Autobio Diagnostics Bundle

How Does Autobio Diagnostics Stack Up in the IVD Arena?

The in-vitro diagnostics (IVD) market is a dynamic sector, constantly evolving with new innovations in disease detection. Autobio Diagnostics Co., Ltd., a key player in this space, has significantly impacted both the Chinese and global markets. This article provides a detailed look into the competitive landscape surrounding this leading Autobio Diagnostics SWOT Analysis company.

This detailed market analysis examines the competitive landscape of the autobio diagnostics, including its market position and key competitors. We'll explore industry trends and delve into the competitive advantages of autobio companies, offering insights into the diagnostic testing sector. Understanding the autobio diagnostics market size and trends is crucial for anyone looking to navigate this complex industry, from investment decisions to strategic business planning.

Where Does Autobio Diagnostics’ Stand in the Current Market?

Autobio Diagnostics Co., Ltd. holds a significant market position within the global in-vitro diagnostics (IVD) industry, particularly in China. The company is recognized as one of the leading domestic IVD manufacturers in China, offering a comprehensive suite of instruments, reagents, and services for clinical laboratories. Its product lines include immunoassay, microbiology, biochemistry, molecular diagnostics, and point-of-care testing (POCT) products.

The company has expanded its geographic presence beyond China, with its products being sold in over 100 countries and regions globally. This international reach underscores a shift in positioning from a purely domestic focus to a more global outlook, diversifying its customer segments. Autobio Diagnostics serves a broad range of customers, including hospitals, clinics, and independent diagnostic laboratories.

While specific global market share figures for 2024-2025 are not readily available, the company has historically demonstrated robust financial performance, enabling it to invest in R&D and global expansion. Autobio Diagnostics maintains a particularly strong position in the immunoassay segment within China, a testament to its early focus and continuous innovation in this area. For more details on their customer base, consider reading about the Target Market of Autobio Diagnostics.

Autobio Diagnostics is a leading domestic IVD manufacturer in China. The company's strong presence in China is a key aspect of its overall market position. Autobio Diagnostics has a significant market share in the immunoassay segment within China.

Autobio Diagnostics products are sold in over 100 countries and regions globally. This international presence is a key factor in the company's competitive landscape. The company's global expansion diversifies its customer segments, reducing reliance on the domestic market.

Autobio Diagnostics serves a broad range of customers. Key customers include hospitals, clinics, and independent diagnostic laboratories. The diverse customer base helps to stabilize revenue streams and mitigate risks associated with market fluctuations.

Historically, the company has demonstrated robust financial performance. This strong financial health enables investments in R&D and global expansion. The company's financial stability supports its long-term growth strategy and competitive advantages.

Autobio Diagnostics' success is rooted in its strong domestic presence and expanding global reach. The company's diverse product portfolio and comprehensive solutions cater to a wide range of diagnostic needs. Continuous innovation and investment in R&D are vital for maintaining a competitive edge in the IVD market.

- Leading position in the Chinese IVD market.

- Expanding global presence with products in over 100 countries.

- Strong financial performance enabling R&D and expansion.

- Focus on immunoassay, a key segment in the industry.

Autobio Diagnostics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Autobio Diagnostics?

The competitive landscape for autobio diagnostics is intensely shaped by both global and domestic players in the in-vitro diagnostics (IVD) market. This environment is characterized by rapid technological advancements, stringent regulatory requirements, and evolving customer demands. Understanding the key competitors is crucial for any autobio company looking to maintain or expand its market position.

Autobio diagnostics faces a multifaceted competitive environment, necessitating a detailed market analysis to identify and assess its rivals. The competition spans a wide range of companies, from established multinational corporations to emerging domestic firms, each vying for market share through various strategies, including product innovation, pricing, and distribution network expansion. This dynamic landscape requires continuous monitoring and strategic adaptation.

