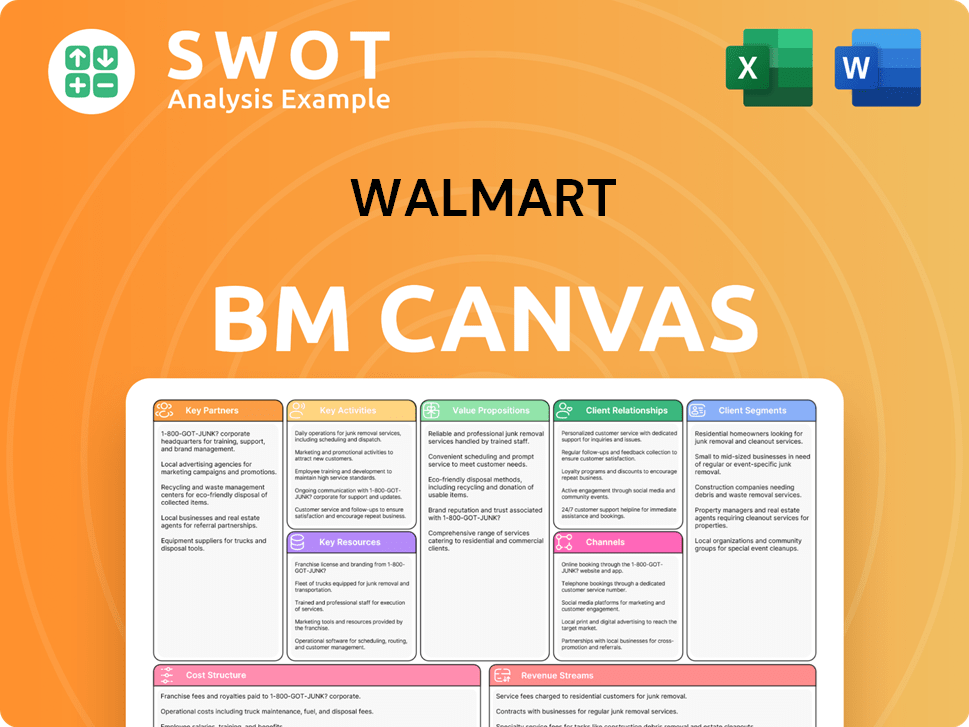

Walmart Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Walmart Bundle

What is included in the product

Walmart's BMC reflects real-world operations. It details customer segments, channels, and value propositions in full.

Condenses company strategy into a digestible format for quick review.

Preview Before You Purchase

Business Model Canvas

This Business Model Canvas preview mirrors the complete Walmart document you'll get. It's not a sample; it's the full file's snapshot. Purchasing grants access to the same, ready-to-use Canvas.

Business Model Canvas Template

Explore Walmart's strategic architecture with our detailed Business Model Canvas. It uncovers the company's key partnerships, activities, and value propositions. Analyze how Walmart captures value through diverse revenue streams and optimizes its cost structure. Understand its customer segments and distribution channels for market dominance.

Partnerships

Walmart's supplier relationships are vital. They negotiate favorable terms with thousands of suppliers. In 2024, Walmart sourced goods from over 100,000 suppliers globally. These partnerships support its 'Everyday Low Prices' strategy, optimizing costs. This ensures product availability and competitive pricing for consumers.

Walmart collaborates with tech providers to boost its digital presence. They work with cloud services, software developers, and cybersecurity firms. These partnerships improve e-commerce, supply chains, and customer experiences. In 2024, Walmart invested over $10 billion in technology and automation.

Walmart relies heavily on partnerships with logistics and transportation companies like J.B. Hunt and Schneider. These collaborations are crucial for optimizing its supply chain. In 2024, Walmart spent approximately $70 billion on transportation. Efficient logistics help Walmart manage inventory effectively. This ensures timely delivery and reduces operational costs.

Financial Service Providers

Walmart collaborates with financial service providers to deliver financial products like credit cards, money transfers, and check cashing to its customers. These partnerships boost customer convenience and create extra revenue streams for Walmart. Offering these services allows Walmart to meet the diverse financial needs of its customer base. In 2024, Walmart's financial services partnerships generated approximately $1.5 billion in revenue.

- Walmart's money transfer service, provided through partnerships, processed over $20 billion in transactions in 2024.

