Air Liquide Bundle

How Does Air Liquide Dominate the Industrial Gas Market?

Air Liquide, a titan in the industrial gas industry, has consistently adapted and thrived since its inception in 1902. Its strategic focus on innovation, especially in areas like hydrogen energy and sustainable solutions, highlights its forward-thinking approach. This article will dissect the Air Liquide SWOT Analysis, examining its competitive landscape and strategic positioning.

Understanding the Air Liquide competitive landscape is crucial for investors and strategists alike. We'll explore Air Liquide's competitors, analyzing their market share and how Air Liquide maintains its leading position. This competitive analysis will delve into Air Liquide's business strategy, detailing its strengths, weaknesses, and strategic partnerships within the global industrial gas market. Furthermore, we will examine Air Liquide's market position analysis to understand its performance compared to its main rivals.

Where Does Air Liquide’ Stand in the Current Market?

Air Liquide holds a strong market position in the industrial gas industry. It is often considered one of the top two global leaders, alongside Linde plc. The company's primary offerings include a wide range of industrial gases, such as oxygen, nitrogen, and hydrogen, along with related equipment and services. These products serve diverse sectors, including healthcare, chemicals, electronics, and energy.

Air Liquide's business strategy focuses on providing essential gases and services to various industries. Their value proposition centers around reliability, innovation, and sustainability. The company's commitment to these areas helps them maintain a competitive edge in the market. They also focus on expanding in emerging markets and strengthening their presence in established economies.

Air Liquide's global presence is substantial, operating in over 75 countries and serving more than 4 million customers and patients. The company's financial health remains robust, with a net profit of €3,083 million in 2023, showcasing its operational efficiency and market resilience. Air Liquide's market share is significant, and it consistently maintains a leading position in key markets.

Air Liquide's market share fluctuates by region and product segment, but it consistently holds a leading or co-leading position in key markets. The company's revenue in 2023 was €27.6 billion, demonstrating its significant scale within the industrial gas industry. This strong financial performance reflects its competitive advantages and strategic positioning.

Air Liquide operates in over 75 countries, serving a diverse customer base worldwide. The company has a particularly strong presence in Europe and North America. Air Liquide is actively expanding its presence and market share in Asia, demonstrating its commitment to global growth.

Air Liquide's product lines encompass a wide array of industrial gases, including oxygen, nitrogen, and hydrogen. They also provide related equipment and services. These offerings cater to various sectors, such as healthcare, chemicals, and electronics. The company's focus on innovation and sustainability drives its product development.

Air Liquide is increasing its emphasis on sustainable solutions and the hydrogen energy market. In 2024, the company announced significant investments in renewable hydrogen production. This strategic shift aims to capture growth opportunities in decarbonization efforts. For more details, check out the Revenue Streams & Business Model of Air Liquide.

Air Liquide's competitive advantages include its global presence, diverse product portfolio, and focus on innovation. The company's strong financial performance, with a net profit of €3,083 million in 2023, reflects its operational efficiency. Air Liquide's strategic partnerships and investments in sustainable solutions further strengthen its market position.

- Strong global presence in over 75 countries.

- Diverse product portfolio catering to multiple industries.

- Focus on innovation and sustainable solutions.

- Robust financial health and operational efficiency.