The autobio company must navigate a complex web of competitors, each with unique strengths and weaknesses. These competitors range from global giants with extensive resources to agile domestic players with a deep understanding of local markets. The competitive dynamics are further complicated by the ongoing trends in the diagnostic testing industry, including mergers, acquisitions, and technological advancements.

The primary global competitors include Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Danaher Corporation (through its subsidiaries like Beckman Coulter), and Thermo Fisher Scientific. These companies have a significant impact on the autobio diagnostics market due to their extensive product portfolios and global reach.

Roche Diagnostics is a major player in immunoassays and molecular diagnostics. In 2024, Roche reported sales of CHF 43.4 billion in its diagnostics division, demonstrating its strong market presence and financial capabilities. They often challenge autobio diagnostics with advanced technology and comprehensive solutions.

Abbott Laboratories competes strongly across immunoassay, molecular diagnostics, and point-of-care testing. Abbott's diagnostics sales in 2024 were approximately $10.5 billion, reflecting its strong brand and established market presence. They are a significant competitor in the diagnostic testing market.

Siemens Healthineers offers a wide range of IVD solutions, including immunoassay, clinical chemistry, and molecular diagnostics. In fiscal year 2024, Siemens Healthineers reported revenues of EUR 21.7 billion, with a substantial portion from its diagnostics segment. They are a major player in the industry trends.

Danaher, through its diagnostics subsidiaries like Beckman Coulter, is a significant competitor. Danaher's diagnostics segment generated approximately $9.5 billion in revenue in 2024. They offer a broad portfolio of IVD products and services.

Thermo Fisher Scientific is a major player in the IVD market, offering a diverse range of products. In 2024, the company's revenues reached approximately $42.3 billion, with a significant portion from its healthcare and diagnostics segments. The company's acquisitions have further intensified the competitive dynamics.

In the domestic market, autobio diagnostics faces competition from Chinese companies such as Mindray Medical International and Leadman Biochemistry. These competitors often emphasize price, localized service, and a deep understanding of the Chinese healthcare system. The autobio diagnostics market share analysis reveals that these domestic players have a significant foothold in their local market.

Domestic competitors, such as Mindray Medical International and Leadman Biochemistry, pose significant challenges. These companies often compete on price and localized service, leveraging their understanding of the Chinese healthcare system. Emerging players in molecular diagnostics and next-generation sequencing are also disrupting the traditional landscape.

- Mindray Medical International: Mindray has a strong presence in various medical device segments, including IVD. In 2024, Mindray's revenue reached approximately RMB 36 billion, reflecting its robust market position and competitive strength.

- Leadman Biochemistry: Leadman focuses on clinical chemistry and immunoassay products. Leadman's revenue in 2024 was approximately RMB 1.5 billion, indicating its strong presence in the domestic market.

- Emerging Players: Numerous emerging players, particularly in molecular diagnostics and next-generation sequencing, are also disrupting the traditional landscape. These companies often introduce specialized technologies or innovative business models.

- Competitive Advantages: Domestic competitors often benefit from lower labor costs and a deeper understanding of local market dynamics. This allows them to compete effectively on price and service.

The autobio diagnostics industry growth forecast indicates a need for strategic adaptation. Mergers and acquisitions, such as those by Thermo Fisher Scientific, further consolidate market power. For more insights, consider reading about Owners & Shareholders of Autobio Diagnostics. This analysis is crucial for understanding the autobio diagnostics key competitors analysis, and the autobio diagnostics market size and trends.

Autobio Diagnostics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Autobio Diagnostics a Competitive Edge Over Its Rivals?

The Brief History of Autobio Diagnostics reveals a company that has strategically positioned itself in the competitive landscape of in-vitro diagnostics (IVD). Key milestones include significant investments in research and development, particularly in immunoassay technology, leading to a broad portfolio of diagnostic solutions. These strategic moves have enabled the company to offer a wide range of products, catering to diverse clinical needs and expanding its market reach.

