Air France-KLM Bundle

How Does Air France-KLM Navigate the Turbulent Skies of Airline Competition?

The airline industry is a high-stakes arena, constantly reshaped by strategic partnerships, technological advancements, and evolving consumer demands. Air France-KLM, a major player in this dynamic market, has demonstrated resilience and growth. Understanding the Air France-KLM SWOT Analysis is crucial to grasping its position in the competitive landscape.

This exploration delves into Air France-KLM's competitive landscape, examining its market share, strategic alliances, and key rivals. We'll analyze its financial performance, including its impressive revenue of €31.5 billion in 2024, and assess its position relative to competitors like Lufthansa and British Airways. Furthermore, we'll explore the impact of fuel prices, sustainability initiatives, and digital transformation on Air France-KLM's future strategies, providing a comprehensive airline industry analysis.

Where Does Air France-KLM’ Stand in the Current Market?

Air France-KLM holds a significant position in the global aviation market, operating from its dual hubs at Paris-Charles de Gaulle and Amsterdam-Schiphol. The group's core activities include passenger and cargo air transport, alongside aircraft maintenance, repair, and overhaul (MRO) services. This diversified approach allows Air France-KLM to capture various revenue streams and serve a broad customer base.

In 2024, Air France-KLM transported approximately 97.9 million passengers, marking a 4.7% increase from the previous year. This growth, combined with available seat kilometers (ASK) increasing by 3.6%, demonstrates the airline's capacity to expand its services and meet rising demand. The group's strategic focus on premium offerings and efficient operations contributes to its competitive edge within the airline industry analysis.

Air France-KLM maintains a strong market position, leveraging its extensive route network and strategic alliances. The group competes with major airlines globally, including Lufthansa and British Airways. Its market share is influenced by factors such as route profitability, customer satisfaction, and operational efficiency.

The group's revenue streams include passenger transport, cargo services, and MRO. In 2024, revenues reached €31.5 billion, reflecting a 4.8% increase compared to 2023. The operating result for the year was €1.601 billion, with an operating margin of 5.1%. This financial performance highlights the group's ability to generate substantial revenue and maintain profitability.

Air France-KLM serves a diverse customer base, including leisure and business travelers. The group offers premium and budget options through its main airlines, Air France and KLM, and its low-cost subsidiary, Transavia. Enhancements in premium offerings, such as La Première and Premium Comfort, cater to the high-end market.

Air France-KLM focuses on strategic initiatives to enhance its competitive position, including digital transformation and sustainability efforts. The company aims to achieve an operating profit margin of at least 8% by the end of 2024. For Q1 2025, the group reported revenues of €7.2 billion, up 7.7% compared to Q1 2024.

The airline's financial health is further evidenced by its efforts to reduce debt. As of March 2025, the net debt decreased to €6.9 billion, with a leverage ratio improving to 1.6x, aligning with its medium-term target. To better understand the group's customer base, you can explore the Target Market of Air France-KLM.

Air France-KLM's financial performance in 2024 and its projections for 2025 highlight its recovery and growth trajectory. The company's strategic focus on cost management and revenue generation is evident in its improved operating results and reduced debt.

- Revenue in 2024: €31.5 billion.

- Operating result in 2024: €1.601 billion.

- Operating margin in 2024: 5.1%.

- Net debt as of March 2025: €6.9 billion.

