EL AL Isreal Airline Bundle

How Does EL AL Navigate the Turbulent Skies of Airline Competition?

The global aviation industry is a battlefield of strategic alliances, shifting consumer demands, and geopolitical uncertainties. EL AL Israel Airlines, the flag carrier of Israel, operates within this dynamic environment, facing both commercial pressures and unique operational considerations. Established in 1948, EL AL has a rich history of connecting Israel to the world, a mission that has shaped its identity and strategic approach. This article will explore the EL AL Isreal Airline SWOT Analysis, its competitive landscape, and its future prospects.

Understanding the EL AL competitive landscape is crucial for investors, analysts, and anyone interested in the Israeli aviation industry. This analysis will dissect EL AL's position, examining its main competitors and the strategies they employ in the airline competition. We'll delve into EL AL market analysis, exploring its strengths, weaknesses, and opportunities in a rapidly changing market. The goal is to provide actionable insights into EL AL's strategic positioning and its ability to thrive amidst challenges like the impact of low-cost carriers on EL AL and other factors.

Where Does EL AL Isreal Airline’ Stand in the Current Market?

EL AL Israel Airlines, as the flag carrier of Israel, centers its core operations around providing air travel services, primarily international passenger flights and cargo services. It functions as a crucial air link, connecting Israel to major international hubs. The airline's value proposition revolves around offering reliable, secure, and culturally sensitive services, including kosher meals, catering to a specific segment of travelers.

The airline's market position is significantly influenced by its unique role within the Israeli aviation industry. EL AL's primary focus is on scheduled international passenger flights and cargo services, with a strong emphasis on destinations serving both business and leisure travelers, as well as the large Israeli diaspora. EL AL's strong brand recognition and reputation for security provide a distinct advantage, especially on routes to and from Israel.

In 2023, EL AL reported a net profit of $109 million, a considerable improvement from previous years, reflecting its recovery and operational efficiency. This financial health and strategic importance position it as a resilient player in the competitive landscape. EL AL's geographic presence is concentrated on routes connecting Tel Aviv to key cities across Europe, North America, Africa, and Asia, making it a key player in the Israeli aviation industry.

EL AL's dominance is most evident on routes connecting Israel to major international hubs. While specific global market share figures fluctuate, its presence on routes to North America and Europe is substantial. EL AL's strong brand recognition and reputation for security provide a distinct advantage, especially on routes to and from Israel.

EL AL caters to both business and leisure travelers, as well as the large Israeli diaspora. The airline's services, including kosher meals, are tailored to meet the needs of a specific customer segment. The airline focuses on providing services that are aligned with the cultural and religious needs of its passengers.

EL AL's geographic presence is concentrated on routes connecting Tel Aviv to key cities across Europe, North America, Africa, and Asia. These routes are critical for both business and leisure travel, as well as for maintaining connections with the Israeli diaspora. The airline's route network is designed to serve the most important international destinations.

In 2023, EL AL reported a net profit of $109 million. This financial performance reflects the airline's recovery and operational efficiency. The financial health of EL AL is crucial for its ability to invest in its fleet, services, and competitive strategies within the Israeli aviation industry.

EL AL's competitive advantages include its strong brand recognition, security reputation, and direct connections, particularly on routes to and from Israel. The airline faces intense competition from other carriers, necessitating continuous adaptation and strategic investment. The competitive landscape includes both legacy carriers and low-cost airlines.

- Brand Recognition: Strong brand loyalty and recognition within the Israeli market.

- Security Reputation: High standards of security, crucial for travelers.

- Direct Connections: Offers direct flights, which are highly valued by passengers.

- Competition: Faces competition from both legacy and low-cost carriers.

- Adaptation: Requires continuous adaptation to remain competitive.

- Strategic Investment: Needs strategic investments in fleet and services.

For more insights into EL AL's strategic direction, consider exploring the Growth Strategy of EL AL Isreal Airline. This analysis provides a deeper understanding of the company's plans for the future.

