Autoliv Bundle

Can Autoliv Maintain Its Dominance in the Ever-Evolving Automotive Safety Sector?

The automotive safety industry is a high-stakes arena, constantly reshaped by technological leaps and stringent safety mandates. Autoliv, a titan in this domain, has long been synonymous with safeguarding lives through its comprehensive suite of Autoliv SWOT Analysis. Its journey, from a humble seatbelt manufacturer to a global safety leader, is a testament to its commitment to innovation and quality.

This exploration of the Autoliv competitive landscape dives deep into the company's strategies for navigating intense rivalries and maintaining its significant Autoliv market share. We'll dissect the Autoliv competitors, analyze its core differentiators, and examine its market position within the automotive safety systems industry. Understanding Autoliv's strengths and weaknesses is critical for anyone seeking to understand the dynamics of this crucial sector, including Autoliv market analysis.

Where Does Autoliv’ Stand in the Current Market?

Autoliv holds a leading position in the automotive safety industry. It is recognized as the world's largest manufacturer of automotive safety systems, supplying to all major global automakers. The company's core operations revolve around the design, development, and manufacturing of passive and active safety systems.

The company's value proposition centers on enhancing vehicle and occupant safety through innovative technologies and reliable products. Autoliv's commitment to safety is evident in its extensive research and development efforts, stringent quality control, and global manufacturing footprint. Owners & Shareholders of Autoliv benefit from the company's strong market position and consistent financial performance.

In 2023, Autoliv reported net sales of approximately $9.4 billion, underscoring its significant scale within the industry. Its primary product lines include airbags, seatbelts, and steering wheels. Autoliv also offers active safety systems, such as radar and vision systems, which contribute to accident prevention.

Autoliv maintains a substantial market share in the automotive safety systems sector, particularly in passive safety components. The company's market share is supported by its long-standing relationships with OEMs and its global manufacturing and distribution network. Autoliv's strong market share reflects its competitive advantages analysis and its ability to meet the evolving demands of the automotive industry.

Autoliv has a robust global presence, with manufacturing facilities and technical centers strategically located across Asia, Europe, and the Americas. This extensive geographic footprint allows Autoliv to serve a diverse customer base of automotive manufacturers worldwide. The company's geographic market analysis reveals a strong presence in key automotive production regions.

Autoliv's product portfolio includes a comprehensive range of automotive safety systems. Key products include airbags (frontal, side, curtain, and knee airbags), seatbelts (including pretensioners and load limiters), and steering wheels. Autoliv is also expanding its active safety offerings, such as radar and vision systems, to address the growing demand for advanced driver-assistance systems.

Autoliv's competitive advantages include its strong brand reputation, extensive R&D capabilities, and long-term relationships with major automakers. The company's focus on innovation in automotive safety and its adherence to stringent safety standards contribute to its market leadership. Autoliv's supplier relationships are also a key factor in its success.

Autoliv is strategically expanding its focus on active safety solutions to address evolving market demands and maintain its competitive edge. This diversification is aimed at maintaining its competitive edge and addressing evolving market demands. The company is also investing in innovation in automotive safety to stay ahead of industry trends.

- Expansion into active safety systems, including radar and vision technologies.

- Continued investment in research and development to enhance product offerings.

- Strategic partnerships and acquisitions to strengthen market position.

- Focus on sustainable and environmentally friendly manufacturing practices.

Autoliv SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Autoliv?

The Autoliv competitive landscape is shaped by a dynamic mix of established players and emerging challengers. The automotive safety systems market, where Autoliv is a major force, sees intense competition. Understanding the key rivals is crucial for assessing Autoliv market analysis and future prospects. The industry is constantly evolving due to technological advancements, regulatory changes, and shifts in consumer preferences.

Direct competitors, such as ZF Friedrichshafen AG and Joyson Safety Systems, present significant challenges. These companies, along with other specialized suppliers, compete on innovation, pricing, and securing long-term contracts with major automotive manufacturers. The competitive environment also includes new entrants from the tech sector, particularly in active safety and autonomous driving technologies. This convergence of traditional automotive safety with advanced electronics and software is reshaping the industry.

The Autoliv industry faces pressure from various sources, including the need for continuous innovation and cost efficiency. The global nature of the automotive market means that Autoliv market share is influenced by factors such as regional demand, currency fluctuations, and supply chain dynamics. The company's ability to adapt to these challenges will determine its success in the coming years.

ZF Friedrichshafen AG, particularly through its Active and Passive Safety Technology division, is a major competitor. ZF offers a broad portfolio that includes airbags, seatbelts, steering systems, and advanced driver-assistance systems (ADAS). This comprehensive product range positions ZF as a strong competitor across multiple segments.