- Walmart's co-branded credit cards saw a 10% increase in usage among its customers in 2024.

- Check cashing services at Walmart stores served over 50 million customers in 2024.

- These partnerships enable Walmart to broaden its customer service offerings.

Community Organizations

Walmart actively collaborates with community organizations, supporting local projects and addressing social challenges. These partnerships range from charitable contributions to volunteer programs and joint projects aimed at meeting community needs. The goal is to foster goodwill and boost its image as a responsible corporate entity. This strategy is crucial for maintaining a positive public perception and supporting local economies.

- In 2024, Walmart donated over $70 million to various local community organizations.

- Walmart's volunteer programs involved over 1.5 million employee hours in 2024.

- Partnerships with Feeding America resulted in over 1 billion pounds of food donated in 2024.

- Local initiatives include supporting education and environmental sustainability projects.

Walmart's key partnerships are crucial for its operations. They span suppliers, tech providers, and logistics companies. Collaboration boosts efficiency and expands customer services, driving revenue.

| Partnership Type | Partner Examples | 2024 Impact |

|---|---|---|

| Suppliers | Procter & Gamble, Unilever | Sourced from 100k+ suppliers |

| Technology | Microsoft, IBM | $10B+ invested in tech |

| Logistics | J.B. Hunt, Schneider | $70B spent on transportation |

Activities

Walmart's strength lies in its supply chain, a key activity. It focuses on sourcing, procurement, and distribution. This ensures products are affordable and readily available. In 2024, Walmart's supply chain handled over $600 billion in goods. Efficient supply chain is key for its competitive edge.

Walmart's retail operations are pivotal, involving store management, layout, and merchandising. In 2024, Walmart operated approximately 10,500 stores worldwide, demonstrating its vast retail footprint. Effective staffing and customer service are crucial for a positive shopping experience. Walmart's sales in Q3 2024 reached around $160.8 billion, reflecting the importance of efficient operations.

Walmart's e-commerce operations are central to its strategy. They manage their website, handle online marketing, and fulfill orders. Customer support is also a key part. In Q3 2024, e-commerce sales grew by 15%.

Marketing and Sales

Walmart heavily invests in marketing and sales to boost customer engagement and sales. This involves diverse strategies like advertising, special promotions, and loyalty programs. Efficient marketing is crucial for maintaining Walmart's leading market position, and it uses customer relationship management to tailor offerings. In 2024, Walmart's advertising expenses were a significant part of its overall budget, reflecting its commitment to these areas.

- Walmart allocated billions to advertising in 2024.

- Promotions, like seasonal sales, are frequent.

- Walmart's loyalty program, Walmart+, has millions of members.

- Customer Relationship Management (CRM) systems are used to personalize marketing.

Technology Development and Innovation

Walmart's commitment to technology development and innovation is a cornerstone of its business model. The company heavily invests in data analytics, artificial intelligence, and automation to improve operations. This focus allows Walmart to enhance efficiency and personalize the customer experience. Technology also drives growth and keeps the company competitive in the market.

- Walmart invested approximately $10 billion in technology in fiscal year 2024.

- E-commerce sales grew by 22% in Q3 2024, driven by tech integrations.

- AI is used to optimize supply chains, reducing costs by an estimated 15%.

- Automation in warehouses increased picking efficiency by 30%.

Walmart's partnerships with suppliers are vital. It focuses on sourcing and negotiating contracts. These relationships ensure a steady supply of goods. In 2024, Walmart collaborated with over 10,000 suppliers globally.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Supplier Relations | Sourcing and contract negotiations. | Over 10,000 global suppliers |

| Technology | Investing in data analytics & AI. | $10B tech investment, Q3 e-commerce +22% |

| Marketing & Sales | Advertising, promotions, and loyalty programs. | Advertising: Billions, Walmart+ members: Millions |

Resources

Walmart's expansive store network is a cornerstone of its business model. It provides convenient access to products for many customers. These locations function as distribution centers, customer service hubs, and brand interaction points. In 2024, Walmart operated roughly 4,615 stores in the United States. This extensive network gives Walmart a strong competitive edge.

