Zijin Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Zijin Mining Bundle

What is included in the product

Zijin Mining's BCG Matrix analysis: investment recommendations, market positions, and strategic actions.

Export-ready design for quick drag-and-drop into PowerPoint, streamlining presentations on Zijin Mining's portfolio.

What You See Is What You Get

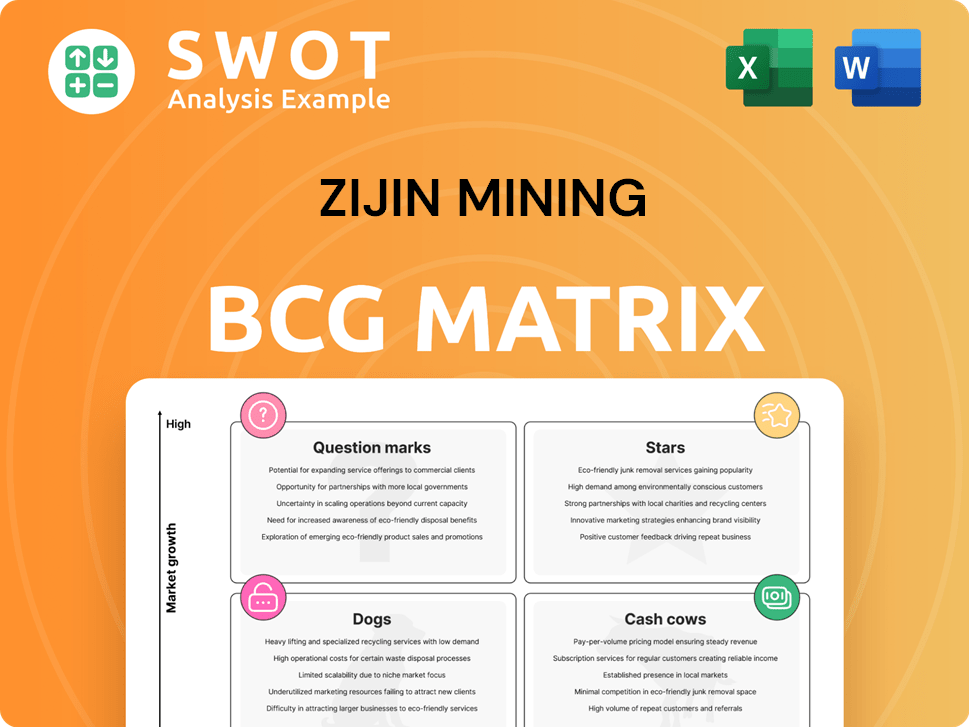

Zijin Mining BCG Matrix

The Zijin Mining BCG Matrix preview is the complete document you'll receive. Download the same, fully analyzed report after purchase, ready for immediate strategic use and in-depth review.

BCG Matrix Template

Zijin Mining operates across diverse markets, creating a complex portfolio. This simplified view suggests potential "Stars" like gold mining, with high growth & market share. Some copper projects might be "Question Marks," needing investment. Others could be "Cash Cows," like mature zinc mines, generating profits. But, are there any "Dogs," draining resources?

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Kamoa-Kakula, a star for Zijin, boasts high growth and market share. Its Phase 3 expansion boosts output to over 600,000 tonnes annually. Zijin's copper output is projected to grow significantly by 2028. The mine's strategic importance is underscored by its massive copper reserves.

The Julong Copper Mine, located in Tibet, China, is a "Star" in Zijin Mining's BCG Matrix. Phase 2 expansion is set for completion by late 2025, increasing copper production. This expansion aims for an annual output of 300,000 to 350,000 tonnes. The mine emphasizes green, sustainable operational practices.

Zijin Mining is heavily investing in its gold segment, aiming for a 35% production increase by 2025. This push will bring annual output to approximately 1.6 million ounces. Expansion at sites like the Buriticá mine fuels this growth. Gold accounted for over 35% of the total gross profit in Q1 2025, showcasing its importance.

New Copper-Gold Discoveries in Serbia

Zijin Mining's Serbian ventures are a "Star" in its BCG Matrix. The Malka Golaja deposit holds 2.81 million tonnes of copper and 92 tonnes of gold, boosting Zijin's resource base. Upgrades at the Cukaru Peki mine aim to produce 450,000 tonnes of copper annually. This positions Zijin as a major player in Europe's copper market.

- Malka Golaja deposit: 2.81 million tonnes of copper, 92 tonnes of gold.

