Synchrony Financial Bundle

How Did Synchrony Financial Rise to Financial Prominence?

Ever wondered about the origins of a financial giant? Synchrony Financial, a major player in financial services, boasts a fascinating Synchrony Financial SWOT Analysis, tracing its roots back to a strategic spin-off. This journey from its inception within General Electric (GE) to its current standing is a testament to its adaptability and strategic focus. Dive into the brief history of Synchrony Financial to understand its evolution.

Synchrony Financial's story is one of transformation and strategic foresight. Initially part of GE Capital, the company's independence in 2014 marked a new chapter, allowing it to specialize in credit cards and installment loans. Understanding the Synchrony company background and its relationship with GE is key to appreciating its current market position. This article will delve into Synchrony Financial's key milestones, exploring its growth in the consumer finance sector, and its impact on the financial services landscape, including its credit card offerings.

What is the Synchrony Financial Founding Story?

The story of Synchrony Financial, a prominent player in the financial services sector, is deeply intertwined with the legacy of General Electric (GE). The Synchrony history begins long before its official independence, rooted in GE's consumer finance operations.

Initially, the focus was on providing financing for consumer purchases, particularly for GE appliances. Over time, this evolved into a significant provider of private label credit cards, establishing a strong presence in the retail sector. The eventual spin-off from GE marked a strategic shift, aiming to streamline operations and reduce exposure to financial services.

The company's journey to independence was formalized in 2014. This transition was driven by GE's strategic decisions, leading to an Initial Public Offering (IPO) in July 2014, followed by a complete separation in November 2015. Margaret Keane, a veteran of GE Capital, led Synchrony Financial through this pivotal period.

The creation of Synchrony Financial was a strategic move to create a more agile and specialized financial services provider. This allowed it to focus on adapting to the changing retail landscape.

- 1932: GE Capital Retail Finance is established.

- 2013: GE announces the spin-off of GE Capital Retail Finance.

- July 2014: The IPO of Synchrony Financial.

- November 2015: Full separation from GE.

The core business model of Synchrony Financial involves offering private label credit cards, co-branded credit cards, and installment loans through partnerships with various businesses. This approach enables partners to provide financing directly to their customers, enhancing the shopping experience. The name 'Synchrony' reflects the company's mission to synchronize with its partners, creating seamless credit experiences.

As of 2024, Synchrony Financial has over $80 billion in total assets and approximately 70 million active accounts. The company's focus on strategic partnerships has driven significant growth, with a diverse portfolio of partners across various sectors. The company's financial performance in 2024 reflects its strong market position and effective business model. For example, in Q1 2024, net earnings were $669 million, or $1.33 per diluted share. The company's success is also evident in its stock performance and market capitalization. To understand how Synchrony Financial targets its market, you can read more about it in the article: Target Market of Synchrony Financial.