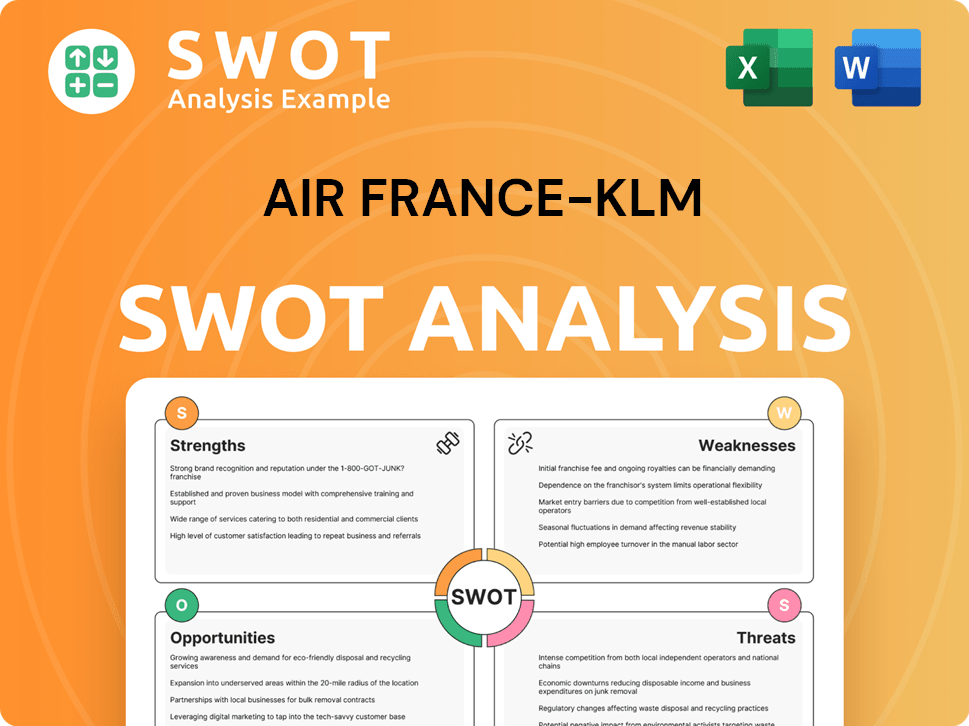

Air France-KLM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Air France-KLM?

The Air France-KLM operates within a highly competitive global aviation market, facing a multitude of rivals. This airline industry analysis reveals a complex interplay of traditional and emerging players, each vying for market share and customer loyalty. Understanding the competitive landscape is crucial for assessing the group's strategic positioning and future prospects.

The group's performance is significantly influenced by its ability to navigate this competitive environment, which includes managing costs, optimizing routes, and adapting to evolving customer preferences. The airline's financial health and strategic decisions are directly impacted by the actions of its competitors and the broader trends in the aviation sector. For a deeper dive into the group's financial performance, you can explore detailed insights on its revenue streams and financial strategies.

Air France-KLM's main competitors are diverse, spanning both European and international airlines. The group must continuously innovate and adapt to maintain its position in the global market. This requires a comprehensive understanding of its rivals' strategies and market dynamics.

Major European legacy carriers such as the Lufthansa Group and International Airlines Group (IAG) are primary competitors. These airlines challenge Air France-KLM through extensive networks and loyalty programs. They also focus on modernizing fleets and services.

Lufthansa Group includes Lufthansa, Swiss, Austrian Airlines, and Brussels Airlines. They compete directly on routes and customer service. The group's financial results and strategic decisions significantly impact the competitive dynamics.

IAG comprises British Airways, Iberia, Aer Lingus, and Vueling. They compete with Air France-KLM on various routes, particularly transatlantic and European routes. The group's strategies and financial performance are key factors.

Emirates, Qatar Airways, and Etihad Airways offer strong competition, especially on long-haul routes. These airlines often provide competitive pricing and high-quality premium services. Their extensive networks and customer service are significant factors.

Delta Air Lines and United Airlines are major competitors, particularly on transatlantic routes. These airlines have strong networks and frequent flyer programs. Their strategic alliances also impact the competitive landscape.

Ryanair and EasyJet drive price competition in short and medium-haul segments. Transavia, part of Air France-KLM, also competes in this segment. These carriers focus on point-to-point leisure and price-sensitive markets.

Air France-KLM's strategic alliances are crucial for expanding its network and enhancing competitiveness. Recent partnerships and acquisitions are aimed at improving global connectivity and customer benefits. These alliances directly impact market share and customer retention.

- The acquisition of a minority stake in SAS.

- Strategic partnership with Riyadh Air to expand network reach.