Autobio Diagnostics' competitive edge is multifaceted, stemming from robust R&D capabilities, cost-effectiveness, and a strong distribution network. The company's focus on innovation has allowed it to develop proprietary reagents and automated instruments, setting it apart from competitors. Furthermore, its ability to offer competitive pricing, especially in emerging markets, has enhanced its attractiveness. The company's extensive distribution network, particularly within China, ensures broad accessibility of its products, contributing significantly to its market penetration.

The company's product portfolio, spanning immunoassay, microbiology, biochemistry, molecular diagnostics, and point-of-care testing, allows it to serve as a one-stop solution provider for clinical laboratories. This comprehensive approach, combined with its strategic advantages, positions Autobio Diagnostics for continued growth. However, the company faces challenges from rapid technological advancements and increasing competition, requiring sustained investment in R&D and strategic international expansion to maintain its competitive position.

Autobio Diagnostics' commitment to research and development is a cornerstone of its competitive strategy. The company consistently invests in innovation, particularly in immunoassay technology. This focus enables it to develop proprietary reagents and automated instruments, providing a wide range of diagnostic solutions.

A significant advantage for Autobio Diagnostics is its cost-effectiveness, especially when compared to multinational competitors. As a Chinese manufacturer, the company benefits from lower production costs. This allows it to offer competitive pricing without compromising quality, making its products attractive in budget-constrained healthcare systems.

Autobio Diagnostics has established a robust distribution network, particularly within China. This network provides extensive market penetration and efficient service delivery. The company's strong domestic presence, combined with an expanding international footprint, ensures broad accessibility of its products in over 100 countries.

The company's comprehensive product portfolio, spanning immunoassay, microbiology, biochemistry, molecular diagnostics, and point-of-care testing, acts as a competitive edge. This diverse range allows Autobio to serve as a one-stop solution provider for clinical laboratories, meeting various diagnostic needs.

Autobio Diagnostics differentiates itself through several core competitive advantages, crucial in the fiercely competitive in-vitro diagnostics (IVD) market. These advantages include strong R&D, cost-effectiveness, and a robust distribution network.

- Strong R&D: Consistent investment in research and development, particularly in immunoassay technology, leading to a broad portfolio of proprietary reagents and automated instruments.

- Cost-Effectiveness: Lower production costs enable competitive pricing, making products attractive in emerging markets.

- Distribution Network: Extensive market penetration through a strong domestic presence and expanding international footprint.

- Comprehensive Portfolio: A wide range of products, including immunoassay, microbiology, biochemistry, molecular diagnostics, and point-of-care testing, serving as a one-stop solution provider.

Autobio Diagnostics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Autobio Diagnostics’s Competitive Landscape?

The in-vitro diagnostics (IVD) sector, where autobio diagnostics operates, is currently undergoing significant transformation. Technological advancements, changing regulatory environments, and global economic shifts are key drivers influencing the competitive landscape. Understanding these factors is crucial for assessing the future prospects of autobio company.

This analysis will provide insights into the industry trends, future challenges, and opportunities facing autobio diagnostics, enabling a comprehensive market analysis. It will also identify potential risks and growth areas, helping stakeholders make informed decisions in this dynamic market.

Technological advancements, such as molecular diagnostics and point-of-care testing (POCT), are reshaping the IVD market. There's a growing demand for personalized medicine and early disease detection, driving innovation in diagnostic assays. Automation and digitalization are also becoming increasingly important.

Stricter regulatory requirements, especially for product approval, pose a challenge, requiring substantial investment in compliance. Competition is intensifying with new entrants and aggressive pricing strategies. Economic shifts and healthcare reforms focused on cost-effectiveness impact the market.

There are opportunities in expanding the molecular diagnostics portfolio, especially in infectious diseases and oncology. High-growth markets in Asia, Africa, and Latin America present significant growth potential. Strategic partnerships could accelerate market entry and product adoption.