Walmart's robust brand reputation, centered on low prices and extensive product selection, is a key resource. This attracts customers and fosters loyalty, crucial in a competitive market. In 2024, Walmart's brand value reached approximately $113.8 billion, reflecting its market dominance. A positive brand image helps maintain its leading position in the retail sector.

Walmart's efficient supply chain is a cornerstone of its business model, allowing competitive pricing. This includes distribution centers, transportation, and inventory systems. In 2024, Walmart's supply chain handled over 12 billion units. A strong supply chain helps maintain its cost advantage.

E-commerce Platform

Walmart's e-commerce platform is a vital resource, enabling online customer reach and convenient shopping. This encompasses its website, mobile app, and online marketplace, all key to its digital strategy. Investing in and enhancing this platform is crucial for competing in the digital market. Walmart's e-commerce sales grew 11% in fiscal year 2024.

- Website and Mobile App: Key digital touchpoints for customer engagement.

- Online Marketplace: Expands product offerings and attracts third-party sellers.

- Digital Strategy: Essential for adapting to changing consumer behaviors.

- E-commerce Growth: Reflects the company's success in online retail.

Data and Analytics Capabilities

Walmart's strength lies in its data and analytics. They use data to understand customers, improve operations, and personalize marketing. This involves analyzing sales data, customer demographics, and market trends. Data-driven decisions are crucial for efficiency and satisfaction.

- Walmart processes over 100 million transactions weekly.

- They utilize AI to predict demand and optimize inventory.

- Personalized ads increased click-through rates by 20% in 2024.

- Data analytics helped reduce supply chain costs by 10% in 2024.

Walmart’s Key Resources include its store network, brand reputation, and supply chain. These assets support its business model and competitive advantage. Additionally, its e-commerce platform and data analytics capabilities are crucial for growth and operational efficiency. A data-driven approach drives personalized marketing and supply chain optimization.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Store Network | Physical stores offering products and services. | Approx. 4,615 U.S. stores |

| Brand Reputation | Walmart's brand image emphasizing low prices and wide selection. | Brand value: $113.8 billion |

| Supply Chain | Distribution centers, transportation, and inventory management. | Handled over 12B units |

| E-commerce Platform | Website, app, and marketplace for online sales. | E-commerce sales up 11% |

| Data & Analytics | Data analysis for customer insights and operational improvements. | Personalized ads increased click-through rates by 20% |

Value Propositions

Walmart's core strength lies in "Everyday Low Prices," attracting budget-conscious consumers. This value prop drives customer traffic to both physical stores and online platforms. In 2024, Walmart's focus on low prices helped boost its U.S. sales by 3.3% demonstrating its continued success. This strategy is crucial for its market dominance.

Walmart's wide product selection is a key value proposition. They offer everything from food to electronics, making shopping convenient. This attracts customers seeking a one-stop experience. In 2024, Walmart's diverse product range drove significant sales. The broad assortment is a major customer draw.

Walmart's vast store network and online platform offer a convenient shopping experience. In 2024, Walmart saw significant growth in online grocery sales, reflecting the importance of convenience. Services like pickup and delivery further enhance customer ease, saving time and effort. The focus on convenience aligns with evolving consumer preferences, boosting sales and customer loyalty. Walmart's revenue in 2024 was around $650 billion.

Accessibility

Walmart's value proposition emphasizes accessibility, ensuring products and services reach a wide customer base. This is achieved through affordable pricing and strategic store locations, including rural and underserved areas. In 2024, Walmart's focus remained on expanding its reach, with over 4,600 stores in the U.S., showcasing its commitment. Accessibility is crucial for serving diverse customer needs effectively.

- Affordable Prices: Walmart offers competitive pricing.

- Store Locations: Stores are strategically placed.

- Serving All Customers: Accessibility is a key mission component.

- 2024 Expansion: Over 4,600 U.S. stores.

Trust and Reliability

Walmart's value proposition centers on trust and reliability, core to its business model. Customers trust Walmart for consistent quality and service across its vast network. This builds customer loyalty, driving repeat purchases and strong sales figures. Maintaining this trust is critical for Walmart's long-term success in a competitive market.

- Walmart's Net Promoter Score (NPS) remains a key indicator of customer trust and loyalty.

- In 2024, Walmart's global sales reached approximately $648 billion, reflecting customer confidence.

- Walmart's investments in supply chain and technology aim to further enhance reliability.

