Arrow Electronics Bundle

How Does Arrow Electronics Compete in Today's Tech World?

In the fast-paced world of technology, understanding the competitive landscape is crucial for success. Arrow Electronics, a giant in the electronics distribution industry, plays a vital role in connecting innovation with practical application. But who are its main rivals, and what strategies does it employ to maintain its leading position? A deep dive into the Arrow Electronics SWOT Analysis reveals key insights.

This exploration of Arrow Electronics' competitive landscape will provide a comprehensive market analysis, examining its key rivals and competitive advantages within the semiconductor market and broader technology supply chain. We'll analyze Arrow Electronics' market share analysis, financial performance, and industry position, along with its supplier relationships and customer base analysis. Furthermore, we'll examine its growth strategies, recent acquisitions, geographic presence, and future outlook, comparing it to competitors like Avnet and Future Electronics to understand the challenges and opportunities ahead.

Where Does Arrow Electronics’ Stand in the Current Market?

The competitive landscape for Arrow Electronics is shaped by its significant presence in the electronics distribution industry and its strategic focus on enterprise computing solutions. The company's core operations revolve around distributing electronic components and providing enterprise computing solutions, serving a broad customer base across various sectors. In 2024, the company reported consolidated sales of $27.923 billion, demonstrating its substantial scale and market reach.

Arrow's value proposition lies in its ability to provide a comprehensive range of products and services, including electronic components, enterprise computing solutions, and supply chain management. This integrated approach enables the company to meet the diverse needs of its customers, from design and engineering to supply chain optimization. Despite facing market challenges, Arrow's focus on operational efficiency and strategic investments, such as a 15% increase in investments in the Asia-Pacific region in fiscal year 2024, supports its position in the Arrow Electronics market analysis.

In 2023, Arrow Electronics reported $9.4 billion in global electronic components distribution revenue. The company held a 34.2% market share in North American electronic components distribution. These figures highlight Arrow's strong market position in the electronics distribution industry.

The Global Enterprise Computing Solutions (ECS) segment saw Q4 2024 sales increase by 12% year-over-year to $2.47 billion. The ECS segment also saw an 18% increase year-over-year in Q1 2025, reaching $2.04 billion. These results indicate growth and effective execution in key areas.

Arrow serves over 85 countries with a global network of more than 460 locations. The company's widespread presence allows it to cater to a diverse customer base and adapt to regional market dynamics. Strategic expansion in high-growth markets, such as the Asia-Pacific region, is a key focus.

Arrow generated over $1.1 billion in cash flow from operations in 2024. The company reduced its inventory by $1.1 billion and returned $250 million to shareholders through stock repurchases. These financial metrics demonstrate the company's financial discipline.

Arrow Electronics' competitive advantages include its extensive product portfolio, global reach, and strong supplier relationships. The company's ability to navigate market fluctuations, as seen in its exceeding guidance ranges in Q4 2024 and Q1 2025, is also significant. These strengths are crucial in the electronics distribution industry.

- Strong Market Position: High market share in North American electronic components distribution.

- Diversified Revenue Streams: Operations through Global Components and Global ECS segments.

- Global Footprint: Presence in over 85 countries, facilitating broad market access.

- Financial Discipline: Demonstrated by strong cash flow and shareholder returns.

Arrow Electronics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Arrow Electronics?

The Arrow Electronics competitive landscape is characterized by intense rivalry within the electronics distribution industry. Several companies compete directly with Arrow, vying for market share in the semiconductor market and technology supply chain. Understanding these key rivals is crucial for a comprehensive Arrow Electronics market analysis.

The competition affects Arrow's financial performance and industry position. Analyzing Arrow Electronics key rivals provides insights into the company's competitive advantages, challenges, and opportunities. This analysis also helps in understanding Arrow Electronics' growth strategies and future outlook.

Arrow Electronics faces a dynamic competitive environment. The electronics distribution industry is subject to fluctuations, including changes in sales and the emergence of new players. The competitive landscape is also influenced by mergers and alliances.

The primary competitor in the electronic components distribution space is Avnet. Other notable competitors include TD SYNNEX, Insight Enterprises, and PC Connection.

In 2023, Avnet surpassed Arrow in revenue, reporting $25.58 billion compared to Arrow's $25.42 billion.

Additional competitors include ScanSource, Richardson Electronics, Ingram Micro, TTI, and Integrated Micro-Electronics.

In IT services solutions, Arrow ECS faces competition from companies such as UST, Genpact, Wipro, and Tata Consultancy Services.

The global electronic components industry experienced declining sales in 2024, impacting distributors like Arrow and Avnet. New players in AI-driven supply chain analytics also pose a disruptive force.

TD SYNNEX is often viewed favorably by equities analysts. Some competitors, like WPG and Wintrue Technology, saw revenue growth in the second half of 2023.

Arrow's operating revenue declined in 2024, indicating potential market share loss. The electronics distribution industry is highly competitive, with rivals constantly seeking to capture market share. Understanding these challenges is essential for assessing Arrow Electronics' future outlook.

