Ipsos Bundle

How Did Ipsos Rise to Become a Global Research Giant?

Embark on a journey through the Ipsos SWOT Analysis, a company that began in 1975 in Paris, France. Founded by Didier Truchot, Ipsos quickly distinguished itself by delivering actionable insights to its clients. From its humble beginnings, Ipsos has transformed into a global force in market research.

The Ipsos company has a rich Ipsos history, expanding from a French startup to a worldwide leader in market research. With offices in 89 countries and a revenue of 2.44 billion euros in 2024, Ipsos's global research capabilities are undeniable. This remarkable Ipsos timeline demonstrates its strategic adaptability and dedication to providing insightful data for informed decision-making.

What is the Ipsos Founding Story?

The story of the Ipsos company began in Paris, France, in 1975. Didier Truchot, the founder, saw an opportunity to provide specialized market research services to advertising and media companies. This was a fresh approach in France at the time, focusing on measuring the effectiveness of campaigns.

Truchot aimed to build strong relationships with clients, offering not just data but also valuable interpretations and actionable advice. This focus on providing insights helped Ipsos quickly establish itself in the market.

The company's commitment to innovation and client service has been a constant throughout its history, driving its expansion and influence in the global market research industry.

Ipsos launched its first key measurement tool, the Baromètre d'Affichage (BAF), in 1977, designed to analyze billboard advertisement effectiveness.

- In 1979, Ipsos introduced the France des Cadres Actifs (FCA), a survey focusing on the reading habits of French executives.

- Jean-Marc Lech joined Ipsos in 1982 as co-President, forming a crucial partnership with Truchot.

- These early offerings showcased Ipsos's innovative approach to market research.

- Ipsos is an independent company, managed and run by market research professionals.

In 1977, Ipsos launched its first major measurement tool, the Baromètre d'Affichage (BAF), which analyzed the effectiveness of billboard advertisements. This was followed by other media-specific instruments. In 1979, the company introduced the France des Cadres Actifs (FCA), a survey designed to determine the reading habits of French executives. These early initiatives demonstrated Ipsos's innovative approach to market research, setting the stage for its future growth. A deeper dive into the financial aspects can be found in the Revenue Streams & Business Model of Ipsos.

In 1982, Jean-Marc Lech joined Ipsos as co-President alongside Didier Truchot. This partnership was instrumental in shaping the company's trajectory. Truchot's background in economics and interest in market research, combined with Lech's expertise, which stemmed from his time at IFOP, where he became president and CEO in 1980 before joining Ipsos, complemented each other, driving the company forward. Ipsos has remained an independent company, managed by market research professionals dedicated to gathering, interpreting, and distributing information derived from individuals.

Ipsos SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Ipsos?

The early years of the company marked significant growth and expansion. By 1989, it had become the fifth-largest market research company in France, achieving sales of FFr100 million. The 1990s were a period of aggressive international expansion, establishing the company as a major player in the global research landscape.

The company's expansion began across Europe, with initial acquisitions outside of France. Key acquisitions included NFL-Research in England and Eco Consulting in Spain in 1992. This strategic move solidified its position as a significant European research entity, expanding its reach and capabilities within the continent.

Further global reach was achieved through expansion into North America and Latin America. In 1997, the company entered the Latin American market by acquiring Novaction, which included subsidiaries in Mexico, Brazil, and Argentina. This was followed by its entry into the North American market in 1998 with the purchase of ASI Market Research.

To fuel its rapid international growth, the company brought in new investment partners in 1997, selling 40% of its shares to Artemis Group and the Amstar investment fund. In 1999, the company was listed on the Paris Stock Exchange, which further supported its expansion efforts and increased its visibility in the market.

By 2001, the company had surpassed its French rival Sofres to claim the number one spot in France. The acquisition of NPD Marketing Research in 2001 made the company a major research player in the U.S. The company continued to diversify its offerings, including qualitative research with the acquisition of Understanding UnLtd (UU) in 2005.

Ipsos PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Ipsos history?

