CAF Bundle

How Did a Spanish Rail Manufacturer Become a Global Mobility Powerhouse?

Journey back in time to uncover the CAF SWOT Analysis, a company that began its journey in 1917 as a freight car specialist in Spain. From its humble beginnings, Construcciones y Auxiliar de Ferrocarriles (CAF) has evolved into a global leader in railway solutions. Explore the fascinating CAF history and see how this CAF Company has shaped the world's rail infrastructure.

This article delves into the brief history of CAF Company, exploring its pivotal moments and strategic decisions. Discover the evolution of CAF trains and CAF rolling stock, its significant milestones, and innovations. Understand how CAF's adaptability and foresight have led to its current market standing and future outlook, making it a key player in sustainable urban mobility.

What is the CAF Founding Story?

The story of the Compañía Auxiliar de Ferrocarriles (CAF) began in 1917. The company started in Beasain, in the Basque Autonomous Community, Spain. Initially, CAF focused on producing freight cars.

The company's founding was tied to the economic and industrial climate of the early 20th century. Railway infrastructure was essential for both economic growth and industrial development. The establishment of the Marketing Strategy of CAF marked the beginning of a long-term commitment to the railway sector.

The initial business model centered on manufacturing freight cars. This addressed the need for efficient goods transport by rail. The Irun factory, established in 1940, was a major development. It aided in expanding activities, especially in the reconstruction of the Spanish rail fleet after the Spanish Civil War. This highlights CAF's role in national infrastructure recovery and its ability to adapt to industry changes.

CAF's early years were marked by a focus on freight car production, crucial for the railway industry's growth.

- Founded in 1917 in Beasain, Spain.

- Initially specialized in freight car manufacturing.

- The Irun factory, established in 1940, expanded operations.

- Played a key role in rebuilding the Spanish rail fleet after the Civil War.

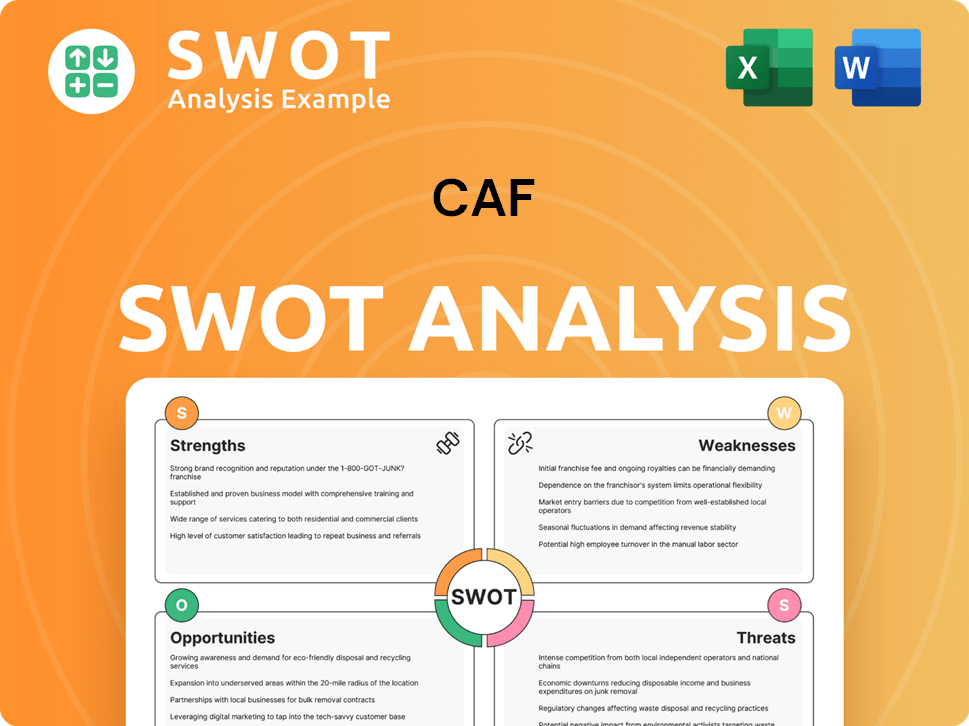

CAF SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CAF?