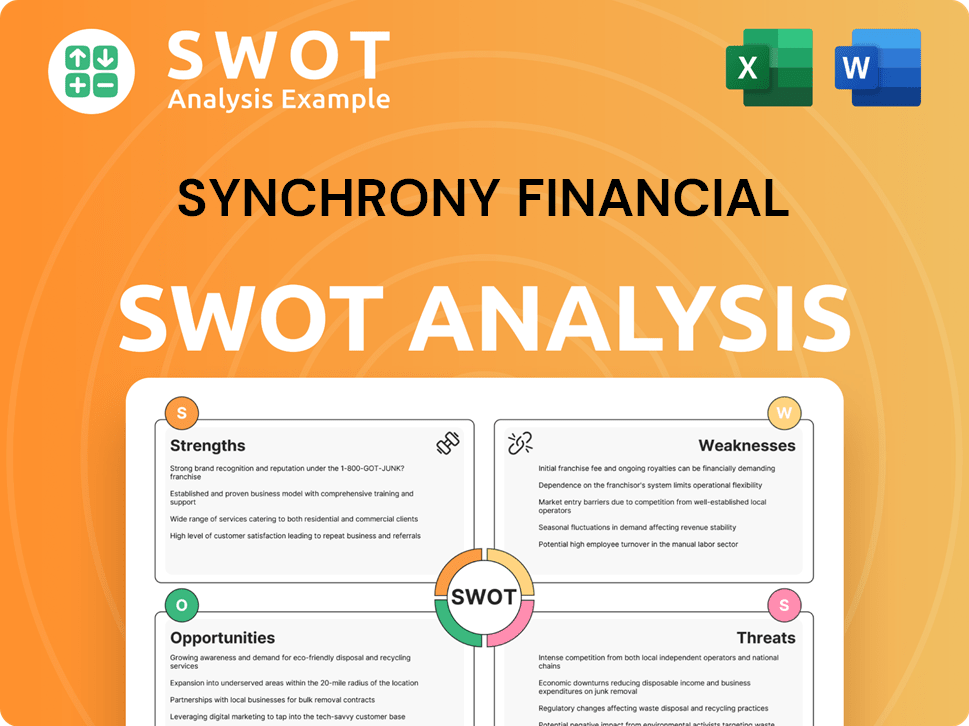

Synchrony Financial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Synchrony Financial?

Following its separation from GE in November 2015, Synchrony Financial experienced significant growth and diversification. The company focused on expanding its partnerships and enhancing its digital capabilities to meet evolving customer needs. This strategic approach led to substantial growth and strengthened its position in the financial services sector. The company's journey from its roots to its current status is a testament to its adaptability and strategic vision.

One of the key strategies for Synchrony Financial was the expansion of its partner network. This involved adding new retailers and extending its reach into various sectors. The aim was to offer customized credit programs that integrated seamlessly into partners' sales processes, driving growth and customer acquisition.

Synchrony Financial invested heavily in digital capabilities to improve customer experience. This included online application processes and mobile account management tools. These enhancements aimed to make financial services more accessible and convenient for customers, aligning with the growing trend of digital banking.

In 2017, Synchrony Financial acquired the PayPal Credit loan receivables portfolio. This significant move expanded its digital payment offerings and customer base. The acquisition, valued at approximately $6.8 billion, demonstrated its commitment to adapting to the evolving digital payments landscape and expanding its digital footprint.

The company focused on diversifying its product offerings beyond traditional credit cards. This included an increased focus on installment loans and revolving credit options. This strategy aimed to meet varied consumer needs and provide a broader range of financial solutions, contributing to its overall growth.

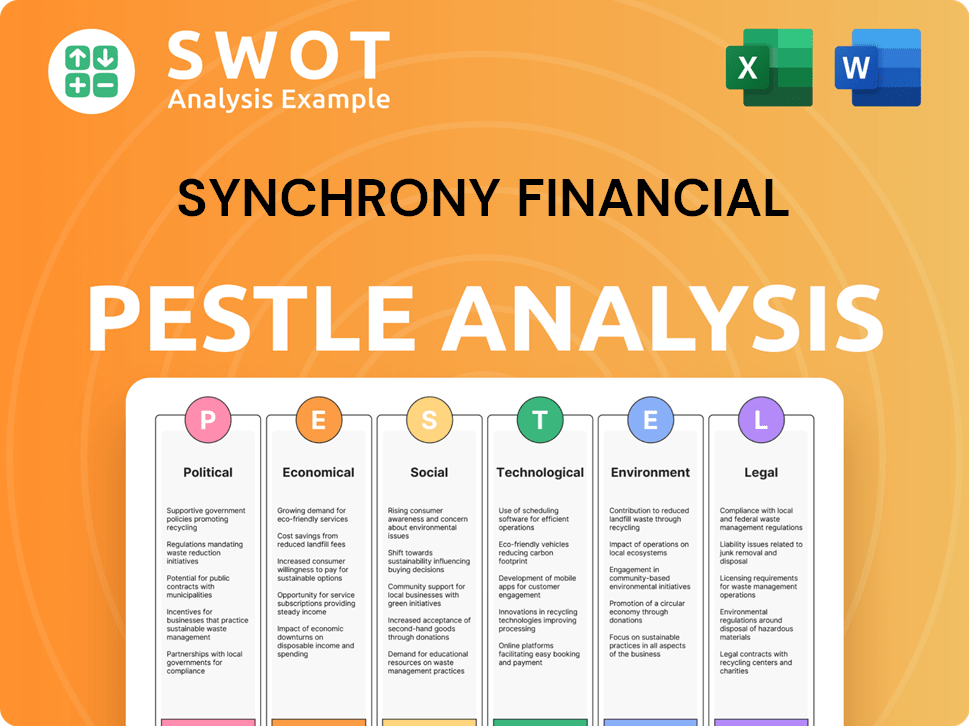

Synchrony Financial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Synchrony Financial history?

