HF Foods Bundle

How did HF Foods Company rise to become a foodservice leader?

HF Foods Company, a key player in the HF Foods SWOT Analysis, has an interesting history. It all began in 1997 with a vision to serve the underserved Asian/Chinese restaurant market. This brief history of HF Foods Company details its journey from a small operation to a major Asian food distributor across the United States.

Founded by Zhou Min Ni and his spouse, HF Foods's story is one of strategic growth and adaptation within the foodservice industry. From its humble beginnings in North Carolina, HF Foods expanded its reach, establishing a robust distribution network. Understanding the HF Foods history provides valuable insights into its current market position and future prospects.

What is the HF Foods Founding Story?

The story of HF Foods Company begins in 1997, when Zhou Min Ni and his wife, Chan Sin Wong, co-founded the company in Kernersville, North Carolina. Initially known as HF Group, the company was built on the vision of serving the specific needs of Asian/Chinese restaurants across the United States. Zhou Min Ni led the company as CEO from its inception, shaping its growth and direction.

The founders saw a gap in the market, with many Asian restaurants struggling to find reliable suppliers for their unique culinary needs. This led to the creation of a wholesale food distribution business, focused on providing a wide array of products tailored to Asian cuisine. This focus allowed HF Group to establish a strong presence in a niche market, setting the stage for future expansion.

The company's initial business model centered on centralized procurement and distribution. This approach allowed for the efficient management of a diverse product range, from fresh produce to packaging, offering over 1,000 different items. This strategy helped to optimize inventory turnover and reduce operational expenses, which were critical for early success. For more details on the company's operations, check out Revenue Streams & Business Model of HF Foods.

HF Foods was established in 1997 in Kernersville, North Carolina, by Zhou Min Ni and Chan Sin Wong.

- The company started as HF Group, focusing on wholesale food distribution.

- The primary target market was Asian/Chinese restaurants, offering specialized products.

- The business model emphasized centralized procurement and distribution of a wide range of products.

- The founders identified a significant opportunity in serving the underserved market of Asian/Chinese restaurants.

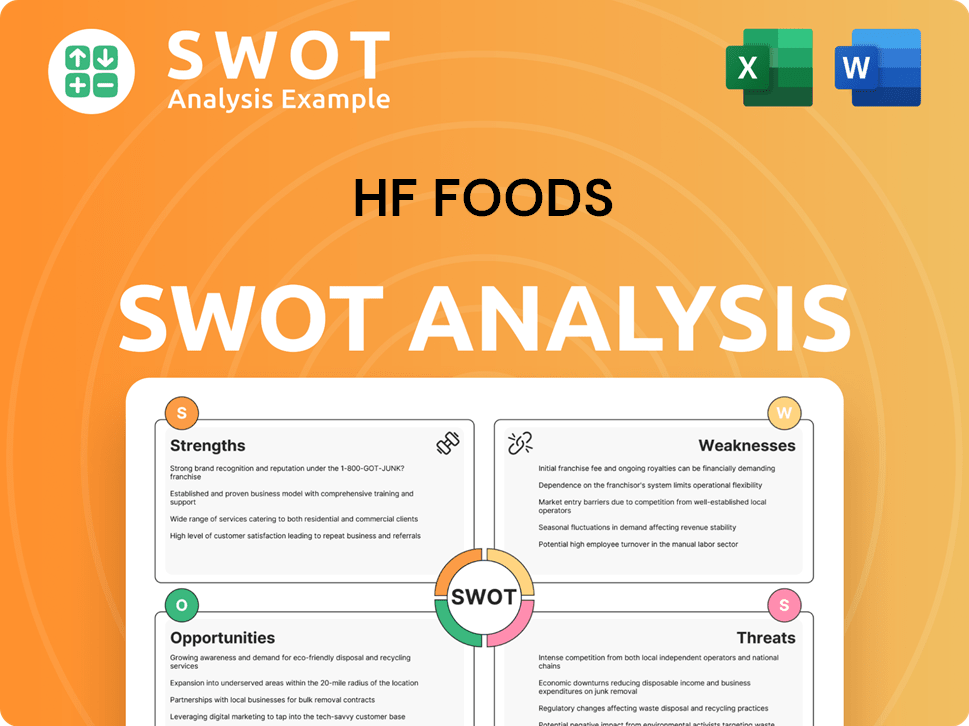

HF Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of HF Foods?