Joyson Safety Systems, formed from the acquisition of Takata Corporation's global assets, is a significant competitor. Despite the challenges faced by Takata, Joyson has re-emerged as a major player, especially in airbags and seatbelts. They leverage their global manufacturing footprint and established customer relationships.

Smaller, specialized suppliers focusing on specific components or niche technologies also compete. These companies often concentrate on particular product areas, allowing them to develop deep expertise and potentially offer specialized solutions. The competitive landscape is also influenced by new entrants from the tech sector, particularly in the realm of active safety and autonomous driving.

The automotive industry is experiencing rapid technological advancements, particularly in areas such as autonomous driving and advanced driver-assistance systems (ADAS). These innovations are reshaping the competitive landscape, with tech companies entering the market and traditional automotive suppliers investing heavily in new technologies. The convergence of traditional automotive safety with advanced electronics and software is a key trend.

Mergers and alliances continue to influence competitive dynamics, creating larger, more integrated suppliers with broader product offerings and increased market power. These consolidations can lead to greater economies of scale, enhanced research and development capabilities, and stronger customer relationships. Recent acquisitions and mergers have reshaped the industry.

Pricing strategies are critical in the competitive landscape, with companies constantly seeking to balance profitability and market share. This is particularly important in a market where cost pressures are significant and automotive manufacturers are focused on reducing overall vehicle costs. The ability to offer competitive pricing while maintaining quality and innovation is a key challenge.

Several factors influence the competitive dynamics within the automotive safety systems market. These include technological innovation, pricing strategies, securing long-term supply agreements, and global manufacturing capabilities. Understanding these factors is crucial for assessing Autoliv key competitors analysis and its overall market position. For more insights, consider reading about the Growth Strategy of Autoliv.

- Technological Innovation: Continuous development of new safety technologies, including advancements in airbags, seatbelts, and ADAS.

- Pricing Strategies: Competitive pricing to secure contracts with major automotive manufacturers.

- Supply Agreements: Securing long-term supply agreements with major automotive manufacturers.

- Global Manufacturing: Having a global manufacturing footprint to serve customers worldwide.

- Customer Relationships: Strong relationships with automotive manufacturers.

Autoliv PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Autoliv a Competitive Edge Over Its Rivals?

Understanding the Autoliv competitive landscape involves recognizing its core strengths. The company has built a strong position in the automotive safety systems market. This position is supported by its technological leadership, global presence, and deep customer relationships.

Autoliv's competitive advantages are rooted in its decades of experience and innovation in automotive safety. The company's focus on research and development, with investments around $600 million annually, fuels its ability to create advanced safety solutions. Autoliv's reputation for quality and reliability further strengthens its market position.

To gain a deeper understanding, consider reading a Brief History of Autoliv. It provides valuable context for the company's evolution and strategic decisions.

Autoliv's technological prowess is a key differentiator, particularly in airbags, seatbelts, and active safety systems. The company invests heavily in R&D, with approximately $600 million spent annually. This commitment enables Autoliv to stay ahead of the curve in a rapidly evolving industry, ensuring its products meet and exceed safety standards.

Autoliv's extensive global network, spanning over 27 countries, provides significant advantages. This widespread presence allows for economies of scale, cost efficiencies, and localized service. It is essential for serving a global customer base and navigating the complexities of the automotive supply chain.

Autoliv's long-standing relationships with major automakers are a significant asset. The company is a preferred supplier for many leading brands. This loyalty is a result of Autoliv's reputation for quality, reliability, and its ability to meet diverse regional requirements.

The company's brand equity is built on a foundation of safety and reliability. Autoliv's products are trusted by consumers and automakers worldwide. This strong brand reputation enhances its market position and fosters customer loyalty.

Autoliv's competitive edge stems from its technological innovation, particularly in passive and active safety systems. The company's global presence allows it to serve customers worldwide. Autoliv's strong customer relationships and brand reputation further solidify its market position.

- Technological Innovation: Continuous investment in R&D, with approximately $600 million annually, drives advancements in automotive safety.

- Global Footprint: Manufacturing facilities in over 27 countries provide economies of scale and local service.

- Customer Relationships: Strong ties with leading automakers ensure continued demand and market share.

- Brand Reputation: A trusted brand known for quality and reliability in the automotive industry.

Autoliv Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Autoliv’s Competitive Landscape?