- Avnet: A major direct competitor, consistently vying for market share.

- TD SYNNEX: Often favored by analysts, presenting a strong competitive force.

- Market Fluctuations: The overall decline in sales in the global electronic components industry in 2024.

- Emerging Players: New companies, particularly in AI-driven supply chain analytics, pose a disruptive threat.

Arrow Electronics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Arrow Electronics a Competitive Edge Over Its Rivals?

Understanding the Brief History of Arrow Electronics is crucial for assessing its competitive advantages within the electronics distribution industry. The company has strategically positioned itself through key milestones and strategic moves. These actions have shaped its competitive edge in a dynamic market, influencing its market share and industry position.

The company's success stems from a combination of factors, including its extensive global reach and a focus on value-added services. These elements differentiate it from competitors in the semiconductor market. Arrow's ability to adapt and innovate, particularly in emerging technologies, further strengthens its position. This approach is vital for navigating the challenges and opportunities within the technology supply chain.

Arrow Electronics' competitive advantages are multifaceted, encompassing its global infrastructure, comprehensive service offerings, and strategic focus on cutting-edge technologies. These advantages contribute to its sustainable competitive edge in the evolving technology distribution sector. The company's strategic initiatives and investments underscore its commitment to maintaining a strong market position.

Arrow's expansive global network is a cornerstone of its competitive strategy. With operations in over 85 countries and more than 460 locations worldwide, the company ensures efficient product delivery. This broad geographic presence facilitates access to diverse markets for both suppliers and customers. The company's distribution network is a key factor in its market share analysis and overall financial performance.

A significant differentiator for Arrow is its commitment to value-added services. These services include engineering support and supply chain management solutions. This focus helps customers navigate complex technology challenges, which is crucial in the semiconductor market. The shift towards specialization and support in high-demand verticals is a strategic move, impacting its customer base analysis.

Arrow actively engages in emerging technologies, focusing on AI and automotive solutions in 2024. The company plans to expand in smart AI-related fields, enabling channel partners to monetize technology trends. This includes expanding its managed services portfolio, offering private label services. These initiatives are key to its growth strategies.

In 2024, Arrow invested $150 million in research and development, driving advancements in areas such as IoT and cloud computing. This investment demonstrates its commitment to innovation and maintaining a competitive edge. These efforts are crucial for addressing the challenges and opportunities within the electronics distribution industry.

Arrow Electronics' competitive advantages are rooted in its extensive global network, value-added services, and strategic focus on emerging technologies. These elements collectively contribute to its strong industry position. The company's ability to adapt and innovate is key to its future outlook.

- Global Footprint: Serving over 85 countries with more than 460 locations.

- Value-Added Services: Providing engineering support and supply chain management.

- Strategic Technology Focus: Investments in AI, IoT, and cloud computing.

- Financial Commitment: R&D investment of $150 million in 2024.

