Protech Home Medical Bundle

How has Protech Home Medical evolved into Quipt Home Medical?

Delve into the fascinating Protech Home Medical SWOT Analysis and discover the remarkable journey of a leading Protech Home Medical company in the home healthcare sector. From its inception in 1997 to its current status as Quipt Home Medical Corp., the Protech Home Medical history is a story of strategic adaptation and growth. Uncover the key milestones that transformed this medical supply company into a prominent provider of healthcare services.

This exploration of the Protech Home Medical company background will illuminate its pivotal shifts, including name changes and strategic expansions. Understanding the Protech Home Medical timeline provides valuable insights into the company's ability to navigate the ever-changing landscape of the home medical equipment industry. Learn how this North American leader continues to innovate and serve patients with advanced respiratory and sleep solutions.

What is the Protech Home Medical Founding Story?

The founding of Protech Home Medical Corp. began on March 5, 1997, under the initial name 730285 Alberta Inc. The company's formation was driven by the growing need for in-home medical solutions. This was in response to an aging population and the rise of chronic diseases.

The founders aimed to provide in-home medical equipment and services. Their goal was to serve patients with chronic illnesses. This approach sought to alleviate the strain on traditional healthcare systems.

The company's initial focus was on fulfilling prescriptions for services and products. They offered a range of in-home monitoring and disease management services. The primary funding came from equity financing. The company's evolution included trading on the TSX Venture Exchange under the symbol 'PHM' starting June 8, 2010. The name changed to Protech Home Medical Corp. on May 4, 2018, as part of a strategic shift.

Protech Home Medical's journey started with a focus on home medical equipment and services.

- Incorporated in 1997 as 730285 Alberta Inc.

- Listed on the TSX Venture Exchange in 2010.

- Name changed to Protech Home Medical Corp. in 2018.

- Focused on providing home healthcare solutions for chronic illnesses.

The company's growth reflects the increasing demand for home healthcare. The market for home medical equipment and services has seen consistent growth. In recent years, the home healthcare market has grown significantly. The home healthcare market was valued at approximately $307.6 billion in 2023. Projections estimate it will reach $515.4 billion by 2030, with a CAGR of 7.6% from 2024 to 2030. This expansion highlights the importance of companies like Protech Home Medical in meeting the needs of an aging population and the rise of chronic diseases. For more information on the company's strategic direction, consider reading about the Growth Strategy of Protech Home Medical.

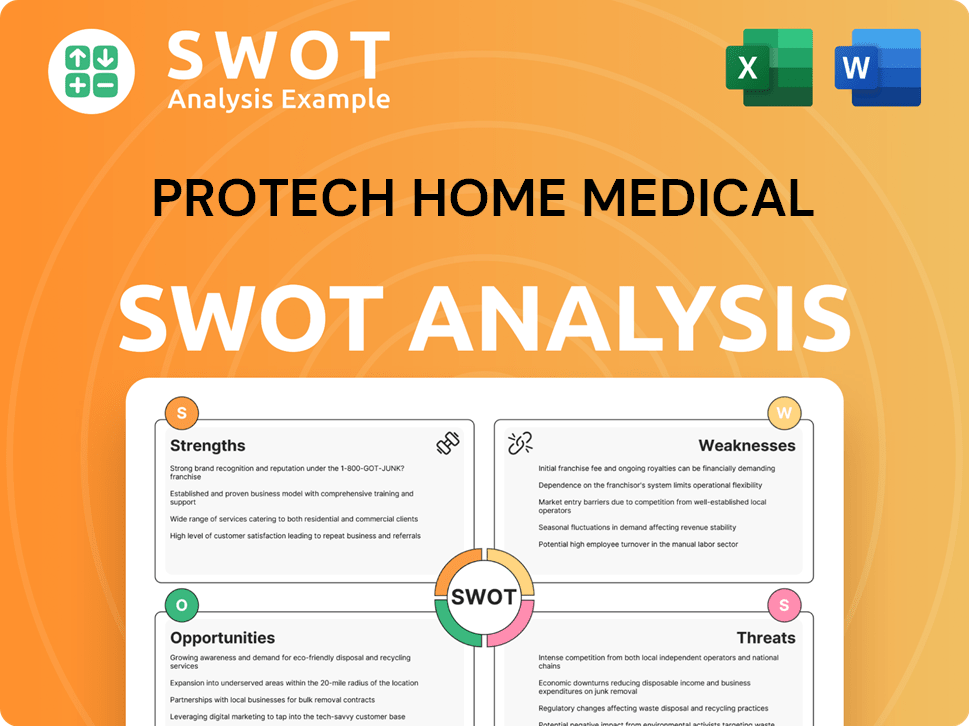

Protech Home Medical SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Protech Home Medical?