The Synchrony Financial journey is marked by key milestones that have shaped its position in the financial services industry. Understanding the Synchrony history provides insights into its strategic evolution and market adaptability.

| Year | Milestone |

|---|---|

| 2003 | GE Consumer Finance rebrands to GE Money, marking a significant shift in the company's branding and market approach. |

| 2014 | Synchrony Financial becomes an independent public company, trading on the NYSE under the ticker SYF, a pivotal moment in its corporate structure. |

| 2018 | The company ends its long-standing credit card program with Walmart, transitioning the portfolio to Capital One, a major strategic adjustment. |

| 2024 | Synchrony Financial announces a new multi-year agreement with JCPenney, continuing a nearly 20-year partnership, highlighting its commitment to key client relationships. |

Synchrony Financial has consistently embraced innovation to enhance its offerings within the financial services sector. A key focus has been on leveraging technology to improve customer experiences and operational efficiency.

The SyncPay platform has been a core innovation, providing integrated payment solutions for businesses, streamlining transactions and enhancing customer payment options. This platform supports various payment methods and integrates seamlessly with merchant systems.

Synchrony Financial has invested heavily in data analytics and artificial intelligence to improve credit underwriting, fraud detection, and the personalization of customer offers. These technologies help manage risk and enhance customer engagement.

The Synchrony Car Care program offers financing for automotive maintenance and repairs, expanding the company's service offerings into a new market segment. This program provides flexible financing options for consumers.

Despite its successes, Synchrony Financial has faced various challenges throughout its history. These challenges have required strategic adjustments and a focus on adaptability within the dynamic financial landscape.

The Synchrony Financial faces intense competition from other financial services providers, which necessitates continuous innovation and customer service improvements to maintain market share. Competitors include major banks and other credit card issuers.

Economic downturns can significantly impact consumer spending and credit performance, requiring Synchrony Financial to manage credit risk and adjust its lending practices. These adjustments are crucial for maintaining financial stability during economic instability.

The company must constantly adapt to evolving regulatory landscapes, which can impact operations and compliance costs. Staying compliant with changing regulations is essential for long-term sustainability.

The termination of the Walmart credit card program in 2018 presented a significant challenge, leading to a temporary dip in receivables and the need to find and cultivate new partnerships. This required strategic reallocation of resources.

The need to enhance digital capabilities and adapt to changing consumer preferences requires continuous investment in technology and digital platforms. This includes mobile apps, online account management, and digital payment solutions.

Market shifts, such as changes in consumer spending habits and the rise of new payment technologies, require Synchrony Financial to be agile and innovative. This includes adapting to new trends and consumer behaviors.

For a deeper dive into the strategies employed by Synchrony Financial, consider reading this article about the Marketing Strategy of Synchrony Financial.

