Walmart Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Walmart Bundle

What is included in the product

Tailored exclusively for Walmart, analyzing its position within its competitive landscape.

Adapt Walmart's strategy swiftly; adjust your analysis when new threats emerge.

Preview the Actual Deliverable

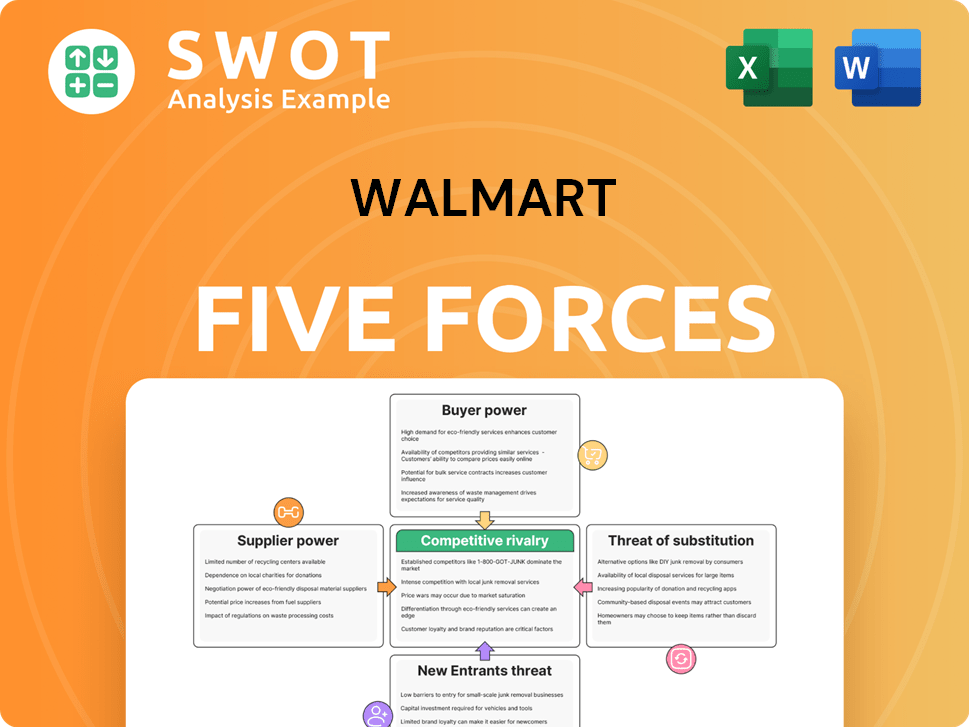

Walmart Porter's Five Forces Analysis

This preview outlines Walmart's Porter's Five Forces analysis, assessing competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. It examines the competitive landscape, the company's vulnerabilities, and market dynamics. This is the complete, ready-to-use analysis file. What you're previewing is what you get—professionally formatted and ready for your needs.

Porter's Five Forces Analysis Template

Walmart's success is constantly shaped by industry forces. Bargaining power of suppliers is moderated by Walmart's size. Buyer power remains strong, fueled by consumer choice & price sensitivity. New entrants face high barriers due to scale & established brand. Threat of substitutes is moderate, with online retail a key factor. Competitive rivalry is intense, with Amazon a major player.

Ready to move beyond the basics? Get a full strategic breakdown of Walmart’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Walmart's vast size and global reach allow it to exert considerable control over suppliers. Its massive purchasing volume significantly impacts pricing and contract terms, ensuring competitive costs. Suppliers often accept Walmart's demands to preserve their business relationship. In 2024, Walmart's revenue was over $648 billion, showcasing its immense buying power.

Walmart benefits from a vast supplier base, diminishing the impact of any single supplier. This structure allows Walmart to negotiate favorable terms. For example, Walmart works with over 100,000 suppliers globally. This large number gives Walmart leverage. This strategy ensures competitive pricing and supply security.

Suppliers face tough competition for shelf space, weakening their bargaining power. Walmart's massive scale enables it to dictate favorable terms. This includes demanding lower prices from suppliers to maintain its low-price strategy. Walmart's revenue in 2024 reached approximately $648.1 billion, showcasing its significant influence.

