Walmart Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Walmart Bundle

What is included in the product

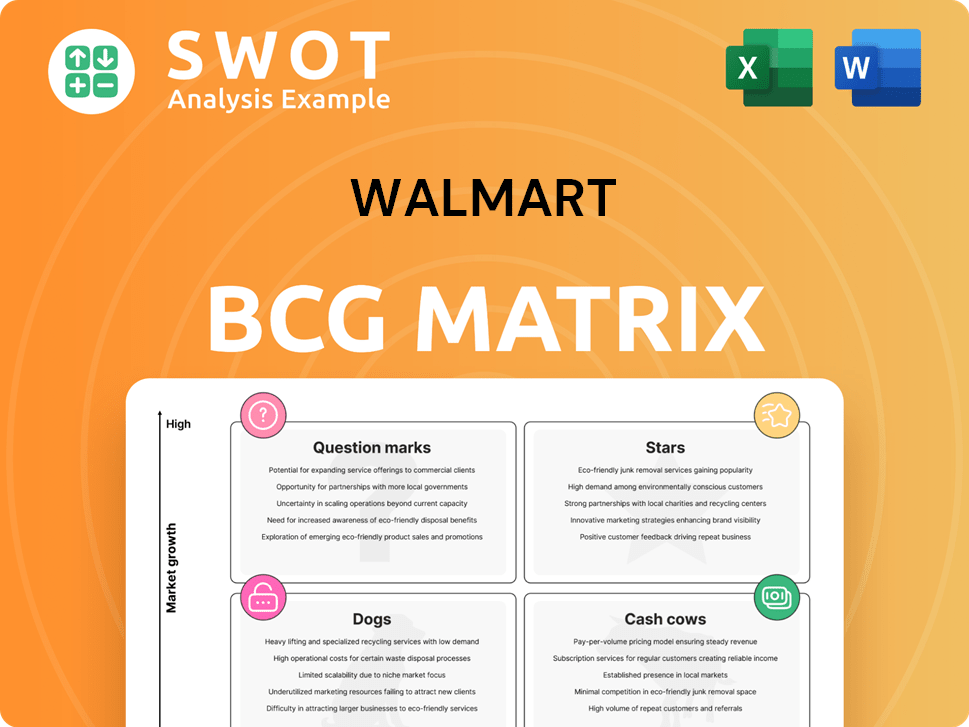

Walmart's BCG Matrix analysis offers strategic insights for product portfolio management, highlighting investment, hold, or divest strategies.

Printable summary optimized for A4 and mobile PDFs, helping teams strategize with easy-to-share insights.

What You’re Viewing Is Included

Walmart BCG Matrix

The preview displays the complete Walmart BCG Matrix you'll receive after buying. This is the full, finalized document, expertly crafted for in-depth analysis and strategic planning.

BCG Matrix Template

Walmart's product portfolio is vast, offering a complex mix of growth potential and resource demands.

This glimpse into its BCG Matrix reveals where key items like groceries or electronics fit: Stars, Cash Cows, Question Marks, or Dogs.

Understanding this categorization is vital for smart investment and strategic focus.

This preview offers a snapshot, but the complete BCG Matrix unlocks deep insights.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks.

Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Walmart's e-commerce platform is a "Star" in its BCG Matrix, showcasing rapid growth. E-commerce sales hit $73.2 billion in fiscal year 2024, a 23% YoY increase. It holds a significant market share, at 6.2% in the U.S. online market. This growth trajectory highlights its potential.

Walmart+ has shown strong growth, drawing in loyal customers. The membership's benefits are increasing across Walmart and Sam's Club, boosting renewals. This model improves the omnichannel shopping experience, offering perks like free shipping and fuel discounts. In 2024, Walmart+ had over 18 million members, reflecting its appeal.

Walmart's grocery segment is a Star within its portfolio. It commands a significant market share, leveraging its vast store network and aggressive pricing. The grocery market is expanding, driven by consumer demand for convenience and fresh food options. Walmart's investments in delivery and pickup services have boosted its market position. In 2024, Walmart's U.S. grocery sales grew, reflecting its strong performance.

Global Advertising Business

Walmart's global advertising business is booming, making it a "Star" in its BCG Matrix. In 2023, revenue hit $4.4 billion, reflecting strong growth. Walmart Connect in the U.S. saw a 24% rise. This surge is due to digital advertising's importance in Walmart's e-commerce and retail operations.

