Breedon Group Bundle

How Does Breedon Group Navigate the Construction Materials Battlefield?

The construction materials market is a dynamic arena, constantly reshaped by sustainability, technology, and infrastructure demands. Breedon Group, a major player in Great Britain and Ireland, has demonstrated its strength, reporting impressive revenue figures in 2023. This sets the stage for an in-depth look at its competitive position.

From its inception in 2006, Breedon Group has strategically expanded, becoming a leading supplier of essential construction materials through acquisitions and organic growth. This evolution necessitates a comprehensive Breedon Group SWOT Analysis to understand its strengths and weaknesses within the competitive landscape. This analysis will delve into Breedon Group's market share analysis, its key competitors, and the strategic advantages that fuel its performance in the quarrying industry, providing a detailed Breedon Group analysis.

Where Does Breedon Group’ Stand in the Current Market?

Breedon Group holds a significant market position as a leading construction materials group within Great Britain and Ireland. The company's core operations revolve around the production and supply of essential materials such as aggregates, asphalt, cement, and ready-mixed concrete. These products are critical for infrastructure and construction projects, underpinning Breedon's value proposition of providing high-quality, reliable materials to the construction industry.

Breedon's integrated supply chain and focus on essential materials contribute to its resilient market standing. The company's strategic acquisitions, such as the Cemex UK operations in 2020, have significantly bolstered its market share and geographic reach, particularly in cement and ready-mixed concrete. This strategic approach allows Breedon to offer a comprehensive suite of products, catering to a wide range of construction needs across its operational areas.

In 2023, Breedon Group reported a revenue of £1,372.4 million, with an underlying EBIT of £146.4 million, demonstrating its strong financial performance. The company's focus on essential materials and its integrated supply chain contribute to its resilient market standing, though its position is naturally stronger in its core geographic markets than in broader international contexts. A deep dive into the Growth Strategy of Breedon Group provides further insights into its market approach.

Breedon Group's market share is particularly strong in Great Britain and Ireland, where it operates extensively. The company's geographical presence is concentrated in these regions, allowing it to serve a diverse range of customers. This focus enables Breedon to efficiently manage its operations and maintain a strong competitive edge within its core markets.

The company's product portfolio includes aggregates, asphalt, cement, and ready-mixed concrete. In 2023, Breedon produced 25.8 million tonnes of aggregates, 3.8 million tonnes of asphalt, 2.8 million cubic meters of ready-mixed concrete, and 1.6 million tonnes of cement. This diverse offering supports various construction projects.

Breedon's financial performance in 2023 included an underlying profit before tax of £136.9 million. This financial strength positions the company favorably within the construction materials market. The company's ability to maintain profitability despite market fluctuations underscores its robust business model.

Strategic acquisitions, such as the Cemex UK operations, have been pivotal in expanding Breedon's market share. These acquisitions have enhanced its geographic reach and product offerings, particularly in the cement and ready-mixed concrete segments. This strategy supports Breedon's growth and market dominance.

Breedon Group's competitive landscape is shaped by its strong market position and strategic initiatives. The company's focus on essential construction materials and its integrated supply chain are key drivers of its success.

- Leading producer and supplier of aggregates, asphalt, cement, and ready-mixed concrete.

- Strong financial performance with significant revenue and underlying EBIT.

- Strategic acquisitions that have expanded market share and geographic reach.

- Concentrated operations in Great Britain and Ireland, serving diverse customer segments.