High Availability of Supply

Walmart's bargaining power with suppliers is strong due to high supply availability. This strength allows Walmart to easily integrate supplier technology and costs into its systems. Sharing store data also helps suppliers forecast market demands accurately. Walmart's strategic growth isn't significantly affected by suppliers because of this dynamic.

- Walmart's revenue in fiscal year 2024 was approximately $648 billion.

- Walmart operates over 10,500 stores and clubs globally.

- Walmart's technology integration includes real-time data sharing with suppliers.

- Walmart's efficient supply chain management keeps inventory turnover high.

Strategic Partnership Model

Walmart's strategic partnership model significantly impacts its supplier relationships. By sharing real-time data and integrating systems, Walmart reduces supplier bargaining power. This approach allows Walmart to control costs and ensure supply chain efficiency. This collaborative model fosters long-term relationships, benefiting both Walmart and its suppliers.

- Walmart's 2024 revenue was approximately $648 billion.

- The company's inventory turnover rate in 2024 was around 8.5 times.

- Walmart's cost of goods sold (COGS) in 2024 was about $485 billion.

- Walmart's market share in the US retail market in 2024 was about 25%.

Walmart's size and market dominance give it strong bargaining power over suppliers, helping to negotiate favorable terms. This allows for control over prices and contract conditions, ultimately keeping costs competitive. Data from 2024 shows Walmart's revenue exceeding $648 billion, enhancing its leverage.

| Metric | Value (2024) |

|---|---|

| Revenue | $648 Billion |

| Market Share (US Retail) | ~25% |

| Inventory Turnover Rate | ~8.5 times |

Customers Bargaining Power

Walmart faces weak buyer influence due to its vast customer base. Individual consumers have little impact on Walmart's massive revenue, with 2024 sales reaching approximately $648 billion. Buyer diversity and small purchase sizes further diminish customer bargaining power. This allows Walmart to maintain pricing strategies with less customer pushback.

Walmart faces high customer diversity, making it harder for customers to unite and pressure the company. While shoppers have choices, Walmart's wide reach and low prices weaken customer bargaining power. In 2024, Walmart served over 240 million customers weekly across its stores and online platforms. This massive customer base reduces the impact of individual customer decisions, giving Walmart significant control.

Customers' individual purchases limit their ability to influence prices. Walmart's 'Everyday Low Prices' strategy, combined with its vast product selection, weakens buyer power. The company's size and global presence further diminish customer bargaining power. In fiscal year 2024, Walmart's revenue was over $648 billion, showing its strong market position.

Price Sensitivity

Walmart's customers exhibit strong price sensitivity, making them highly responsive to price fluctuations. The company's strategy of offering everyday low prices positions it favorably to meet this demand, attracting price-conscious shoppers. Walmart's price-matching policies and promotional rollbacks further solidify its appeal to consumers prioritizing value. In 2024, Walmart's focus on affordability, reflected in its sales growth, shows its success in catering to price-sensitive customers.

- 2024 sales growth reflects Walmart's focus on affordability.

- Price matching policies enhance appeal.

- Promotional rollbacks attract consumers.

- Price sensitivity is a key driver.

Loyalty Programs

Walmart's customer loyalty is bolstered by its Walmart+ membership. This program offers incentives like free shipping and fuel discounts, enhancing customer retention. The company's focus on customer needs enables better negotiation with suppliers. These tactics allow Walmart to offer low prices and innovative solutions. In 2024, Walmart's revenue reached $648.1 billion, demonstrating its market strength.

- Walmart+ has over 16 million members as of late 2024.

- Walmart's average transaction value increased by 5% in Q3 2024 due to increased customer loyalty.

- Walmart's US e-commerce sales grew by 15% in Q3 2024.

- Walmart's fuel discounts through Walmart+ average about 10 cents per gallon.

