Tyler Technologies Bundle

How Did Tyler Technologies Become a Government Software Giant?

In the ever-evolving tech landscape, few companies have reshaped their focus as dramatically as Tyler Technologies. From its origins as a diversified holding company in 1966, the company has transformed into a leading provider of Tyler Technologies SWOT Analysis, software solutions for the public sector. This strategic pivot highlights its ability to adapt and capitalize on the growing need for digital transformation in government operations. This brief history of Tyler Technologies explores the key milestones that shaped its journey.

Tyler Technologies' evolution offers valuable lessons in strategic focus and market adaptation. Its shift towards government software has allowed it to capture a significant market share, serving thousands of clients across various regions. Understanding the Tyler Technologies SWOT Analysis, company's history provides insights into its core products, its approach to local government solutions, and its overall financial performance. Exploring the brief history of Tyler Technologies helps to understand its impact on public sector technology.

What is the Tyler Technologies Founding Story?

The story of Tyler Technologies history begins on December 30, 1966, with the establishment of Tyler Corporation by Joseph F. McKinney. McKinney, drawing from his experience in various sectors, envisioned a diversified holding company. This company would acquire and develop businesses across multiple industries.

The initial goal was to create value through strategic acquisitions and operational improvements within a diverse portfolio of companies. This early strategy set the stage for the company's future transformation. The company's name, 'Tyler,' was selected to represent its commitment to a diversified portfolio, symbolizing a 'tyler' or 'tile layer' who builds a strong foundation.

The original business model of Tyler Corporation involved acquiring established businesses and providing them with management expertise and capital for growth. While not a software company at its inception, this foundational strategy of acquiring and integrating diverse operations would later prove crucial in its transformation into a specialized technology provider.

Tyler Corporation's early focus was on acquiring and managing a range of industrial businesses.

- The initial funding came from initial public offerings and strategic investments.

- The company's early acquisitions included businesses in pipes, heavy equipment, and explosives.

- The late 1960s saw a trend of corporate conglomeration, influencing Tyler's initial strategy.

- This early phase was characterized by a focus on industrial businesses, including pipe, heavy equipment, and even explosives, a stark contrast to its current software-centric identity.

The early acquisitions were a mix of different industries. The company's focus was on building a diversified portfolio. The cultural and economic context of the late 1960s, marked by a period of corporate conglomeration, influenced Tyler's initial strategy of broad diversification. This strategy laid the groundwork for its future pivot towards government software and local government solutions.

The company's evolution from its industrial roots to its current focus on public sector technology is a significant part of the Tyler Technologies history. To understand how the company generates revenue, you can read about the Revenue Streams & Business Model of Tyler Technologies.

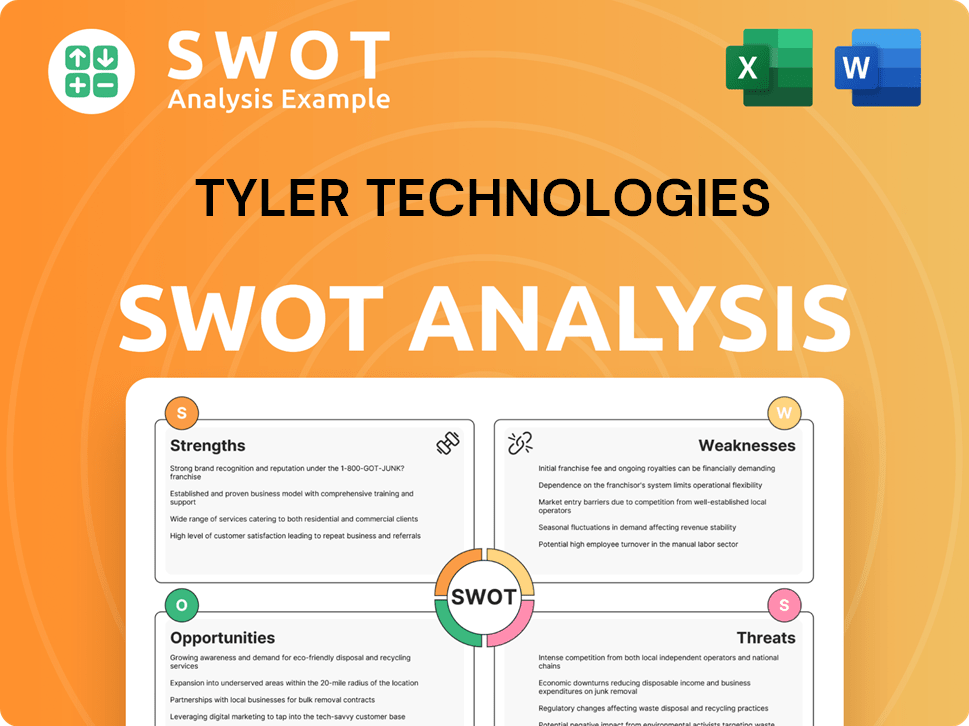

Tyler Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Tyler Technologies?