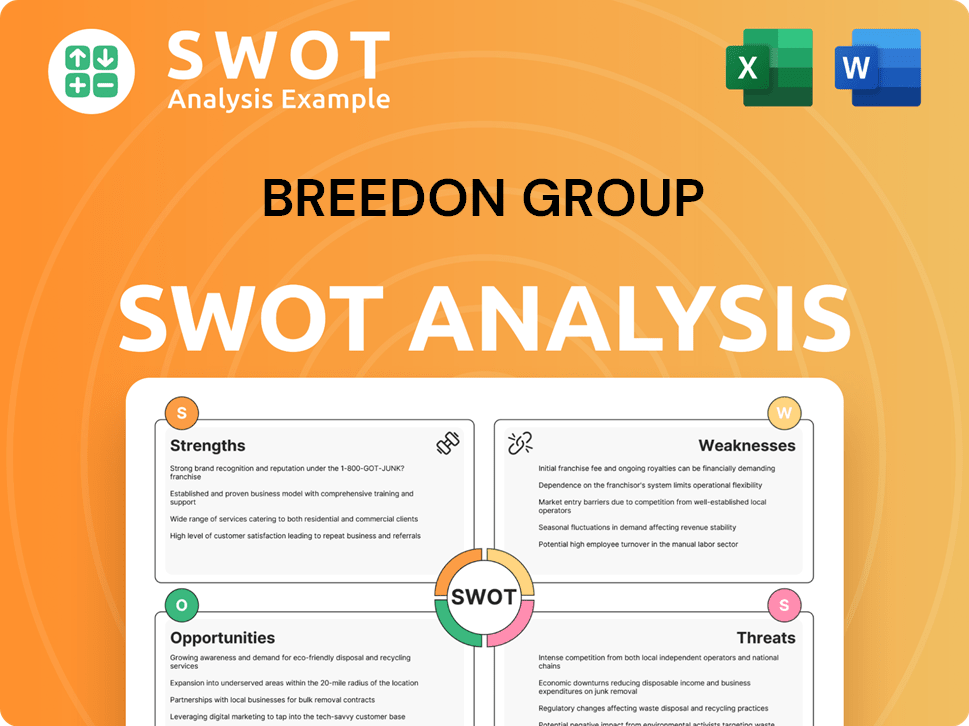

Breedon Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Breedon Group?

The Marketing Strategy of Breedon Group operates within a dynamic competitive landscape. This environment is characterized by a mix of large multinational corporations and smaller regional players. Understanding the key competitors is crucial for assessing the company's position and strategic direction.

The construction materials market is highly competitive, with companies vying for market share through various strategies. These include competitive pricing, logistical efficiency, and the ability to secure large-scale infrastructure projects. The industry also sees constant shifts due to mergers, acquisitions, and the emergence of new technologies.

Breedon Group's competitive landscape is dominated by several major players in the construction materials market. These companies compete across various product lines, including aggregates, asphalt, and ready-mixed concrete. The industry's dynamics are constantly evolving due to market consolidation and the entry of new players.

CRH plc is a major global competitor, known for its extensive geographic reach and diverse product portfolio. As of 2023, CRH reported revenues of approximately $32.7 billion, demonstrating its significant market presence. Its broad range of materials and services makes it a formidable player in the industry.

Hanson UK, part of Heidelberg Materials, is a key competitor, particularly in cement, aggregates, and ready-mixed concrete. Heidelberg Materials reported sales of approximately €21.1 billion in 2023. Hanson UK's established market presence and operational efficiency pose a direct challenge to Breedon Group.

Tarmac, a subsidiary of CRH plc, directly competes with Breedon across aggregates, asphalt, and ready-mixed concrete in the UK. Tarmac's established distribution networks and involvement in major projects make it a significant competitor. The company leverages its parent company's resources to compete effectively.

Indirect competitors include specialized material suppliers and companies offering alternative construction methods. These players can disrupt traditional supply chains. The industry is also seeing the emergence of companies focused on sustainable or recycled materials, which adds to the competitive pressure.

Mergers and acquisitions continually reshape the competitive landscape. Breedon's own acquisitions, such as the Cemex UK assets, reflect this trend. These activities lead to market consolidation and shifts in market power. These changes impact the strategic positioning of all players.

Key competitive factors include price, logistical capabilities, and product quality. Securing major infrastructure projects and long-term supply contracts is crucial. Companies must demonstrate operational efficiency and the ability to meet project-specific requirements to succeed.

Breedon Group's competitive advantages include its focus on local markets and efficient operations. The company has expanded its geographical presence through strategic acquisitions. Its ability to integrate acquired assets and improve operational efficiencies is a key strength.