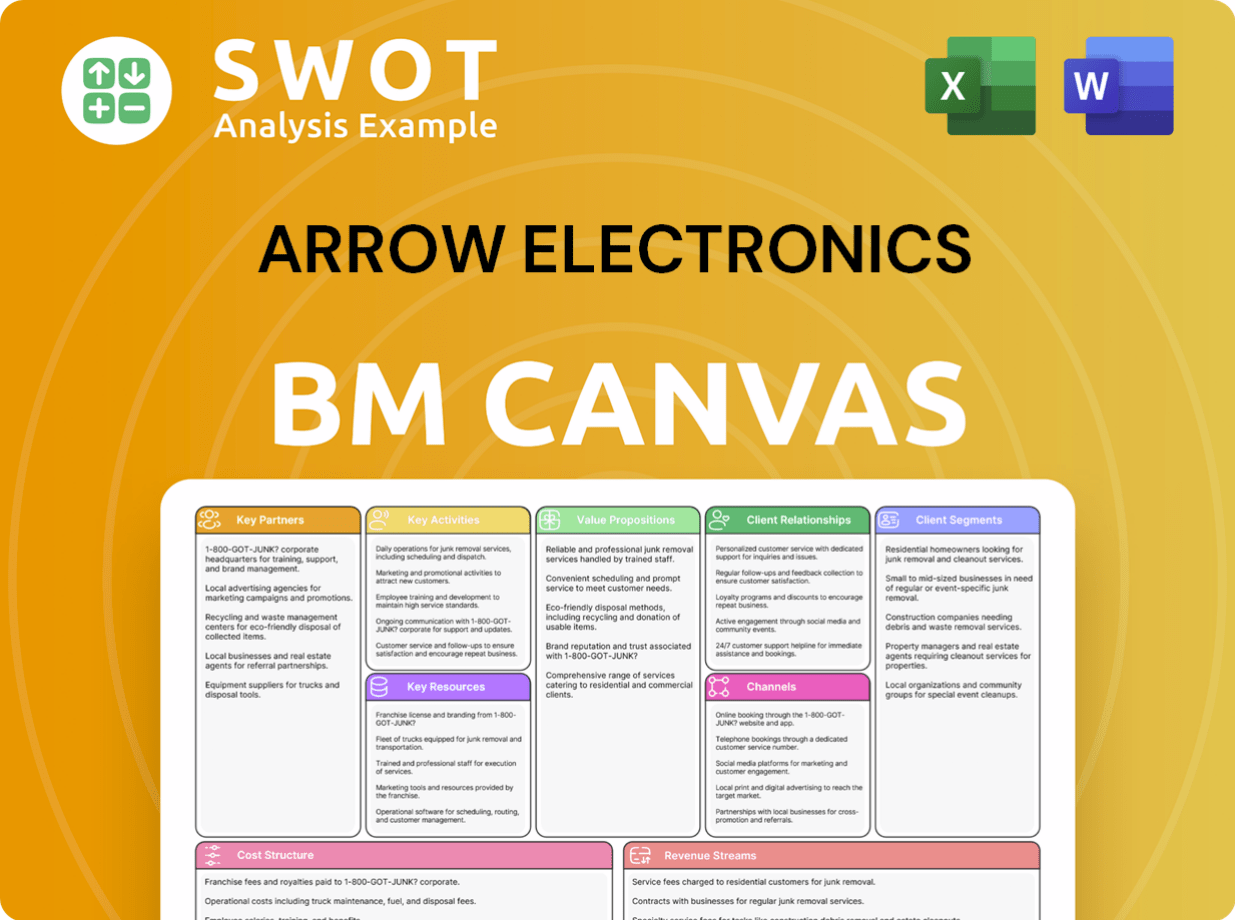

Arrow Electronics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Arrow Electronics’s Competitive Landscape?

The Growth Strategy of Arrow Electronics is significantly influenced by the dynamic shifts within the electronics distribution industry. The company navigates a landscape shaped by technological advancements, evolving consumer demands, and global economic fluctuations. Analyzing the Arrow Electronics competitive landscape reveals a strategic focus on emerging trends, including AI and green energy solutions, to maintain its industry position and capitalize on future growth opportunities.

Understanding the Arrow Electronics market analysis is crucial for assessing its ability to overcome challenges like supply chain complexities and macroeconomic uncertainties. The company's strategic initiatives and its response to market dynamics are key to its financial performance and long-term success. The competitive landscape also involves understanding the Arrow Electronics key rivals, such as Avnet and Future Electronics, to assess its market share and competitive advantages.

The electronics distribution industry is undergoing significant transformation. A major trend is the increasing integration of AI across various sectors. Arrow is actively involved in this space, showcasing AI, robotics, and cyber resilience solutions. The shift of AI to Edge devices also creates new opportunities for designers. The company is focusing on AI and automotive solutions, planning to expand further into smart AI-related fields, and is working to help customers design and build AI products by providing expertise in component selection, model training, and deployment strategies.

The industry faces several challenges, including supply chain complexities and macroeconomic uncertainty. Semiconductor shortages have eased, but their impact was substantial, with an estimated $510 billion in lost revenue between 2021 and 2022. Tariffs and geopolitical conflicts re-emerge as critical concerns for electronics component distributors, creating uncertainty and increased risk. The global electronic components industry has also experienced a destocking cycle and weakened downstream demand, leading to a general decline in sales in 2024 for many distributors, including Arrow.

Opportunities for growth abound, particularly in hybrid cloud and AI-related solutions. Arrow is well-positioned to capitalize on these trends within its enterprise computing solutions segment. Diversification into green energy solutions, such as EV components, and cybersecurity infrastructure, also supports long-term tech trends. Strategic initiatives like its push into AI-driven supply chain analytics are key areas for future growth. As the market anticipates a gradual recovery in 2025, driven by declining inventory levels and expanding customer and supplier bases, Arrow's strategic direction is crucial for maximizing returns.

The market anticipates a gradual recovery in 2025. Arrow's strategic direction, including its focus on value-added services and alignment with high-growth markets, is crucial for remaining resilient. The company's ability to adapt to changing conditions, manage supply chain risks, and capitalize on emerging technologies will determine its future success. The company's focus on value-added services and alignment with high-growth markets is crucial for remaining resilient and maximizing returns.

Arrow's strategic focus areas include AI, automotive solutions, and green energy. The company's initiatives in AI-driven supply chain analytics and its expansion into hybrid cloud solutions are key drivers for future growth. These initiatives are designed to capitalize on emerging trends and improve operational efficiency.

- AI and Automotive Solutions: Expanding into smart AI-related fields.

- Green Energy Solutions: Focusing on EV components and cybersecurity infrastructure.

- Supply Chain Analytics: Implementing AI-driven solutions for improved efficiency.

- Value-Added Services: Offering expertise in component selection and deployment strategies.

Arrow Electronics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Arrow Electronics Company?

- What is Growth Strategy and Future Prospects of Arrow Electronics Company?

- How Does Arrow Electronics Company Work?

- What is Sales and Marketing Strategy of Arrow Electronics Company?

- What is Brief History of Arrow Electronics Company?

- Who Owns Arrow Electronics Company?

- What is Customer Demographics and Target Market of Arrow Electronics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.