The early years of Tyler Technologies, formerly known as Tyler Corporation, were marked by a diverse range of acquisitions across various industries. This period of early growth focused on expanding the company's portfolio, leading to significant revenue increases. This initial phase provided valuable experience in managing diverse operations, setting the stage for future strategic shifts.

During the 1970s and 1980s, Tyler Technologies expanded into sectors such as truck components and industrial cleaning equipment. These ventures helped to build a solid foundation in managing diverse business operations. The company's early strategy involved integrating acquired businesses and improving operational efficiencies.

A pivotal change occurred in the late 1990s and early 2000s when Tyler Technologies began to focus on government software. This strategic pivot was driven by the growing demand for specialized technology solutions within government entities. Key acquisitions, like Eden Systems in 1998 and MuniFinancial in 2000, laid the groundwork for the company's future.

The acquisition of Eden Systems in 1998 provided financial management software, while MuniFinancial, acquired in 2000, specialized in property appraisal software. These acquisitions were crucial in establishing Tyler Technologies as a leading provider of government software. The company's growth was further fueled by the increasing adoption of digital solutions by government agencies.

By the mid-2000s, Tyler Technologies had largely completed its transformation, shedding its industrial past and fully embracing its new identity. This period saw an expansion of its client base and a broadening of its software offerings. The company established a strong foothold in the public sector market, becoming a key player in providing local government solutions.

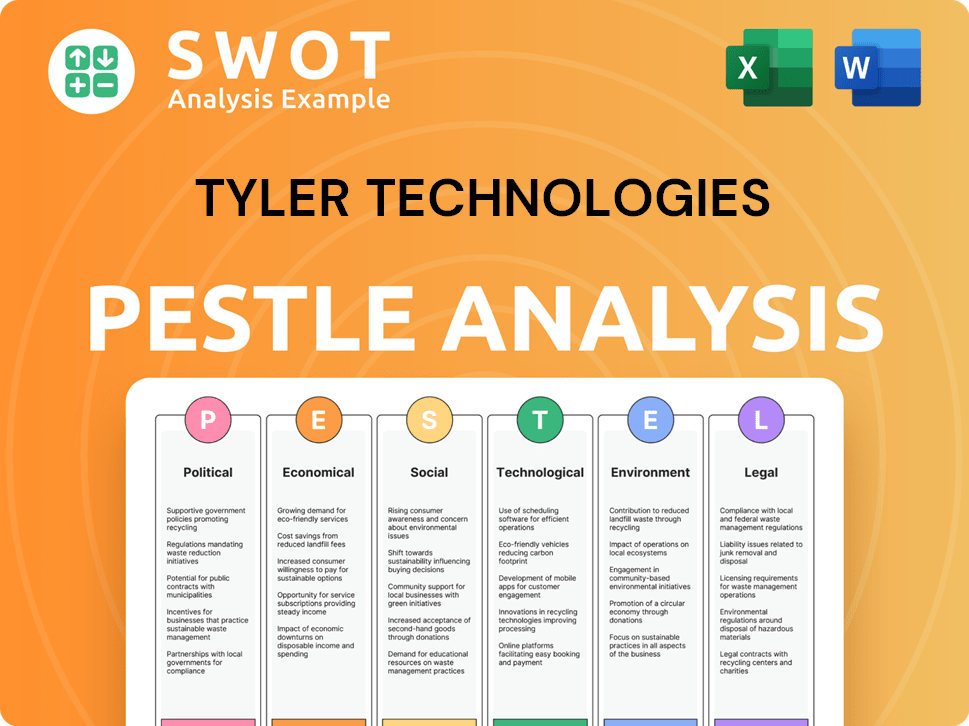

Tyler Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Tyler Technologies history?

The brief history of Tyler Technologies is marked by strategic decisions, technological advancements, and responses to market dynamics. A significant shift occurred in the early 2000s when the company focused solely on the public sector technology market, a move that shaped its trajectory. This strategic focus allowed it to develop specialized solutions and deepen its expertise in government software.

| Year | Milestone |

|---|---|

| Early 2000s | Strategic decision to concentrate solely on the public sector technology market. |

| 2021 | Acquisition of NIC Inc. for approximately $2.3 billion, expanding digital government services. |

| Ongoing | Continuous investment in research and development and strategic acquisitions to enhance offerings. |

Innovations at Tyler Technologies include the development of integrated platforms and the continuous enhancement of enterprise resource planning (ERP) solutions. The company has also been at the forefront of cloud-based solutions, improving data management for government agencies.

