Cathay Pacific Airways Bundle

Can Cathay Pacific Soar Above Its Rivals?

Cathay Pacific Airways, a cornerstone of the global aviation industry, has navigated turbulent skies for decades. From its Hong Kong base, the airline has built a reputation for service and resilience. But in the fiercely competitive world of air travel, understanding the landscape is crucial for success.

This analysis dives deep into the Cathay Pacific Airways SWOT Analysis, examining its position within the airline industry competition. We'll explore the Cathay Pacific competitors, analyze its market share compared to competitors, and assess its competitive advantages of Cathay Pacific within the Hong Kong aviation market. Furthermore, we'll dissect the Cathay Pacific market analysis to uncover its strengths, weaknesses, opportunities, and threats, providing a comprehensive view of its strategic position.

Where Does Cathay Pacific Airways’ Stand in the Current Market?

Cathay Pacific, a key player in the airline industry, centers its operations around premium full-service passenger travel, cargo services, and low-cost travel via HK Express. The airline leverages its strategic hub at Hong Kong International Airport to serve a wide network of destinations, particularly in the Asia-Pacific region. This approach allows it to maintain a strong presence and capitalize on its geographical advantage.

The company's value proposition includes offering premium services, efficient cargo solutions, and budget-friendly travel options. Cathay Pacific aims to cater to diverse customer needs, from luxury travelers to cost-conscious flyers. By providing a range of services, Cathay Pacific seeks to capture a significant share of the aviation market, especially within the competitive landscape of the Asia-Pacific region.

Cathay Pacific holds a robust market position, particularly in the Asia-Pacific region. As of December 31, 2024, the Cathay Group, including HK Express, served 88 destinations with scheduled passenger services and an additional 154 through codeshare agreements. The Group's fleet comprised 236 aircraft as of December 31, 2024, with plans for expansion.

In 2024, Cathay Pacific and HK Express saw a combined increase of over 30% in passenger numbers year-on-year. Cathay Pacific alone carried 22.8 million passengers in 2024, a 26.9% increase from 2023. The airline is a leader in international seat capacity in the Asia-Pacific region, alongside Singapore Airlines.

Cathay Pacific dominates several key regional routes. As of May 2025, it held significant market shares: Hong Kong-Japan (51%), Hong Kong-China (49%), Hong Kong-India (84%), Hong Kong-Indonesia (75%), and Hong Kong-Singapore (57%). This strong presence highlights its competitive advantage.

The Cathay Group's revenue increased by 10.5% year-on-year to HK$104.3 billion (US$13.4 billion) in 2024. Cathay Cargo performed well, with cargo tonnage up 11% and yield about 3% higher than in 2023. Despite passenger yield normalization, the Group reported an attributable profit of HK$9.9 billion in 2024.

Cathay Pacific's competitive advantages include its strategic hub location, strong brand reputation, and comprehensive service offerings. These factors contribute to its ability to compete effectively in the airline industry. Understanding the Brief History of Cathay Pacific Airways provides insights into its evolution and market strategies.

- Strategic Hub: Hong Kong International Airport provides a key advantage.

- Service Variety: Offers premium, cargo, and low-cost travel options.

- Market Dominance: Holds significant market share on key regional routes.

- Financial Strength: Demonstrated by strong revenue growth and profitability in 2024.