The early growth of Protech Home Medical Corp. was marked by a combination of organic strategies and strategic acquisitions. The company focused on increasing revenue per patient by offering multiple services, aiming to consolidate services and enhance patient convenience. This approach also helped Protech Home Medical gain market share. This period was crucial in establishing Protech Home Medical as a significant player in the home medical equipment sector.

In fiscal year 2019, Protech Home Medical served 76,146 unique patients, a 10% increase from 69,500 in fiscal 2018. Respiratory resupply set-ups and/or deliveries increased by 22% in the three months ended September 30, 2019, compared to the same period in 2018. By Q3 2020, the customer base grew by 19% year-over-year to 37,128 unique patients, with respiratory resupply set-ups increasing by 31%.

Full-year revenue for fiscal 2019 reached $81.0 million, a 15% increase from $70.5 million in fiscal 2018. In the second quarter of 2020, revenues were $24.1 million, a 16% increase compared to the same period in 2019. Preliminary third-quarter 2020 results showed revenue in the range of $25.6 million to $25.9 million, aiming for a run-rate revenue of $100 million. First-quarter fiscal year 2021 revenue was $22.8 million, a 32% increase over the prior year. By Q4 2020, revenue rose 28% year-over-year to $25 million, with full fiscal year revenue reaching $97.8 million, a 21% increase from 2019.

Protech Home Medical actively pursued acquisitions to build scale and enter new markets. Key acquisitions included Coastal Med Tech Inc. (CMT) in September 2018, Cooley Medical, Inc. (CMI) in October 2019, Health Technology Resources, LLC (HTR) in August 2020, Sleepwell, LLC in October 2020, and Mayhugh Drugs Inc. (MME) in February 2021. These acquisitions expanded Protech Home Medical's geographic footprint and service offerings.

The company secured significant capital through a bought deal private placement of 8.0% unsecured convertible debentures in March 2019, raising $15 million. By July 2020, Protech Home Medical had over $41 million in cash. The home medical equipment industry benefited from increased in-home healthcare demand during the COVID-19 pandemic. Protech's business model proved resilient, with stable EBITDA margins above 20% by FQ3 2020.

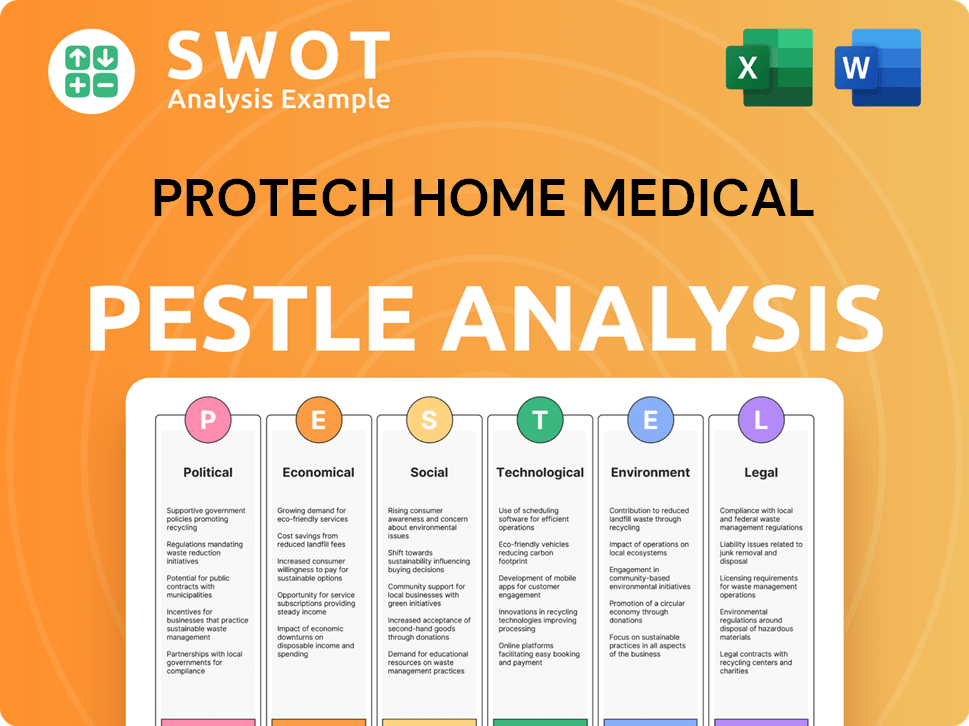

Protech Home Medical PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Protech Home Medical history?