The development of integrated platforms, such as the Odyssey court case management system, has become a widely adopted solution for courts across the U.S. These platforms streamline operations and improve efficiency.

Continuous enhancement of enterprise resource planning (ERP) solutions, like Munis, helps governments manage financial operations, human resources, and other critical functions. These solutions are designed to meet the evolving needs of local government solutions.

Tyler Technologies has been at the forefront of cloud-based solutions, enabling government agencies to access and manage their data more efficiently and securely. This shift provides better data management and security.

Through acquisitions like NIC Inc., Tyler Technologies has expanded its digital government services. This expansion enhances citizen-facing solutions and payment processing capabilities.

Tyler Technologies consistently invests in research and development to meet client needs. This approach reinforces its commitment to client success and adapting to market demands.

Strategic acquisitions have been a key part of Tyler Technologies' growth strategy. These acquisitions complement existing offerings and expand its market reach.

Challenges for Tyler Technologies include the complexities of the public sector market and competition. Economic downturns and the need for continuous innovation also present ongoing hurdles.

Serving a diverse public sector market with varying regulatory requirements and budget constraints is a significant challenge. Adapting to these diverse needs requires flexibility and specialized solutions.

Economic downturns can impact government spending on technology, presenting financial challenges. This requires careful financial planning and strategic resource allocation.

Competition from other technology providers in the government space necessitates continuous innovation and differentiation. Staying ahead of the competition is critical for sustained success.

Adapting to evolving regulatory requirements in the public sector is an ongoing challenge. Compliance and adaptability are crucial for maintaining market relevance.

Government budget constraints can impact the adoption and implementation of new technologies. Providing cost-effective solutions is essential for securing contracts.

The company consistently invests in research and development, acquiring companies that complement its existing offerings. This focus reinforces Tyler's commitment to client success.

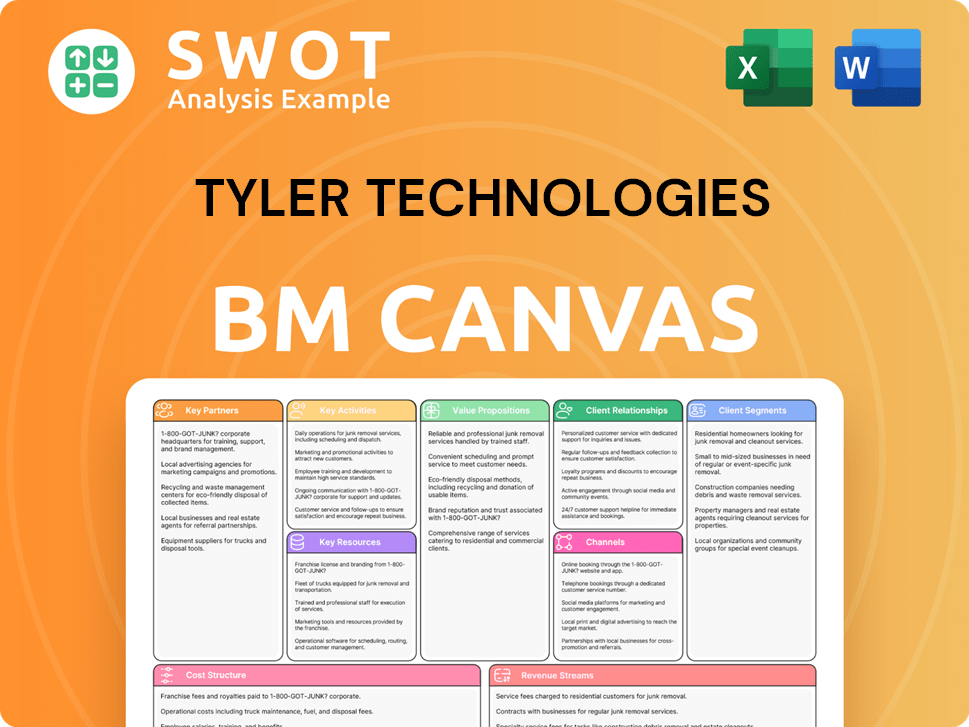

Tyler Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Tyler Technologies?