The early phase of HF Foods Company, initially known as HF Group, centered on establishing a strong distribution network to cater to Asian restaurants. This involved a strategic expansion of operations, with the establishment of multiple distribution centers across the nation. A significant turning point in its growth was the transition to a publicly listed company in August 2018, achieved through a reverse merger, which provided crucial access to capital for further expansion.

A key move in HF Foods' expansion strategy was the acquisition of B&R Global in November 2019. B&R Global, founded in 1999, supplied around 6,800 restaurants across 11 Western states. The merger created what the company believed to be the largest Asian food distributor in the United States. This acquisition significantly broadened HF Foods' geographic footprint.

The acquisition increased its distribution centers to 14 strategically located facilities in nine states, and expanded its service to over 10,000 restaurants in 21 states. Further expansion occurred in the seafood category through additional acquisitions in Illinois, Texas, and Virginia. This strategic growth solidified its position in the foodservice industry.

For the full year 2024, HF Foods reported total net revenue of $1,201.7 million, a 4.6% increase from 2023. In the first quarter of 2025, net revenue increased by 0.9% year-over-year to $298.4 million, with gross profit rising by 1.1% to $51.0 million. These figures reflect continued volume growth.

The company has actively managed its financial flexibility, amending its credit facility in February 2025 to increase its revolving commitment by $25 million to $125 million. This involved the addition of Wells Fargo as a lender alongside JPMorgan Chase Bank and Comerica Bank. This period of expansion was characterized by strategic acquisitions and infrastructure development.

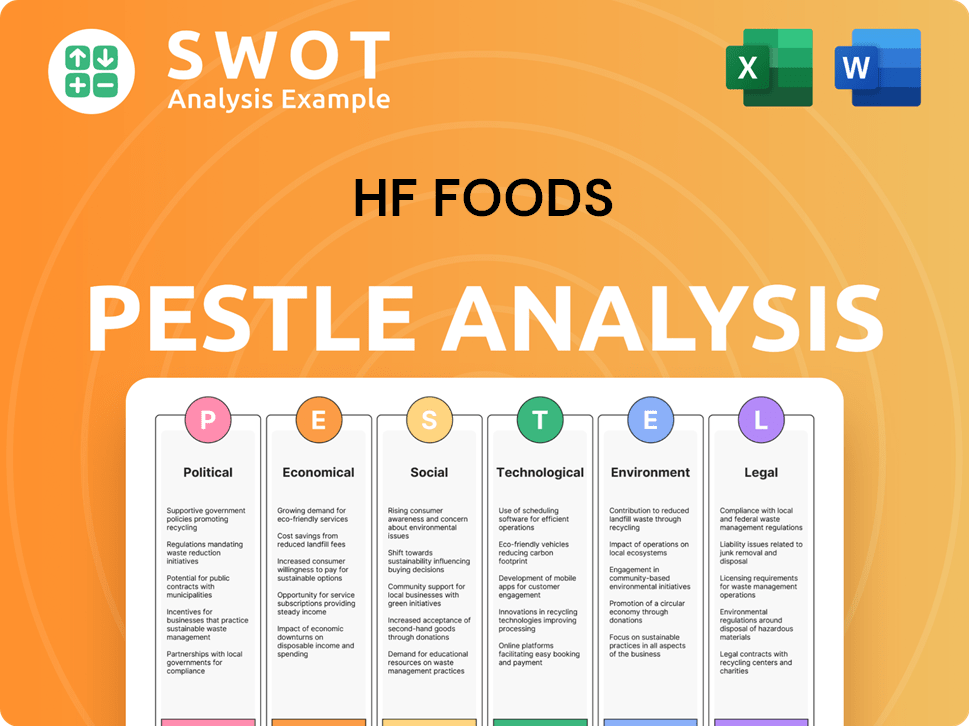

HF Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in HF Foods history?

The HF Foods Company has experienced a dynamic journey marked by strategic milestones and significant developments within the foodservice industry. This brief history of HF Foods reflects its evolution and adaptation to market demands.

| Year | Milestone |

|---|---|

| 2024 | The SEC announced findings related to materially false and misleading disclosures and other fraudulent conduct by former executives. |

| 2024 | The company initiated facility enhancement initiatives, including renovations at the Charlotte distribution center. |

| May 2025 | Launched a new e-commerce platform to allow restaurant employees and owners to directly purchase specialty products. |

| 2025 | Successfully completed the implementation of a new ERP application across its entire network. |

HF Foods has focused on innovation to enhance its operational capabilities and customer service. The launch of the new e-commerce platform in May 2025 is a prime example, designed to drive future growth and improve efficiency.

