Evergreen Marine Corp. (Taiwan) Bundle

How Does Evergreen Marine Corp. Navigate the Global Shipping Wars?

The Evergreen Marine Corp. (Taiwan) SWOT Analysis reveals a company deeply entrenched in the volatile world of global container transport. Understanding the competitive landscape is crucial in the dynamic shipping industry, especially with evolving geopolitical factors influencing trade routes and supply chains. This analysis dives into the strategies and rivalries shaping Evergreen Marine's position.

Evergreen Marine Corp., a prominent Taiwan shipping company, faces a complex competitive landscape, making market analysis essential for investors and industry professionals. This article examines Evergreen Marine's key competitors, evaluating their strengths and weaknesses to understand the company's industry position. Furthermore, we will explore the competitive advantages of Evergreen Marine and its recent developments within the global trade arena, offering insights into its future strategy and operational efficiency within the shipping industry.

Where Does Evergreen Marine Corp. (Taiwan)’ Stand in the Current Market?

Evergreen Marine Corp. (Taiwan) is a major player in the global container transport sector, offering comprehensive shipping services. Its core operations revolve around the transportation of goods in containers across various trade lanes. The company provides full container load (FCL) and less than container load (LCL) options, catering to diverse customer needs, from multinational corporations to small and medium-sized enterprises.

The value proposition of Evergreen Marine includes reliable and efficient container transportation services. It focuses on providing extensive global coverage, connecting major ports across the world. The company continually invests in its fleet, including the recent delivery of new 24,000 TEU class containerships in 2024, to enhance its capacity and operational efficiency, ensuring it meets evolving environmental regulations and customer demands.

As of March 2024, Evergreen Marine's active fleet capacity exceeded 1.7 million TEUs, solidifying its position among the largest container carriers globally. This substantial capacity supports its extensive network and ability to serve major trade routes.

Evergreen Marine consistently ranks among the top ten largest container carriers worldwide by TEU capacity. Specific market share figures fluctuate, but its substantial fleet size ensures a significant presence in the shipping industry. This strong market position allows Evergreen to compete effectively in key trade lanes.

The company's geographic reach is extensive, covering major trade lanes such as trans-Pacific, Asia-Europe, and intra-Asia routes. Evergreen also provides services to the Mediterranean, North America, Central America, the Caribbean, the Indian subcontinent, and Australia. This broad coverage supports its global container transport operations.

Evergreen serves a diverse customer base, including multinational corporations and small and medium-sized enterprises involved in international trade. This diverse customer base helps to stabilize its revenue streams and provides opportunities for growth. The company's ability to cater to a wide range of clients is a key factor in its market position.

Recent developments include investments in larger, more fuel-efficient vessels to meet evolving environmental regulations. The delivery of new 24,000 TEU class containerships in 2024 demonstrates its commitment to expanding capacity and improving operational efficiency. These investments are crucial for maintaining a competitive edge.

Evergreen Marine's competitive advantages include its substantial fleet size, extensive global network, and strategic alliances. These factors enhance its service offerings and market reach, particularly in the intra-Asia trade and key East-West routes. However, the company faces challenges such as fluctuating freight rates and the cyclical nature of the shipping industry, which can impact its financial performance. For more insights into Evergreen Marine's strategic approach, consider reading about the Growth Strategy of Evergreen Marine Corp. (Taiwan).

- Market Analysis: Evergreen Marine's market position is influenced by global trade dynamics and the demand for container shipping services.

- Competitive Analysis: The company competes with other major shipping lines in terms of capacity, route coverage, and service quality.

- Financial Performance: Evergreen's financial health generally reflects the cyclical nature of the shipping industry, but its consistent profitability and strategic investments indicate a robust financial standing.

- Future Strategy: The company focuses on expanding its fleet, improving operational efficiency, and adapting to environmental regulations to maintain its competitive edge.

Evergreen Marine Corp. (Taiwan) SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Evergreen Marine Corp. (Taiwan)?

The competitive landscape for Evergreen Marine Corp. (Taiwan) is intense, shaped by the dynamics of the global container shipping market. Several major players vie for market share, influencing pricing, service offerings, and technological advancements. Understanding these competitors is crucial for evaluating the company's position and strategic direction.

Evergreen Marine Corp., a significant player in the shipping industry, faces constant pressure from rivals. These competitors drive innovation and efficiency improvements, impacting Evergreen Marine Corp.'s market share and overall performance. The company must navigate these challenges to maintain its competitive edge.

The primary competitors include A.P. Moller-Maersk, Mediterranean Shipping Company (MSC), CMA CGM, COSCO Shipping Lines, Hapag-Lloyd, and Ocean Network Express (ONE). These companies compete on various fronts, including fleet capacity, service offerings, and global network reach. They are constantly striving to gain a competitive advantage in the global container transport market.

A.P. Moller-Maersk is a significant competitor, often competing for the top spot in fleet capacity. Maersk focuses on end-to-end logistics solutions and digital transformation. In 2024, Maersk reported a revenue of approximately $51 billion, demonstrating its substantial market presence.