- Walmart's focus on value and everyday low prices also boosts customer trust.

Walmart's core value propositions include affordability, convenience, and accessibility. This is supported by everyday low prices and a vast network of stores and online platforms. Walmart's focus on these areas resulted in approximately $648 billion in global sales in 2024.

| Value Proposition | Description | 2024 Impact |

|---|---|---|

| Affordable Prices | Offers competitive pricing to attract budget-conscious consumers. | U.S. sales grew by 3.3%. |

| Convenience | Wide product selection, store network, online shopping. | Significant online grocery sales. |

| Accessibility | Strategic locations, affordable pricing. | Over 4,600 stores in the U.S. |

Customer Relationships

Walmart's in-store customer service involves employees helping shoppers. They assist with product choices, address queries, and solve problems. This direct interaction builds trust and keeps customers happy. Good service improves the shopping experience. Walmart's customer satisfaction score was 73 in 2024.

Walmart's online customer support is accessible via its website, mobile app, and social media. They provide information, answer questions, and resolve issues efficiently. In 2024, Walmart's e-commerce sales reached $83.3 billion. Convenient online support is crucial for e-commerce success.

Walmart strategically uses loyalty programs, like Walmart+, to foster customer retention. These programs, offering perks like free shipping and special deals, are key. Walmart+ members in 2024 saw benefits, contributing to a rise in customer engagement. Loyalty programs are proven to boost customer lifetime value. In 2024, Walmart saw a significant increase in sales.

Personalized Marketing

Walmart leverages data analytics to personalize marketing, offering customers tailored deals and suggestions. This approach involves targeted emails, online ads, and in-store promotions. Personalized marketing boosts customer interaction and sales. In 2024, Walmart's digital ad revenue is projected to reach $3.5 billion.

- Personalized marketing increases customer lifetime value.

- Walmart’s loyalty program uses personalized offers.

- Personalization leads to higher conversion rates.

- Data-driven insights improve marketing ROI.

Community Engagement

Walmart's community engagement strategy involves various initiatives. It supports local areas through charitable donations and volunteer programs, fostering a positive image. Partnerships with community organizations further reinforce its commitment to social responsibility. This approach boosts customer loyalty and strengthens Walmart's brand.

- Walmart's charitable giving in 2024 totaled over $1.7 billion.

- Walmart employees volunteered over 1.5 million hours in 2024.

- Walmart partners with over 4,000 local community organizations.

- Approximately 90% of Americans live within 10 miles of a Walmart store.

Walmart's customer relations focus on in-store service, online support, loyalty programs, and personalized marketing. They use employee assistance and online platforms for direct interactions. Walmart+ boosted customer engagement in 2024, supporting sales growth. Community engagement through donations strengthens brand image.

| Aspect | Strategy | 2024 Data |

|---|---|---|

| In-Store Service | Employee Assistance | Customer satisfaction score: 73 |

| Online Support | Website, App, Social Media | E-commerce sales: $83.3B |

| Loyalty Programs | Walmart+ | Sales increase |

| Personalized Marketing | Targeted Deals | Digital ad revenue: $3.5B (projected) |

Channels

Walmart's main channel is its extensive physical retail network, offering a tangible shopping experience. These stores provide a wide array of products and services. In 2023, Walmart operated approximately 4,615 stores in the U.S. alone. This vast physical presence gives Walmart a significant competitive edge.

Walmart's e-commerce website lets customers shop online for home delivery. This boosts convenience and broadens Walmart's market. Online sales are a growing part of Walmart's business. In fiscal year 2024, Walmart's U.S. e-commerce sales grew by 17%, reaching $83.3 billion.

Walmart's mobile app is a key channel for customer interaction. It offers shopping, account management, and service access. This boosts convenience and personalizes the shopping journey. In Q3 2024, Walmart's app had 140 million active users, driving significant sales. The app enhances engagement and supports e-commerce growth.

Social Media

Walmart heavily utilizes social media to connect with its vast customer base. This strategy supports product promotion, customer service, and brand building. Social channels are key for marketing and communication efforts. In 2024, Walmart's social media ad spending reached $250 million.

- Customer Engagement: Walmart uses social platforms to interact directly with its customers.

- Marketing and Promotion: Social media channels are crucial for advertising products and sales.