The early growth of the CAF Company, formally known as Construcciones y Auxiliar de Ferrocarriles, was marked by strategic moves that broadened its capabilities beyond freight car production. This period saw significant expansions and acquisitions that set the stage for its future in the railway industry. These early initiatives were crucial in establishing CAF's presence and influence in the market. The company's early history is a testament to its adaptability and vision in a changing industrial landscape.

In 1940, CAF established a factory in Irun. This expansion was vital for assisting in the reconstruction of the Spanish rail fleet following the Spanish Civil War. The Irun factory played a key role in supporting the modernization of the Spanish railway infrastructure. This strategic move highlighted CAF's commitment to the domestic market.

A pivotal acquisition occurred in 1954, when CAF acquired Material Móvil y Construcciones (MMC) from Zaragoza. MMC brought extensive experience in manufacturing long-distance and subway trains. This acquisition significantly diversified CAF's product offerings and expertise in rolling stock, enhancing its market position.

From 1958 onwards, CAF enlarged its Beasain plant and broadened its activities to include all types of rolling stock. This expansion reflected the company's ambition to become a comprehensive provider in the railway sector. The move allowed CAF to meet a wider range of customer needs and increase its production capacity.

In 1971, CAF officially merged with Material Móvil y Construcciones (MMC), adopting the name Construcciones y Auxiliar de Ferrocarriles. This merger solidified its position and laid the groundwork for future growth. The name change reflected the company's expanded scope and its commitment to the railway industry.

The early 1990s marked CAF's significant entry into the international market. This global expansion gained momentum in the early 2000s. In 2005, CAF supplied high-speed trains to Turkey. These international ventures, alongside consistent domestic projects, shaped CAF's trajectory from a national player to a globally recognized entity in the railway industry. For more details on CAF's history, see this article on the brief history of CAF Company.

- 1940: Establishment of the Irun factory.

- 1954: Acquisition of Material Móvil y Construcciones (MMC).

- 1958: Expansion of the Beasain plant.

- 1971: Merger with MMC and adoption of the name Construcciones y Auxiliar de Ferrocarriles.

- Early 1990s: Entry into the international market.

- 2005: First export of high-speed trains to Turkey.

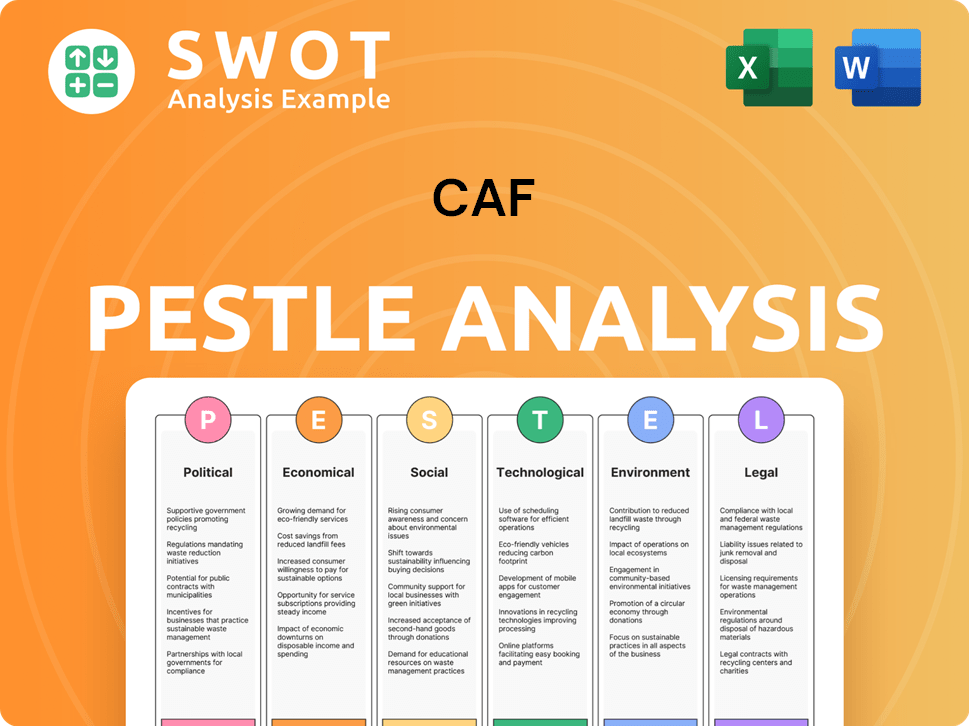

CAF PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CAF history?

