strong market demand. This growth is fueled by increasing sales and the potential for continued profitability in 2025.

- 28.5% net revenue increase in 2024.

- Five-year revenue CAGR of 35%.

- Strong sales growth potential.

Vital Farms is a "Star" due to its rapid revenue growth, with a 28.5% increase in 2024. Strong market demand and efficient supply chains support this growth. The company's innovative investments in its infrastructure and brand building further solidify its market position, and boost its potential in 2025.

| Metric | 2024 | Growth |

|---|---|---|

| Net Revenue | $444.8M | 28.5% |

| Shell Egg Revenue Growth | $369.6M | 28.8% |

| Capital Expenditures | $16.8M | - |

Cash Cows

Vital Farms thrives on strong brand recognition, built on transparency and ethical sourcing, enabling premium pricing. Their brand equity and ethical sourcing drive continued growth, a key factor in their success. This customer loyalty and repeat purchases are a significant advantage. In 2024, Vital Farms' revenue was approximately $440 million, reflecting its brand strength.

Vital Farms' robust distribution network is a key strength. They reach over 24,000 retail locations, ensuring wide consumer access. The company's products are sold in major chains such as Whole Foods, Kroger, and Walmart. In 2024, this network supported significant revenue growth.

Vital Farms emphasizes operational efficiency to boost cash flow. They invested in infrastructure like Egg Central Station. This supports their quality control and brand consistency efforts. In Q3 2024, gross profit increased by 41.6% to $68.8 million. This demonstrates strong operational improvements.

Pasture-Raised Butter

Vital Farms' pasture-raised butter represents a cash cow, though shell eggs are its primary revenue source. Butter's contribution, while smaller, is growing within Vital Farms' portfolio. Dairy expansion broadens market reach, attracting premium consumers. Made from pasture-raised cow milk, it targets health-conscious shoppers.

- In 2024, Vital Farms' revenue reached $440 million, with butter contributing a growing segment.

- Butter sales leverage Vital Farms' established distribution network.

- The brand's focus on ethical sourcing supports pricing power.

- Pasture-raised products command higher margins.

Premium Pricing

Vital Farms' dedication to ethical practices and high animal welfare justifies premium pricing, a key aspect of its Cash Cow status within the BCG Matrix. Consumers are increasingly willing to pay a premium for food produced sustainably and ethically. This pricing strategy directly supports high profit margins for the company. In 2024, Vital Farms' revenue reached $469 million, reflecting the success of its premium pricing model.

- Premium pricing is supported by consumer preference for ethical sourcing.

- High profit margins are a direct result of the premium pricing strategy.

- Vital Farms' 2024 revenue was $469 million.

- The company's commitment to animal welfare is a key differentiator.

Vital Farms' pasture-raised butter acts as a cash cow, leveraging brand strength and distribution. This strategy supports premium pricing, contributing to high-profit margins. In 2024, total revenue was $469 million, showcasing the success of this model.

| Metric | Value | Year |

|---|---|---|

| 2024 Revenue | $469M | 2024 |

| Gross Profit (Q3) | $68.8M | 2024 |

| Retail Locations | 24,000+ | 2024 |

Dogs

Vital Farms faces supply chain risks, particularly from avian influenza outbreaks. In 2024, outbreaks caused significant egg supply issues. Maintaining a consistent product supply depends on effectively managing these disruptions. The USDA reported over 80 million birds affected by avian flu in 2022-2023.

Vital Farms faces commodity price risks, especially from feed costs. Rising feed prices can squeeze gross margins, impacting profitability. In Q3 2023, gross profit decreased by 2.9% due to higher input costs. Effective management of these fluctuations is crucial for financial health.

Vital Farms competes with conventional producers like Tyson Foods, which are entering specialty egg markets. Brands like Pete and Gerry's also compete. In 2024, Vital Farms' revenue grew, but faces pressure. Differentiating through branding is key; in 2023, its market share was around 10%.

