Zijin Mining Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zijin Mining Group Bundle

What is included in the product

Examines the impact of external factors on Zijin Mining using PESTLE framework. Focuses on both challenges & potential growth prospects.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

Preview Before You Purchase

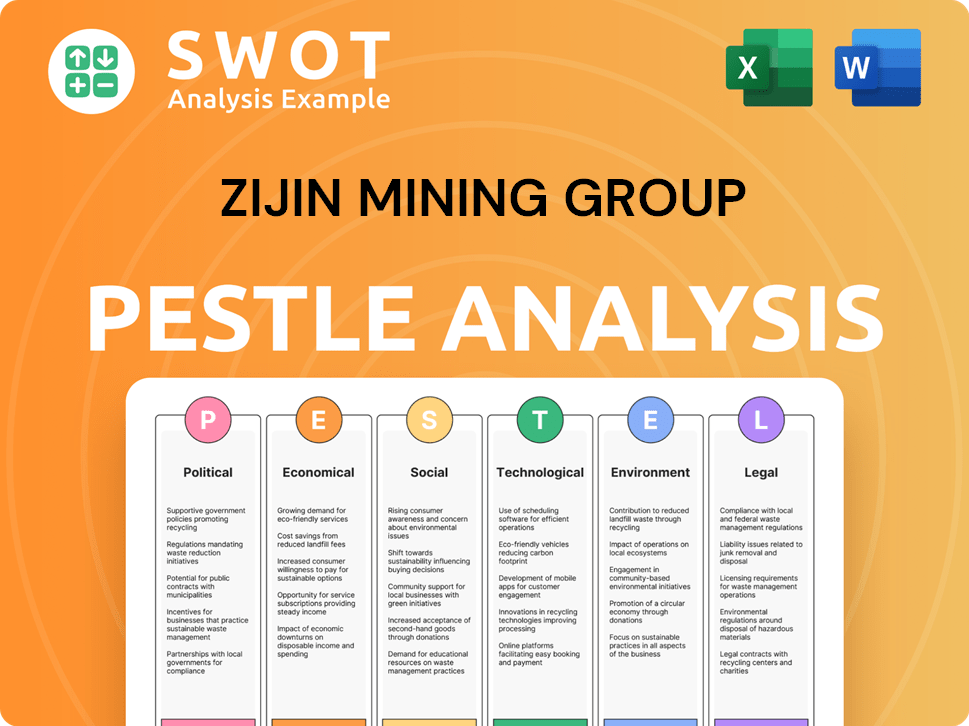

Zijin Mining Group PESTLE Analysis

The PESTLE analysis preview reveals the same content you'll get after buying. This analysis assesses Zijin Mining's Political, Economic, Social, Technological, Legal, and Environmental factors. The layout shown, including analysis, is exactly what you'll download. See, explore, and gain actionable insights immediately. The document is fully formatted, ready for immediate use.

PESTLE Analysis Template

Zijin Mining Group faces complex global challenges. Our PESTLE analysis reveals the political risks impacting its operations worldwide, including regulatory changes. We dissect the economic forces that shape commodity prices and investment opportunities. Discover how social and technological trends affect its sustainability and innovation. Gain an edge by understanding the legal and environmental pressures on the company. Download the full report for actionable strategies.

Political factors

Zijin Mining faces the impact of diverse mining regulations across its global operations. Alterations in resource extraction, environmental protection, and labor laws directly influence its profitability. Permit delays in Serbia have already affected copper output targets. In 2024, Serbia's mining sector saw regulatory adjustments, potentially impacting Zijin's operations. Such factors demand adaptive strategies for sustained success.

Zijin Mining's global presence makes it vulnerable to geopolitical risks. Political instability in regions like the DRC and Peru can disrupt operations. For example, in 2024, political unrest in Peru affected mining output by 10%. Resistance to Chinese acquisitions also hinders expansion. Changes in trade agreements could also impact costs.

Zijin Mining's success hinges on stable governments in its operating regions. Supportive policies, like investment incentives and solid legal structures, are vital. Political instability or government changes can disrupt operations. China's state-backed financing gives Zijin a competitive edge. For instance, in 2024, Zijin's revenue was approximately $38.8 billion, reflecting its global presence.

Trade Policies and Tariffs

Trade policies and tariffs significantly affect Zijin Mining. The US's UFLPA Entity List inclusion of some subsidiaries restricts US market access. This impacts Zijin's ability to export and import, affecting costs and competitiveness. Changes in tariffs can directly influence revenue. The company needs to navigate these policies carefully.

- US tariffs on Chinese goods, including minerals, could increase costs.

- UFLPA restrictions potentially limit sales to the US market.

- Global trade agreements can create both opportunities and challenges.

