Baker Hughes Company Bundle

How has Baker Hughes Shaped the Energy Landscape?

Delve into the fascinating Baker Hughes Company SWOT Analysis to understand the forces shaping this energy giant. From its humble beginnings in Houston, Texas, to its current global footprint, Baker Hughes has consistently redefined the boundaries of the energy industry. Discover how this company has not only survived but thrived through a century of innovation and change.

The Baker Hughes company story is a testament to adaptability and foresight within the energy industry. Tracing the Baker Hughes history reveals a journey from pioneering drilling tools to advanced energy solutions, including its evolution in the oil and gas sector. Understanding the Baker Hughes company overview, including its early years, is crucial for investors and strategists alike, especially when considering the company's enduring impact and its place alongside industry peers like Schlumberger and Halliburton.

What is the Baker Hughes Company Founding Story?

The story of Baker Hughes, a prominent player in the oil and gas and energy industry, is a tale of innovation and strategic mergers. The company's roots are firmly planted in the early days of the oil boom, with its origins stemming from two pioneering entities.

These companies, Baker Oil Tools and Hughes Tool Company, each brought unique technological advancements to the forefront. Their eventual union created one of the largest oilfield services companies globally, shaping the industry as we know it today. The Marketing Strategy of Baker Hughes Company has always been focused on innovation.

Let's delve into the founding stories of these two companies, which ultimately merged to form the Baker Hughes we know today.

Reuben C. Baker, an inventive entrepreneur, laid the groundwork for Baker Hughes. His invention, a casing shoe developed in July 1907, revolutionized cable tool drilling. This innovation ensured the continuous flow of oil through the casing, marking a significant advancement in drilling technology.

- Baker established the Baker Casing Shoe Company in 1913 to protect his patents.

- The company's name evolved to Baker Oil Tools, Inc. in 1928, reflecting its expanding product range.

- Baker's innovations were critical to the early success of the energy industry.

Simultaneously, Howard R. Hughes Sr. and Walter Benona Sharp founded the Sharp-Hughes Tool Company in December 1908 in Houston, Texas. Their focus was on manufacturing a groundbreaking two-cone drill bit, patented by Hughes in August 1909. This innovation significantly improved rotary drilling in harder formations.

- After Sharp's death in 1912, Hughes acquired Sharp's share.

- The company was renamed Hughes Tool Company in 1915.

- Howard Hughes Jr. inherited the company in 1924.

The merger of Hughes Tool and Baker Oil Tools in 1987 officially formed Baker Hughes Incorporated. This union brought together two companies with rich histories of innovation, creating a powerhouse in the oilfield services sector.

- The merger combined decades of expertise in drilling and oilfield equipment.

- The combined entity quickly became a major player in the global energy industry.

- The merger helped position Baker Hughes for future growth and expansion.

