Evolent Health Bundle

What's the Story Behind Evolent Health?

Founded in 2011, Evolent Health has rapidly become a significant player in the healthcare industry. This Evolent Health SWOT Analysis will explore the company's journey, from its initial vision to transform healthcare through value-based care. Its innovative approach has reshaped how healthcare services are delivered and managed.

Evolent Health's mission to improve clinical and financial performance has positioned it as a key player in the health services sector. The company's focus on value-based care solutions and population health management demonstrates its commitment to improving patient outcomes. With a strong financial performance and strategic focus, understanding the brief history of Evolent Health is crucial for anyone interested in the evolving healthcare landscape.

What is the Evolent Health Founding Story?

The Evolent Health company was established in 2011. It was co-founded by Seth Blackley, who currently serves as the Chief Executive Officer. The company's founding aimed to address inefficiencies and fragmentation within the healthcare system.

Evolent Health's mission was to bridge the gap between insurance companies and healthcare providers. This was done by enabling a shift towards value-based care models. These models tie compensation to patient outcomes and cost-effectiveness. This approach was a direct response to the issues of uncoordinated care, high costs, and suboptimal patient outcomes prevalent in the traditional fee-for-service model.

Evolent Health's initial business model focused on long-term strategic partnerships with providers. These partnerships helped them evolve their care delivery and compensation methods. The company's first major offering was its proprietary technology system, Identifi. This system streamlined data management and care workflows. This was a foundational element for their value-based operations.

Evolent Health's founding was influenced by the demand for value-based care and population health management.

- Founded in 2011 in Arlington, Virginia.

- Co-founded by Seth Blackley.

- Focused on value-based care models.

- Developed Identifi technology for data management.

Evolent Health SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Evolent Health?

The early growth and expansion of the Evolent Health company have been marked by consistent growth and strategic moves. This growth strategy involves both organic expansion and strategic acquisitions. The company has focused on enhancing its service offerings and broadening its market reach. For the full year 2024, Evolent Health reported significant revenue growth, demonstrating its commitment to expansion within the health services sector.

Evolent Health's revenue for 2024 reached $2.55 billion. This represents a substantial increase of 30.1% compared to 2023. This growth is attributed to new revenue agreements and the expansion of existing client relationships, reflecting the company’s successful market strategies.

Key developments include the continuous evolution of its Identifi platform and the introduction of specialized solutions. Evolent's focus on specialty care, particularly in oncology, cardiology, and musculoskeletal markets, has been a significant driver of its expansion. The company has successfully entered new markets by expanding its geographic reach.

In Q1 2025, Evolent extended its medical oncology Technology & Services solution to cover an additional 800,000 Medicare Advantage lives for a national payer client. Additionally, an existing partner in a southern state expanded their use of Evolent's Technology and Services solution for advanced imaging and cardiac imaging for approximately 100,000 Medicaid lives. The company also expanded its musculoskeletal services to the Medicare Advantage line of business for an existing partner in the northeast, adding over 100,000 lives.

Strategic acquisitions have been vital to Evolent Health's growth. Notable acquisitions include New Century Health, Vital Decisions, IPG, NIA, and certain assets of Machinify, Inc. The acquisition of NIA in January 2023 significantly contributed to Evolent's specialty care revenue growth, with specialty care offerings accounting for 91% of total revenue in Q1 2024, up from 60% three years prior.

In June 2024, Evolent acquired certain assets and an exclusive license for Machinify Auth, an AI-powered software platform, to enhance clinical workflow automation and improve efficiency. This acquisition is expected to streamline data collection and reduce clinician workforce time by 55%.

Evolent has also focused on team expansion and securing major capital raises to fuel its growth. The company reported 100% partner contract retention across its top customers, which represent over 90% of its 2024 revenue. Despite a competitive landscape, Evolent's integrated platform and strategic initiatives have allowed it to maintain a strong position and continue its growth trajectory.