The CAF Company, a prominent Spanish rail manufacturer, has a rich CAF history marked by significant achievements. Construcciones y Auxiliar de Ferrocarriles (CAF) has expanded its global footprint and product offerings. The company's evolution reflects its adaptability and strategic vision within the competitive railway industry.

| Year | Milestone |

|---|---|

| 2018 | CAF acquired the Polish bus manufacturer Solaris, expanding its reach into the bus segment. |

| 2022 | CAF strengthened its position by acquiring the Talent 3 platform from Bombardier Transportation and the Coradia Polyvalent platform and Reichshoffen plant from Alstom. |

| Ongoing | CAF continues to secure prestigious projects, including supplying trains for various national railway operators and creating trams for major cities. |

CAF has consistently demonstrated its commitment to innovation. A notable innovation is the development of variable gauge axles, enhancing the versatility of its CAF rolling stock. This allows the company to adapt to different rail networks and customer needs.

These axles can be fitted on any existing truck or bogie, increasing the adaptability of their rolling stock.

This system is part of the company's railway automation projects.

Trials in the Netherlands and Norway show a commitment to forward-looking strategies.

Acquisitions like Solaris, Talent 3, and Coradia Polyvalent expanded the company's market presence.

CAF adapts its offerings to meet evolving global mobility needs.

CAF is increasingly focused on sustainable solutions.

Despite its successes, CAF Company faces ongoing challenges. The company must continuously adapt to a competitive global market. The need for constant innovation and strategic repositioning is essential for sustained growth.

CAF operates in a highly competitive global market, requiring constant adaptation.

Keeping pace with rapid technological changes in the railway industry is crucial.

The company must navigate economic downturns and market volatility effectively.

Efficiently managing the supply chain is critical to maintain production and profitability.

Adhering to evolving industry standards and regulations globally is essential.

Maintaining high levels of customer satisfaction is crucial for repeat business and market reputation.

For more detailed insights, consider exploring the Target Market of CAF.

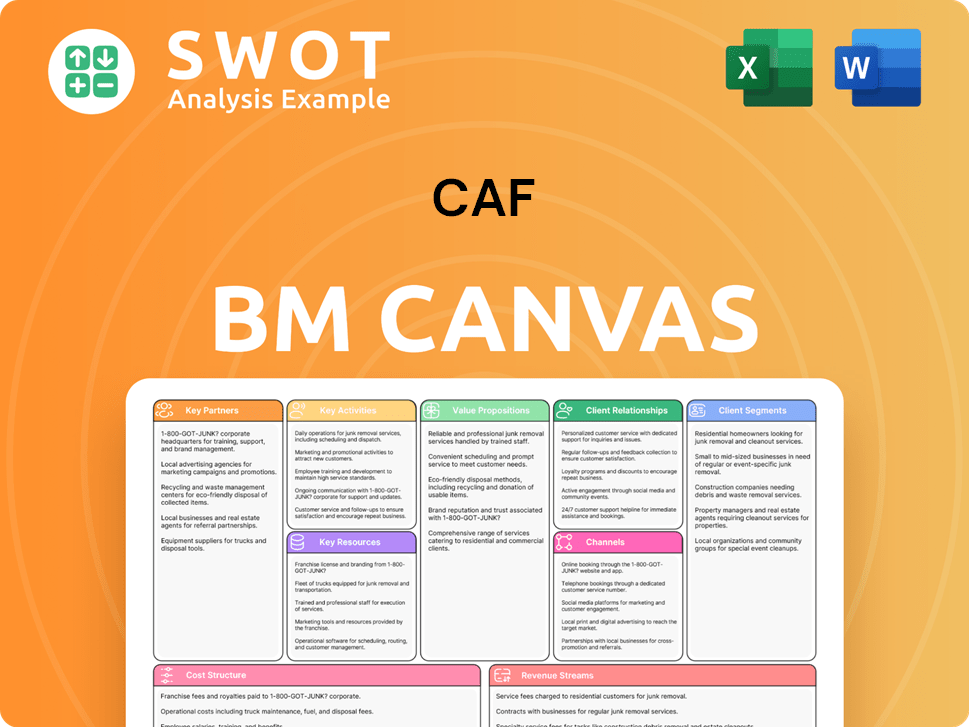

CAF Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CAF?