- Customer Support: Walmart provides customer service through social media platforms.

- Brand Awareness: Social media helps Walmart build and maintain its brand image.

Third-Party Marketplaces

Walmart leverages third-party marketplaces to broaden its product offerings and boost its customer base. This strategic move enables Walmart to present a vast array of items without incurring the expense of managing extra inventory. In 2024, Walmart's online marketplace saw significant growth, with third-party sellers contributing substantially to overall e-commerce sales. This expansion is crucial for competing in the dynamic retail landscape. The marketplaces notably enhance Walmart's e-commerce operations.

- In 2024, Walmart's e-commerce sales grew, with third-party sellers playing a key role.

- The marketplace model allows Walmart to offer a wider product selection.

- Walmart benefits from increased product variety without extra inventory costs.

- This strategy boosts Walmart's e-commerce competitiveness.

Walmart’s diverse channels, including physical stores and e-commerce, boost accessibility. Social media platforms and mobile apps are key for direct customer engagement. In 2024, Walmart’s e-commerce sales grew, and their app had 140 million active users. Third-party marketplaces boost product variety and e-commerce competitiveness.

| Channel | Description | 2024 Data |

|---|---|---|

| Physical Stores | Main retail locations | 4,615 stores in U.S. |

| E-commerce | Online shopping | $83.3B U.S. sales (17% growth) |

| Mobile App | Shopping, services | 140M active users (Q3) |

Customer Segments

Walmart's business model heavily relies on price-conscious shoppers. This segment, including budget-minded families, is attracted by Walmart's promise of everyday low prices. In 2024, Walmart's focus on value helped it capture a significant market share, with over 230 million weekly customers globally. Offering affordable options is crucial for retaining this large customer base.

Families represent a core customer segment for Walmart, drawn to its comprehensive offerings. They appreciate the convenience of one-stop shopping for various needs. Walmart's focus on affordability strongly resonates with family budgets. In 2024, approximately 60% of Walmart's sales came from groceries and household essentials, critical for families.

Walmart's customer base includes value-oriented consumers. These shoppers seek a good balance between price and product quality. Around 70% of U.S. households shop at Walmart, showing its wide appeal. They are ready to spend more on specific items, but still want affordability. Walmart's strategy focuses on offering a mix of value and quality to cater to this group.

Suburban and Rural Residents

Walmart strategically targets suburban and rural residents, often the primary retail option in these areas. These customers prioritize convenience and rely on Walmart for essential goods. This focus helps Walmart capture significant market share outside major urban centers. In 2024, Walmart operated over 3,500 stores in rural areas.

- Accessibility is key for these customers, driving loyalty.

- Walmart's strategy includes providing a wide product range.

- This segment contributes significantly to overall revenue.

Digital Shoppers

Walmart's digital shoppers are a key customer segment, growing with e-commerce's rise. They prioritize convenience, selection, and personalized shopping. Walmart's e-commerce expansion is vital for attracting and keeping these customers. In 2024, online sales saw significant growth, reflecting this shift.

- E-commerce sales grew by 12% in Q3 2024.

- Walmart's online grocery pickup and delivery services are popular.

- Personalized recommendations and experiences are being enhanced.

Walmart's customer segments encompass price-conscious shoppers, families, value-oriented consumers, and suburban/rural residents. Price-conscious shoppers are drawn by low prices, families appreciate one-stop shopping. Value-oriented consumers seek a balance of price and quality, while suburban/rural residents value convenience. Digital shoppers are another key segment.

| Customer Segment | Description | Key Benefit |

|---|---|---|

| Price-Conscious Shoppers | Budget-minded individuals & families. | Everyday low prices. |

| Families | Those seeking one-stop shopping solutions. | Convenience and wide product range. |

| Value-Oriented Consumers | Seek quality & affordability. | Balance of price and quality. |

| Suburban/Rural Residents | Prioritize convenience and essentials. | Accessibility and essential goods. |

| Digital Shoppers | Prioritize convenience and selection. | Personalized experiences and online access. |

Cost Structure

Cost of Goods Sold (COGS) is a substantial expense for Walmart. It includes the cost of merchandise bought from suppliers, which is a major part of their operations. Walmart's success relies heavily on efficient supply chain management to reduce COGS. In 2023, Walmart's COGS was roughly $470 billion, demonstrating its importance to profitability.