- These partnerships aim to offer reciprocal loyalty program benefits.

- These collaborations are key for Air France-KLM to stay competitive.

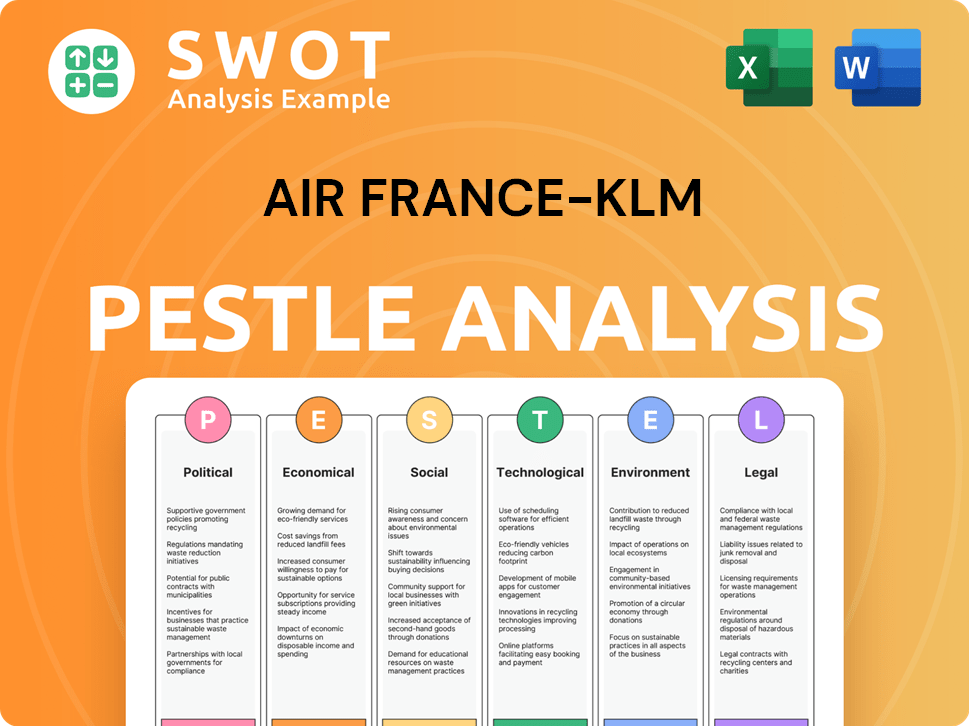

Air France-KLM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Air France-KLM a Competitive Edge Over Its Rivals?

Analyzing the Air France-KLM competitive landscape reveals several key advantages that position it strongly within the airline industry. The company's strategic moves, including fleet modernization and digital transformation, are designed to enhance operational efficiency and customer experience. These initiatives, coupled with a focus on sustainability, aim to solidify its market position and ensure long-term competitiveness.

Key milestones for Air France-KLM include investments in new-generation aircraft and the expansion of its sustainable aviation fuel (SAF) program. The group's commitment to customer satisfaction and digital innovation, such as personalized travel planning, further distinguishes it from competitors. These efforts are geared towards improving financial performance and adapting to evolving market dynamics. For a deeper dive, consider the Marketing Strategy of Air France-KLM.

The competitive edge of Air France-KLM is shaped by its extensive global network, strong brand equity, and dedication to operational excellence. By focusing on these areas, the company aims to maintain its market share and navigate the challenges of airline competition. Strategic alliances and a customer-centric approach are essential components of its long-term growth strategy.

Air France-KLM boasts a vast network, serving up to 300 destinations across 90 countries. This extensive reach, facilitated by hubs in Paris-Charles de Gaulle and Amsterdam-Schiphol, provides broad connectivity. This wide-ranging network is a significant advantage in the airline industry analysis.

The group benefits from strong brand equity and customer loyalty, particularly through its Flying Blue program, which celebrated its 20th anniversary in June 2025. The focus on service excellence aims to increase customer satisfaction ratings by 10% year-over-year as of 2024. This loyalty is a key factor in maintaining market share.

