Yext Bundle

How Did Yext Become a Digital Powerhouse?

In the ever-evolving digital landscape, understanding the Yext SWOT Analysis is crucial. From its humble beginnings in 2006, Yext has carved a significant niche in the business world. This journey showcases how a company can transform from a lead-generation platform into a leading digital presence platform. Its story offers valuable insights into the strategies that drive success in the digital age.

The Yext company began with a clear vision to help businesses master their online presence, evolving from a local advertising focus to a comprehensive digital knowledge management solution. Exploring the Yext history reveals how the company adapted to the changing needs of the digital world. Today, Yext continues to innovate, leveraging AI and machine learning to empower brands. Understanding the Yext platform and its evolution is key to grasping its impact on how businesses connect with their customers.

What is the Yext Founding Story?

The story of the Yext company began on November 28, 2006. The company was founded by Howard Lerman, Brian Distelburger, and Brent Metz. These founders brought experience from previous internet ventures to the table.

Initially, the company was named GymTicket.com. It operated out of a small office in Columbus Circle, New York City. The initial goal was to help internet users find gyms and charge a fee when users called a gym for a trial membership. This early model proved successful, achieving $1 million in sales within its first year.

The founders identified a significant problem: businesses struggled to manage their online information and connect with potential customers. This insight led to a shift in strategy. By 2009, the company adopted a pay-per-call model and rebranded as Yext. Revenue grew rapidly, reaching $20 million that same year. Early financial backing came from venture capital. By 2012, Yext had raised $65.8 million from investors like Sutter Hill Ventures and Institutional Venture Partners. The founding team's experience in the internet landscape provided a strong base for their digital presence management venture. To learn more about the company's mission, vision, and core values, you can read this article: Mission, Vision & Core Values of Yext.

Yext's journey began with a simple idea that evolved to meet the needs of businesses in the digital age. The company's early success and strategic pivots highlight its adaptability and vision.

- Yext's early days started with GymTicket.com, a lead-generation service for gyms.

- The founders recognized the need for better online information management for businesses.

- The company's revenue hit $20 million by 2009 after rebranding to Yext.

- By 2012, Yext had secured $65.8 million in funding.

Yext SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Yext?

The early growth of the company, now known for its digital knowledge management platform, involved a significant strategic pivot. Initially focused on a pay-per-call lead generation model, the company shifted its focus to listings updates. This move allowed the company to concentrate on its core service, which became the foundation of its platform.

After selling its pay-per-call lead generation segment to IAC's CityGrid Media in August 2012, the company channeled its resources into its listings update service. By the time of this transition, the company had already managed approximately 950,000 updates for around 50,000 businesses. This strategic decision was supported by $65.8 million in funding, which facilitated the company's growth and expansion.

The company broadened its product offerings beyond basic listings, incorporating features like Pages, Reviews, and Analytics. This evolution into a comprehensive suite was driven by the need to provide businesses with a centralized platform for managing their online information across various digital channels. Early customer acquisition strategies targeted multi-location brands, assisting them in synchronizing data across search engines, maps, and voice assistants.

In 2016, the company reported revenues of $89 million, which reflected its growing market presence. The company's expansion was also marked by a significant increase in office space. The company's growth culminated in a successful Initial Public Offering (IPO) on the New York Stock Exchange in 2017, with a market capitalization of roughly $2 billion at the time. For more insights into the company's growth, consider reading about the Growth Strategy of Yext.

The company also expanded its global footprint, opening new offices worldwide. Key leadership changes included Michael Walrath, who became CEO in March 2022, succeeding founder Howard Lerman. This strategic shift marked a new chapter for the company, positioning it for continued growth and adaptation in the evolving digital landscape. The company's evolution showcases its commitment to innovation and its ability to adapt to market demands.

Yext PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Yext history?

The Yext company has achieved significant milestones, evolving from its early days to become a key player in digital knowledge management. The company's journey includes strategic pivots and product launches that have shaped its position in the market.

| Year | Milestone |

|---|---|

| 2019 | Rebranding and launch of the 'Search' product, expanding market focus. |

| August 2024 | Acquisition of Hearsay Systems, enhancing digital presence offerings. |

| February 2025 | Acquisition of Places Scout (now Yext Scout) for $20.3 million, bolstering competitive intelligence. |

| Q1 2025 | Achieved a 95% dollar-based net retention rate for direct customers. |

The company has continuously innovated, leveraging AI and machine learning to enhance its

The 'Search' product launch in 2019 was a pivotal innovation, enabling businesses to directly answer consumer questions across digital platforms.

Launched in early 2025, Yext Scout is an AI search and competitive intelligence agent designed to redefine brand visibility and simplify online reputation management.

The acquisition in August 2024 strengthened Yext's capabilities, aiming to provide an end-to-end digital presence platform.

Despite its successes,

Navigating macroeconomic challenges has required strategic adjustments and a focus on sustainable growth. The company has adapted by focusing on product innovation.

The rise of generative AI has necessitated rapid adaptation in the search landscape. Yext has responded by focusing on AI-driven solutions.

Improving customer retention rates has been a key strategy to navigate challenges. The company's focus on customer satisfaction has been crucial.

Yext Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Yext?