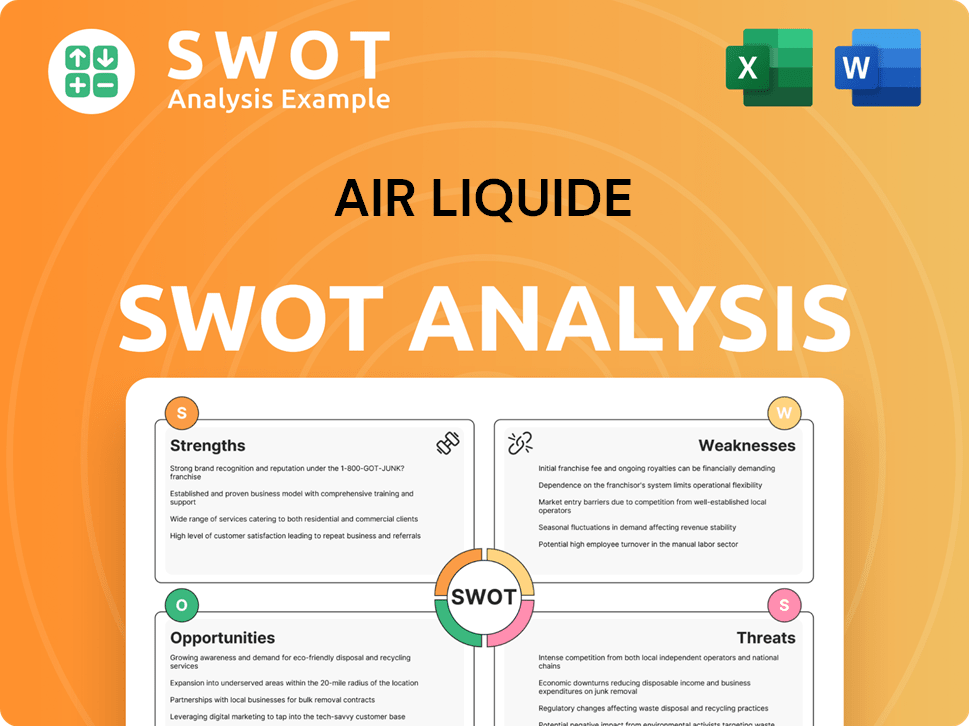

Air Liquide SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Air Liquide?

The Air Liquide competitive landscape is dominated by a few large players in the industrial gas industry. These companies compete globally, offering a wide range of gases and services to various sectors. Understanding the key Air Liquide competitors is crucial for assessing its market position and strategic direction.

Air Liquide's market share is influenced by its ability to compete effectively against these rivals. The competitive dynamics are shaped by factors such as geographical presence, technological innovation, and the ability to secure long-term contracts. The industrial gas market is capital-intensive, with significant barriers to entry, which further concentrates the competitive landscape.

Air Liquide's business strategy involves focusing on key growth areas like hydrogen and healthcare. The company aims to maintain its competitive edge through innovation and strategic partnerships. For more information about the company, you can check out the article about Owners & Shareholders of Air Liquide.

Linde plc is the most significant competitor to Air Liquide. Formed from the merger of Praxair and Linde AG in 2018, it is comparable in size and scope. The company offers a similar portfolio of industrial, medical, and specialty gases, along with related services and equipment.

Air Products and Chemicals, Inc. is another major competitor, particularly strong in North America. It is a key player in the hydrogen and helium markets. The company challenges Air Liquide through its focus on large-scale industrial gas projects.

Taiyo Nippon Sanso Corporation is a Japanese multinational company that represents a significant competitor, especially in Asia. It offers a comprehensive range of industrial gases and equipment. While smaller in global revenue, it holds strong regional market positions.

Indirect competition comes from companies developing in-house gas production capabilities. Technological advancements that alter gas consumption patterns also pose a challenge. Emerging players in renewable hydrogen could disrupt the traditional landscape.

Mergers and alliances have reshaped the competitive dynamics, leading to a more consolidated market. Scale and global reach are paramount in this environment. The Linde-Praxair merger is a prime example of this trend.

Air Liquide's competitive advantages include its global presence, technological expertise, and ability to secure long-term contracts. The company's focus on innovation and sustainability also contributes to its competitive edge. These factors help Air Liquide maintain its strong position in the market.

Several factors determine the competitive environment for Air Liquide. These include market share, pricing strategies, and technological advancements. The ability to adapt to changing market conditions is also crucial.

- Global Presence: Air Liquide operates in numerous countries, allowing it to serve a diverse customer base.

- Technological Innovation: Investment in R&D is critical for developing new products and processes.

- Customer Relationships: Long-term contracts and strong customer relationships are essential for retaining market share.

- Sustainability: Growing focus on sustainable practices and green technologies, like hydrogen.

- Financial Performance: The company's financial health and investment in future growth.