- Market Share: Breedon Group holds a significant share in the UK construction materials market, although specific figures vary.

- Financial Performance: The company's financial performance is a critical factor in its competitive position.

- Strategic Initiatives: Breedon Group's strategic initiatives, including acquisitions and sustainability efforts, influence its competitive standing.

- Geographical Presence: Its strong presence in the UK and Ireland is a key element of its competitive strategy.

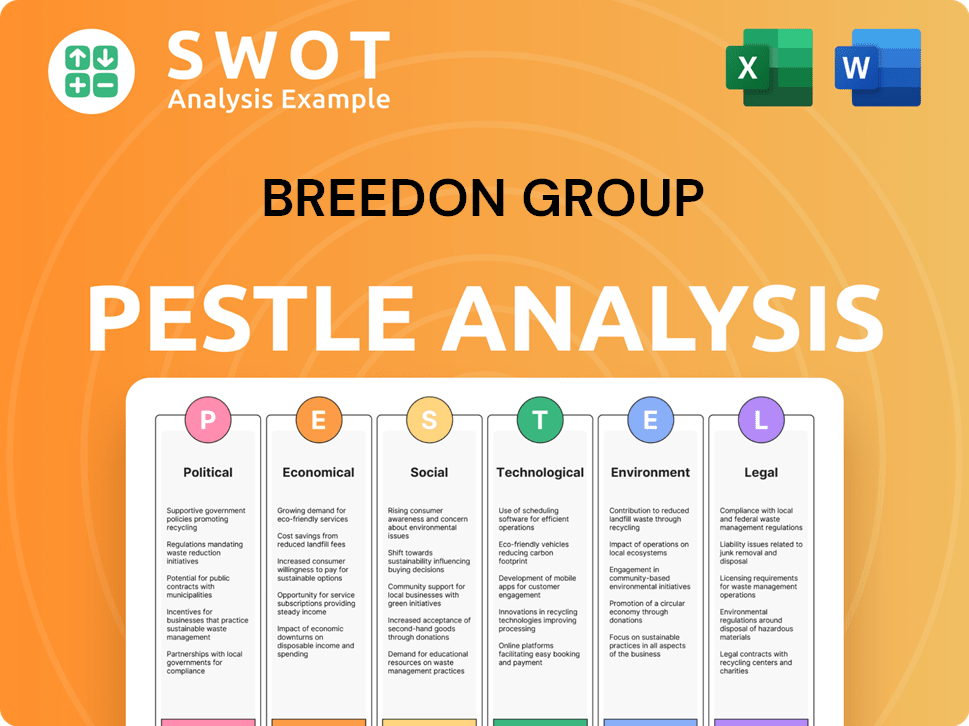

Breedon Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Breedon Group a Competitive Edge Over Its Rivals?

The Owners & Shareholders of Breedon Group have established a strong foothold in the construction materials market. Their competitive landscape is shaped by an integrated business model and a vast asset base. Breedon Group analysis reveals a focus on operational efficiency and customer service, which are key drivers of its market position.

Breedon Group's strategic moves include vertical integration, encompassing quarries, asphalt plants, and cement production. This integration allows for cost control and consistent product quality. The company's extensive geographic footprint provides a robust distribution network, reducing transportation costs and enabling efficient service across Great Britain and Ireland.

The company's recent financial performance highlights the effectiveness of its strategy. Increased volumes in aggregates, asphalt, and cement in 2023 demonstrate the operational efficiency derived from its integrated model. This, combined with a focus on sustainability, positions the company favorably in a market increasingly prioritizing environmentally responsible suppliers.

Breedon Group's vertically integrated operations, including quarries, asphalt plants, ready-mixed concrete plants, and cement production, provide a significant competitive edge. This integration allows the company to control its supply chain, optimize costs, and ensure consistent product quality. This model is a key differentiator in the construction materials market.

The company's substantial portfolio of quarries and depots across Great Britain and Ireland forms a robust distribution network. This extensive geographic footprint enables efficient service and quick responses to local demand. This strong asset base is crucial for serving a wide range of projects and maintaining a competitive edge.