Walmart's operating expenses encompass store upkeep, utilities, and employee salaries. In 2024, Walmart's selling, general, and administrative expenses totaled approximately $160 billion. Effective management is key to lowering these costs. Reducing operating expenses directly boosts profitability, a critical goal for Walmart.

Walmart strategically allocates resources to marketing and advertising, a crucial cost component. In 2024, Walmart's advertising expenses reached billions, reflecting their commitment to brand visibility. They employ diverse strategies, from digital ads to in-store promotions. Effective marketing boosts sales and helps them maintain their leading market position.

Technology and Infrastructure

Walmart heavily invests in technology and infrastructure to boost its operations. This includes its e-commerce platform, supply chain management, and data analytics. These are crucial for staying competitive and improving efficiency. Walmart's capital expenditures were about $10.8 billion in fiscal year 2024.

- E-commerce platform enhancements.

- Supply chain optimization.

- Data analytics for decision-making.

- Investments in automation.

Logistics and Distribution

Walmart's cost structure heavily involves logistics and distribution. This includes transportation expenses, warehousing, and delivering goods efficiently. In 2024, Walmart's supply chain costs were approximately $60 billion, underscoring the importance of these operations. Effective logistics are key to controlling expenses and maintaining product availability.

- Transportation costs are a major part of the expense.

- Warehousing and storage also contribute significantly.

- Efficient delivery systems are vital for timely product arrival.

- Walmart focuses on streamlining these processes.

Walmart's cost structure is extensive, with key components like COGS, which was about $470 billion in 2023. Operating expenses, including store and employee costs, were roughly $160 billion in 2024. Marketing and advertising expenses reached billions in 2024, boosting brand visibility.

| Cost Category | 2023 (USD Billion) | 2024 (USD Billion) |

|---|---|---|

| Cost of Goods Sold (COGS) | 470 | N/A |

| Operating Expenses | N/A | 160 |

| Marketing & Advertising | N/A | Billions |

Revenue Streams

Walmart's main money-maker is retail sales from its stores and online platform. They sell everything from food to clothes. In 2024, retail sales made up a huge part of their total revenue. For example, Walmart's total revenue was over $600 billion in the fiscal year 2024.

E-commerce sales are a vital revenue stream, reflecting the rise of online shopping. Walmart's website, app, and marketplace fuel this. In 2024, e-commerce sales grew, contributing significantly to overall revenue. Walmart's focus is expanding digital capabilities.

Walmart's Walmart+ membership is a revenue stream. It offers benefits like free shipping and discounts. This model boosts customer loyalty and provides recurring revenue. In 2024, Walmart's focus is growing its membership base, driving financial growth.

Advertising Revenue

Walmart's advertising revenue is a significant and expanding part of its business model. The company leverages its extensive customer data and online presence through Walmart Connect, its retail media network. This allows suppliers and other advertisers to reach Walmart's vast customer base. Advertising revenue is a growing stream, fueled by the increasing significance of digital advertising.

- Walmart's advertising revenue increased by 28% in fiscal year 2024.

- Walmart Connect saw over 1,000 advertisers in 2024.

- Digital advertising is a key growth area for Walmart.

Financial Services

Walmart's financial services generate revenue through various offerings. These include credit cards, money transfers, and check cashing services, adding to its revenue streams. This diversification enhances customer convenience and increases overall profitability. Financial services help Walmart capture a broader customer base and boost its financial performance. Offering these services aligns with its strategy to become a one-stop-shop for customers.

- Walmart's financial services include credit cards, money transfers, and check cashing.

- These services provide additional revenue streams.

- They enhance customer convenience.

- This diversification increases overall profitability.

Walmart's revenue streams are diverse, including retail sales and e-commerce, key drivers in 2024. Advertising, especially through Walmart Connect, is a growing segment. Financial services also contribute to revenue and customer convenience.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Retail Sales | Sales from stores and online platforms. | Over $600B total revenue. |

| E-commerce | Sales via website, app, and marketplace. | Growing segment. |

| Advertising | Revenue from Walmart Connect. | 28% increase. |

Business Model Canvas Data Sources

The Walmart Business Model Canvas integrates financial reports, consumer surveys, and supply chain data. These sources offer crucial strategic perspectives.