Calbee Bundle

Can Calbee Conquer the Snack Food World?

Calbee, a global snack food giant, has been delighting consumers with its delicious treats since 1949. From its humble beginnings in Japan, the company has expanded its product portfolio and global presence, becoming a significant player in the competitive snack food industry. But how does Calbee stack up against its rivals, and what strategies does it employ to maintain its market position?

To understand Calbee's position, this analysis dives into the Calbee SWOT Analysis, exploring its competitive landscape, including its key competitors and market strategies. We'll examine the company's market share, financial performance, and product portfolio overview within the Japanese food market and beyond. This deep dive into Calbee's competitive advantages and its response to market changes provides valuable insights for investors and industry observers alike, offering a comprehensive Calbee market analysis.

Where Does Calbee’ Stand in the Current Market?

Calbee holds a strong market position within the Japanese snack food industry, particularly in the potato chip and savory snack segments. The company's success is built on its ability to consistently deliver high-quality products that resonate with consumers. Understanding the Calbee competitive landscape is crucial for investors and industry analysts.

The company's core operations revolve around the manufacturing and distribution of a wide range of snack products. This includes potato chips (like its flagship brand), shrimp crackers, and other savory snacks. Calbee's value proposition centers on providing delicious and convenient snacks that cater to various consumer preferences and consumption occasions, from everyday snacking to special events.

Calbee's financial health remains robust, supported by consistent revenue streams and strategic investments in research and development. While its position in Japan is exceptionally strong, Calbee continues to work on strengthening its presence and market share in international markets where competition from global food giants is more intense. For more insights into the company's ownership structure, you can refer to Owners & Shareholders of Calbee.

Calbee consistently ranks among the top snack manufacturers in Japan. While specific 2024-2025 market share figures are subject to ongoing market dynamics, the company maintains a significant portion of the potato chip market and overall snack food industry.

In the fiscal year ending March 2024, Calbee reported net sales of ¥286.7 billion (approximately $1.85 billion USD). This financial performance underscores the company's substantial scale within the Japanese food market and its ability to generate consistent revenue.

Calbee's product portfolio includes a diverse range of snacks. Key products include Calbee Potato Chips, Kappa Ebisen shrimp crackers, Jagarico, and Jagabee. This variety helps the company cater to a broad consumer base and maintain its competitive edge.

Calbee has a strong presence across Asia, with significant operations in China, North America, and the UK. Its robust domestic Japanese market is complemented by these international operations. This global presence helps diversify revenue streams.

Calbee's key strengths include its strong brand recognition, extensive distribution network, and consistent product innovation. These factors contribute to its Calbee's competitive advantages in the snack food industry.

- Strong Brand Recognition: Calbee's flagship brands are well-known and trusted by consumers.

- Extensive Distribution Network: Calbee has established efficient distribution channels across Japan and internationally.

- Product Innovation: The company continuously introduces new products and flavors to meet evolving consumer preferences.

- Strategic Market Position: Calbee is well-positioned in both the domestic and international markets.