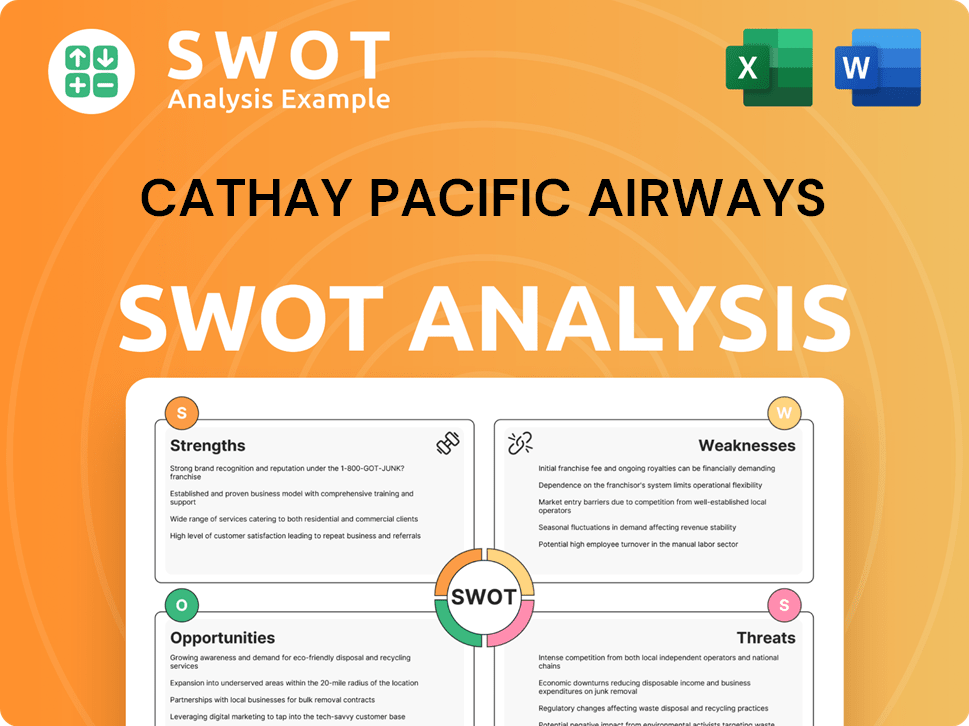

Cathay Pacific Airways SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Cathay Pacific Airways?

The competitive landscape for Cathay Pacific Airways is incredibly dynamic, shaped by a multitude of factors including global economic conditions, geopolitical events, and evolving consumer preferences. Understanding the key players and their strategies is critical for assessing Cathay Pacific's position in the market. This analysis of Cathay Pacific's target market provides a foundation for understanding its competitive environment.

Cathay Pacific faces both direct and indirect competition across its passenger and cargo operations. The airline industry is characterized by high capital expenditures, fluctuating fuel prices, and intense price competition, making it essential to analyze the strengths and weaknesses of its rivals. The airline's success depends on its ability to differentiate itself through service quality, route network, and operational efficiency.

The airline industry is undergoing constant change, with new business models and technological advancements disrupting traditional competition. This requires Cathay Pacific to continually adapt its strategies to stay competitive.

In the full-service airline segment, Cathay Pacific competes with major Asian carriers. These rivals include Singapore Airlines, which Cathay Pacific recognizes as a significant competitor. Other key players in the Asia-Pacific region with considerable international seat capacity also pose a challenge.

For long-haul routes, especially to North America and Europe, Cathay Pacific faces strong competition. Airlines like United Airlines and Korean Air are significant in the Asia-North America route, where Cathay Pacific holds a 9% market share. In Asia-Europe, Lufthansa and Singapore Airlines are key rivals, with Cathay Pacific holding a 6% market share as of May 2025.

Mainland China-based airlines are also a major source of competition. These airlines are aggressively expanding their international capacity, increasing the pressure on Cathay Pacific. This expansion impacts Cathay Pacific's market share and profitability.

Cathay Pacific's subsidiary, HK Express, faces intense price competition from low-cost carriers on regional routes. Airlines like AirAsia are significant competitors in this segment. This price competition affects the profitability of HK Express.

The air cargo operations market is highly competitive. Cathay Pacific competes with major players such as Emirates SkyCargo, Lufthansa Cargo, Singapore Airlines Cargo, and CargoLux. Korean Air Cargo also holds a significant market share in terms of revenue-ton kilometers.

Operational challenges, such as the grounding of HK Express Airbus A320neo aircraft due to engine issues in 2024, can impact competitive standing. Emerging players and shifting alliances constantly reshape the competitive dynamics. These factors can influence Cathay Pacific's financial performance.

Understanding the key competitive factors is crucial for a thorough Cathay Pacific market analysis. These factors include route network, pricing strategies, customer service, and brand reputation. Cathay Pacific's strategic partnerships and alliances also play a significant role in its competitive position.

- Route Network: Cathay Pacific's extensive route network, particularly in Asia-Pacific, is a key competitive advantage. Comparing its routes with competitors helps identify strengths and weaknesses.

- Pricing Strategies: Cathay Pacific's pricing strategies must be competitive to attract customers. Analyzing pricing versus competitors is essential.

- Customer Service: The quality of customer service is a crucial differentiator. Cathay Pacific's customer service compared to rivals significantly impacts its brand reputation.