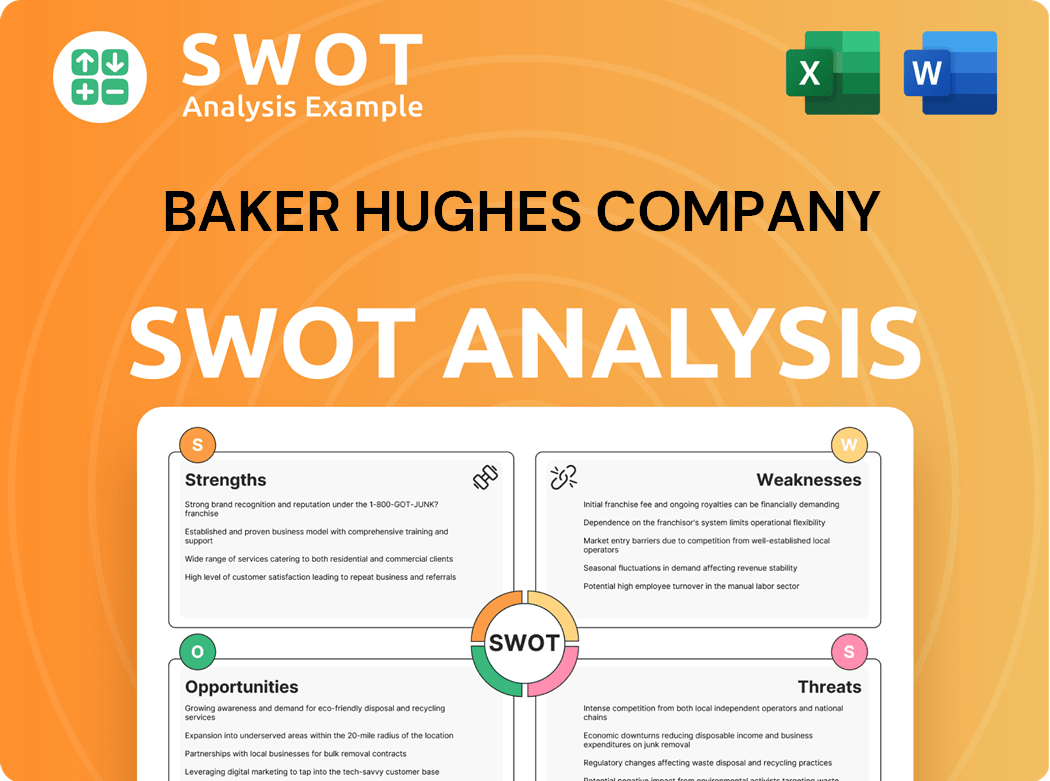

Baker Hughes Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Baker Hughes Company?

The early years of the Baker Hughes company, saw both Baker Oil Tools and Hughes Tool Company concentrate on perfecting their core drilling technologies. This period was crucial for establishing their presence in the oil and gas sector. Significant advancements and strategic moves during this time shaped the future of the Baker Hughes company.

During the 1920s, Baker Oil Tools expanded into both national and international markets, solidifying its position in the energy industry. This expansion was a key step in establishing the company's global footprint. The focus was on providing essential tools and services to the growing oil exploration and production sector.

In 1933, under Howard Hughes Jr., Hughes Tool Company introduced the Tricone drill bit, a major advancement in drilling technology. This innovation significantly improved drilling efficiency. This technological leap helped the company to stay ahead of its competitors.

Hughes Tool Company remained privately owned by the Hughes family through the 1950s and 1960s. Baker Oil Tools diversified into mining-equipment production in the late 1960s and early 1970s. This diversification helped to broaden the company's revenue streams.

In 1975, Baker Oil Tools acquired Reed Tool, another oil drill bit manufacturer. In 1979, the company achieved a significant milestone, earning over a billion dollars for the first time. The acquisition and financial success marked a period of growth.

Both companies faced challenges in the mid-1980s due to declining revenues and expansion-related debt. This led to their merger in 1987, a $728 million stock transaction, forming Baker Hughes Incorporated. The merger was a strategic response to the changing market conditions.

Post-merger, Baker Hughes continued its expansion, including the acquisition of BJ Services Company in 2009. This acquisition broadened its portfolio in pressure pumping and cementing services. The company has also been involved in various partnerships and collaborations to enhance its technological capabilities. For more details, you can explore the Baker Hughes history.

Baker Hughes Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Baker Hughes Company history?

The Baker Hughes company has a rich history marked by significant achievements and strategic shifts within the energy industry. From its early roots to its current status as an energy technology leader, the company has consistently adapted to market dynamics and technological advancements. Its journey reflects the evolution of the oil and gas sector and the broader energy industry.

| Year | Milestone |

|---|---|

| 1907 | Reuben C. Baker's casing shoe revolutionized cable tool drilling. |

| 1909 | Howard R. Hughes Sr.'s patent for the roller cone drill bit transformed well-drilling. |

| 1972 | The introduction of the first commercial logging-while-drilling system enhanced drilling efficiency. |

| Mid-1980s | Merger of Hughes Tool and Baker Oil Tools in response to the oil glut. |

| Q1 2025 | Expanded leadership in LNG with a liquefaction train award for a North American project. |

Baker Hughes has consistently pushed the boundaries of innovation within the oil and gas sector. The company's early innovations, such as the roller cone drill bit and the casing shoe, fundamentally changed drilling practices. More recently, it has focused on technologies that enhance drilling efficiency and accuracy, as well as sustainable energy solutions.

Howard R. Hughes Sr.'s 1909 patent for the roller cone drill bit revolutionized well-drilling by allowing efficient penetration of harder rock formations. This innovation significantly improved drilling speed and efficiency.