The history of Tyler Technologies is marked by strategic shifts and significant growth in the public sector technology market. Starting as a diversified holding company, the firm evolved into a leading provider of software solutions for government entities. Key acquisitions and product launches have shaped its trajectory, leading to its current position as a major player in the industry.

| Year | Key Event |

|---|---|

| 1966 | Founded as Tyler Corporation, a diversified holding company. |

| 1998 | Acquired Eden Systems, marking an early entry into government software. |

| 2000 | Acquired MuniFinancial, expanding its presence in property appraisal and tax administration. |

| Early 2000s | Began divesting non-software businesses to focus exclusively on public sector technology. |

| 2009 | Launched the Odyssey court case management system, a key product in the justice sector. |

| 2012 | Surpassed $1 billion in annual revenue, demonstrating substantial growth. |

| 2015 | Expanded cloud-based offerings, aligning with industry trends. |

| 2021 | Acquired NIC Inc. for approximately $2.3 billion, boosting digital government services. |

| 2023 | Announced strategic partnerships to integrate AI and data analytics. |

| 2024 | Continued to expand its client base, now serving over 13,000 public sector clients. |

The company is investing heavily in cloud-based solutions to meet the growing demand for Software-as-a-Service (SaaS) in the public sector. This includes migrating existing solutions to the cloud and developing new cloud-native applications. These efforts aim to improve scalability, security, and accessibility for clients. The shift towards cloud technology is driven by the need for greater flexibility and cost-effectiveness.

The company is integrating AI and data analytics to enhance its product offerings and provide more insights to its clients. This includes using AI for predictive analytics, automating tasks, and improving decision-making. The firm is also focused on leveraging data analytics to help government agencies improve efficiency and effectiveness. Strategic partnerships are being formed to accelerate these initiatives.

The acquisition of NIC Inc. significantly enhanced the company's digital government services, including online payment processing and licensing. The company is working to integrate these services further to provide more seamless digital interactions between governments and citizens. This includes expanding its payment processing capabilities and offering more citizen engagement platforms. The goal is to improve the overall user experience.

The company aims to expand its market share by targeting new government agencies and expanding its presence in existing client accounts. This involves offering a broader range of solutions and services. The firm's focus remains on client success, with a commitment to innovation and providing value to its customers. The company is working to enhance its customer support and training programs.

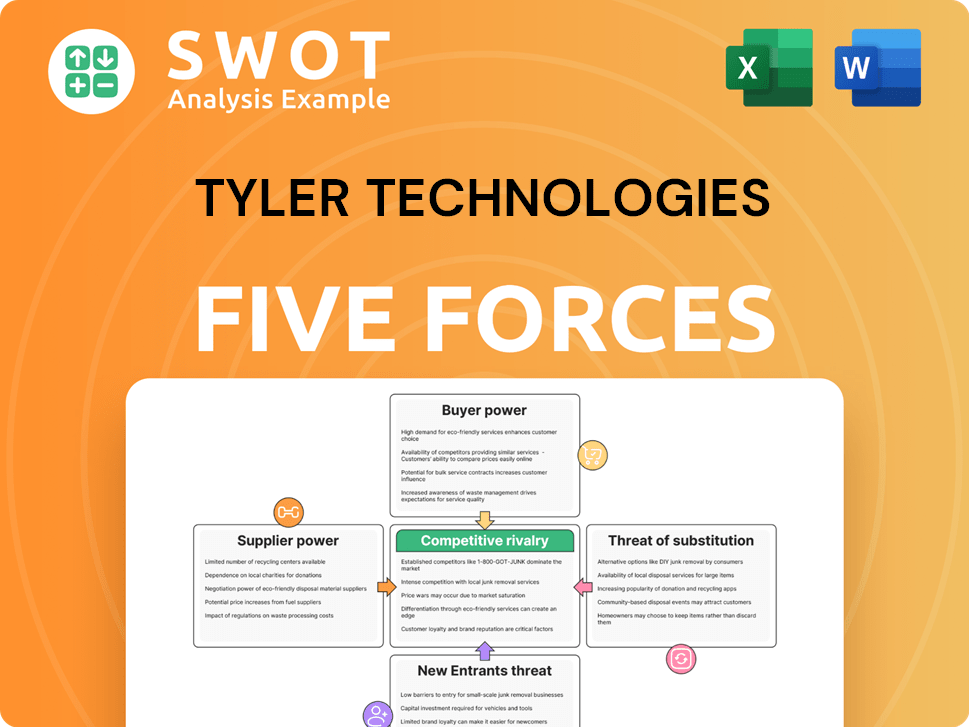

Tyler Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Tyler Technologies Company?

- What is Growth Strategy and Future Prospects of Tyler Technologies Company?

- How Does Tyler Technologies Company Work?

- What is Sales and Marketing Strategy of Tyler Technologies Company?

- What is Brief History of Tyler Technologies Company?

- Who Owns Tyler Technologies Company?

- What is Customer Demographics and Target Market of Tyler Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.