- Brand Reputation: Cathay Pacific's brand reputation influences customer loyalty and market share. Analyzing its brand reputation against competitors is important.

- Financial Performance: Cathay Pacific's financial performance compared to competitors provides insights into its market position.

- Strategic Partnerships: Strategic partnerships and alliances can enhance Cathay Pacific's competitive position.

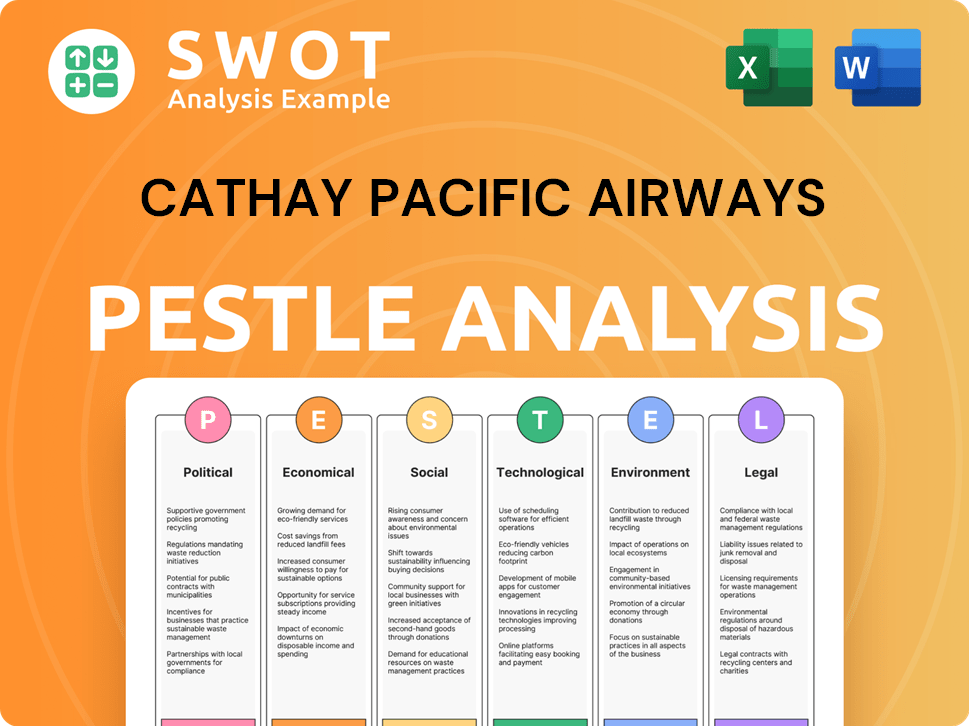

Cathay Pacific Airways PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Cathay Pacific Airways a Competitive Edge Over Its Rivals?

Understanding the Revenue Streams & Business Model of Cathay Pacific Airways is crucial for assessing its competitive advantages within the dynamic airline industry. The company's strategic positioning and operational strengths are key factors in its market performance. This analysis delves into the core elements that enable it to compete effectively, considering both its internal capabilities and external market dynamics.

Cathay Pacific's competitive advantages are multifaceted, stemming from its strategic hub location, dual-brand strategy, and strong brand reputation. These elements, combined with robust cargo operations and financial stability, position the airline favorably against its rivals. The following sections will provide a comprehensive look at these advantages, supported by recent data and insights into its market strategies.

A thorough Cathay Pacific market analysis reveals a company focused on long-term growth and customer satisfaction. Its ability to adapt and innovate is critical in maintaining its competitive edge. This chapter explores the specific advantages that define the airline's success in a competitive global market.

The strategic location of its hub at Hong Kong International Airport is a significant advantage. This hub serves as a key gateway connecting Asia with the world, solidifying Hong Kong's status as a global aviation hub. This advantageous position supports an extensive network, with over 100 passenger destinations served by Cathay Pacific and HK Express by 2025.

The dual-brand strategy, encompassing Cathay Pacific and HK Express, enables the company to cater to diverse customer needs and market segments. This approach allows it to offer both premium full-service options and low-cost carrier services. This flexibility enhances market penetration and customer reach.