Breedon Group differentiates itself through a strong focus on customer service and a comprehensive range of construction materials and contracting services. This approach enhances customer relationships and supports market share growth. The ability to provide a wide array of products and services meets diverse project needs.

The company's emphasis on sustainability, including its commitment to achieving Net Zero by 2050 and a 30% reduction in carbon emissions by 2030 (from a 2019 baseline), positions it favorably. This focus on environmental responsibility is increasingly important to clients and stakeholders. These initiatives enhance the company's brand reputation and market appeal.

Breedon Group's competitive advantages include its integrated business model, extensive asset base, and strong regional presence. These advantages have been developed through strategic acquisitions and continuous investment in its asset base. These factors help the company leverage economies of scale and maintain strong customer relationships.

- Vertical Integration: Controls supply chain, optimizes costs, and ensures quality.

- Geographic Footprint: Provides a robust distribution network and reduces transportation costs.

- Customer Focus: Offers a comprehensive range of materials and services.

- Sustainability: Commitment to Net Zero and carbon emission reduction.

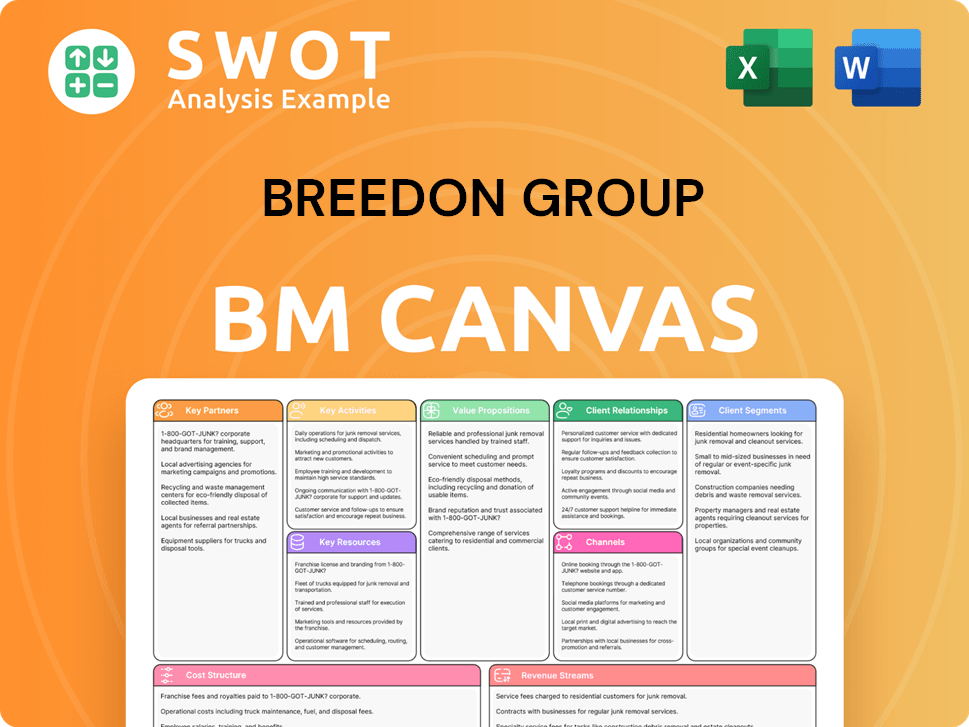

Breedon Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Breedon Group’s Competitive Landscape?

The Breedon Group operates within a construction materials market that is currently undergoing significant transformation. This evolution is driven by trends like sustainability, digitalization, and the increasing demand for infrastructure projects. Understanding the competitive landscape is crucial for assessing Breedon Group's strategic position and future prospects.

Risks for Breedon Group include volatile energy prices, securing planning permissions, and the increasing regulatory burden related to environmental compliance. Geopolitical uncertainties and the potential for disruptive technologies also pose challenges. However, the company is also presented with opportunities, such as the robust pipeline of infrastructure projects in Great Britain and Ireland and the growing demand for sustainable construction materials.