The new e-commerce platform allows restaurant employees and owners to directly purchase specialty products. This leverages the company's existing delivery infrastructure, enhancing customer service.

Successful implementation of a new ERP application across the entire network has enhanced efficiency. This also supports data-driven decision-making.

Despite these advancements, HF Foods has faced various challenges. The company reported a net loss of $1.5 million in Q1 2025, primarily due to unfavorable fair value changes in interest rate swap contracts.

HF Foods faced a net loss of $1.5 million in Q1 2025, influenced by unfavorable fair value changes. This highlights the impact of financial market fluctuations.

The company has encountered macroeconomic headwinds such as new tariffs, inflationary pressures, and shifts in consumer spending. These factors have impacted the foodservice industry.

HF Foods has been actively diversifying its supplier base and exploring alternative sourcing strategies. This is to ensure supply chain continuity and cost-effectiveness.

In June 2024, the SEC announced findings related to materially false and misleading disclosures. This led to a cease-and-desist order against HF Foods.

The company is focusing on enhancing margins, streamlining operations, and making strategic technology investments. These initiatives support long-term profitability.

Facility enhancement initiatives, including renovations at the Charlotte distribution center, are in progress. These efforts aim to optimize the distribution network.

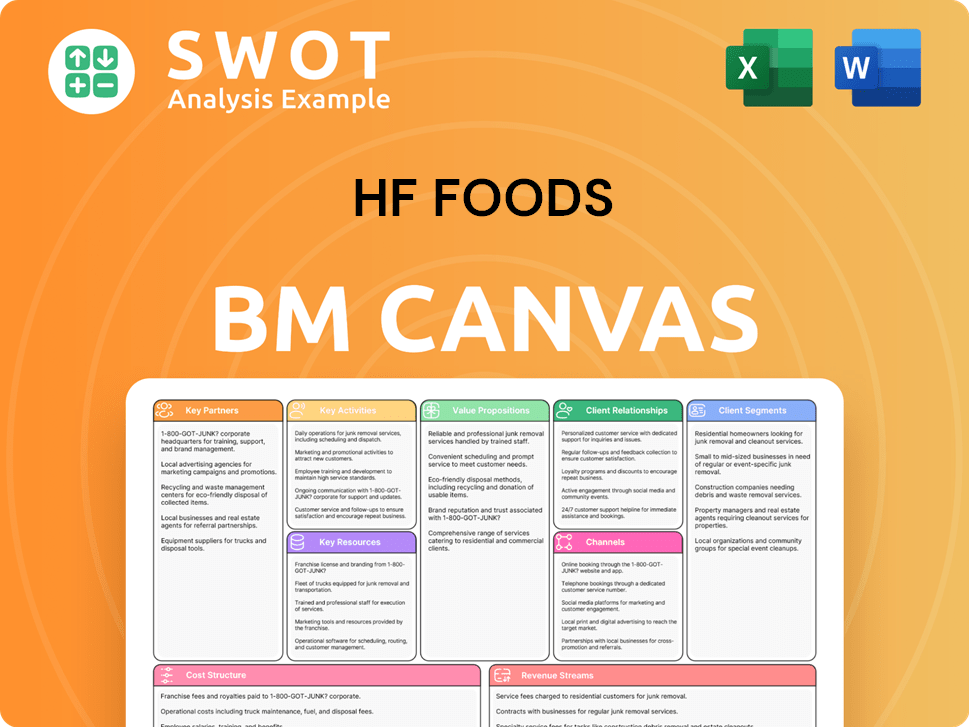

HF Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for HF Foods?

The brief history of HF Foods Company reveals a journey of strategic growth and adaptation within the foodservice industry. From its humble beginnings in 1997 as HF Group, founded by Zhou Min Ni and his spouse, to its current standing as a significant Asian food distributor, HF Foods has undergone several key transformations. The company went public in August 2018 through a reverse merger and expanded its reach with the November 2019 merger with B&R Global Holdings. Leadership transitions, including Zhou Min Ni's resignation in February 2021 and Felix Lin's appointment as permanent CEO in December 2024, have shaped the company's trajectory. Financial milestones include a 6.0% increase in net revenue to $298.4 million in Q3 2024 and a full-year revenue of $1,201.7 million for 2024. Recent developments, such as the amendment of its credit agreement in February 2025 and the launch of a new e-commerce platform in May 2025, highlight HF Foods' commitment to strategic investments and operational enhancements.