- Revenue reached $4.4 billion in 2023.

- Walmart Connect U.S. increased by 24%.

- Growth driven by digital advertising.

Technology and Automation

Walmart's "Stars" category includes technology and automation, areas where it is heavily investing. In 2023, the company allocated a significant $9.7 billion towards technology and digital capabilities. These investments are designed to boost efficiency and improve customer experiences. Key initiatives involve AI-driven inventory management and autonomous robots for tasks like floor cleaning.

- $9.7 billion invested in 2023.

- Focus on AI and automation.

- Enhances efficiency and customer experience.

- Includes autonomous robots.

Walmart's Stars are key growth drivers. These segments show high growth with substantial market share. The e-commerce platform led with $73.2 billion in 2024 sales.

| Category | 2024 Performance | Key Highlights |

|---|---|---|

| E-commerce | $73.2B sales | 23% YoY growth, 6.2% U.S. market share |

| Walmart+ | 18M+ members | Boosting omnichannel experience, loyalty |

| Grocery | Strong growth | Large market share, investments in services |

Cash Cows

Walmart's brick-and-mortar stores are a cash cow, still generating significant revenue. In 2024, these stores, including Supercenters and Discount Stores, contributed a substantial portion to Walmart's $648.1 billion in revenue. Their vast network ensures a steady stream of income, solidifying their status as a reliable revenue source.

Walmart's grocery and household essentials are classic cash cows, delivering consistent sales and a reliable revenue stream. These items, essential for daily life, boast stable demand, ensuring a steady income. Walmart's robust supply chain and economies of scale enable cost leadership in this category. In 2024, these segments generated billions in sales, reinforcing their cash cow status.

Walmart's private label products, like Great Value, are cash cows, boosting margins and offering competitive prices. These products are highly profitable and attract budget-conscious consumers. In 2024, private brands accounted for over 30% of Walmart's sales, a significant portion. Walmart expands and innovates its private label offerings to meet customer needs.

U.S. Retail Sales

Walmart's U.S. retail operations are a significant cash cow. In fiscal year 2025, Walmart U.S. generated $462.415 billion in net sales. This segment is fueled by a vast store network and customer loyalty. It consistently provides strong cash flow for Walmart.

- Walmart U.S. net sales in fiscal year 2025 reached $462.415 billion.

- The U.S. segment represents 67.9% of Walmart's total revenue.

- Walmart benefits from a wide store network and brand recognition.

- This segment ensures steady cash flow.

Sam's Club Membership

Sam's Club, a Walmart subsidiary, is a cash cow due to its consistent revenue from memberships and sales. The membership model ensures a reliable income stream, while product sales boost profitability. For instance, in Q4 2023, Sam's Club's sales increased by 4.8% to $21.8 billion. The company focuses on enhancing member experiences.

- Membership fees provide a stable revenue base.

- Sales of diverse products contribute to profits.

- Sam's Club focuses on member experience.

- Sam's Club's Q4 2023 sales were $21.8B.

Cash cows for Walmart are established businesses with high market share and low growth. Walmart's brick-and-mortar stores and grocery are prime examples, consistently generating revenue. In 2024, Walmart's U.S. retail generated $462.415 billion in sales, a testament to their cash cow status.

| Segment | Description | 2024 Revenue (approx.) |

|---|---|---|

| Walmart U.S. | Large store network | $462.415B |

| Grocery/Essentials | Stable demand | Billions |

| Sam's Club | Membership & Sales | $21.8B (Q4 2023) |

Dogs

Small format stores like Neighborhood Market face limited growth. They offer convenience, yet generate lower revenue than larger stores. In 2024, these stores showed declining metrics. Their market share remains constrained, indicating a "Dog" status within Walmart's portfolio.

Underperforming international markets, such as those where Walmart has struggled, fall into the "Dog" quadrant of the BCG matrix. These markets often face revenue declines and operational issues. Walmart's exits from Germany in 2006 and South Korea in 2006 illustrate these challenges. In 2024, Walmart's international sales growth was 6.5%, a key factor in its overall performance.