Resource Nationalism

Zijin Mining Group faces resource nationalism risks, especially in countries rich in minerals. Governments may seek greater control, affecting profitability and operations. Recent examples include increased mining taxes in certain regions. These actions can alter project economics and investment returns.

- Resource nationalism can lead to higher operating costs.

- Changes in ownership rules may limit project control.

- Increased taxes reduce profit margins.

- Stricter regulations can delay project timelines.

Zijin Mining must navigate global mining regulations that directly influence profitability; permit delays and environmental laws pose challenges. Geopolitical risks, particularly in politically unstable regions such as Peru (affected output by 10% in 2024), can significantly disrupt operations. Trade policies, including US tariffs and UFLPA restrictions, impact costs and market access.

| Political Factor | Impact | 2024 Data |

|---|---|---|

| Mining Regulations | Profitability, Operations | Serbia regulatory adjustments, impacting operations. |

| Geopolitical Risks | Disrupted operations | Peru unrest impacted output by 10%. |

| Trade Policies | Costs, Market Access | UFLPA restrictions and tariffs. |

Economic factors

Zijin Mining's financial health strongly correlates with global commodity prices. In 2024, rising gold and copper prices boosted their earnings significantly. Lithium price declines, however, present challenges. These fluctuations directly influence revenue and investment decisions.

Global economic growth significantly influences the demand for minerals vital to sectors like construction and electronics. A robust global economy typically boosts demand and prices for Zijin's products. Conversely, economic downturns can reduce demand and revenue. The rising need for copper and lithium, fueled by electrification and renewable energy, offers Zijin Mining Group substantial opportunities. In 2024, copper prices fluctuated, reflecting global economic uncertainties, but the long-term outlook remains positive due to these trends.

Inflation significantly impacts Zijin Mining Group's operational costs. Rising prices for materials, fuel, and labor directly affect expenses. In 2024, the company focused on cost control, particularly in its international ventures. Zijin's ability to manage these costs is essential for maintaining profitability. The company's financial reports will reveal the specific impact.

Exchange Rates

Zijin Mining's international operations expose it to exchange rate risk. The company's profitability is sensitive to fluctuations between the Chinese Yuan and other currencies. These shifts affect operational costs and the value of profits returned to China.

- In 2024, the Yuan's fluctuations against the USD and AUD influenced Zijin's financial results.

- Currency volatility can lead to both gains and losses, impacting reported earnings.

Access to Capital and Financing

Zijin Mining's access to capital is crucial for its growth. State-backed financing gives it an edge in exploration and acquisitions. However, increasing global interest rates pose risks. In Q1 2024, Zijin's net profit was RMB 6.8 billion, indicating financial health.

- Zijin's financing benefits expansion.

- Rising rates could impact project costs.

- Q1 2024 profit: RMB 6.8 billion.

Zijin Mining’s profits correlate with commodity prices and global economic growth, heavily influenced by construction and electronics demand, impacting copper, gold, and lithium. Rising inflation affects operational costs, pushing the company to manage costs. Exchange rates also affect profitability, especially with fluctuations in Yuan, USD, and AUD, affecting reported earnings. Access to capital is vital for expansion. In Q1 2024, Zijin's profit was RMB 6.8 billion.

| Economic Factor | Impact on Zijin Mining | 2024 Data/Forecast |

|---|---|---|

| Commodity Prices | Directly impacts revenue, profit | Gold prices increased, copper prices fluctuated. Lithium prices decreased. |

| Global Economic Growth | Influences mineral demand | Copper demand rose driven by electrification. |

| Inflation | Affects operational costs (materials, fuel, labor) | Focus on cost control. |

| Exchange Rates | Impacts profitability, Yuan vs USD/AUD | Yuan fluctuations affected financial results. |

| Access to Capital/Interest Rates | Financing for growth, project costs | Q1 2024 Profit: RMB 6.8 Billion |

Sociological factors

Zijin Mining Group's success hinges on strong community ties, essential for its 'social license to operate.' Community conflicts, often arising from land disputes or environmental concerns, can halt operations. Zijin invests in community development and stakeholder engagement to mitigate these risks. For example, in 2024, Zijin allocated $50 million for local community projects. This proactive approach helps maintain positive relationships.

Zijin Mining's extensive operations rely on a large workforce, making labor practices a key sociological factor. In 2024, the mining industry faced increased scrutiny regarding worker safety and fair treatment. Allegations of labor violations can significantly harm Zijin's reputation. Investment in safety training and fair wages is crucial for mitigating risks and maintaining operational stability. The company needs to prioritize worker well-being to avoid disputes and ensure long-term sustainability.