Mediterranean Shipping Company (MSC) is another major player, known for its rapid fleet expansion. MSC's strategy includes aggressive growth and a broad global network. MSC's fleet capacity continues to grow, putting pressure on competitors like Evergreen Marine Corp.

CMA CGM competes through diverse service offerings, including air cargo and logistics, and strategic acquisitions. CMA CGM's diversified approach adds to the competitive pressure. In 2024, CMA CGM's revenue was around $29 billion, highlighting its significant market share.

COSCO Shipping Lines leverages its strong presence in Asian trade lanes and significant fleet size. Backed by the Chinese state, COSCO poses a strong challenge in key markets. COSCO's fleet expansion and strategic alliances enhance its competitive position.

Hapag-Lloyd is known for its operational efficiency and focus on profitability, competing on service quality and reliability. Hapag-Lloyd's efficiency and customer service contribute to its competitive advantage. The company's strong financial performance supports its market position.

Ocean Network Express (ONE), a consortium of Japanese shipping lines, offers a comprehensive network, particularly in the trans-Pacific and intra-Asia trades. ONE's network and service offerings provide strong competition in key trade routes. The alliance structure enables ONE to compete effectively.

These competitors challenge Evergreen Marine Corp. across various fronts. Competition manifests in pricing, digital solutions, branding, and global distribution networks. The competitive analysis of Evergreen Marine Corp. involves understanding these dynamics. For more details on the company's financial strategies, see Revenue Streams & Business Model of Evergreen Marine Corp. (Taiwan).

The competition among these companies is fierce, with several factors driving their strategies and performance. These factors shape the competitive advantages of Evergreen Marine and its rivals.

- Price Competitiveness: Particularly during periods of overcapacity, pricing wars on key routes are common.

- Innovation: Digital solutions and sustainable shipping practices are crucial for staying competitive.

- Branding and Customer Service: Strong branding and excellent customer service differentiate companies.

- Global Distribution Networks: The breadth and depth of global networks are critical for reaching customers.

Evergreen Marine Corp. (Taiwan) PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Evergreen Marine Corp. (Taiwan) a Competitive Edge Over Its Rivals?

The competitive landscape for Evergreen Marine Corp. (Taiwan) is shaped by its strategic focus on fleet modernization, extensive global network, and strong brand reputation. These elements contribute to its competitive advantages within the dynamic shipping industry. A detailed market analysis reveals how these factors position the company against its rivals in the global container transport sector.

Evergreen Marine Corp. has consistently invested in expanding its fleet, including the introduction of large, fuel-efficient vessels. This commitment enhances its cost structure and aligns with environmental standards. The company's participation in THE Alliance further strengthens its network, offering comprehensive connectivity and competitive transit times. Understanding the target market of Evergreen Marine Corp. (Taiwan) is crucial for appreciating its strategic positioning.

The shipping industry's competitive analysis highlights Evergreen's operational efficiencies and strong customer loyalty, which are essential for navigating market fluctuations. While the industry faces challenges like aggressive pricing and the need for technological advancements, Evergreen's strategic approach to fleet management and global network continues to support its competitive edge. The company's focus on prudent financial management and strategic asset deployment has allowed it to navigate challenging periods.

Evergreen's investment in new vessels, such as the 24,000 TEU class containerships delivered in 2024, enhances economies of scale. This fleet renewal reduces operational costs and aligns with evolving environmental regulations. The focus on fuel-efficient ships improves the company's competitive position in the shipping industry.

Evergreen's extensive global network covers major trade routes across Asia, Europe, and North America. Participation in THE Alliance enhances its network coverage and operational efficiency. This wide reach allows Evergreen to offer competitive transit times and a broad range of service options.

Evergreen's long-standing brand equity and reputation for reliability foster customer loyalty. The company's operational efficiencies, including effective terminal management, contribute to its competitive edge. Strong customer relationships are crucial in the competitive shipping market.

Evergreen's focus on prudent financial management helps navigate market fluctuations. Strategic asset deployment supports its competitive advantages. The company's ability to adapt to industry challenges is a key factor in its success.

Evergreen Marine Corp. (Taiwan) benefits from several key competitive advantages that support its strong position in the global container transport market. These advantages include a modern fleet, an extensive global network, and a strong brand reputation.

- Fleet Modernization: Continuous investment in new, fuel-efficient vessels reduces operational costs.

- Global Network: Comprehensive coverage of major trade routes provides competitive transit times.

- Brand Reputation: Strong brand equity fosters customer loyalty and trust.

- Operational Efficiency: Effective terminal management and streamlined logistics processes enhance its edge.

Evergreen Marine Corp. (Taiwan) Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Evergreen Marine Corp. (Taiwan)’s Competitive Landscape?

The competitive landscape for Evergreen Marine Corp. (Taiwan), a prominent Taiwan shipping company, is shaped by dynamic industry trends and global economic shifts. Understanding these factors is crucial for market analysis and strategic planning. The company faces both challenges and opportunities in the shipping industry, requiring adaptability and forward-thinking strategies to maintain its position in global container transport.