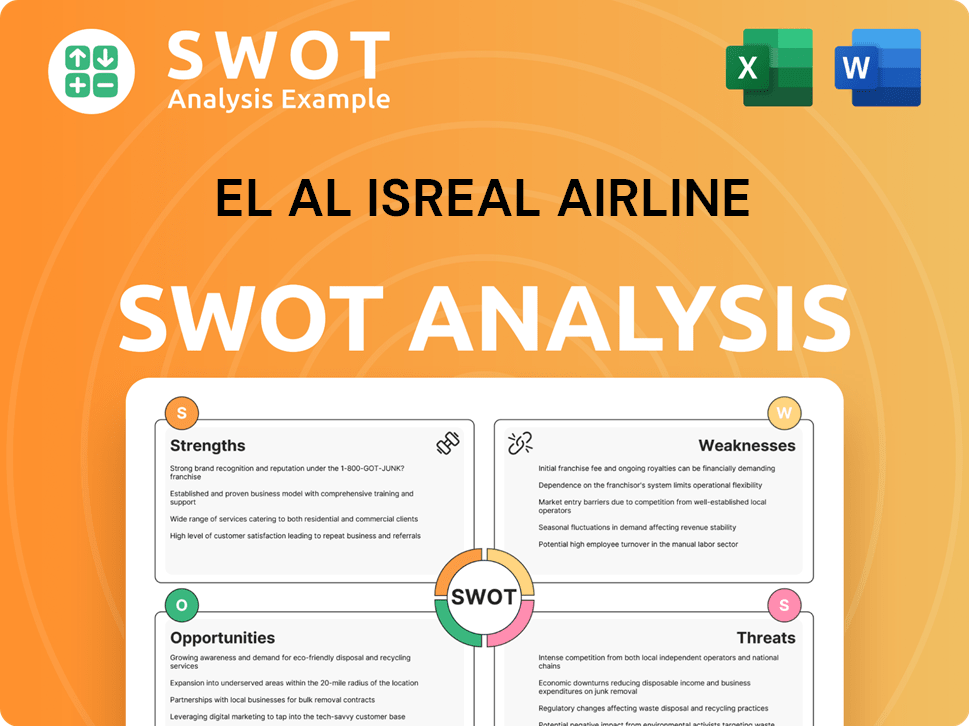

EL AL Isreal Airline SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging EL AL Isreal Airline?

The EL AL competitive landscape is shaped by a diverse range of airlines vying for market share in the Israeli aviation industry. This includes both direct and indirect competitors, each employing different strategies to attract passengers. Understanding these competitive dynamics is crucial for EL AL market analysis and strategic planning.

EL AL Israel airline faces significant challenges and opportunities in this environment. Factors such as geopolitical considerations, fluctuating fuel prices, and evolving consumer preferences further complicate the competitive landscape. This analysis aims to provide a comprehensive overview of the key players and their impact on EL AL's operations.

Direct competitors are primarily full-service airlines operating routes to and from Israel. These airlines offer similar services and target the same customer segments as EL AL. They often compete on price, route network, and service quality.

Major European carriers like Lufthansa, Air France-KLM, British Airways, and Turkish Airlines are significant rivals. They leverage their extensive global networks and hub-and-spoke models. For example, Lufthansa Group consistently competes on routes between Europe and Tel Aviv.

United Airlines and Delta Air Lines are key competitors on transatlantic routes, offering direct flights from major US cities to Tel Aviv. They compete through loyalty programs and premium services. These airlines target business travelers and tourists.

LCCs such as Ryanair, Wizz Air, and easyJet have increased their presence in the Israeli market, offering lower fares. This challenges EL AL's pricing power, especially for leisure travelers. The price sensitivity of some market segments is a key factor.

Indirect competition comes from charter airlines and, in some cases, cruise lines. These competitors target specific leisure segments. Mergers and alliances also intensify competition, offering seamless travel experiences.

The expansion of Gulf carriers like Emirates and Qatar Airways also poses a potential future threat. Geopolitical factors influence these competitive dynamics. Alliances like Star Alliance, SkyTeam, and Oneworld create further competitive pressures.

Several factors influence the competitive landscape. These include route networks, pricing strategies, service quality, and brand perception. EL AL's challenges in the aviation market are significant, requiring strategic responses to maintain its market position.

- Route Network: The breadth and frequency of routes offered by each airline.

- Pricing: Competitive fares and pricing strategies, including discounts and promotions.

- Service Quality: The level of comfort, in-flight amenities, and customer service provided.