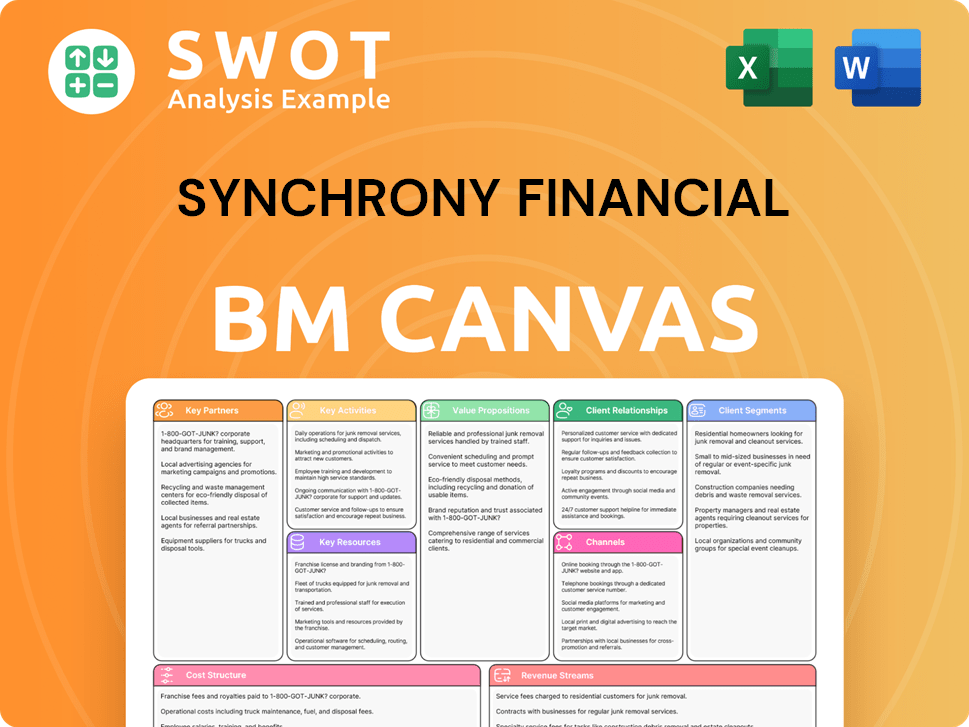

Synchrony Financial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Synchrony Financial?

The story of Synchrony Financial is a journey marked by strategic pivots and financial milestones. From its origins as GE Capital Retail Finance in 1932, the company has evolved into a leading financial services provider. Key moments include the 2014 IPO, the 2015 separation from General Electric, and significant acquisitions like the PayPal Credit portfolio in 2017. The company has adapted to market changes, such as the transition of the Walmart credit card program to Capital One in 2018, and has expanded into new sectors, including the launch of its SetPay installment loan solution for healthcare in 2020. In 2023, Synchrony reported net earnings of $2.4 billion, demonstrating its continued financial stability, and in 2024, it announced a new multi-year agreement with JCPenney, extending a long-standing partnership.

| Year | Key Event |

|---|---|

| 1932 | GE Capital Retail Finance, the precursor to Synchrony, is established. |

| July 2014 | Synchrony Financial completes its Initial Public Offering (IPO). |

| November 2015 | Synchrony Financial fully separates from General Electric, becoming an independent company. |

| 2017 | Synchrony acquires the PayPal Credit loan receivables portfolio. |

| 2018 | Walmart transitions its credit card program from Synchrony to Capital One. |

| 2020 | Synchrony launches its SetPay installment loan solution for healthcare. |

| 2021 | Synchrony expands its digital payment solutions and partnerships. |

| 2023 | Synchrony reports net earnings of $2.4 billion, reflecting continued financial stability. |

| 2024 | Synchrony announces a new multi-year agreement with JCPenney, continuing a long-standing partnership. |

| 2025 | Synchrony continues to focus on digital innovation and strategic partnerships. |

Synchrony is focused on enhancing its digital payment solutions. This includes investing in new technologies to improve customer experiences and streamline financial transactions. The company aims to provide seamless and innovative credit solutions in a competitive market.

The company is actively seeking new partnerships to expand its reach. This includes collaborations in high-growth sectors such as healthcare and pet care. These partnerships are crucial for attracting new customers and deepening existing relationships.

Synchrony is investing in advanced analytics and AI. These tools help personalize credit offers and enhance risk management. This focus on data-driven insights supports more effective customer engagement and operational efficiency.

Analysts predict continued demand for flexible financing options, aligning with Synchrony's core business model. The company's leadership is committed to driving shareholder value through disciplined capital allocation and strategic investments. This forward-looking approach supports accessible and adaptable credit solutions.

Synchrony Financial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Synchrony Financial Company?

- What is Growth Strategy and Future Prospects of Synchrony Financial Company?

- How Does Synchrony Financial Company Work?

- What is Sales and Marketing Strategy of Synchrony Financial Company?

- What is Brief History of Synchrony Financial Company?

- Who Owns Synchrony Financial Company?

- What is Customer Demographics and Target Market of Synchrony Financial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.