The journey of the CAF Company, a prominent Spanish rail manufacturer, has been marked by strategic expansions and technological advancements. From its inception in 1917 as Compañía Auxiliar de Ferrocarriles, specializing in freight car production, to its current status as a global provider of comprehensive mobility solutions, CAF history reflects a commitment to innovation and growth. Key milestones include the establishment of the Irun factory in 1940, the acquisition of Material Móvil y Construcciones (MMC) in 1954, and the merger in 1971 that resulted in the name Construcciones y Auxiliar de Ferrocarriles. International expansion began in the early 1990s, followed by the supply of high-speed trains to RENFE and exports to Turkey in 2005. Recent acquisitions, such as Solaris in 2018, Euromaint in 2019, and key platforms from Bombardier and Alstom in 2022, have broadened its portfolio. In 2024, the company achieved €4.21 billion in revenue, and in Q1 2025, revenue reached €1,118 million, with a significant increase in order intake, demonstrating its robust performance and market position. To understand the CAF Company's competitive position, you can explore the Competitors Landscape of CAF.

| Year | Key Event |

|---|---|

| 1917 | Founding of Compañía Auxiliar de Ferrocarriles (CAF) in Beasain, Spain, focusing on freight car production. |

| 1940 | Establishment of the Irun factory, expanding operations to reconstruct the Spanish rail fleet. |

| 1954 | Acquisition of Material Móvil y Construcciones (MMC), broadening product range to include long-distance and subway trains. |

| 1958 | Modernization and enlargement of the Beasain plant; expansion to all types of rolling stock. |

| 1971 | Merger of Compañía Auxiliar de Ferrocarriles and Material Móvil y Construcciones, adopting the current name Construcciones y Auxiliar de Ferrocarriles. |

| Early 1990s | CAF begins international expansion. |

| Early 2000s | Supplies high-speed trains to Spanish RENFE. |

| 2005 | First export of high-speed trains to Turkey. |

| 2018 | Acquisition of Polish bus manufacturer Solaris. |

| 2019 | Acquisition of Swedish company Euromaint. |

| 2022 | Acquisition of Talent 3 platform from Bombardier Transportation and Coradia Polyvalent platform and Reichshoffen plant from Alstom. |

| 2024 | Achieved €4.21 billion in revenue, a 10% increase from 2023, with net profit rising by 16% to €103 million. |

| Q1 2025 | Reported consolidated revenue of €1,118 million, an 11% increase year-over-year, and net profit jumped 53% to €36 million. Order intake reached €2,026 million, a 356% increase compared to Q1 2024, pushing the order backlog to a record €15.6 billion. |

CAF anticipates near double-digit revenue growth in 2025 compared to 2024. This growth is supported by a record order backlog and strategic initiatives. The company aims to maintain a strong book-to-bill ratio, ensuring sustainable expansion.

The company focuses on sustainable urban mobility, with a strong emphasis on underground trains, trams, and low-emission buses. Technological synergies between its rail and bus divisions will be leveraged. Continuous innovation and participation in international trade fairs are key.

The railway segment accounts for 78% of total revenue, highlighting its significance. The record order backlog of €15.6 billion provides substantial revenue visibility. Stability in the net financial debt to EBITDA ratio is expected.

CAF is developing green systems to maximize railway line signaling capacity. The company is also focused on energy-efficient installations in manufacturing processes. These efforts align with a commitment to sustainable and innovative solutions.

CAF Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CAF Company?

- What is Growth Strategy and Future Prospects of CAF Company?

- How Does CAF Company Work?

- What is Sales and Marketing Strategy of CAF Company?

- What is Brief History of CAF Company?

- Who Owns CAF Company?

- What is Customer Demographics and Target Market of CAF Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.