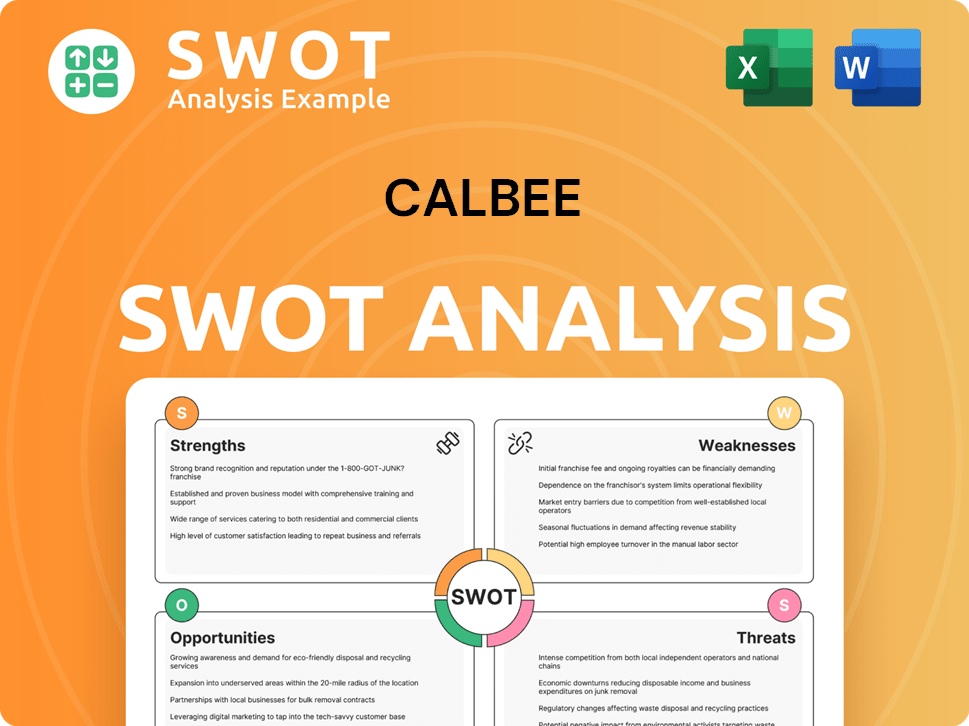

Calbee SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Calbee?

Understanding the Calbee competitive landscape is crucial for assessing its market position and future prospects. The snack food industry is highly competitive, with numerous players vying for consumer attention and market share. This analysis examines Calbee's key competitors across various geographical markets, highlighting their strategies and impact on Calbee's business.

Calbee's market analysis reveals a complex competitive environment shaped by both direct and indirect rivals. The company faces challenges from established snack manufacturers, multinational corporations, and emerging regional players. Factors such as product innovation, distribution networks, and marketing investments significantly influence the competitive dynamics within the potato chip market and the broader snack category.

In Japan, Calbee's home market, the primary competitors include Koikeya and Yamazaki Baking. Koikeya is a direct competitor known for its potato chips and other savory snacks. Yamazaki Baking, while primarily a bakery, has a presence in the snack market. These companies compete through product innovation, aggressive marketing, and competitive pricing strategies. Koikeya's focus on unique flavor profiles and targeted marketing campaigns directly challenges Calbee's market share.

Koikeya is a significant direct competitor to Calbee in Japan, with a strong presence in the potato chip and snack market. Koikeya's product innovations and marketing strategies directly challenge Calbee's market position.

Yamazaki Baking, although primarily a bakery, has a presence in the snack food industry. They compete with Calbee by offering a variety of snack products, leveraging their extensive distribution network.

PepsiCo, through its Frito-Lay division, is a major global competitor. Frito-Lay's brands like Lay's, Doritos, and Cheetos pose a substantial threat due to their extensive scale and marketing budgets.

Mondelez International competes in the broader snack category with brands such as Oreo and Ritz. They vie for consumer spending on indulgent and convenient foods, impacting Calbee's market share.

Emerging players and regional manufacturers present localized challenges. They often leverage their understanding of local tastes and distribution channels to compete with Calbee.

Mergers and acquisitions in the snack industry can alter market dynamics. These consolidations create stronger rival entities, changing the competitive landscape.

Globally, Calbee competes with multinational food and beverage companies. PepsiCo (Frito-Lay) and Mondelez International are major players in the snack food industry, posing significant competitive challenges.

- PepsiCo (Frito-Lay): Frito-Lay's extensive distribution, marketing budgets, and brand recognition give it a significant advantage. For example, Frito-Lay's revenue in 2024 was approximately $25 billion.

- Mondelez International: Mondelez competes in the broader snack category with brands like Oreo and Ritz. In 2024, Mondelez International's revenue was around $36 billion, indicating its substantial market presence.

- Regional Manufacturers: These competitors often leverage local market knowledge and distribution networks. They can introduce products tailored to regional tastes, creating niche competition.