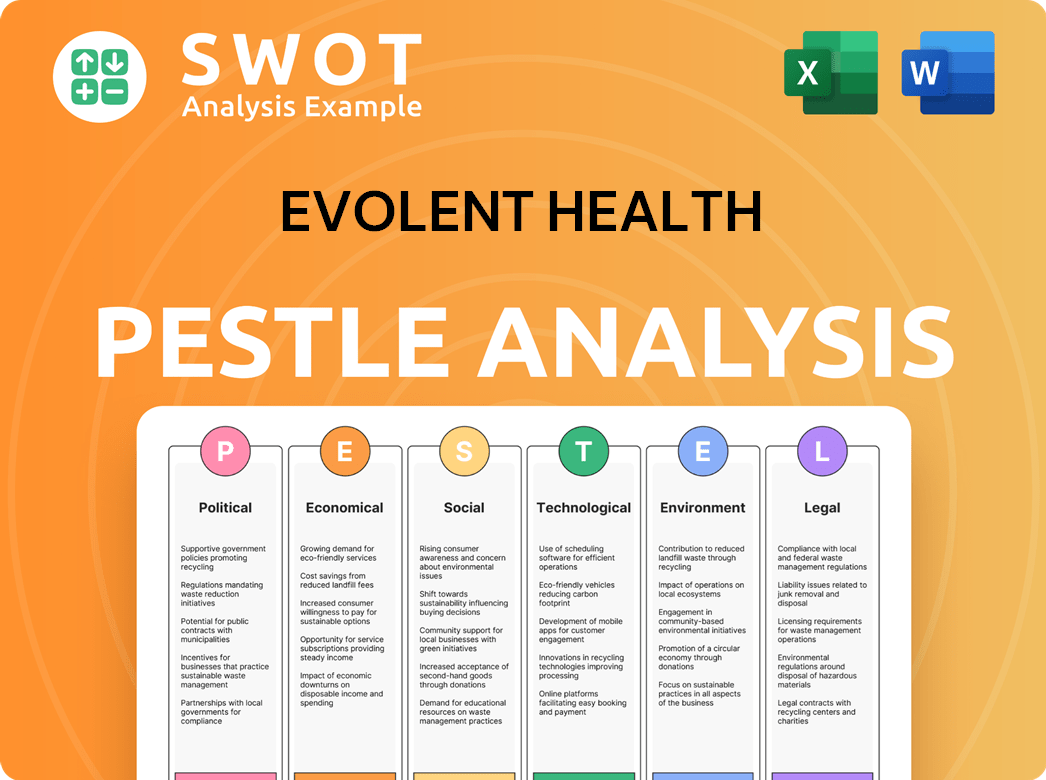

Evolent Health PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Evolent Health history?

The Evolent Health company has achieved several significant milestones, demonstrating its growth and impact in the healthcare industry. These achievements highlight its evolution and commitment to improving healthcare delivery through value-based care models. For more insights, you can explore the Competitors Landscape of Evolent Health.

| Year | Milestone |

|---|---|

| 2024 | Partnered with Careology to provide coordinated cancer care in the U.S., with a national rollout planned for 2025. |

| 2024 | Acquired Machinify Auth's AI-powered platform to enhance clinical reviews. |

| 2025 | Anticipates a $115 million annual improvement in net income and adjusted EBITDA from renegotiated Performance Suite contracts. |

Evolent Health has consistently focused on innovation to enhance its service offerings and improve patient care. A key innovation is its proprietary technology platform, Identifi, which supports value-based care initiatives. Furthermore, the acquisition of Machinify Auth's AI-powered platform in June 2024 represents a significant advancement in leveraging technology for healthcare solutions.

The Identifi platform is a core innovation, enabling Evolent Health to manage complex health conditions effectively. It supports value-based care models, enhancing care coordination and patient outcomes.

The acquisition of Machinify Auth's AI-powered platform in June 2024 leverages machine learning to improve clinical reviews. This is expected to create cost efficiencies by the end of 2025 and reduce clinician workload by 55%.