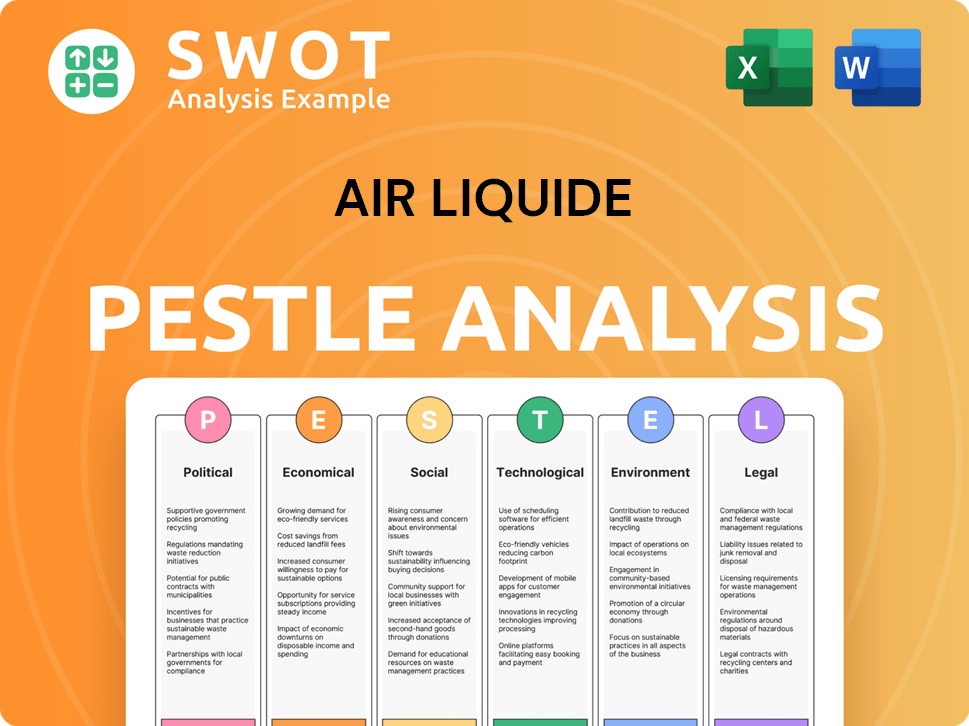

Air Liquide PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Air Liquide a Competitive Edge Over Its Rivals?

Understanding the Air Liquide competitive landscape involves assessing its key strengths and strategic positioning within the industrial gas industry. The company's robust infrastructure, technological prowess, and established customer relationships are crucial elements. Analyzing Air Liquide's market share and comparing its performance against Air Liquide competitors provides a comprehensive view of its competitive advantages.

Air Liquide's competitive edge is significantly shaped by its global reach and operational efficiency. The company's extensive network, spanning over 75 countries, facilitates reliable supply chains and economies of scale. This global presence allows Air Liquide to serve a diverse customer base efficiently, reducing transportation costs and enhancing its market position. A detailed competitive analysis of Air Liquide reveals how these factors contribute to its sustained success.

Air Liquide's business strategy emphasizes innovation and sustainability, particularly in the hydrogen market. Its investments in research and development, especially in areas like healthcare and electronics, ensure a continuous pipeline of innovative products. The company's focus on decarbonization and low-carbon hydrogen solutions positions it favorably for future market demands. Recent strategic moves and acquisitions further strengthen its market position.

Air Liquide operates in over 75 countries, providing a vast network of production and distribution. This extensive footprint allows for efficient supply chains and reduced transportation costs. The company's global presence is a key factor in its ability to serve a diverse customer base and maintain a strong Air Liquide market share.

Air Liquide holds numerous patents in gas production, purification, and application development. Its expertise in hydrogen technologies, including electrolysis and liquefaction, is a significant differentiator. These technological advancements enable the company to offer specialized gases and innovative solutions tailored to specific industry needs.

Air Liquide has cultivated deep relationships with major industrial clients over decades. These long-standing partnerships often involve integrating gas supply directly into their production processes, creating high switching costs. This customer loyalty contributes to the company's stability and sustained market position.

Significant investments in research and development, particularly in healthcare, electronics, and sustainable solutions, ensure a continuous pipeline of innovative products and services. Air Liquide's commitment to decarbonization and the development of low-carbon hydrogen solutions positions it favorably for future market demands. This focus on innovation is key to its long-term success.