Reuben C. Baker's casing shoe in 1907 modernized cable tool drilling. This innovation improved the efficiency and safety of well construction.

The introduction of the first commercial logging-while-drilling system in 1972 enhanced drilling efficiency and accuracy. This system provided real-time data, improving decision-making during drilling operations.

Baker Hughes has expanded its leadership in liquefied natural gas (LNG) technology. This includes advancements in liquefaction processes and equipment, supporting the growing demand for cleaner energy sources.

The company has invested in digital solutions to enhance operational efficiency and reduce emissions. These solutions leverage data analytics and automation to optimize performance across various energy operations.

Baker Hughes is actively involved in carbon capture and storage (CCS) technologies. These technologies aim to reduce carbon emissions by capturing and storing CO2, contributing to a sustainable energy future.

Baker Hughes faces ongoing challenges, including market fluctuations and competitive pressures within the energy industry. The company must navigate geopolitical risks and economic uncertainties while adapting to the energy transition. For instance, the company anticipates a potential $100 million to $200 million hit to adjusted EBITDA in 2025 due to U.S. trade tariffs.

The oil and gas sector is subject to significant market volatility, impacting Baker Hughes' financial performance. Fluctuations in oil prices and demand can create uncertainty and require strategic adjustments.

The energy industry is highly competitive, with Baker Hughes facing competition from major players such as Schlumberger and Halliburton. Maintaining a competitive edge requires continuous innovation and cost management.

Geopolitical events and trade policies can significantly affect Baker Hughes' operations and financial results. Trade tariffs and political instability in key markets pose challenges to the company's global presence.

The shift towards renewable energy sources and sustainable practices presents both challenges and opportunities for Baker Hughes. The company must adapt its portfolio and invest in technologies that support the energy transition.

Economic downturns and global recessions can impact demand for oil and gas services, affecting Baker Hughes' revenues. The company must manage costs and diversify its offerings to mitigate these risks.

U.S. trade tariffs are expected to negatively impact Baker Hughes' adjusted EBITDA in 2025. The company is working to mitigate these effects through strategic adjustments and cost-saving measures.

Despite these challenges, Baker Hughes reported adjusted EBITDA of $1.037 billion in Q1 2025, up 10% year-over-year, demonstrating the impact of its transformation initiatives and structural cost-out programs. The company's commitment to sustainability is evident in its 2024 Corporate Sustainability Report, which highlights a 39.5% reduction in Scope 1 and 2 emissions intensity from its 2019 baseline. To understand the competitive landscape, consider reading about the Competitors Landscape of Baker Hughes Company.