The partnership with Careology provides coordinated cancer care, integrating digital solutions for patients. This collaboration aims to enhance patient journeys and improve care management.

Despite its successes, Evolent Health faces several challenges in the healthcare market. The increasing costs of oncology care, projected to rise by 12% year-over-year in 2025, pose a significant financial burden. Additionally, the company must navigate the impact of Medicare Advantage plan changes and reliance on key partnerships.

Oncology costs are a major challenge, projected to increase significantly. This trend puts pressure on profitability, particularly in the Performance Suite business.

Changes in Medicare Advantage plans are anticipated to affect Adjusted EBITDA in 2025. Potential membership declines pose a risk to revenue.

Evolent Health depends on a limited number of large partners for a significant portion of its revenue. This concentration creates vulnerability to changes in partner relationships.

Revenues can be unpredictable due to factors outside Evolent Health's control, such as governmental funding changes. This necessitates strategic financial planning.

Internal crises or market downturns have required strategic adjustments. The company focuses on disciplined capital allocation and efficiency initiatives.

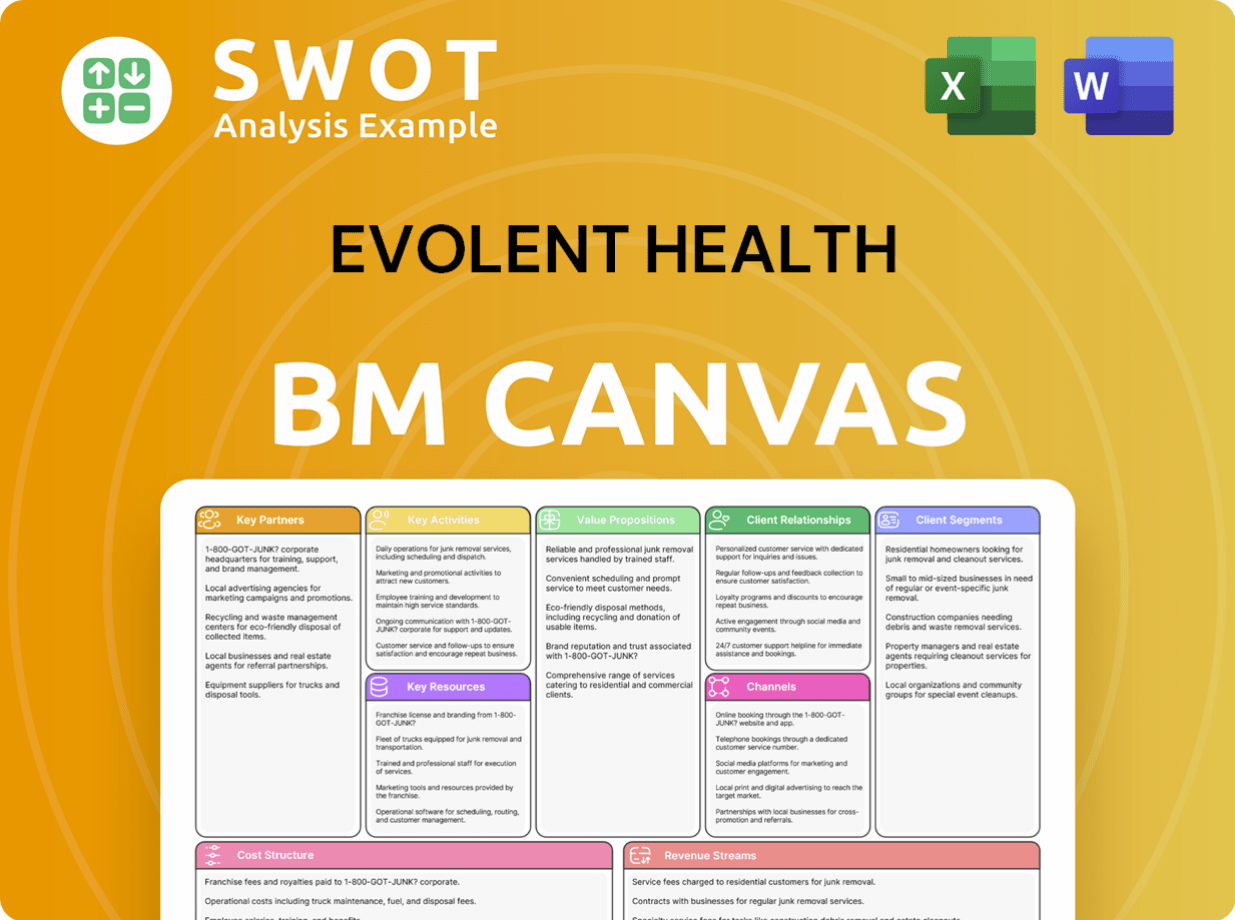

Evolent Health Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Evolent Health?

The Evolent Health company has a history marked by strategic initiatives and growth. The company was founded in 2011, and since then, it has expanded its services and capabilities. Key events include the acquisition of NIA in January 2023, boosting specialty care revenue, and the acquisition of Machinify Auth, an AI-powered software platform, expected to close in Q3 2024. These moves have positioned Evolent Health as a key player in the healthcare company landscape, especially in value-based care.

| Year | Key Event |

|---|---|

| 2011 | Evolent Health is founded. |

| January 2023 | Acquisition of NIA, significantly boosting specialty care revenue. |

| March 31, 2024 | Total cash and cash equivalents reported at $165.1 million. |

| May 9, 2024 | Evolent announces partnership with Careology to enhance cancer care in the U.S., with integrated platform launch by end of 2024 and national rollout in 2025. |