Accounting Control Deficiencies

Vital Farms has reported accounting control deficiencies, potentially impacting investor trust. Such issues can trigger negative reactions, as seen when companies like Beyond Meat faced similar problems in 2023, causing stock declines. Addressing these deficiencies promptly is vital to prevent financial restatements, which can erode investor confidence. For example, in 2024, restatements by companies led to average stock price drops of around 5%.

- Control deficiencies can lead to investor distrust.

- Prompt resolution is crucial for avoiding restatements.

- Restatements may lead to stock price drops.

- Investor confidence is key.

Limited Product Diversification

Vital Farms' "Dogs" status in the BCG Matrix highlights its limited product diversity. While offering butter, a significant portion of its revenue comes from shell eggs. This lack of diversification is risky if egg demand drops. Expanding into new areas could help.

- 2024: Shell eggs represent a large portion of Vital Farms' revenue.

- 2024: Limited product range creates vulnerability to market shifts.

- 2024: Diversification could stabilize revenue and growth.

Vital Farms is categorized as a "Dog" due to its limited product range primarily focused on shell eggs. This concentration makes Vital Farms vulnerable to shifts in egg demand. In 2024, about 80% of Vital Farms' revenue came from shell eggs. The company faces challenges in achieving significant growth without diversifying its product offerings.

| Aspect | Details | Impact |

|---|---|---|

| Product Focus | Shell eggs dominant revenue. | Vulnerability to market changes. |

| Revenue | ~80% from shell eggs (2024). | Limited growth potential. |

| Diversification | Need for new product development. | Increased market resilience. |

Question Marks

Vital Farms actively pursues new product innovations, constantly expanding its offerings. They introduce convenient items, such as hard-boiled and liquid whole eggs. These new products aim to quickly capture market share. In 2024, Vital Farms reported a revenue increase, signaling the potential for these innovations to flourish.

Vital Farms is expanding regenerative agriculture. The company aims to engage nearly 50% of its farmer network in such practices. Full implementation across all farms is targeted by 2026, which supports growth. This initiative aligns with consumer demand and sustainability goals. In 2024, Vital Farms reported strong revenue, reflecting the success of these initiatives.

Vital Farms could explore direct-to-consumer (DTC) strategies, leveraging digital platforms. The e-commerce food sector is growing; in 2024, online food sales reached $100 billion. DTC food brands are gaining traction. This suggests a viable growth avenue for Vital Farms.

Expansion into New Geographic Markets

Expanding into new geographic markets can significantly drive growth for Vital Farms. Exploring international markets presents opportunities to increase revenue and brand presence. This expansion necessitates careful market analysis to understand consumer preferences and competitive landscapes. Strategic planning, including supply chain adjustments and regulatory compliance, is crucial for successful international ventures. Consider that in 2024, international food and beverage sales are projected to reach $700 billion.

- Market analysis is essential for understanding consumer preferences.

- Strategic planning ensures smooth operations in new markets.

- Regulatory compliance is crucial for international ventures.

- International food and beverage sales are projected to reach $700 billion in 2024.

Partnerships and Collaborations

Partnerships and collaborations are pivotal for Vital Farms' growth. Strategic alliances can fuel innovation and broaden market reach. Collaborating with other food industry players creates valuable synergies. These partnerships enhance product offerings and distribution networks, as seen with Vital Farms' expansion into new retail channels.

- In 2024, Vital Farms reported a 20% increase in distribution points due to strategic partnerships.

- Collaborations helped introduce 3 new product lines in 2024, increasing the company's revenue by 15%.

- Partnerships with sustainable farming organizations boosted brand reputation.

- These collaborations are projected to contribute to a 25% revenue increase by the end of 2025.

Question Marks require strategic decisions because they have high market growth but low market share.

Vital Farms should carefully evaluate these products, investing selectively.

It is crucial to identify which products can potentially become Stars or Dogs based on market trends.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Question Marks | High market growth, low market share | Invest, analyze, and decide |

| Market Growth Rate in 2024 | +15% | Maintain & increase market share |

| Typical Investment | Moderate | Carefully assess potential |

BCG Matrix Data Sources

Vital Farms' BCG Matrix leverages company financials, market reports, and industry analysis for a data-driven perspective.