Air Liquide's competitive advantages are rooted in its global infrastructure, technological leadership, and strong customer relationships. These factors create significant barriers to entry for new competitors, ensuring sustainable growth. For a deeper dive, consider reading an article about Air Liquide's financial performance compared to competitors.

- Extensive Global Network: Operations in over 75 countries, providing efficient supply chains.

- Technological Innovation: Numerous patents and expertise in hydrogen technologies.

- Strong Customer Relationships: Long-standing partnerships with major industrial clients.

- Focus on Sustainability: Investments in decarbonization and low-carbon hydrogen solutions.

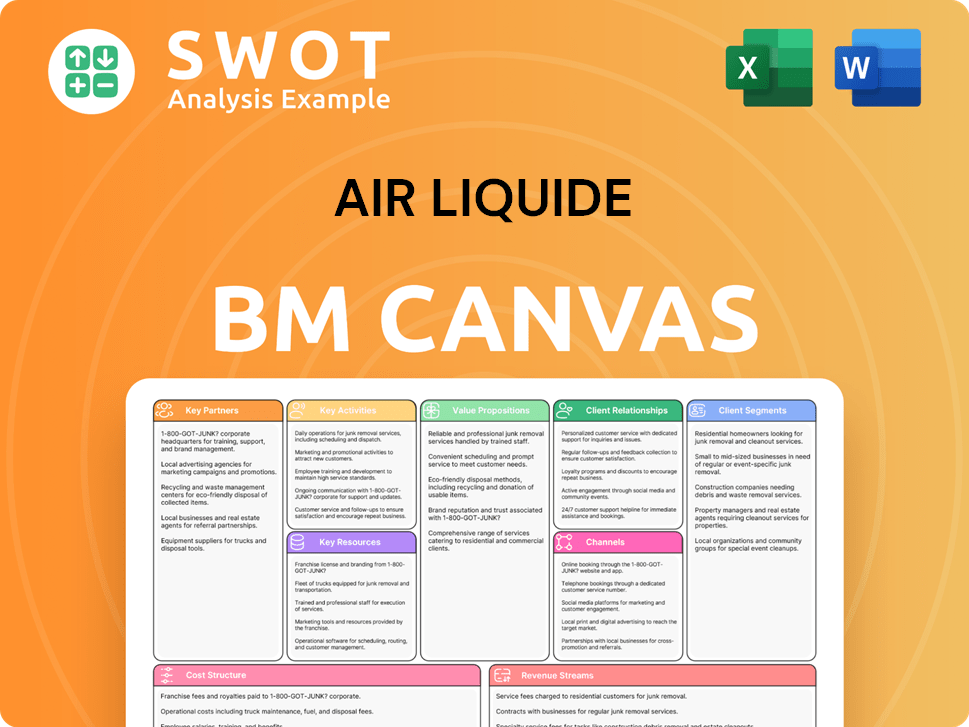

Air Liquide Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Air Liquide’s Competitive Landscape?

The industrial gas industry is experiencing significant shifts, driven by sustainability efforts, technological advancements, and evolving market demands. These trends present both challenges and opportunities for companies like Air Liquide, impacting its competitive landscape and strategic direction. Understanding these dynamics is crucial for assessing Air Liquide's future prospects and its ability to maintain its market share.

Air Liquide's competitive position is influenced by its ability to adapt to these changes, manage risks, and capitalize on emerging opportunities. The company faces pressures from competitors, regulatory changes, and economic fluctuations. Simultaneously, it can leverage its expertise, strategic partnerships, and innovation to drive growth and enhance its market presence. A thorough competitive analysis Air Liquide is essential for investors and stakeholders to make informed decisions.

The industrial gas industry is currently undergoing a transformation, with a strong emphasis on decarbonization and sustainability. The growth of the electronics and healthcare sectors is also fueling demand. Technological innovations in green hydrogen production and carbon capture are reshaping the competitive environment for companies like Air Liquide. These trends are further detailed in a Marketing Strategy of Air Liquide article.