- Cukaru Peki mine: Target of 450,000 tonnes of copper per year.

- Serbia: Key location for Zijin's copper and gold expansion.

Akyem Gold Mine Acquisition

The Akyem Gold Mine acquisition boosts Zijin Mining's gold assets. It aligns with their goal of exceeding 100 tonnes of annual mined gold by 2028. The mine's processing capacity is substantial, at 8.5 million tonnes yearly. This strategic move bolsters Zijin's position in the gold market, supporting growth.

- Acquisition strengthens gold portfolio.

- Designed processing capacity of 8.5 million tonnes per year.

- Supports target of 100+ tonnes of gold by 2028.

- Located on a productive gold belt in Ghana.

Zijin's "Stars" like Kamoa-Kakula and Julong show high growth with significant market share. Gold production boosts are expected to rise to 1.6 million ounces by 2025. Serbian ventures and Akyem Gold Mine bolster Zijin's portfolio.

| Project | Location | Production Goal |

|---|---|---|

| Kamoa-Kakula | DRC | 600,000+ tonnes/yr Cu |

| Julong | China | 300-350,000 tonnes/yr Cu |

| Gold Projects | Global | 1.6M ounces by 2025 |

Cash Cows

The Zijinshan Copper-Gold Mine, a cornerstone asset, consistently generates substantial cash flow for Zijin Mining. Its mature infrastructure and operational excellence contribute to sustained profitability. For 2024, the mine produced approximately 38,000 tonnes of copper and 140,000 ounces of gold. This stable financial performance supports Zijin's investments in future growth.

The Bor Copper Complex in Serbia is a cash cow for Zijin Mining. Zijin invested 1.14 billion Chinese yuan in upgrades in 2024. This mature asset is key for consistent revenue. It's expected to produce 290,000 tonnes of copper and 7 tonnes of gold in 2025.

The Rosebel Gold Mine in Suriname, a cash cow for Zijin Mining, is undergoing upgrades to boost production. Zijin is leveraging its operational expertise to improve efficiency and extend the mine's life. In 2024, the mine contributed significantly to Zijin's gold output, with production figures expected to be released by year-end. This strategic focus aligns with Zijin's goal of maximizing returns from its established assets.

Bisha Copper-Zinc Mine

The Bisha copper-zinc mine in Eritrea is a key cash cow for Zijin Mining, consistently contributing to its copper output. In 2023, Bisha produced 17,000 tonnes of copper, and production is forecast to reach 20,000 tonnes in 2024. This mine's established operations and stable production levels solidify its position as a reliable asset. This steady performance provides a dependable revenue stream for Zijin.

- Location: Eritrea

- 2023 Copper Production: 17,000 tonnes

- 2024 Expected Production: 20,000 tonnes

- Role: Reliable cash flow generator

Longnan Zijin

Longnan Zijin, a key asset for Zijin Mining, operates in China and is a steady gold producer. The mine is undergoing expansion to increase gold production. Its established infrastructure and operational efficiencies significantly boost Zijin's profitability. Longnan Zijin's reliable output makes it a crucial cash cow. In 2024, Zijin Mining's gold production is expected to be around 67 tons.

- Located in China, a stable gold producer.

- Expansion projects are in progress to boost output.

- Benefits from operational efficiencies.

- Contributes to Zijin's profitability.

Cash cows are mature assets, consistently generating substantial cash flow. Bisha copper-zinc mine in Eritrea is a steady contributor to Zijin's copper output. Longnan Zijin in China is a reliable gold producer.

| Asset | Location | 2024 Production (Est.) |

|---|---|---|

| Bisha Mine | Eritrea | 20,000 tonnes copper |

| Longnan Zijin | China | ~67 tons gold |

| Zijinshan Mine | China | 38,000 tonnes copper, 140,000 oz gold |

Dogs

Zijin Mining's zinc and lead operations include assets that might be classified as "Dogs" in a BCG matrix. These assets, potentially smaller or less efficient, could have low market share and growth. Careful management is needed for these, as they might generate minimal profits or even losses. In 2024, Zijin produced approximately 490,000 tonnes of zinc and 160,000 tonnes of lead.

Zijin Mining's lithium projects are struggling. The company cut its 2025 lithium production target by 60%, now aiming for 40,000 tons instead of 100,000 tons. Regulatory hurdles in Argentina and tech problems with extraction are the main issues. This is a significant setback.