The competitive landscape includes established players and emerging biotech firms. Key competitors may employ aggressive pricing or focus on specialized diagnostic platforms. Autobio company needs to differentiate itself through innovation, cost-effectiveness, and strategic partnerships.

The IVD market is projected to reach $125.7 billion by 2025, growing at a CAGR of 4.1% from 2020 to 2025. The molecular diagnostics segment is expected to grow significantly, driven by the increasing prevalence of infectious diseases and cancer. The POCT market is also expanding, offering rapid and convenient diagnostic solutions. The rise of personalized medicine is fueling demand for advanced diagnostic tests. To understand more about the financial aspects, consider reading about the Revenue Streams & Business Model of Autobio Diagnostics.

To remain competitive, Autobio should focus on continuous R&D investment, strategic alliances, and diversification. Adapting to technological advancements and expanding into high-growth markets are also crucial.

- Invest in R&D for new product development and technological upgrades.

- Form strategic partnerships to expand market reach and access new technologies.

- Diversify product offerings and geographic markets to mitigate risks.

- Focus on cost-effectiveness to compete in price-sensitive markets.

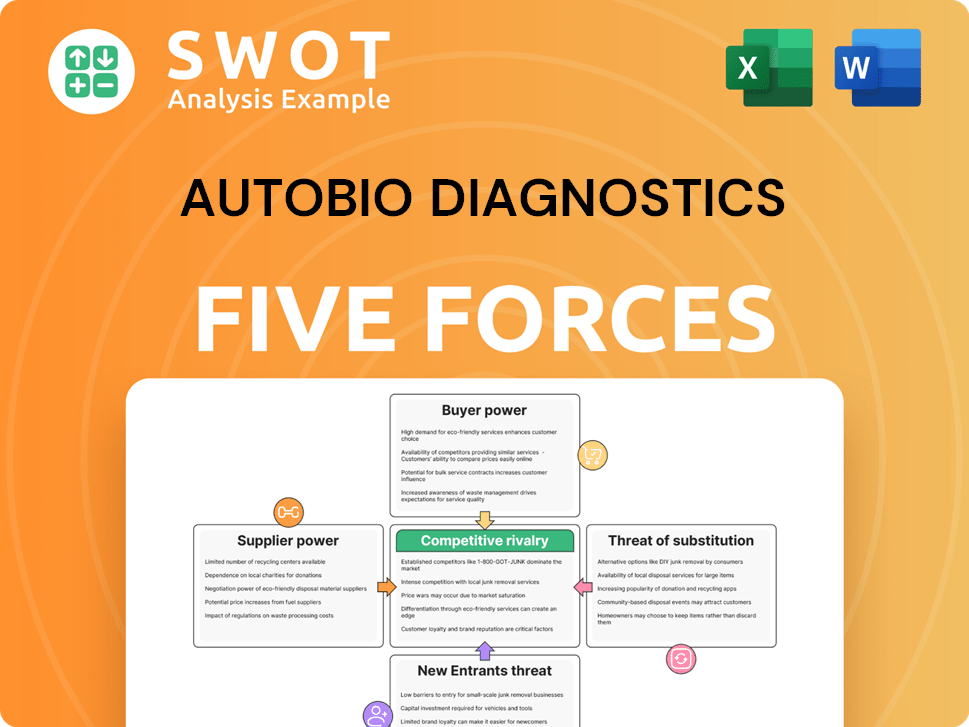

Autobio Diagnostics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Autobio Diagnostics Company?

- What is Growth Strategy and Future Prospects of Autobio Diagnostics Company?

- How Does Autobio Diagnostics Company Work?

- What is Sales and Marketing Strategy of Autobio Diagnostics Company?

- What is Brief History of Autobio Diagnostics Company?

- Who Owns Autobio Diagnostics Company?

- What is Customer Demographics and Target Market of Autobio Diagnostics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.