Air France-KLM is investing significantly in fleet modernization, with 27% of its fleet comprising new-generation aircraft by the end of 2024, aiming for 80% by 2030. These new aircraft are at least 15% more fuel-efficient, reducing CO2 emissions. This commitment to sustainability is crucial in the airline competition.

The group is engaged in a multi-year initiative with Accenture to migrate its digital applications to the cloud. This transformation aims to enhance agility and performance across all functions. KLM's 'Back on Track' program targets a €450 million structural improvement in EBIT. These efforts are vital for financial performance.

Air France-KLM's competitive advantages are multifaceted, encompassing its global network, strong brand, and sustainability initiatives. These elements contribute to its ability to navigate the airline competition landscape effectively. The group's strategic focus is on enhancing customer experience and operational efficiency.

- Extensive global network with strategic hub locations.

- Strong brand equity and customer loyalty, enhanced by the Flying Blue program.

- Significant investments in fleet modernization and sustainability, including SAF.

- Operational efficiency and digital transformation initiatives.

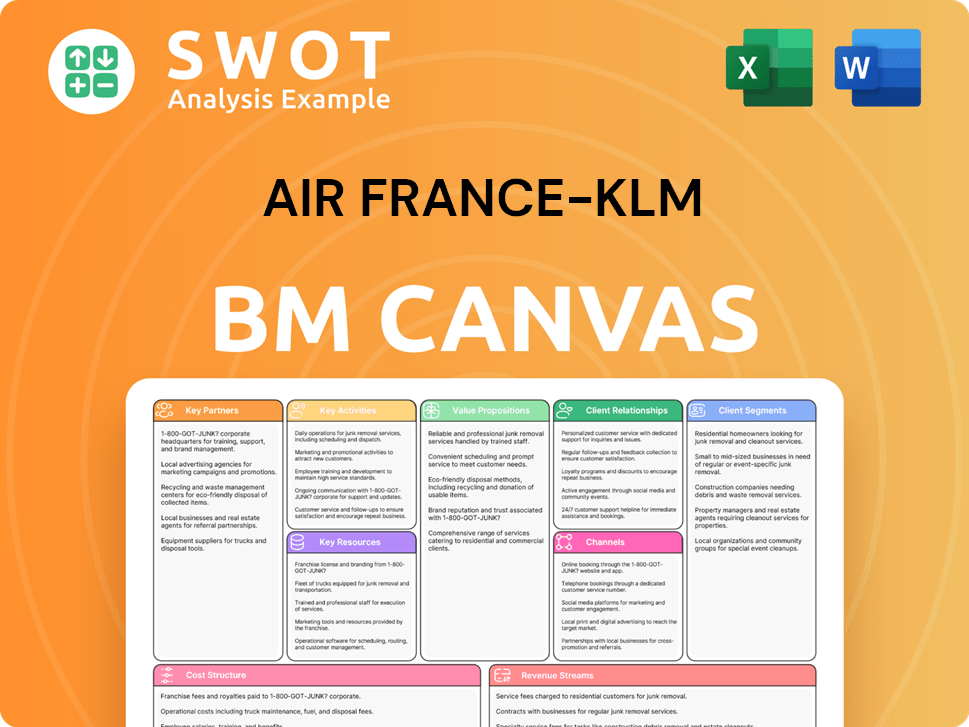

Air France-KLM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Air France-KLM’s Competitive Landscape?

The aviation industry's competitive landscape is currently undergoing significant shifts, driven by technological advancements, sustainability pressures, and evolving consumer expectations. For Air France-KLM, understanding these trends is crucial for maintaining and improving its market position. A comprehensive Growth Strategy of Air France-KLM is essential for navigating these complexities and capitalizing on emerging opportunities.

Air France-KLM faces both challenges and opportunities in this dynamic environment. Key risks include volatile fuel prices, geopolitical uncertainties, and inflationary pressures. However, strategic initiatives such as fleet renewal, digital transformation, and partnerships offer pathways to growth and enhanced operational efficiency.

