Gammon India Ltd. Bundle

Can Gammon India Ltd. Thrive in Today's Infrastructure Race?

India's infrastructure boom is creating a fiercely contested arena, and Gammon India Ltd. is a key player in this dynamic environment. Understanding the Gammon India Ltd. SWOT Analysis is crucial for anyone looking to understand its position. This analysis dives deep into the competitive landscape, providing a comprehensive view of the challenges and opportunities ahead for this historic company.

This detailed company analysis explores Gammon India Ltd.'s market position within the construction industry, examining its historical performance and current standing. We will dissect the competitive advantages, challenges faced, and the future outlook for Gammon India Ltd., considering key players and market trends. The goal is to provide a clear picture of Gammon India Ltd.'s financial health and business strategy in this evolving sector, including its recent performance and revenue streams.

Where Does Gammon India Ltd.’ Stand in the Current Market?

Gammon India Ltd. operates within the highly competitive and fragmented Indian infrastructure construction sector. The company's primary focus involves infrastructure development, including roads, bridges, flyovers, ports, power projects, and water treatment plants. It also engages in engineering, procurement, and construction (EPC) contracts, primarily within India.

The company's market position has been significantly impacted by financial difficulties in recent years. This has led to a shift from a position of prominence to one focused on resolving legacy issues and seeking revival. The Owners & Shareholders of Gammon India Ltd. have been navigating challenges within the construction industry.

While specific, up-to-date market share figures for Gammon India in 2024-2025 are not readily available due to the company's current financial restructuring and operational challenges. Historically, it has been a significant player in segments like bridges and civil engineering.

Gammon India Ltd. specializes in infrastructure construction, covering roads, bridges, ports, and power projects. The company undertakes EPC contracts, managing projects from design to completion. Its operations are primarily concentrated within India, serving various states.

Gammon India offers comprehensive infrastructure solutions, leveraging its expertise in civil engineering. It provides end-to-end services, including project planning, execution, and management. The company aims to deliver high-quality infrastructure projects, contributing to India's development.

Gammon India's geographic presence is predominantly within India, undertaking projects across various states. The company has historically focused on civil construction projects, including bridges and other infrastructure. Its market position has been affected by financial challenges in recent years.

Gammon India has faced considerable financial strain, as reflected in its ongoing corporate insolvency resolution process. The company's current standing is a stark contrast to its earlier years when it was considered a leader in specialized infrastructure projects. The company's financial performance has been a key factor affecting its market position.

The competitive landscape for Gammon India Ltd. includes numerous players in the Indian infrastructure construction sector. Key competitors include large construction firms with diverse project portfolios. Gammon India faces challenges due to its financial difficulties and the need to restructure its operations.

- Intense competition from both domestic and international construction companies.

- Financial constraints impacting project bidding and execution capabilities.

- Need to secure new projects and regain market share in a challenging environment.

- Regulatory and economic factors influencing project timelines and profitability.