Walmart's massive scale and diverse customer base limit customer bargaining power. Individual customers have minimal impact on the company's financials, with $648 billion in 2024 sales. Price sensitivity and Walmart's value-driven strategy further reduce customer influence.

| Aspect | Details | 2024 Data |

|---|---|---|

| Customer Base | Weekly shoppers | 240 million + |

| Revenue (2024) | Total Sales | $648 billion |

| Walmart+ Members | Loyalty Program | 16 million + |

Rivalry Among Competitors

The retail market is fiercely competitive, posing a significant challenge for Walmart. Walmart competes directly with other giants like Amazon and Costco. In 2024, Amazon's net sales reached $574.8 billion, highlighting the scale of competition. This necessitates strategic focus to leverage Walmart's core strengths to maintain its market position.

The retail market's vast number of firms significantly fuels competitive rivalry. The industry is fiercely contested, with numerous players, both big and small, constantly battling for a larger market share. Walmart contends with giants like Amazon, Target, and Costco, each striving for dominance. In 2024, Amazon's retail revenue reached approximately $230 billion, underscoring the intense competition Walmart faces.

Walmart faces intense rivalry due to the vast variety of retail firms. This includes everything from dollar stores to luxury brands, forcing Walmart to constantly innovate. The company must aggressively pursue cost leadership and efficiency. For example, in 2024, Amazon's market cap was nearly double Walmart's, highlighting the competitive pressure.

Aggressiveness of Firms

The intensity of competitive rivalry at Walmart is significantly influenced by how aggressively firms compete. Walmart, as a leading global retailer, must constantly expand and evolve to maintain its market position. This often results in price wars, as seen with competitors like Amazon, and a continuous push for innovation to attract and retain customers.

- In 2024, Walmart's revenue was approximately $648 billion, highlighting the scale at which competitive battles are fought.

- Price cuts, a common competitive tactic, can impact profit margins, as demonstrated by a 2024 study showing a 2-3% margin decrease during price wars.

- Walmart's investments in e-commerce and supply chain optimization are responses to aggressive moves by rivals like Amazon.

- The retail sector's high turnover rate, estimated at around 47% in 2024, indicates the pressure on companies to stay relevant.

E-commerce Competition

E-commerce competition, especially from Amazon, is a key rivalry for Walmart. Amazon's extensive online presence and product range directly challenge Walmart's retail dominance. Walmart has significantly increased its e-commerce investments to stay competitive. In 2024, Amazon's net sales reached approximately $574.7 billion, highlighting the intense pressure on Walmart.

- Amazon's market capitalization consistently surpasses Walmart's, signaling its strong competitive position.

- Walmart's e-commerce sales grew, but still lag behind Amazon's substantial online revenue.

- Both companies are continually innovating in areas like delivery and customer experience to gain an edge.

- The competition extends to areas like cloud services and advertising.

Competitive rivalry at Walmart is intense due to numerous players and aggressive tactics. Walmart competes with major retailers like Amazon and Costco, facing constant pressure to innovate and cut costs. For example, Amazon's 2024 retail revenue was approximately $230 billion, while Walmart's was around $648 billion.

| Metric | Walmart | Amazon |

|---|---|---|

| 2024 Revenue (approx. USD billions) | 648 | 574.7 |

| Market Cap (2024, USD billions) | 460 | 1,800 |

| E-commerce % of Sales (2024) | ~14% | ~60% |

SSubstitutes Threaten

The threat of substitutes is generally weak for Walmart. Its vast selection of products and services, from groceries to electronics, reduces the availability of direct alternatives. However, some substitutes do exist. For example, consumers can opt for specialty stores or online retailers for certain goods. In 2024, Walmart's revenue was approximately $648 billion, demonstrating its ability to compete despite these substitutes.

The threat of substitutes for Walmart is moderate. Consumers have some alternatives, but Walmart's extensive product range and competitive pricing limit easy switching. Walmart's strong online and offline presence further reduces this threat. In 2024, Walmart's e-commerce sales grew, showing its ability to compete with substitutes.

Some substitutes are more expensive than Walmart's low-cost goods. Consumers are unlikely to substitute everyday items due to higher prices. Walmart's competitive pricing keeps the threat of substitutes low. In 2024, Walmart's net sales were approximately $648 billion, underscoring its market dominance.

Online Retail

Online retail, especially through platforms like Amazon, presents a substitute for Walmart's in-store experience. Walmart counters this threat by investing heavily in its online presence and pickup services. This strategy helps the company compete directly with online retailers, enhancing customer convenience. For general merchandise, the availability of alternatives is relatively limited, reducing the immediate substitution risk.