| Year | Key Event |

|---|---|

| 1997 | HF Group, the predecessor to HF Foods, was founded by Zhou Min Ni and his spouse in Kernersville, North Carolina. |

| August 2018 | HF Group became a publicly listed company, HF Foods, through a reverse merger with a SPAC. |

| November 2019 | HF Foods completed the merger with B&R Global Holdings, significantly expanding its geographic reach and market share. |

| February 2021 | Zhou Min Ni resigned as CEO of HF Foods. |

| November 2024 | HF Foods reported third-quarter 2024 financial results, with net revenue increasing by 6.0% to $298.4 million. |

| December 2024 | Felix Lin was named permanent CEO of HF Foods Group. |

| March 2025 | HF Foods reported fourth-quarter and full-year 2024 financial results, with full-year revenue reaching $1,201.7 million. |

| February 2025 | HF Foods amended its credit agreement, increasing its revolving commitment by $25 million to $125 million, adding Wells Fargo as a lender. |

| May 2025 | HF Foods launched a new e-commerce platform to enhance customer access and drive future growth. |

| May 2025 | HF Foods reported Q1 2025 financial results, with net revenue of $298.4 million. |

HF Foods is focusing on digital transformation and infrastructure development in 2025. This includes completing renovations at the Charlotte distribution center by the end of Q2 2025. The company is also making progress on its Atlanta state-of-the-art facility project.

The company aims to drive organic growth through cross-selling opportunities and strategic mergers and acquisitions. HF Foods is also exploring expansion into new key markets. The company is looking to consolidate its market leadership, potentially through vertical expansion.

While short-term uncertainties exist due to macroeconomic factors, HF Foods remains focused on its long-term strategic objectives. The company is diversifying its supplier base to mitigate risks. Analysts anticipate HF Foods to return to profitability in 2025.

Felix Lin, President and CEO, is committed to executing comprehensive transformation initiatives. The goal is to establish a strong foundation for the next phase of growth. This forward-looking approach aligns with the founding vision of serving the growing demand for specialty Asian cuisine.

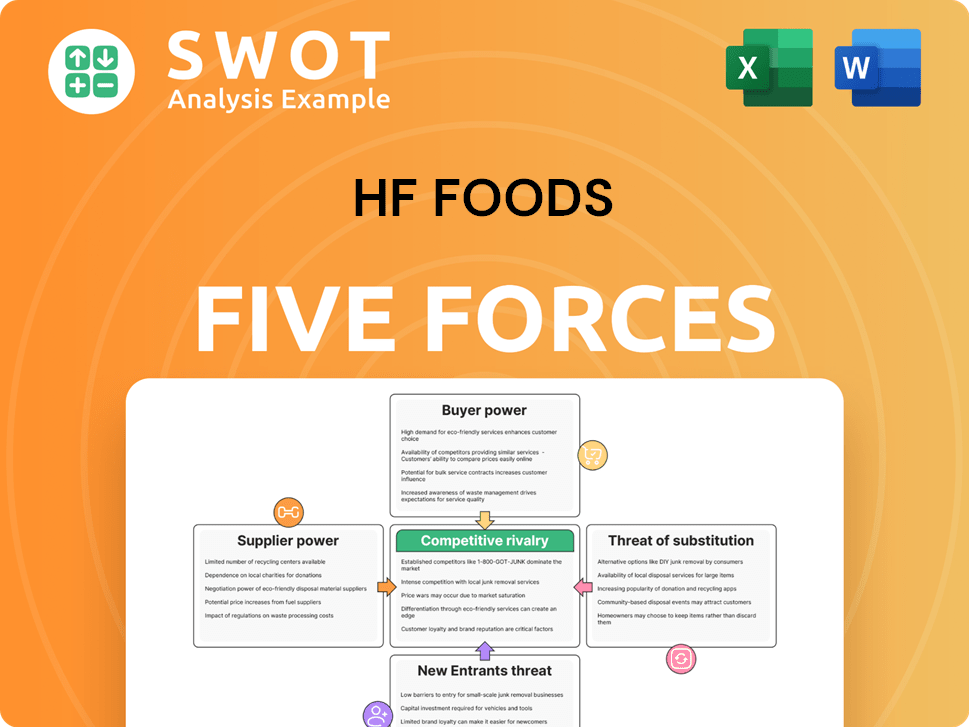

HF Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of HF Foods Company?

- What is Growth Strategy and Future Prospects of HF Foods Company?

- How Does HF Foods Company Work?

- What is Sales and Marketing Strategy of HF Foods Company?

- What is Brief History of HF Foods Company?

- Who Owns HF Foods Company?

- What is Customer Demographics and Target Market of HF Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.