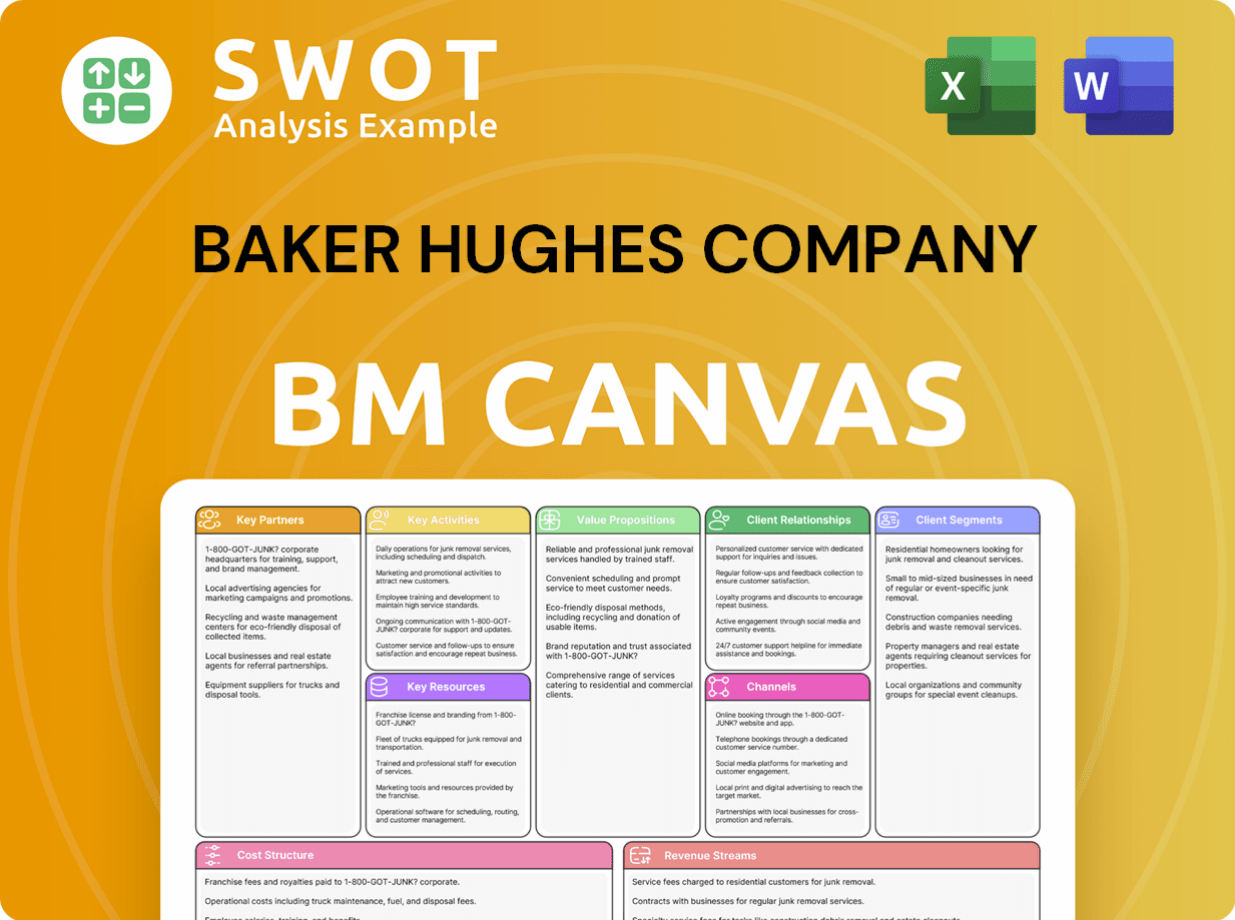

Baker Hughes Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Baker Hughes Company?

The Baker Hughes company has a rich history marked by significant innovations and strategic mergers. From Reuben C. Baker's early casing shoe designs in 1907 to the formation of Hughes Tool Company by Howard R. Hughes Sr. in 1909, the company's roots are firmly planted in the oil and gas industry. Key milestones include the introduction of the Tricone drill bit in 1933 and the first commercial logging-while-drilling system in 1972. The merger of Baker International and Hughes Tool Company in 1987 created Baker Hughes Incorporated, and the acquisition of BJ Services Company in 2009 further expanded its portfolio. In 2024, Baker Hughes achieved record revenue of $27.8 billion and an adjusted EBITDA of $4.591 billion, demonstrating strong financial performance. The company's recent achievements, including crossing the $1 billion mark in new energy orders in 2024 and a revenue of $6.4 billion in Q1 2025, highlight its continued growth.

| Year | Key Event |

|---|---|

| 1907 | Reuben C. Baker developed a modernized casing shoe for cable tool drilling. |

| 1909 | Howard R. Hughes Sr. patented the roller cone drill bit, leading to the formation of Sharp-Hughes Tool Company. |

| 1913 | Baker Casing Shoe Company was incorporated by Reuben C. Baker. |

| 1915 | Sharp's name was dropped, and the company became Hughes Tool Company. |

| 1928 | Baker Casing Shoe Company changed its name to Baker Oil Tools, Inc. |

| 1933 | Hughes Tool Company introduced the Tricone drill bit. |

| 1972 | Baker Hughes introduced the first commercial logging-while-drilling system. |

| 1987 | Baker International merged with Hughes Tool Company to form Baker Hughes Incorporated. |

| 2009 | Baker Hughes acquired BJ Services Company. |

| 2024 | Baker Hughes reached record annual highs for revenue and adjusted EPS, EBITDA, and EBITDA margins, with revenue reaching $27.8 billion and adjusted EBITDA at $4.591 billion. |

| Q1 2025 | Baker Hughes reported $6.4 billion in revenue and $1.037 billion in adjusted EBITDA. |

| May 2025 | Baker Hughes to supply NovaLT™ gas turbines for Frontier Infrastructure's U.S. data center project, delivering 270 MW of reliable power. |

Baker Hughes is strategically positioned for growth in the 'Age of Gas,' anticipating strong EBITDA growth in 2025. The company aims for a 20% EBITDA margin for its Oilfield Services & Equipment (OFSE) segment in 2025 and for Industrial & Energy Technology (IET) by 2026.