The Ipsos history is marked by significant milestones that have shaped its trajectory in the market research industry. From strategic acquisitions to innovative launches, Ipsos has consistently adapted to the evolving needs of its clients and the market.

| Year | Milestone |

|---|---|

| 2011 | Acquisition of Synovate, solidifying Ipsos's position among the top global market research agencies. |

| 2015 | Launch of Ipsos Connect, repositioning its media and advertising businesses. |

| 2018 | Acquisition of Synthesio, a social intelligence suite, expanding its data and analytics capabilities. |

| 2023 | Acquisition of Xperiti, a B2B research company, further broadening its expertise. |

Innovation is a continuous driver for the

Launched in 2014, this program was designed to help clients navigate the rapidly changing market landscape. It focused on providing innovative solutions to meet evolving client needs.

Ipsos launched SMX, a dedicated social media practice, demonstrating its foresight in embracing emerging data sources and enhancing its analytical capabilities. This allowed for more comprehensive market insights.

Launched in 2015, Ipsos Connect repositioned its media and advertising businesses. This initiative aimed to provide more focused and specialized services in the media and advertising sectors.

Reinforced advisory services through the Strategy3 brand, focusing on consumer understanding, innovation, and marketing/brand strategy. This strengthened the company's advisory capabilities.

The 2018 acquisition of Synthesio, a social intelligence suite, expanded Ipsos's capabilities in social media analytics. This enhanced its ability to gather and analyze social data.

Ipsos is actively leveraging Artificial Intelligence (AI) to meet evolving client expectations. This includes continuous investment in platforms, panels, and generative AI tools as part of its strategic plan for 2025.

Despite its achievements,

The market research industry is highly competitive, with established players like Nielsen and Kantar having a longer presence in some critical markets. This requires continuous innovation and strategic adaptation to maintain a competitive edge.

Economic volatility and political uncertainty have impacted Ipsos's performance, particularly in regions like the United States. Fluctuations in economic conditions can influence client spending and project timelines.

The public affairs business has seen declines in certain regions, affecting overall revenue. This necessitates strategic adjustments and diversification of services to mitigate the impact.

Launched in 2018-2019, the 'Total Understanding' transformation project aimed at achieving faster growth. This project focused on streamlining operations and enhancing client service delivery.

Ipsos is actively leveraging Artificial Intelligence (AI) to meet evolving client expectations, providing more relevant insights more quickly. The company's commitment to continuous investment in platforms, panels, and generative AI tools is a key part of its strategic plan for 2025.

The company has responded to these challenges through strategic initiatives, such as the 'Total Understanding' transformation project launched in 2018-2019 aimed at achieving faster growth. Ipsos is also actively leveraging Artificial Intelligence (AI) to meet evolving client expectations, providing more relevant insights more quickly.

Ipsos Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Ipsos?

The Ipsos history is marked by significant milestones, from its inception in Paris to its current status as a global leader in market research. Founded in 1975 by Didier Truchot, Ipsos rapidly expanded across Europe and beyond, strategically acquiring key players and adapting to the evolving demands of the market. The company's journey includes pivotal moments like its listing on the Paris Stock Exchange, acquisitions that broadened its global reach, and strategic initiatives that have shaped its trajectory into 2024 and beyond.

| Year | Key Event |

|---|---|

| 1975 | Ipsos is founded by Didier Truchot in Paris, France. |

| 1977 | Ipsos launches its first media measurement instrument, the Baromètre d'Affichage (BAF). |

| 1982 | Jean-Marc Lech joins Ipsos as co-President. |

| 1990-1998 | Ipsos expands across Europe and into North and Latin America, making its first acquisitions outside France. |

| 1999 | Ipsos is listed on the Paris Stock Exchange. |

| 2001 | Ipsos acquires NPD Marketing Research, becoming a major player in the U.S. |

| 2005 | Ipsos acquires MORI, merging it with Ipsos UK to form Ipsos MORI. |

| 2011 | Ipsos acquires Synovate, significantly strengthening its global position. |

| 2014 | Ipsos launches its 'New Way' program and creates the Ipsos Foundation. |