The Yext company journey began in 2006 as GymTicket.com, evolving into a leading digital presence management platform. The

Yext history

is marked by strategic pivots, technological advancements, and significant financial milestones, including a successful IPO and key acquisitions that have shaped its current market position. The company's evolution highlights its adaptability and commitment to empowering businesses in the digital landscape.| Year | Key Event |

|---|---|

| 2006 | Founded as GymTicket.com, a local advertising business, by Yext founder Howard Lerman, Brian Distelburger, and Brent Metz in New York City. |

| 2009 | Rebranded as Yext, transitioning to a pay-per-call lead generation model, and reaching $20 million in revenue. |

| 2012 | Sold the pay-per-call business to IAC's CityGrid Media to focus on listings management, after raising $65.8 million in funding. |

| 2017 | Completed a successful IPO on the New York Stock Exchange, with an approximate market cap of $2 billion. |

| 2019 | Rebranded and launched its 'Search' product, significantly expanding its market reach. |

| 2020 | Moved to its new headquarters, the Yext Building, in NYC's Chelsea neighborhood. |

| March 2022 | Michael Walrath succeeded Howard Lerman as CEO. |

| August 2024 | Completed the acquisition of Hearsay Systems. |

| December 2024 | Announced Q3 FY2025 financial results, reporting revenue of $114.0 million, up 13% year-over-year. |

| February 2025 | Acquired Places Scout, strengthening competitive intelligence. |

| March 2025 | Reported Q4 FY2025 revenue of $113.1 million, up 12% year-over-year, and full-year FY2025 revenue of $421.0 million. |

| April 2025 | Hosted Investor Day to discuss vision, strategy, and financial objectives. |

| May 2025 | Secured a $200 million debt facility from BlackRock to accelerate growth and strategic opportunities. |

| June 2025 | Announced Q1 FY2026 financial results, with revenue surging 14% year-over-year to $109.5 million and Annual Recurring Revenue (ARR) hitting $446.5 million. |

Yext anticipates continued revenue growth, projecting an average of 5.2% p.a. over the next three years. This growth is fueled by the evolving digital landscape and the increasing demand for effective digital presence management.

The company aims for adjusted EBITDA between $100.0 million and $103.0 million for FY2026. This focus on profitability reflects Yext's commitment to sustainable financial performance and operational efficiency.

Yext plans to expand its platform to meet customer demands across various verticals, including healthcare and data analytics. This expansion strategy aims to broaden its market reach and provide more comprehensive

Yext services

.The company is exploring opportunistic M&A to strengthen its market position and enhance its

Yext products

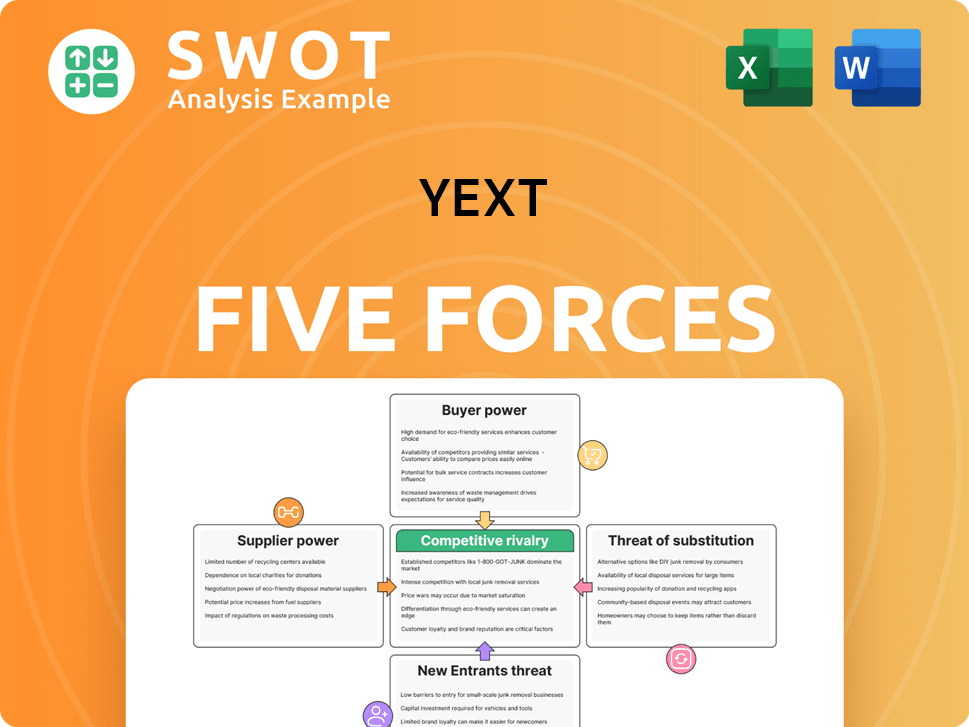

. This proactive approach underscores Yext's commitment to innovation and strategic growth.Yext Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Yext Company?

- What is Growth Strategy and Future Prospects of Yext Company?

- How Does Yext Company Work?

- What is Sales and Marketing Strategy of Yext Company?

- What is Brief History of Yext Company?

- Who Owns Yext Company?

- What is Customer Demographics and Target Market of Yext Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.