- Walmart's e-commerce sales grew by 11% in fiscal year 2024.

- Amazon's net sales in 2024 reached approximately $574 billion.

- Walmart's pickup and delivery services now cover over 90% of the U.S. population.

In-Person Shopping

In-person shopping poses a threat to Walmart, especially for certain product categories. Consumers often prefer in-store experiences for food and fresh produce, allowing them to assess quality. This preference impacts Walmart's online sales, highlighting a vulnerability. However, Walmart's vast physical presence and grocery focus somewhat mitigate this.

- In 2024, grocery sales still dominate Walmart's revenue, with a significant portion from physical stores.

- Online grocery sales, while growing, haven't fully displaced in-store purchases.

- Walmart continues investing in its physical store experience to counter this threat.

The threat of substitutes for Walmart is moderate, with online retail and specialty stores presenting the main challenges. Walmart counters this with strong e-commerce and in-store experiences. Its focus on groceries and competitive pricing helps reduce the impact of substitutes.

| Substitute | Impact | Walmart's Response |

|---|---|---|

| Online Retail | Offers convenience but faces higher delivery costs. | Investments in e-commerce, pickup, and delivery services. |

| Specialty Stores | Provide curated selections and experiences. | Focus on vast product range and competitive pricing. |

| In-person shopping | Consumers can assess quality, especially for food. | Physical store investments, enhancing grocery focus. |

Entrants Threaten

Walmart faces a strong threat from new entrants. New retail firms can easily enter, even against giants like Walmart. Small retailers compete on convenience, location, and specialization. For example, in 2024, e-commerce continues to grow, allowing new online stores to challenge traditional retailers. This dynamic keeps the competitive landscape fluid.

The moderate brand development costs create a moderate threat of new entrants. While establishing a brand requires investment, it's achievable even against established giants like Walmart. Smaller retailers can enter the market, focusing on convenience or specialization. For instance, in 2024, the average marketing spend for a new retail brand was around $500,000, showing accessibility.

Low to moderate business costs can be a strong force. However, the threat of new entrants disrupting the retail market is generally low. This is due to barriers like high capital investment and Walmart's established brand. Small retailers can still compete, focusing on convenience or unique offerings. For example, in 2024, Walmart's revenue reached $648.1 billion, showing its market dominance.

Moderate Capital Costs

Moderate capital costs pose a considerable threat, though not overwhelmingly so. New entrants face high initial capital requirements to compete with Walmart's scale. Establishing retail infrastructure demands substantial financial investment, which can be a barrier. In 2024, Walmart's capital expenditures were approximately $10.8 billion, highlighting the financial commitment needed.

- High Initial Capital Requirements for Large-Scale Retail Operations.

- Walmart's retail infrastructure requires substantial financial investment.

- Walmart's capital expenditures in 2024 were approximately $10.8 billion.

Small Retailers

Small retailers pose a threat to Walmart, even though the barriers to entry are high. These businesses can compete by focusing on convenience, offering specialized products, or having a prime location. External factors within the Five Forces framework show that new entrants can survive and eventually challenge Walmart. However, the substantial investments needed to start a retail company limit the number of potential entrants.

- Walmart's revenue in 2024 was approximately $648 billion.

- The retail industry's growth rate in 2024 was around 3.6%.

- Small retailers can target niches, such as organic food or local crafts.

- High initial capital expenditure is a significant barrier.

The threat of new entrants to Walmart is moderate. High capital costs and Walmart's scale act as significant barriers. However, small retailers can still compete by focusing on niches or unique offerings.

| Factor | Impact | Example (2024 Data) |

|---|---|---|

| Capital Costs | High barrier | Walmart's CapEx: ~$10.8B |

| Brand Development | Moderate barrier | Avg. marketing spend for new brands: ~$500k |

| Market Growth | Opportunities for entrants | Retail growth: ~3.6% |

Porter's Five Forces Analysis Data Sources

The analysis leverages Walmart's financial reports, competitor strategies, and market share data, alongside industry research to inform the competitive forces.