- Brand Perception: The reputation and image of the airline among consumers.

- Loyalty Programs: Benefits and rewards offered to frequent flyers.

- Operational Efficiency: Cost management and on-time performance.

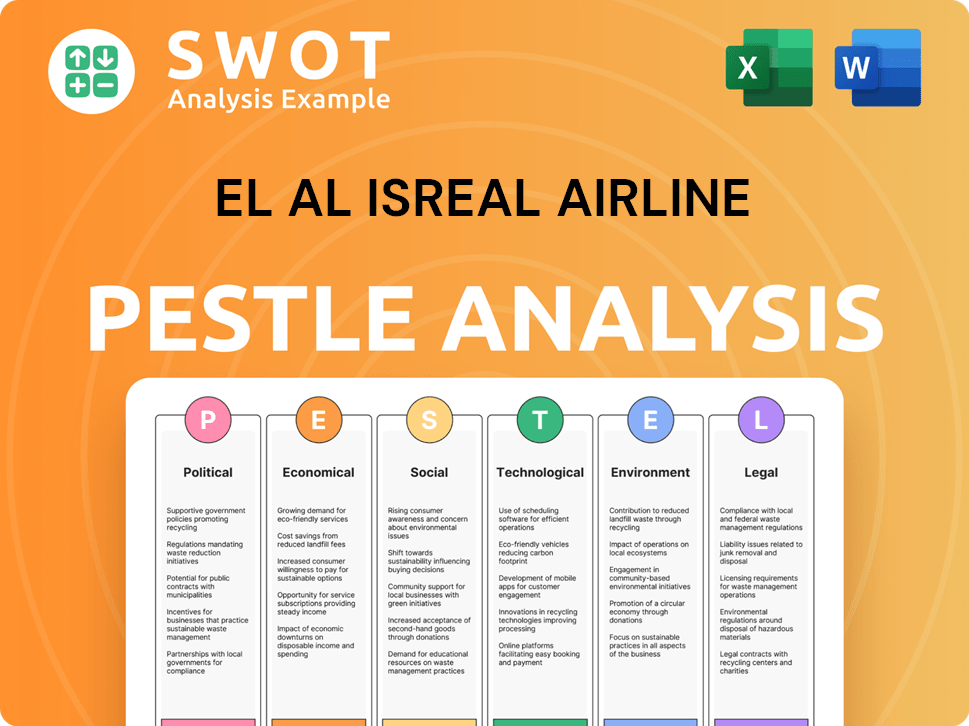

EL AL Isreal Airline PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives EL AL Isreal Airline a Competitive Edge Over Its Rivals?

Analyzing the EL AL competitive landscape reveals several key strengths that position it uniquely within the Israeli aviation industry. As the national carrier, EL AL benefits from a strong brand presence and customer loyalty, particularly among Israeli citizens and the Jewish diaspora. This loyalty is a significant advantage, especially when considering the airline's commitment to cultural and religious needs, like providing kosher meals, which is a crucial factor in its market.

EL AL Israel airline also distinguishes itself through its stringent security measures, recognized globally as among the most secure in the aviation industry. This reputation is critical, especially given the geopolitical environment, and it provides a sense of security that is highly valued by many passengers. These measures are continually updated to address evolving threats. The airline's strategic importance to the State of Israel further supports its operations, offering potential governmental backing that other commercial airlines may not have.

Understanding the EL AL market analysis requires acknowledging these inherent advantages. However, the airline faces challenges, including competition from low-cost carriers and the need to continuously innovate and improve services to maintain its competitive edge. The airline’s financial performance and strategic decisions are crucial in maintaining its position.

EL AL's strong brand equity and customer loyalty provide a solid foundation. As the national flag carrier, it enjoys a high level of trust and preference among Israelis and the Jewish diaspora. This loyalty is reinforced by its focus on cultural and religious needs, like kosher meals, which cater to its core demographic.

EL AL Israel airline is renowned for its rigorous security protocols. These measures are a major differentiator, especially in a region with complex geopolitical dynamics. While security checks may take longer, they offer passengers enhanced peace of mind, which is a significant advantage.