Zijin Mining's public image significantly impacts its operations. Negative perceptions due to environmental issues or labor disputes can damage brand reputation. For example, in 2024, concerns over its Indonesian operations led to increased regulatory oversight. This scrutiny can affect expansion plans and investor confidence. In 2025, maintaining a positive public image is crucial for sustainable growth.

Impact on Local Employment and Economies

Zijin Mining's projects significantly influence local employment and economies. Job creation and support for local businesses are key contributions. These efforts can foster community support for its operations. In 2024, Zijin's projects in Serbia created over 2,000 jobs, boosting local economic activity. These initiatives demonstrate Zijin's commitment to community development.

- Job creation and economic stimulus.

- Community support through local business partnerships.

- Positive impact on host countries' economies.

Cultural and Social Norms

Zijin Mining Group operates globally, necessitating adaptation to diverse cultural and social norms. Respecting local customs is crucial for building strong community and employee relationships. Missteps can lead to project delays or reputational damage. Zijin's commitment to local partnerships is evident in its community investment, with over $150 million spent in 2024.

- Community investment: $150M+ in 2024.

- Focus on local partnerships.

- Risk of reputational damage.

Zijin Mining Group addresses social impacts through community engagement. Labor practices are crucial, focusing on worker safety and fair treatment. Public image, shaped by environmental and labor issues, affects operations. Zijin’s commitment includes community investment of over $150 million in 2024.

| Factor | Impact | Mitigation |

|---|---|---|

| Community Relations | Land disputes, project delays | $50M+ in 2024 for local projects |

| Labor Practices | Reputational damage, strikes | Safety training, fair wages |

| Public Image | Regulatory oversight | Proactive CSR and clear communications |

Technological factors

Advancements in mining tech, like automation and data analytics, boost efficiency, cut costs, and improve safety. Zijin Mining invests heavily in tech innovation and modern management. In 2023, Zijin's R&D spending rose, reflecting its tech focus. This strategic move supports Zijin's goals for sustainable growth.

Technology is key for Zijin Mining's exploration efforts. Advanced methods help discover new mineral deposits. Zijin boosted exploration spending in 2024, targeting promising resources. This supports their growth strategy, using tech for data analysis. It enhances their ability to find and assess new opportunities.

Zijin Mining benefits from advancements in mineral processing, boosting recovery rates and product quality. The company focuses on proprietary extraction technologies to enhance its existing sites. However, challenges in lithium extraction have affected production goals. In 2024, Zijin invested $1.2 billion in technological upgrades. This investment aims to boost efficiency across operations.

Automation and Artificial Intelligence

Automation and artificial intelligence are transforming mining. Zijin Mining Group is adopting these technologies to boost efficiency. For instance, Zijin uses unmanned mining trucks at its copper mines. This could lower labor costs and improve safety. The global AI in mining market is projected to reach $3.6 billion by 2025.

- Zijin's unmanned trucks enhance operational efficiency.

- AI adoption can lead to workforce adjustments.

- The market for AI in mining is rapidly growing.

- Automation can improve safety in hazardous environments.

Renewable Energy Technologies

Zijin Mining Group is increasingly focusing on renewable energy technologies to enhance sustainability. The integration of solar and wind power at sites like the Kolwezi gold project reduces energy costs and emissions. This aligns with global trends toward green energy in mining. In 2024, renewable energy investments in mining increased by 15%.

- Kolwezi gold project uses renewable energy.

- Global mining sector increases renewable energy investments.

- Zijin aims to lower its carbon footprint.

- Renewable energy reduces operational costs.

Zijin Mining leverages tech for efficiency, safety, and cost savings. Their R&D spending saw an increase in 2023, indicating a focus on innovation. Investments, like $1.2B in 2024 upgrades, target operational gains.

| Technology Area | 2023 Focus | 2024 Impact/Goal |

|---|---|---|

| R&D Spending | Increased | Improve Operational Efficiency |

| Unmanned Trucks | Copper Mines | Lower labor costs, increased safety. |

| Renewable Energy | Kolwezi Gold | Reduce energy cost and emissions |

Legal factors

Zijin Mining faces intricate mining laws globally. They must adhere to licensing, permit, and royalty regulations. Delays in permits can hinder production goals. For example, in 2024, permit issues impacted projects in Serbia and Papua New Guinea. These compliance costs are significant, with approximately $500 million spent annually on regulatory compliance.

Compliance with environmental laws is crucial for Zijin Mining. Regulations cover emissions, waste, water use, and land reclamation. Zijin has faced scrutiny regarding waste management permits. In 2024, Zijin invested significantly in environmental management systems. The company allocated $1.2 billion for environmental protection in the latest fiscal year.

Zijin Mining Group must comply with labor laws globally, covering working hours, wages, and safety. Non-compliance can trigger legal issues and hurt its reputation. In 2024, labor disputes cost companies globally billions. For instance, in 2024, the average cost of a labor lawsuit was $250,000.