- Mergers and Acquisitions: Consolidations in the snack industry can alter the competitive landscape. For example, if a major player acquires a smaller competitor, it can strengthen its market position.

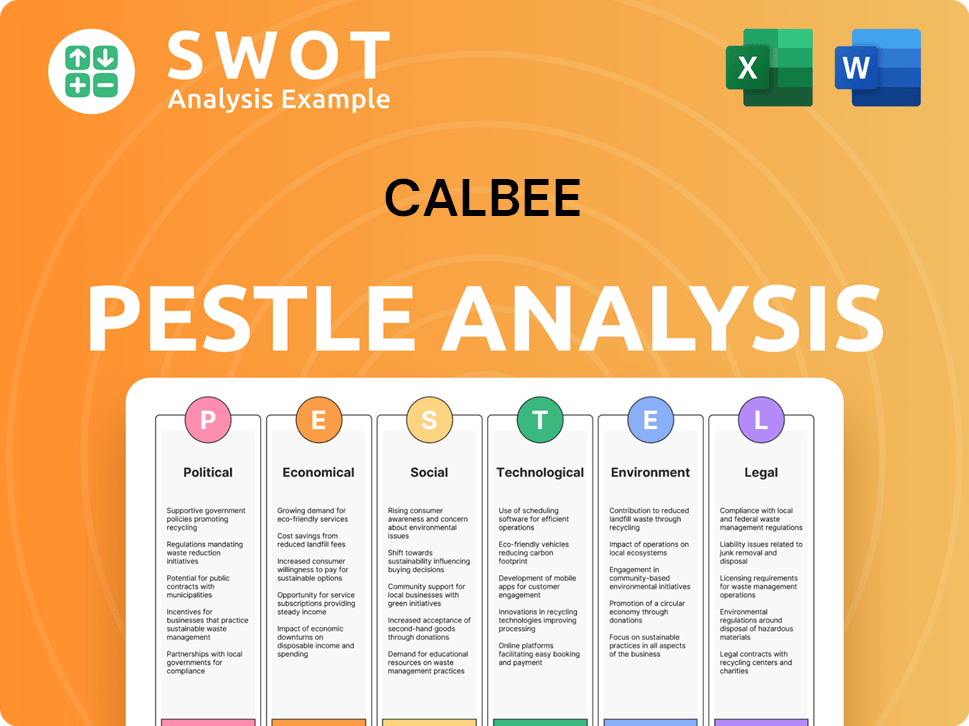

Calbee PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Calbee a Competitive Edge Over Its Rivals?

The competitive landscape for Calbee is shaped by its strong brand recognition and consumer loyalty, particularly in the Japanese market. This loyalty, built over decades, is a key advantage. Calbee's ability to consistently deliver high-quality products and effective marketing campaigns has solidified its position in the snack food industry.

Calbee's proprietary technologies and expertise in snack production give it a competitive edge. These technologies allow for unique textures and flavors, distinguishing its products from those of its competitors. For instance, its specialized frying techniques contribute to the signature crispiness of its potato chips, a key factor in consumer preference.

Furthermore, Calbee's extensive distribution network, especially within Japan, is a significant asset. This network ensures that its products reach a wide consumer base efficiently. The company's focus on natural ingredients and healthier snack options also positions it favorably against rivals. Continuous investment in research and development is another critical aspect of Calbee's strategy, ensuring it remains at the forefront of snack innovation.

Calbee benefits from strong brand equity, particularly in its home market. This loyalty is built on decades of consistent product quality and effective marketing. The company's products are considered household staples in Japan, a testament to its enduring consumer trust.

Calbee's competitive advantage is enhanced by its proprietary technologies in snack production. These technologies enable the creation of unique textures and flavors. Continuous innovation in product development, as seen with the introduction of new flavors and product lines, keeps Calbee at the forefront of the snack food industry.