Air Liquide faces challenges from intensified competition, especially from emerging players. There's also the potential for customers to develop in-house gas production capabilities. Regulatory changes regarding carbon emissions and industrial safety could impact operational costs. Economic slowdowns in key industrial sectors could also temper demand.

Significant growth opportunities exist in emerging markets, driven by industrialization and healthcare infrastructure development. The increasing demand for medical oxygen and home healthcare services presents a robust growth avenue. Innovations in semiconductor manufacturing are driving demand for ultra-pure gases. Strategic partnerships are key to unlocking future growth.

Air Liquide is implementing strategies like its 'ADVANCE' strategic plan, focusing on sustainable performance and decarbonization. This initiative aims to reinforce its competitive position and achieve long-term growth. The company is actively involved in strategic partnerships, particularly in large-scale hydrogen projects and carbon capture initiatives.

The industrial gas industry is projected to continue growing, driven by increasing demand from various sectors. The global industrial gases market was valued at approximately $120 billion in 2023. The hydrogen market, a key area for Air Liquide, is expected to reach a value of over $170 billion by 2030. These figures highlight the potential for Air Liquide to expand its market presence.

- Decarbonization: The push for sustainable solutions is a major trend, creating demand for low-carbon gases and technologies.

- Technological Advancements: Innovations in green hydrogen and carbon capture offer both challenges and opportunities.

- Emerging Markets: Industrialization and healthcare expansion in these regions drive growth.

- Strategic Partnerships: Collaborations are crucial for large-scale projects and market expansion.

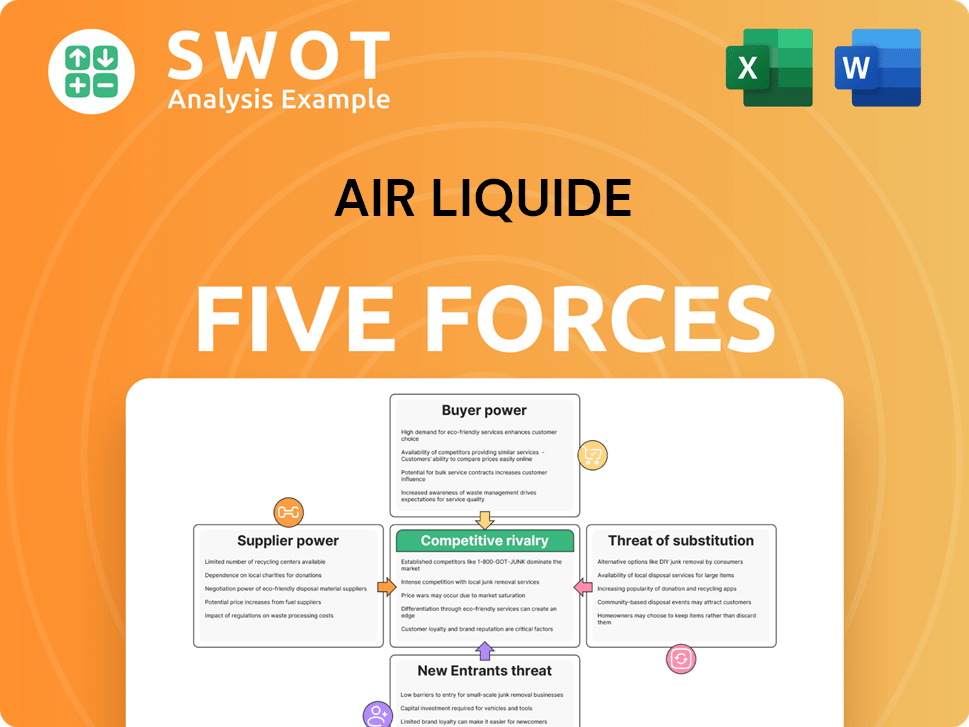

Air Liquide Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Air Liquide Company?

- What is Growth Strategy and Future Prospects of Air Liquide Company?

- How Does Air Liquide Company Work?

- What is Sales and Marketing Strategy of Air Liquide Company?

- What is Brief History of Air Liquide Company?

- Who Owns Air Liquide Company?

- What is Customer Demographics and Target Market of Air Liquide Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.