Legacy physical store formats, facing declining foot traffic and sales growth, are "Dogs." Supercenter foot traffic decreased in 2023. Physical store sales growth lagged behind e-commerce. These formats need strategic revitalization to compete. Walmart's U.S. comp sales growth slowed to 4.0% in Q3 2024.

Low-Margin Product Segments

Low-margin product segments like electronics and apparel at Walmart can be classified as "Dogs" due to their limited profitability. These categories, despite high revenue, often have slim profit margins. For example, in 2024, electronics saw a 3% profit margin, while apparel hovered around 5%. Strategic actions are vital to improve profitability.

- Electronics and apparel face low profit margins.

- High revenue doesn't always equal high profit.

- Profit margins in 2024 were low.

- Strategic adjustments are needed.

Traditional Discount Stores

Traditional Walmart Discount Stores are categorized as "Dogs" in the BCG matrix. The number of these stores has significantly decreased, reflecting a declining market share. By 2025, only 355 traditional Discount Stores remain in the U.S., a 43.6% drop from 2012. This indicates the need for strategic adjustments, including potential repositioning or closure to optimize resources.

- Decline: Traditional Discount Stores show a shrinking footprint.

- Numbers: 355 stores operational in the U.S. by 2025.

- Reduction: A 43.6% decrease since 2012.

- Strategy: Requires repositioning or closure.

Product segments with low profitability and limited growth prospects are classified as "Dogs". These products often require strategic interventions. Walmart's focus shifts toward more profitable areas to enhance overall financial performance.

| Category | Characteristics | Strategy |

|---|---|---|

| Low-Margin Products | Slim profit margins, limited growth | Strategic adjustments or potential divestment |

| Examples | Electronics (3% margin), Apparel (5% margin in 2024) | Focus on higher-margin categories |

| Impact | Negatively affects overall profitability | Optimize resource allocation, increase profitability |

Question Marks

Walmart's healthcare services are a Question Mark. They have high growth potential, yet low market share. In Q4 2023, Walmart had a limited number of health centers. The healthcare market is huge, and Walmart is investing to grow. Walmart's healthcare revenue in 2023 was around $1 billion.

Walmart's pet care services, including vet care and supplies, fit the Question Mark category. The pet market is growing; in 2024, it's estimated to reach $147 billion in the U.S. Walmart invests in pet service centers and online options. This strategy aims to gain market share in this expanding sector.

Walmart's sustainability efforts, like cutting plastic and boosting recycling, are Question Marks in its BCG Matrix. These initiatives target eco-minded consumers, but their effect on market share and profits is unclear. Walmart's invested $100 million in sustainable packaging in 2024. They aim to attract customers with a better brand image.

International Expansion

Walmart's international expansion is a Question Mark in its BCG Matrix. Despite international operations contributing significantly to revenue, challenges persist. The need for localized strategies introduces uncertainty in certain markets. Walmart is investing in emerging markets to grow its global presence and customer base. For instance, Walmart International reported net sales of $108.3 billion in fiscal year 2024.

- International sales represent a significant portion of Walmart's overall revenue.

- Localized strategies are crucial for success in diverse international markets.

- Walmart is actively investing in growth in key markets like India and China.

- The profitability and long-term viability of these investments are still evolving.

Financial Services

Walmart's financial services, including credit cards and money transfers, represent a Question Mark in its BCG Matrix. These services aim to boost customer loyalty and create additional revenue streams. However, they also face regulatory hurdles and intense competition from established financial institutions. Walmart is actively exploring opportunities in this area to provide added value to its customers.

- Walmart's financial services include credit cards and money transfer services.

- These services aim to enhance customer loyalty and generate additional revenue.

- They face regulatory and competitive challenges.

- Walmart is exploring opportunities in financial services.

Walmart's financial services, a Question Mark, include credit cards and money transfers. These services aim to boost loyalty and revenue, but face regulatory and competitive challenges. Walmart is actively exploring opportunities in financial services, aiming to provide added value. In Q4 2024, financial services revenue was $2.5 billion.

| Aspect | Details |

|---|---|

| Services | Credit cards, money transfers |

| Goal | Boost loyalty, revenue |

| Challenges | Regulations, competition |

| 2024 Revenue | $2.5B (Q4) |

BCG Matrix Data Sources

Walmart's BCG Matrix uses data from financial filings, sales figures, market share analysis, and industry reports. Competitor comparisons and consumer behavior insights further enrich the analysis.