As the national carrier, EL AL has a strategic role within Israel. This can translate into governmental support and considerations that benefit its operations. Its direct flight network to and from Israel is also a key advantage, especially for routes where direct service is highly valued.

EL AL's route network analysis shows a focus on direct flights to and from Israel. This is a significant advantage, especially for routes where non-stop service is highly valued by passengers. These direct routes save time and provide convenience, enhancing customer satisfaction.

EL AL benefits from its strong brand recognition and customer loyalty, particularly within Israel and among the Jewish diaspora. Its reputation for stringent security is a major differentiator in the airline competition. Furthermore, its strategic importance to the State of Israel provides additional support.

- Brand recognition and customer loyalty, especially among Israelis and the Jewish diaspora.

- Stringent security measures, which are highly valued by passengers.

- Strategic importance to the State of Israel, potentially leading to governmental support.

- Direct flight network, offering convenient non-stop services.

To further understand EL AL's challenges in the aviation market, one should consider the impact of airline competition, particularly from low-cost carriers, and the need for continuous innovation. For a deeper dive into EL AL's target demographic, consider reading about the Target Market of EL AL Isreal Airline.

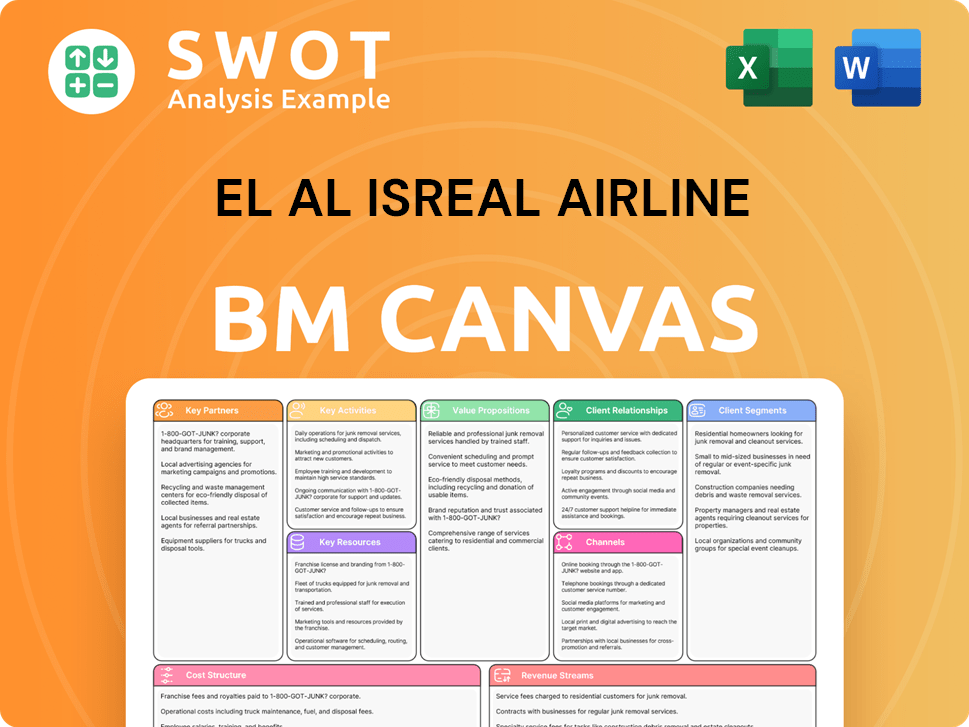

EL AL Isreal Airline Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping EL AL Isreal Airline’s Competitive Landscape?

The Revenue Streams & Business Model of EL AL Isreal Airline is significantly influenced by industry trends, future challenges, and opportunities. The airline's competitive standing within the Israeli aviation industry is shaped by technological advancements, regulatory changes, evolving consumer preferences, and global economic factors. Understanding these elements is crucial for strategic planning and ensuring long-term viability in a dynamic market.

EL AL's market analysis reveals a complex environment. The airline faces challenges such as intensified competition and geopolitical instability. However, opportunities exist in expanding its network, product innovation, and strategic partnerships. Adapting to these dynamics requires a proactive approach to operational efficiency, market expansion, and technological adoption.

Technological advancements, including advanced booking systems and sustainable aviation fuels, are reshaping the industry. Regulatory changes, such as those concerning carbon emissions and data privacy, are also impacting airline operations. Consumer preferences are shifting towards flexible bookings and sustainable travel options, influencing demand.