Calbee's robust distribution network, especially in Japan, provides a significant advantage. This network ensures efficient access to a broad consumer base. This strong logistical infrastructure acts as a barrier to entry for new players in the potato chip market.

Calbee's focus on natural ingredients and healthier snack options aligns with growing consumer trends. This strategic focus positions Calbee favorably against competitors that may rely more on artificial additives. This approach is a key element of Calbee's response to market changes.

Calbee's competitive advantages are multifaceted, including strong brand recognition, proprietary technologies, and an efficient distribution network. These strengths are further enhanced by a focus on natural ingredients and continuous innovation. Understanding the Target Market of Calbee is crucial for appreciating how these advantages contribute to its success.

- Strong Brand Equity: High consumer trust and loyalty, especially in Japan.

- Technological Innovation: Proprietary production techniques for unique product characteristics.

- Efficient Distribution: Extensive network ensuring wide product availability.

- Health-Conscious Products: Focus on natural ingredients and healthier options.

- R&D Investment: Continuous introduction of new flavors and product lines.

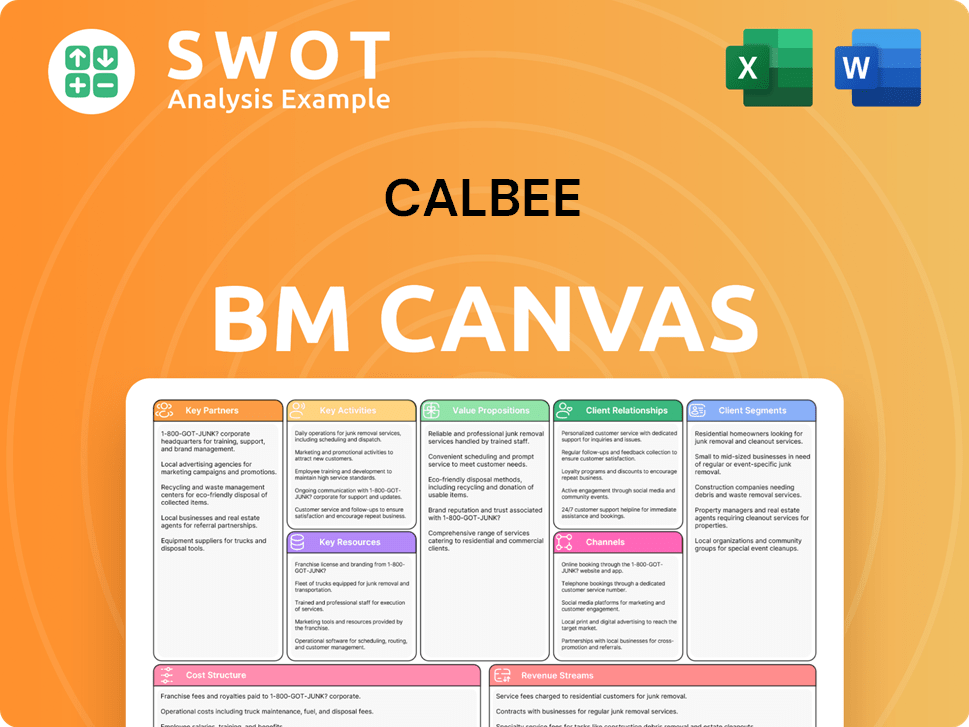

Calbee Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Calbee’s Competitive Landscape?

The Calbee competitive landscape is significantly shaped by evolving consumer preferences and intense competition within the snack food industry. The company faces the need to balance its product offerings with the growing demand for healthier options while navigating rising operational costs. Understanding the Calbee market analysis is crucial for adapting to the current trends and planning for future growth.

The Calbee competitors include both large multinational corporations and smaller, regional brands, all vying for market share in a dynamic environment. This requires continuous innovation in product development, strategic marketing, and efficient distribution to maintain and enhance its position. The company's ability to adapt to these challenges will determine its success in the years to come.