The construction materials market is seeing a strong push toward sustainability, with a focus on reducing carbon emissions. Digitalization is also playing a key role, improving operational efficiency and customer engagement. Infrastructure development, including road, rail, and renewable energy projects, is driving demand for construction materials.

Breedon Group faces challenges such as fluctuating energy prices and securing planning permissions. The increasing regulatory burden associated with environmental compliance is another concern. The potential for market disruption from new technologies and geopolitical uncertainties also poses risks.

The strong pipeline of infrastructure projects in Great Britain and Ireland provides a robust demand outlook. The company can capitalize on the demand for sustainable construction solutions by investing in eco-friendly products. Digitalization offers opportunities to optimize logistics and enhance customer engagement.

Breedon Group's strategy focuses on expanding product offerings and emphasizing sustainable solutions. This includes a commitment to reducing carbon emissions. These initiatives position the company to maintain its competitive edge in the evolving construction materials market.

Breedon Group's ability to navigate volatile energy prices and secure planning permissions will be crucial. Focusing on sustainable products and optimizing operations through digitalization are key strategies. The company's geographical presence and product portfolio need to align with market demands.

- Sustainability Initiatives: Investing in low-carbon cement and recycled aggregates.

- Digitalization: Improving logistics and customer engagement.

- Market Expansion: Expanding product offerings in key markets.

- Geopolitical Impact: Monitoring geopolitical uncertainties and their effect on construction activity.

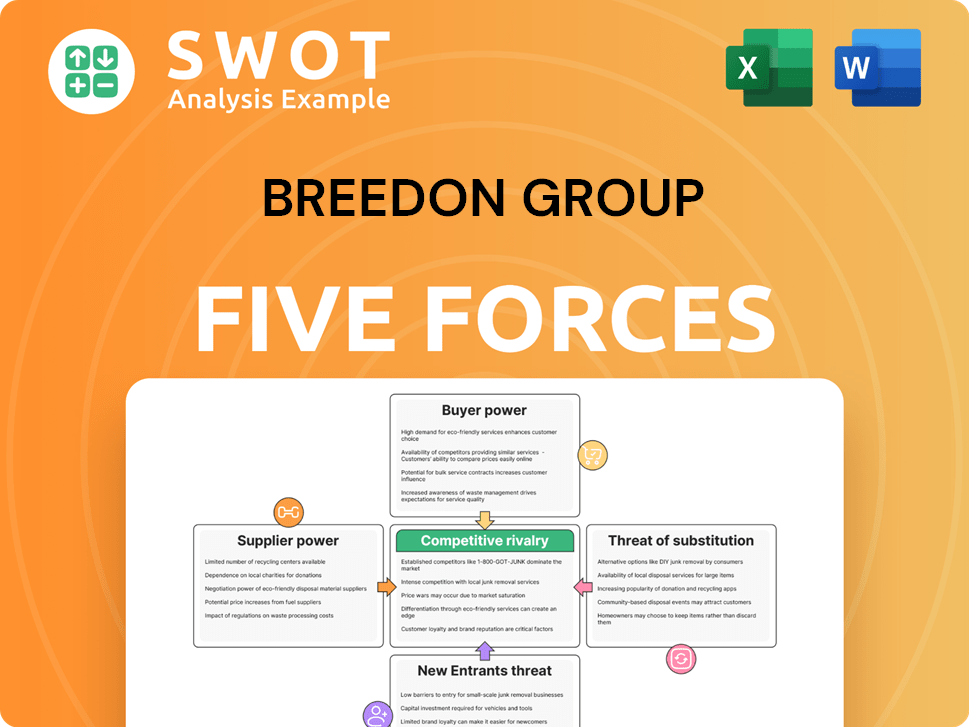

Breedon Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Breedon Group Company?

- What is Growth Strategy and Future Prospects of Breedon Group Company?

- How Does Breedon Group Company Work?

- What is Sales and Marketing Strategy of Breedon Group Company?

- What is Brief History of Breedon Group Company?

- Who Owns Breedon Group Company?

- What is Customer Demographics and Target Market of Breedon Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.