Intensified competition from low-cost carriers and potential new market entrants pose a threat. The ongoing geopolitical situation in the Middle East presents continuous challenges, affecting travel advisories and operational flexibility. Sustained decline in demand due to regional instability and increased regulation are potential risks.

Increasing global travel demand and the emergence of new markets offer significant growth opportunities. Product innovations, such as enhanced premium services and loyalty program enhancements, can attract higher-yield customers. Strategic partnerships and investments in sustainable aviation technologies provide further avenues for expansion.

EL AL must focus on operational efficiency, targeted market expansion, and technological adoption. The airline needs to maintain its unique service offerings while proactively managing geopolitical risks. Adapting to changing consumer demands and leveraging strategic partnerships are also crucial.

EL AL's competitive advantages include its strong brand perception and its established route network. The airline benefits from its reputation for security and its national identity, which are significant in the Israeli market. However, it faces challenges in operational efficiency and pricing strategies compared to competitors.

- Market Share: EL AL's market share analysis in 2024 shows its position in the Israeli aviation market.

- Fleet: EL AL's fleet composition and age influence its operational costs and efficiency.

- Customer Satisfaction: EL AL's customer satisfaction ratings are crucial for maintaining its brand perception.

- Financial Performance: EL AL's financial performance review, including revenue and profitability, is a key indicator of its health.

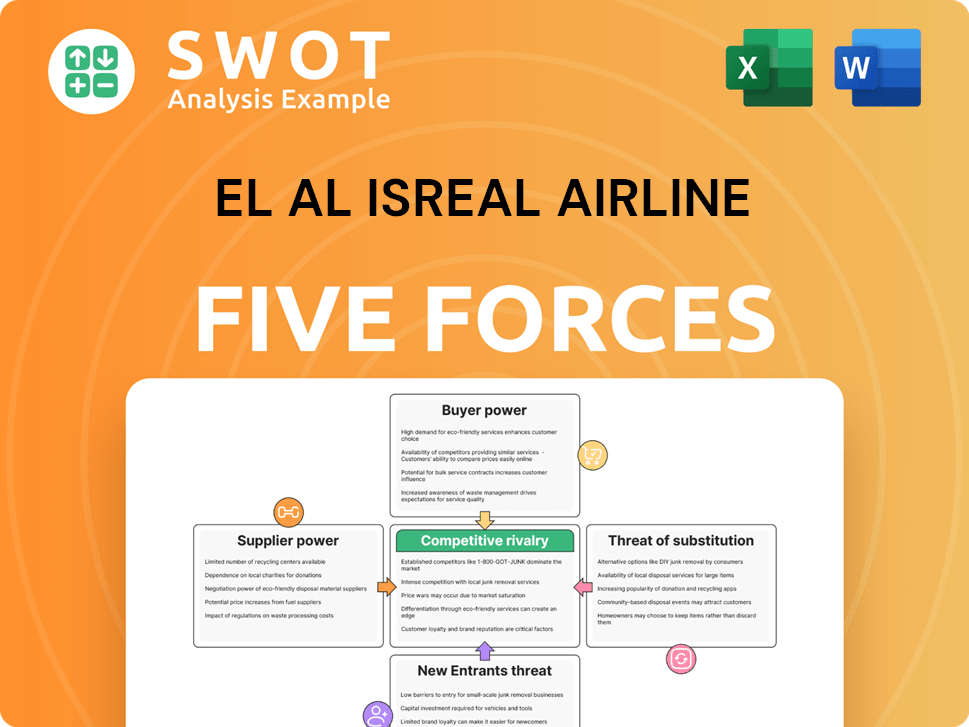

EL AL Isreal Airline Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of EL AL Isreal Airline Company?

- What is Growth Strategy and Future Prospects of EL AL Isreal Airline Company?

- How Does EL AL Isreal Airline Company Work?

- What is Sales and Marketing Strategy of EL AL Isreal Airline Company?

- What is Brief History of EL AL Isreal Airline Company?

- Who Owns EL AL Isreal Airline Company?

- What is Customer Demographics and Target Market of EL AL Isreal Airline Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.