The Evergreen Marine Corp. must navigate technological advancements, regulatory changes, and geopolitical uncertainties. Factors such as the push for decarbonization, fluctuating cargo demand, and the potential for new market entrants significantly impact Evergreen Marine Corp's operational efficiency and strategic direction. Addressing these elements is key to ensuring the company's long-term success and maintaining its competitive edge.

Digitalization and automation are transforming the shipping industry, driving the need for smart ports, AI-driven logistics, and blockchain for supply chain transparency. Regulatory changes, particularly those related to decarbonization, pose substantial challenges. Global economic shifts, including geopolitical tensions and trade policy changes, can lead to volatility in cargo demand.

Evergreen faces the challenge of continually investing in new technologies. It must comply with stricter environmental regulations, including the IMO 2020 sulfur cap and future emissions reduction targets. Maintaining flexible operations and diversified service offerings is crucial due to global economic shifts. The potential for new market entrants could also challenge traditional shipping models.

Emerging markets, particularly in Southeast Asia and Africa, present new trade lanes and increasing demand for shipping services. The continued growth of e-commerce drives demand for efficient global logistics. Innovation in vessel design, alternative fuels, and data analytics can lead to improved operational efficiency and new service offerings.

Evergreen is likely to continue its strategy of fleet modernization, strategic alliances, and exploring digital solutions. They are focused on optimizing operations and better serving customers in a rapidly evolving global trade environment. The company aims to expand its presence in emerging markets and develop tailored services for e-commerce logistics.

The company's success hinges on strategic investments in technology and sustainable practices. The ability to adapt to geopolitical and economic fluctuations is critical. Evergreen Marine Corp. must leverage growth opportunities in emerging markets and the e-commerce sector.

- Focus on Digitalization: Implement advanced technologies to improve efficiency and customer experience.

- Prioritize Sustainability: Invest in cleaner fuels and vessel modifications to meet environmental standards.

- Expand in Emerging Markets: Target Southeast Asia and Africa to capitalize on growing trade lanes.

- Enhance E-commerce Logistics: Develop tailored services to meet the demands of online retail.

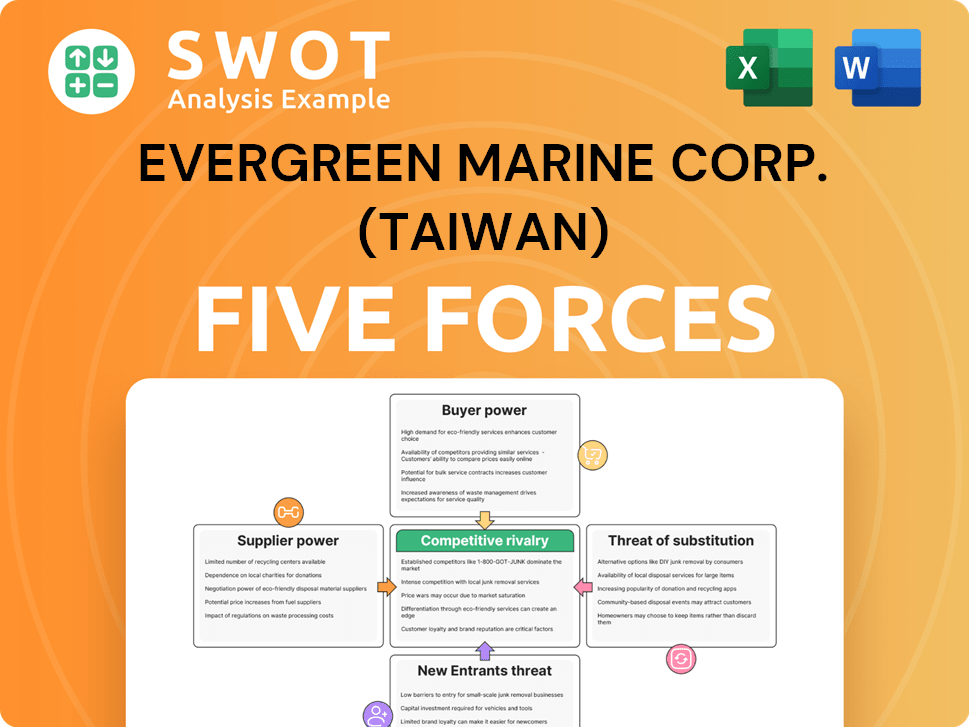

Evergreen Marine Corp. (Taiwan) Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Evergreen Marine Corp. (Taiwan) Company?

- What is Growth Strategy and Future Prospects of Evergreen Marine Corp. (Taiwan) Company?

- How Does Evergreen Marine Corp. (Taiwan) Company Work?

- What is Sales and Marketing Strategy of Evergreen Marine Corp. (Taiwan) Company?

- What is Brief History of Evergreen Marine Corp. (Taiwan) Company?

- Who Owns Evergreen Marine Corp. (Taiwan) Company?

- What is Customer Demographics and Target Market of Evergreen Marine Corp. (Taiwan) Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.