Some of Zijin Mining's smaller environmental protection ventures might have lower returns. These ventures, essential for compliance and sustainability, may not boost revenue substantially. Careful cost management is crucial to prevent these projects from becoming a financial strain. For example, in 2024, environmental spending totaled $300 million, with a modest direct impact on profitability.

Non-Core Trading Activities

Non-core trading activities at Zijin Mining, separate from its main mining operations, are often categorized as "Dogs" in the BCG matrix. These activities typically involve low market share and limited growth prospects, potentially hindering overall profitability. Zijin Mining should consider strategic options for these, like restructuring or divestiture, to optimize resource allocation. In 2024, the company's focus remained on core mining, with non-core areas under scrutiny.

- Focus on core mining operations.

- Low growth potential and limited market share.

- Strategic options: Restructure or divest.

- 2024: Scrutiny of non-core activities.

Older or Depleted Mines

Some of Zijin Mining's older mines, facing resource depletion, could be categorized as "Dogs" in a BCG matrix. These mines might struggle with high operational expenses and dwindling production, impacting profitability. In 2024, operational costs at some of these sites could be notably higher compared to newer, more efficient mines. To optimize its portfolio, Zijin should consider strategic actions such as divestiture or decommissioning these assets.

- High operational costs due to aging infrastructure and reduced output.

- Low production volumes compared to the company's overall output.

- Potential for negative cash flow if operational costs exceed revenue.

- Strategic review needed: divest, decommission, or repurpose.

Dogs in Zijin Mining’s portfolio include zinc and lead operations with low market share and growth. Older mines with high costs and reduced output also fit this category, needing strategic review. Non-core trading activities further contribute to the "Dogs," warranting restructuring or divestiture. In 2024, Zijin's focus remained on core mining operations to counter these challenges.

| Category | Characteristics | Strategic Action |

|---|---|---|

| Zinc/Lead Ops | Low market share, low growth | Management & Optimization |

| Older Mines | High costs, reduced output | Divest, Decommission |

| Non-core Trading | Limited Growth | Restructure, Divest |

Question Marks

Zijin Mining's lithium venture is a 'Question Mark' within its portfolio, signaling potential but uncertain market positioning. The company anticipates producing 40,000 tonnes of lithium carbonate equivalent in 2025. Its success hinges on navigating regulatory hurdles and advancing extraction methods. In 2024, the company's lithium production faces challenges, impacting its market share.

The Manono Northeast Lithium Project is a potential "Question Mark" for Zijin Mining. Zijin has been invited to lead its development in the DR Congo. Its success depends on solving logistics and securing power. In 2024, lithium prices fluctuate, impacting project viability.

Zijin Mining's acquisition of Zangge Mining is a Question Mark in its BCG Matrix. Zangge's lithium and potash market entry is strategic. Uncertainties exist regarding future growth and integration. If successful, it could boost Zijin's lithium capacity. In 2024, global lithium demand surged, with prices fluctuating significantly.

Haiyu Gold Mine

The Haiyu Gold Mine, currently under construction in China, fits the "Question Mark" quadrant of Zijin Mining's BCG Matrix. This project is poised to boost Zijin's gold output substantially. Its future hinges on efficient execution of construction and achieving full production. The mine's contribution to Zijin's gold production is highly anticipated.

- Estimated to add significant gold reserves.

- Construction progress is key to its future.

- Ramp-up to full capacity is crucial.

- Represents a high-growth potential asset.

New Molybdenum Projects

Zijin Mining is strategically focusing on new molybdenum projects, aiming for 10,000 tonnes of mined molybdenum by 2025. [1][1][1]

- Molybdenum prices in 2024 ranged from $20 to $30 per pound.

- Zijin Mining's total revenue in 2023 was approximately $35 billion.

- The company's molybdenum production capacity is expanding.

- Market demand for molybdenum is driven by steel production and industrial applications.

Zijin's molybdenum projects are "Question Marks", with growth potential but uncertain market entry. The company aims for 10,000 tonnes of molybdenum by 2025. In 2024, molybdenum prices fluctuated. Success hinges on operational efficiency and market dynamics.

| Metric | Value | Year |

|---|---|---|

| Molybdenum Price Range | $20-$30/lb | 2024 |

| Zijin Revenue (approx.) | $35B | 2023 |

| Target Molybdenum | 10,000 tonnes | 2025 |

BCG Matrix Data Sources

The Zijin Mining BCG Matrix utilizes company reports, market data, industry analysis, and expert opinions to accurately inform the matrix.