Cathay Pacific has a strong brand reputation built on service excellence, safety, and reliability, fostering customer trust and loyalty. The airline consistently invests in enhancing the customer experience through high-quality in-flight services and new cabin products. New products like the Aria Suite and Premium Economy are available on the Boeing 777-300ERs.

Cathay Pacific's cargo operations are a significant strength, especially in the second half of 2024, driven by e-commerce demand. The airline's cargo business contributes substantially to its revenue and overall financial performance. This strong performance is a key differentiator in the airline industry competition.

Cathay Pacific's competitive advantages are further enhanced by its membership in the Oneworld global alliance and its financial strength. The airline's commitment to a skilled workforce and ongoing investments in fleet expansion and interior renovations also contribute to its operational efficiency.

- Oneworld Alliance: Expands global reach and connectivity.

- Financial Strength: Achieved an attributable profit of HK$9.9 billion in 2024.

- Fleet Expansion: Investing over HK$100 billion for fleet expansion and interior renovations.

- Workforce: Plans to increase staff to around 34,000 by the end of 2025.

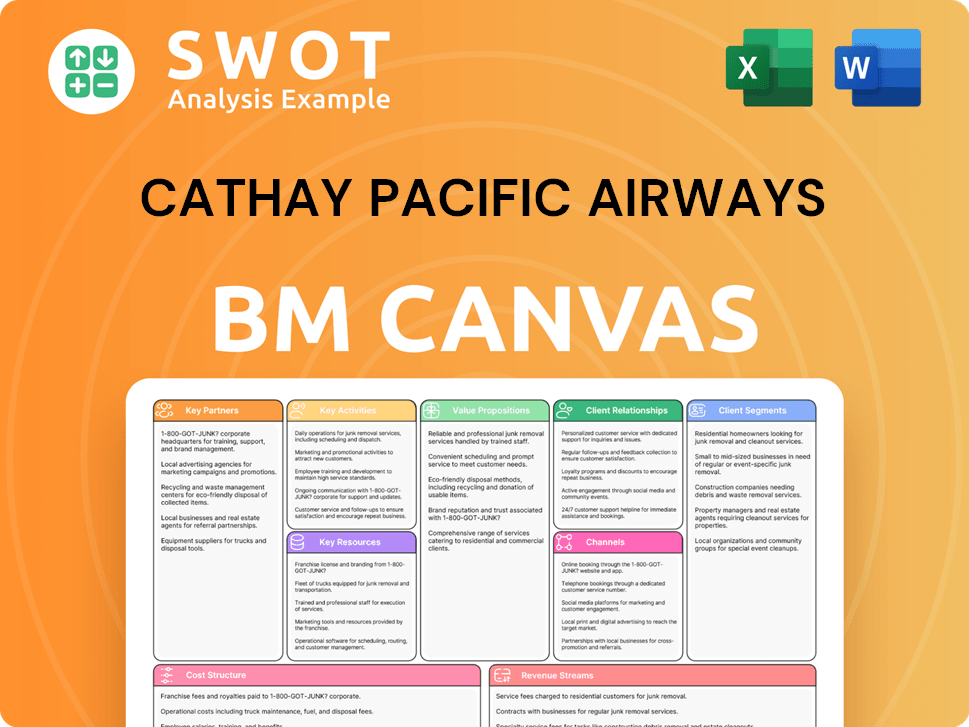

Cathay Pacific Airways Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Cathay Pacific Airways’s Competitive Landscape?

The aviation industry is undergoing significant shifts, with technological advancements and evolving consumer preferences reshaping the competitive landscape. For Cathay Pacific, understanding these trends is vital for strategic planning and maintaining a strong market position. This analysis explores industry trends, future challenges, and opportunities, providing a comprehensive view of the company's prospects.

Cathay Pacific faces a dynamic environment where digital transformation and data analytics are critical for operational efficiency and customer satisfaction. The airline’s performance in 2024 reflects both its strengths and the pressures it faces. This includes navigating intense competition, managing supply chain issues, and adapting to fluctuating fuel prices. Understanding the Owners & Shareholders of Cathay Pacific Airways can also provide insights into the company's strategic direction.

Technological advancements, including AI and advanced analytics, are crucial for streamlining operations and enhancing customer experience. E-commerce continues to drive airfreight growth, especially in the Asia-Pacific region. The return of belly capacity with more passenger flights can put pressure on cargo yields. The airline industry is seeing a return of belly capacity with more passenger flights, which can put pressure on cargo yields.