The automotive safety industry is experiencing rapid transformation, driven by technological advancements and evolving consumer demands. This dynamic environment presents both significant opportunities and challenges for companies like Autoliv. An in-depth Autoliv market analysis reveals the need to adapt to emerging trends such as autonomous driving and stricter safety regulations to maintain a competitive edge. The Autoliv competitive landscape is constantly shifting, requiring strategic agility and innovation.

Autoliv faces challenges from the cyclical nature of the automotive industry and potential supply chain disruptions. The company's success hinges on its ability to navigate these risks while capitalizing on growth opportunities in emerging markets and new mobility solutions. Understanding the Autoliv industry dynamics is crucial for investors and stakeholders to assess its long-term viability and growth potential.

The automotive industry is moving towards autonomous driving and advanced driver-assistance systems (ADAS). There is a growing emphasis on active safety systems designed to prevent accidents. Regulatory changes and consumer preferences for safer vehicles are also driving market growth.

The rapid pace of technological change could lead to disruptive innovations from new market entrants. The cyclical nature of the automotive industry can impact demand. Geopolitical uncertainties and supply chain disruptions remain ongoing challenges.

Significant growth opportunities exist in emerging markets where vehicle penetration and safety awareness are increasing. The development of new mobility solutions, such as ride-sharing and autonomous fleets, presents avenues for new safety system applications. Strategic partnerships and innovation in active safety can drive future growth.

Autoliv is focusing on innovation in active safety. The company is optimizing its global manufacturing footprint. Strategic partnerships are being formed to accelerate technology development and market penetration.

Autoliv's competitive position is expected to evolve with these trends, with a strong emphasis on integrated safety solutions. The company's ability to innovate in active safety systems is crucial. Strategic partnerships and global market presence are vital for sustained growth. For more insights, you can read about Autoliv's strategic positioning in this detailed analysis of Autoliv's market share.

- Technological Advancements: Rapid innovation in ADAS and autonomous driving technologies.

- Market Expansion: Growth in emerging markets and new mobility solutions.

- Strategic Partnerships: Collaborations to enhance technology development and market reach.

- Regulatory Compliance: Adapting to increasingly stringent safety standards globally.

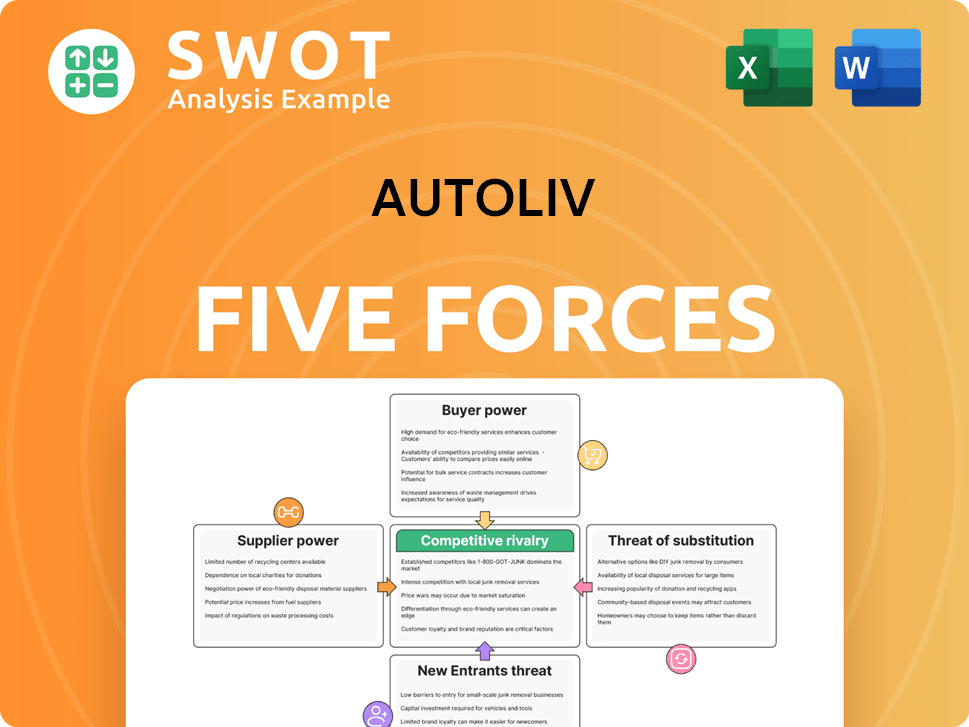

Autoliv Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Autoliv Company?

- What is Growth Strategy and Future Prospects of Autoliv Company?

- How Does Autoliv Company Work?

- What is Sales and Marketing Strategy of Autoliv Company?

- What is Brief History of Autoliv Company?

- Who Owns Autoliv Company?

- What is Customer Demographics and Target Market of Autoliv Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.