The journey of Protech Home Medical, a medical supply company, is marked by strategic shifts and significant growth milestones. The company's evolution reflects its adaptability and commitment to the home healthcare sector. This Protech Home Medical company timeline showcases its key developments.

| Year | Milestone |

|---|---|

| April 2018 | The company changed its name from Patient Home Monitoring Corp. to Protech Home Medical Corp., signaling a strategic refocus. |

| May 2021 | Further rebranding to Quipt Home Medical Corp. occurred, alongside a stock consolidation and application to list on NASDAQ, aiming for national expansion. |

| Ongoing | The company focused on building a pipeline of qualified acquisition targets to expand market share and consolidate distribution channels. |

Protech Home Medical consistently utilized technology to improve patient care and operational efficiency, enhancing its healthcare services. This focus included a patient-centric model and telehealth investments to streamline processes and accelerate patient onboarding.

Protech Home Medical leveraged technology to improve patient care and operational efficiency, focusing on a patient-centric model. This included investments in telehealth to streamline processes.

The company saw significant growth in respiratory resupply set-ups, increasing by 22% in the three months ended September 30, 2019, and 31% in Q3 2020. This growth demonstrates the effectiveness of their tech-focused approach.

Protech Home Medical utilized technology and centralized intake processes to streamline respiratory resupply programs. This reduced fulfillment errors and improved patient care.

The company's focus on a patient-centric model, using technology, was key to improving service. This approach helped to enhance the overall patient experience.

Investments in telehealth technology allowed for more comprehensive service offerings. This accelerated patient onboarding and improved the reach of Protech Home Medical's services.

Technology played a crucial role in improving operational efficiency. This led to better resource allocation and improved service delivery.

Despite its growth, Protech Home Medical faced challenges, including market acceptance issues for new services and a cyberscam breach. The company also dealt with potential delays in financial filings and market volatility.

The home monitoring of patients on anticoagulants presented challenges in the early stages. Market acceptance and expansion were difficult to predict.

Protech Home Medical encountered a cyberscam breach of its email system in May 2019. This highlighted the importance of robust cybersecurity measures.

The company anticipated missing deadlines for filing audited annual financial statements. This posed challenges in maintaining investor confidence.

Periods of market volatility and correction posed risks to the company's ability to secure adequate financing. This required strategic financial planning.

Integrating acquired companies and consolidating distribution channels presented operational challenges. This required careful planning and execution.

Navigating changing healthcare regulations and ensuring compliance added complexity. This required ongoing monitoring and adaptation.

For more insights into the Protech Home Medical's target market, consider reading Target Market of Protech Home Medical.