| 2015 | Ipsos adopts the tagline 'Game Changers' and acquires RDA Group. |

| 2018-2019 | Ipsos initiates the 'Total Understanding' transformation project. |

| 2021 | Ben Page takes over as Ipsos CEO, with Didier Truchot continuing as Chairman. |

| 2023 | Ipsos acquires Xperiti, a business-to-business research company. |

| 2024 | Ipsos records sales of €2,440.8 million, with an operating margin of 13.1%. |

| 2025 (Q1) | Ipsos reports revenue of €568.5 million. |

Ipsos aims for organic growth exceeding 2024's performance. The company plans to maintain an operating margin of approximately 13% at a constant scope, excluding acquisitions. This includes doubling investments in data analytics, technology, and Knowledge Panels.

Ipsos is increasing its data scientists and technologists headcount from 1,500 to 2,000 by 2025, reinforcing its leadership in platforms. The company is actively exploring synthetic data and using Artificial Intelligence to provide faster, more relevant insights to clients.

Ipsos plans to spend between €100 million and €200 million annually on strategic acquisitions. Analyst forecasts predict annual earnings growth of 6.3% and revenue growth of 3.1% for the company.

Ipsos is committed to helping clients navigate a rapidly changing world. This commitment stems from its founding principle of providing actionable truth from information, aligning with the increasing demand for data-driven insights and the impact of generative AI.

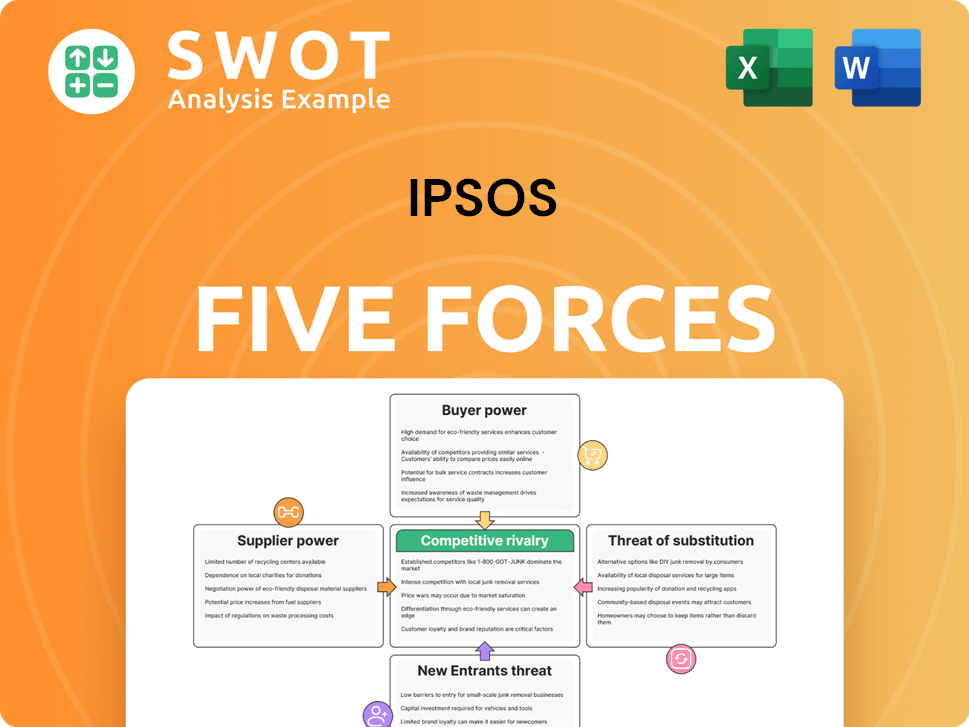

Ipsos Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Ipsos Company?

- What is Growth Strategy and Future Prospects of Ipsos Company?

- How Does Ipsos Company Work?

- What is Sales and Marketing Strategy of Ipsos Company?

- What is Brief History of Ipsos Company?

- Who Owns Ipsos Company?

- What is Customer Demographics and Target Market of Ipsos Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.