The company is expanding its portfolio in LNG, carbon capture, hydrogen production, and digital solutions. Baker Hughes is also exploring portfolio optimization through divesting non-core, cyclical product lines and reinvesting in more stable, industrial-like businesses.

Analyst predictions suggest a potential increase in Baker Hughes stock prices, possibly reaching $79.17 by 2030. CEO Lorenzo Simonelli emphasizes the company's commitment to energy transition and its resilience in a challenging environment.

The company is focused on sustainable growth and shareholder value. Recent developments include significant LNG and data center power solutions awards, showcasing its adaptability and innovation within the energy industry.

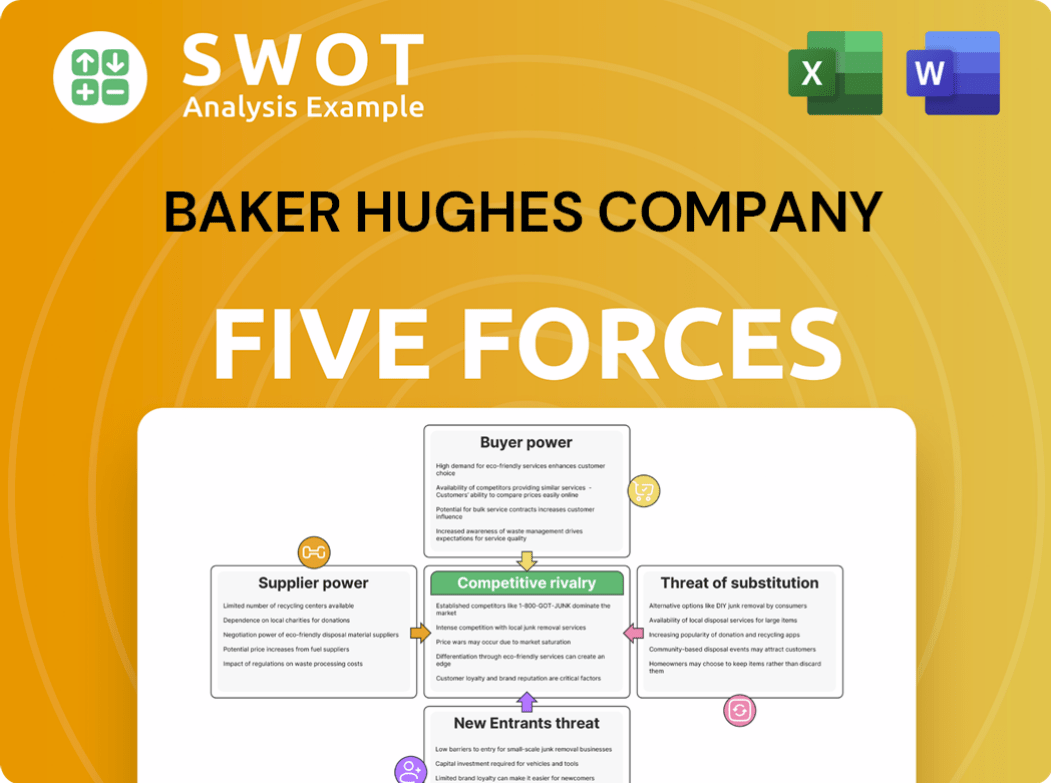

Baker Hughes Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Baker Hughes Company Company?

- What is Growth Strategy and Future Prospects of Baker Hughes Company Company?

- How Does Baker Hughes Company Company Work?

- What is Sales and Marketing Strategy of Baker Hughes Company Company?

- What is Brief History of Baker Hughes Company Company?

- Who Owns Baker Hughes Company Company?

- What is Customer Demographics and Target Market of Baker Hughes Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.