Intense competition on regional routes is leading to a normalization of passenger yields, with Cathay Pacific seeing a 12% decrease and HK Express a 23% decrease in 2024. Supply chain issues and potential trade conflicts could impact operations. Labor shortages and workforce expansion needs pose challenges to operational efficiency and costs. Fuel price volatility remains a threat to profitability.

Rapid growth in international travel demand in Asia presents a significant opportunity for expansion. Emerging markets in Asia and Africa offer unexplored passenger and freight markets. The company's investment of over HK$100 billion in infrastructure and fleet expansion will boost capacity and customer experience. Strategic partnerships and sustainability initiatives can drive growth and differentiate the airline.

Cathay Pacific's competitive landscape includes rivals such as Singapore Airlines and other international carriers. The airline's financial performance must be assessed against these competitors. Understanding the airline industry competition is crucial for future success. The airline's focus on premium travel and enhancing its offerings, such as the new Aria Suite and Premium Economy, caters to discerning travelers and strengthens customer loyalty.

Cathay Pacific's future success hinges on several key factors. These include expanding its route network, investing in customer experience, and embracing sustainability initiatives. The airline must also effectively manage costs and adapt to changing market conditions.

- Route Network Expansion: Adding new destinations and increasing flight frequencies.

- Customer Experience: Enhancing services and premium offerings.

- Sustainability: Investing in SAF and reducing emissions.

- Cost Management: Controlling expenses and improving operational efficiency.

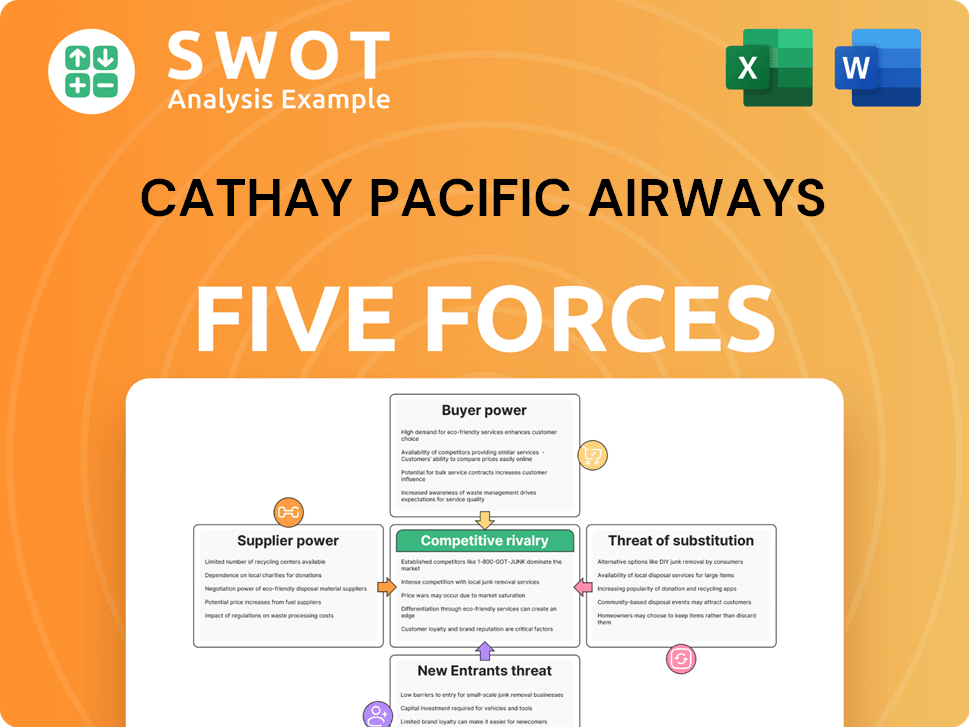

Cathay Pacific Airways Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cathay Pacific Airways Company?

- What is Growth Strategy and Future Prospects of Cathay Pacific Airways Company?

- How Does Cathay Pacific Airways Company Work?

- What is Sales and Marketing Strategy of Cathay Pacific Airways Company?

- What is Brief History of Cathay Pacific Airways Company?

- Who Owns Cathay Pacific Airways Company?

- What is Customer Demographics and Target Market of Cathay Pacific Airways Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.