The airline industry is shaped by technological advancements, particularly in sustainable aviation and digital transformation. Sustainable Aviation Fuel (SAF) and more fuel-efficient aircraft are critical. Digital transformation, including cloud migration and AI integration, is also a key trend.

Challenges include fluctuating fuel prices, geopolitical uncertainties, and inflationary pressures leading to rising unit costs. Unit costs rose by 3.2% in 2024. The competitive landscape remains fierce, especially in the transatlantic market.

Opportunities include capacity increases, with a 4-5% rise expected in 2025. Strategic partnerships, such as with Riyadh Air, are crucial for growth. The focus on premium segments and cargo operations also presents significant opportunities.

Air France-KLM is focusing on fleet renewal, aiming for 80% new-generation aircraft by 2030. The company aims for a 30% reduction in CO2 emissions per passenger-kilometer by 2030 compared to 2019 levels. Capital expenditures are projected between €3.2 billion and €3.4 billion for 2025.

Air France-KLM's competitive position depends on balancing profitability with sustainability, leveraging digital innovation, and expanding its network through partnerships. The cargo sector aims to increase revenues by 15% over the next two years.

- Fleet renewal with new-generation aircraft.

- Strategic partnerships to expand global reach.

- Focus on premium segments and product innovation.

- Digital transformation for operational efficiency.

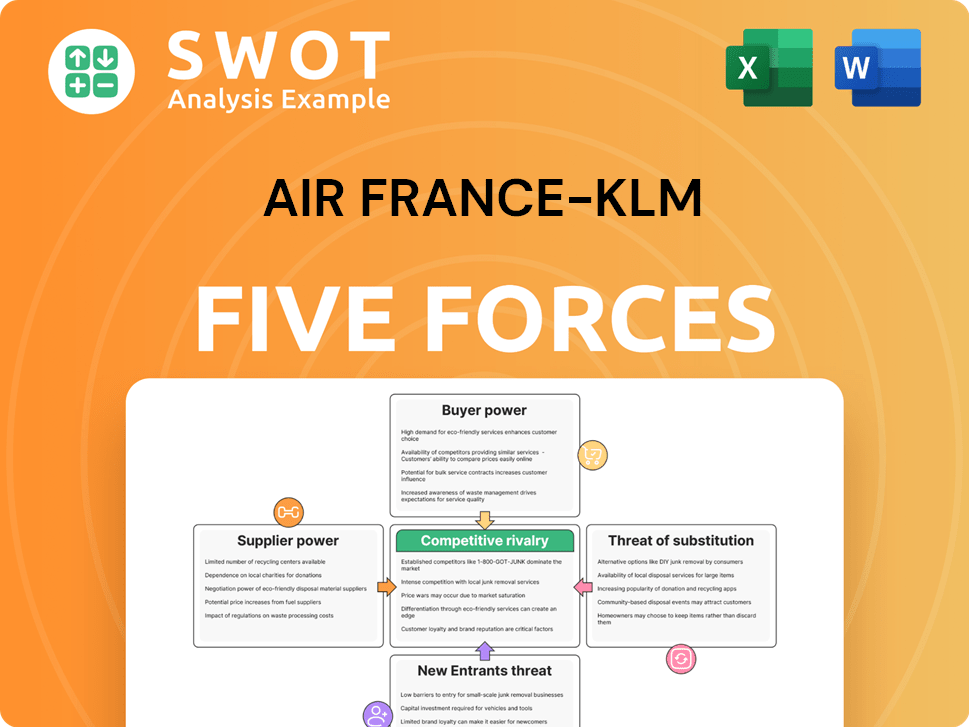

Air France-KLM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Air France-KLM Company?

- What is Growth Strategy and Future Prospects of Air France-KLM Company?

- How Does Air France-KLM Company Work?

- What is Sales and Marketing Strategy of Air France-KLM Company?

- What is Brief History of Air France-KLM Company?

- Who Owns Air France-KLM Company?

- What is Customer Demographics and Target Market of Air France-KLM Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.