International Sanctions and Trade Restrictions

International sanctions and trade restrictions pose significant legal risks for Zijin Mining Group. The company faces potential operational constraints and market access limitations due to these measures. For instance, the U.S. government's UFLPA Entity List inclusion of some subsidiaries restricts their access to the American market. Zijin's operations in sanctioned regions require strict compliance to avoid legal repercussions. The company's future performance hinges on navigating these complex international regulations.

- U.S. sanctions can block access to the American market.

- Compliance is crucial for operations in sanctioned regions.

- Trade restrictions impact supply chains and sales.

Contract and Investment Law

Zijin Mining Group's global footprint means it navigates a web of international contracts and investments, each bound by specific legal rules. Success hinges on a solid grasp of contract and investment laws to safeguard its international projects. Joint ventures and acquisitions form a core strategy for Zijin. In 2024, Zijin's total assets reached approximately RMB 279.9 billion.

- Compliance with contract law helps avoid disputes and ensures projects stay on track.

- Investment law compliance is vital for protecting assets and navigating regulatory hurdles.

- Joint ventures and acquisitions require meticulous legal due diligence to mitigate risks.

- Changes in these laws can significantly affect project viability and profitability.

Zijin Mining faces significant legal hurdles globally, from permit delays to environmental compliance issues. Labor disputes and international sanctions also pose substantial risks, impacting operations. In 2024, compliance costs reached approximately $500 million, highlighting the financial impact.

| Legal Aspect | Impact | Financial Implication (2024) |

|---|---|---|

| Permitting and Licensing | Project delays, production disruptions | Millions in potential lost revenue |

| Environmental Regulations | Fines, remediation costs | $1.2 billion spent on environmental protection |

| Labor Laws | Legal disputes, reputational damage | Average cost of labor lawsuit: $250,000 |

Environmental factors

Zijin Mining faces stricter global environmental rules. Adhering to emission, waste, and water regulations is crucial to avoid penalties and maintain its reputation. In 2024, the company allocated $1.5 billion for environmental protection. Zijin aims to cut carbon emissions by 20% by 2025 and enhance water efficiency across its operations.

Climate change is a significant environmental factor impacting Zijin Mining Group. The company faces increasing pressure to lower its carbon footprint due to global climate concerns. Zijin has established goals to peak carbon emissions and achieve carbon neutrality at specific mines, aiming to boost renewable energy use. In 2024, the mining industry saw a 5% rise in renewable energy adoption, influencing Zijin's strategies.

Mining operations often rely heavily on water, and water scarcity is a significant environmental issue worldwide. Zijin Mining Group recognizes this and has been proactive in implementing water management strategies. For example, in 2024, Zijin's water recycling rate reached 85%, demonstrating its commitment to conservation. This helps reduce environmental impact and supports sustainable practices.

Biodiversity and Land Use

Zijin Mining's operations significantly affect biodiversity and land use. Mining activities can lead to habitat loss and disrupt ecosystems; responsible mining includes minimizing environmental impacts and land reclamation. For instance, in 2024, Zijin Mining Group invested heavily in ecological restoration projects. The company's environmental protection expenditure reached approximately RMB 3.5 billion (USD 485 million) in 2024.

- Land reclamation efforts have increased, with over 80% of disturbed land undergoing restoration.

- Zijin has implemented strict biodiversity protection measures across its global operations.

- The company is focusing on innovative approaches to reduce land usage and waste.

Waste Management and Tailings Dams

Waste management and tailings dams are crucial for Zijin Mining's environmental impact. Proper waste disposal is essential to prevent environmental contamination. Zijin has encountered waste management permit issues in Serbia. Effective management ensures the stability of tailings dams, preventing disasters. In 2023, Zijin allocated $1.2 billion for environmental protection.

- Serbia's environmental regulations pose challenges.

- Tailings dam failures can lead to severe environmental damage.

- Zijin's environmental spending is increasing.

Zijin Mining Group focuses on environmental protection, spending heavily in 2024 to comply with regulations. Key goals include a 20% carbon emission cut by 2025. Biodiversity protection, including land restoration, is also a priority. Serbia's regulations pose challenges for waste management.

| Environmental Aspect | 2024 Performance/Targets | Impact |

|---|---|---|

| Environmental Investment | $1.5 billion allocated in 2024 | Compliance, Reputation |

| Carbon Emission Reduction | 20% cut by 2025 | Lower carbon footprint, compliance. |

| Water Recycling Rate | Reached 85% | Reduced environmental impact |

PESTLE Analysis Data Sources

Our PESTLE analysis relies on IMF, World Bank, governmental reports, and market analysis reports for each factor's insights. This provides solid ground for projections.