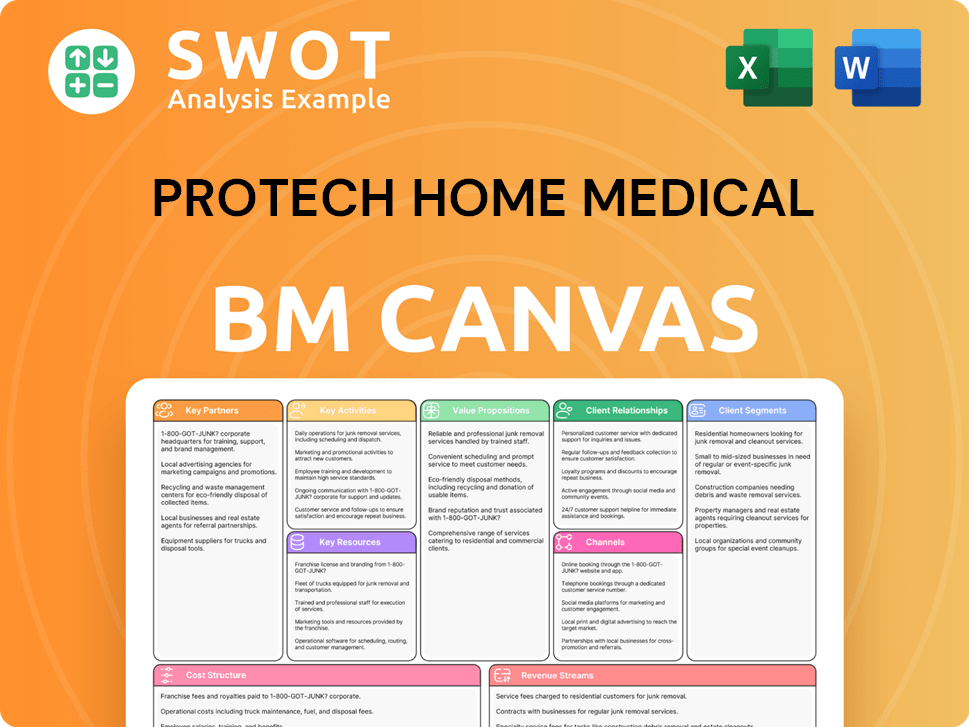

Protech Home Medical Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Protech Home Medical?

The journey of Protech Home Medical company, now known as Quipt Home Medical Corp., has been marked by strategic acquisitions and a shift in focus. From its incorporation in 1997 to its expansion across the United States, the company has evolved significantly. Key milestones include the commencement of trading on the TSX Venture Exchange in 2010, several name changes, and numerous acquisitions that have shaped its current profile as a provider of home medical equipment and healthcare services.

| Year | Key Event |

|---|---|

| March 5, 1997 | Incorporated under the name 730285 Alberta Inc. |

| June 8, 2010 | Trading of consolidated shares commenced on the TSX Venture Exchange under the symbol 'PHM'. |

| May 4, 2018 | Name changed from Patient Home Monitoring Corp. to Protech Home Medical Corp. |

| September 2018 | Acquired Coastal Med Tech Inc. (CMT). |

| March 7, 2019 | Completed a private placement of 8.0% unsecured convertible debentures, raising $15 million. |

| October 2019 | Acquired Cooley Medical, Inc. (CMI). |

| August 2020 | Acquired Health Technology Resources, LLC (HTR), expanding into the Chicago area. |

| October 2020 | Acquired Sleepwell, LLC, adding $13 million in annualized revenues. |

| February 2021 | Acquired Mayhugh Drugs Inc. (MME). |

| May 13, 2021 | Name changed from Protech Home Medical Corp. to Quipt Home Medical Corp. and common shares consolidated. |

| May 14, 2021 | Filed Form 40-F Registration Statement with the SEC, becoming a reporting issuer in the United States. |

| August 21, 2024 | Quipt Home Medical (QIPT) receives a 'Buy' rating from Benchmark Co. |

| January 3, 2024 | Recognized among the 'Best In-Home Medical Alert Systems Of 2024'. |

| February 10, 2025 | Reported Q1 Fiscal Year 2025 revenue of US$61.4 million, compared to $62.6 million for Q1 2024. |

| May 12, 2025 | Quipt Home Medical reports Fiscal Second Quarter 2025 results. |

Quipt Home Medical Corp. continues to focus on market expansion. The company aims to increase its presence and reach within the home medical equipment and healthcare services sector. This strategic move is part of a broader plan to capture a larger share of the growing in-home healthcare market.

Product innovation is a key component of Quipt Home Medical's strategy. The company is committed to expanding its services and product offerings to meet the evolving needs of patients. This includes introducing new home medical equipment and enhancing existing services to improve patient care.

Analysts forecast Quipt Home Medical's annual revenue to grow by 0.1% per year. However, earnings are forecast to decline by 11.8% per annum. The company is expected to remain unprofitable over the next three years, with EPS expected to decline by 17.3% per annum.

Quipt Home Medical is actively seeking accretive acquisition targets to expand its reach. The company plans to leverage its infrastructure to become a national provider of home medical equipment and healthcare services. This strategy is designed to drive growth and enhance its market position.

Protech Home Medical Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Protech Home Medical Company?

- What is Growth Strategy and Future Prospects of Protech Home Medical Company?

- How Does Protech Home Medical Company Work?

- What is Sales and Marketing Strategy of Protech Home Medical Company?

- What is Brief History of Protech Home Medical Company?

- Who Owns Protech Home Medical Company?

- What is Customer Demographics and Target Market of Protech Home Medical Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.