The snack food industry is experiencing a shift towards healthier options. Consumers are increasingly looking for snacks with natural ingredients, reduced sodium, and lower fat content. The global savory snacks market is projected to reach approximately USD $243.6 billion by 2028.

Rising raw material costs, particularly for potatoes, pose a significant challenge. Intense competition from global and local brands pressures market share and margins. Regulatory changes regarding food labeling and sustainability also require constant adaptation. The potato chip market is highly competitive.

Emerging markets offer significant growth potential due to rising disposable incomes and urbanization. Strategic partnerships and collaborations can facilitate market entry and product diversification. E-commerce and digital marketing are crucial for reaching modern consumers. The Japanese food market also presents opportunities.

Focus on sustainable sourcing and environmentally friendly practices can enhance brand image. Innovation in product development is essential to meet changing consumer preferences. Expanding strategically into new geographies will be critical for growth. For a comprehensive look, see the Calbee's annual report.

To maintain a strong position, Calbee must focus on several key areas. These strategies are essential for navigating the competitive landscape and achieving sustainable growth. Adapting to market changes is crucial for long-term success.

- Innovation in healthier snack options to cater to evolving consumer preferences.

- Strategic expansion into emerging markets, leveraging partnerships and digital marketing.

- Sustainable sourcing and environmentally friendly practices to enhance brand image and appeal.

- Efficient supply chain management to mitigate rising raw material costs.

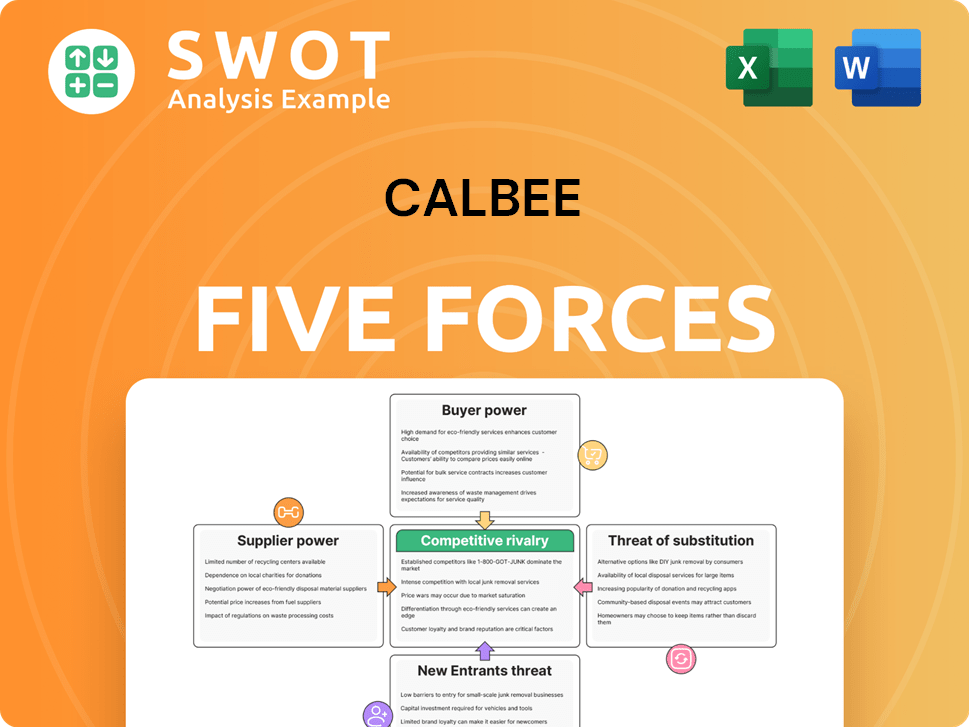

Calbee Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Calbee Company?

- What is Growth Strategy and Future Prospects of Calbee Company?

- How Does Calbee Company Work?

- What is Sales and Marketing Strategy of Calbee Company?

- What is Brief History of Calbee Company?

- Who Owns Calbee Company?

- What is Customer Demographics and Target Market of Calbee Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.