| June 4, 2024 | Evolent announces agreement to acquire certain assets and exclusive license for Machinify Auth, an AI-powered software platform, expected to close in Q3 2024. |

| December 31, 2024 | Evolent reports full-year revenue of $2.55 billion, a 30.1% growth over 2023, and adjusted EBITDA of $160.5 million. Total cash and cash equivalents was $104.2 million. |

| February 20, 2025 | Evolent announces Q4 and full year 2024 results, providing 2025 guidance. |

| March 4, 2025 | Brendan Springstubb, a director, acquires 5,000 shares of Class A Common Stock. |

| April 15, 2025 | Evolent program achieves 20% reduction in use of low-value oncology regimens. |

| May 8, 2025 | Evolent announces Q1 2025 results, with revenue of $483.6 million and adjusted EBITDA of $36.9 million, and reiterates full-year 2025 outlook. |

| May 25, 2025 | Analysts forecast positive earnings of $0.38 per share for Evolent Health in 2025. |

| June 3, 2025 | Evolent Health participates in the 45th Annual William Blair Growth Stock Conference, highlighting strategic initiatives and future growth potential. |

Evolent Health anticipates revenue between $2.06 billion and $2.11 billion in 2025, representing a projected 15%-18% annual growth. This growth is driven by strategic partnerships and expansion of services.

The company expects adjusted EBITDA to range from $135 million to $165 million in 2025. This reflects continued investment in AI and automation for margin expansion.

Evolent Health plans to expand services with existing partners and pursue selective strategic acquisitions. The company aims to achieve a 20% improvement in clinical outcomes.

Industry trends, such as AI-driven tools, and telehealth, are expected to positively impact Evolent. Challenges include heightened oncology cost trends, projected to grow 12% in 2025, and potential impacts from Medicaid redeterminations.

Evolent Health Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Evolent Health Company?

- What is Growth Strategy and Future Prospects of Evolent Health Company?

- How Does Evolent Health Company Work?

- What is Sales and Marketing Strategy of Evolent Health Company?

- What is Brief History of Evolent Health Company?

- Who Owns Evolent Health Company?

- What is Customer Demographics and Target Market of Evolent Health Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.