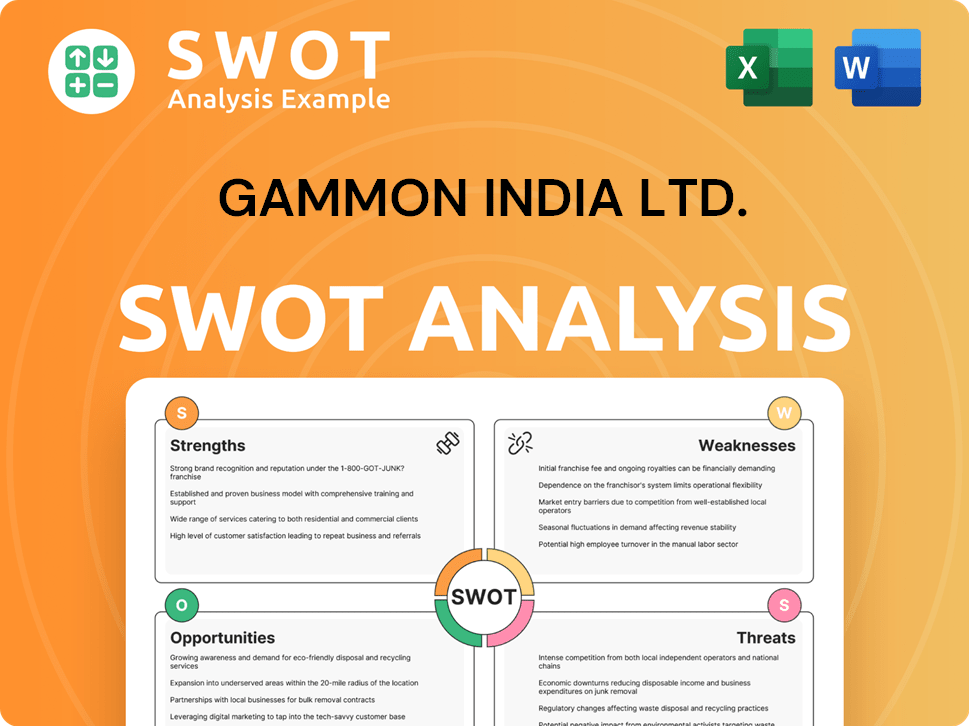

Gammon India Ltd. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Gammon India Ltd.?

The competitive landscape for Gammon India Ltd. (Gammon India Ltd; competitors analysis) in the Indian infrastructure sector is highly competitive, with several established players vying for market share. The company faces challenges from both large, diversified conglomerates and specialized construction firms. Understanding the competitive dynamics is crucial for assessing Gammon India Ltd;'s market position and future outlook.

The infrastructure sector in India is experiencing significant growth, driven by government initiatives and increasing investment in projects such as roads, railways, and urban infrastructure. This growth attracts numerous players, intensifying the competition. Gammon India Ltd. must navigate this environment to maintain its market share and achieve sustainable financial performance.

The competitive landscape is dynamic, with companies constantly adapting their strategies to secure projects and improve profitability. Factors such as project cost, execution timelines, and technical expertise play a crucial role in winning contracts. Understanding the strengths and weaknesses of competitors is essential for Gammon India Ltd; to develop effective business strategies.

L&T is a dominant player in the Indian infrastructure sector, with a vast portfolio of projects across various segments. L&T's financial strength and technological capabilities enable it to undertake large-scale, complex projects. In fiscal year 2024, L&T's infrastructure segment revenue was approximately ₹89,110 crore, demonstrating its significant market presence.

Afcons Infrastructure, a subsidiary of the Shapoorji Pallonji Group, is a strong competitor, particularly in marine, highway, and urban infrastructure projects. Afcons is known for its expertise in specialized projects and efficient project execution. The company has a proven track record of delivering projects on time and within budget.

Dilip Buildcon has emerged as a significant player in the road and highway construction segment, known for its execution speed and asset-light model. The company's focus on specific segments allows it to maintain a competitive edge. In fiscal year 2024, Dilip Buildcon reported a revenue of approximately ₹10,000 crore, reflecting its growth in the sector.

GMR Infrastructure is involved in various infrastructure projects, including airports, energy, and roads. The company's diversified portfolio allows it to compete in multiple segments. GMR Infrastructure's strategic focus on infrastructure development positions it as a key player in the industry.

IRB Infrastructure Developers is a major player in the road infrastructure sector, with a significant presence in highway projects. The company's focus on toll road projects provides a stable revenue stream. IRB Infrastructure Developers' expertise in highway construction makes it a strong competitor in the market.

Numerous regional and specialized contractors also compete in specific segments of the infrastructure market. These companies often focus on niche areas or regional projects. This diverse group of competitors adds to the complexity of the competitive landscape.

The competitive dynamics within the Indian infrastructure sector are influenced by several factors, including government policies, economic conditions, and technological advancements. The government's focus on infrastructure development, as outlined in the National Infrastructure Pipeline, is expected to drive further competition. For a detailed look at the Revenue Streams & Business Model of Gammon India Ltd., refer to the linked article.

Several factors are crucial in determining the success of infrastructure companies. These include project cost, completion timelines, technical expertise, and financial stability. Understanding these factors is essential for Gammon India Ltd. to effectively compete in the market.

- Project Cost: Competitive bidding often hinges on the ability to offer the most cost-effective solutions.

- Completion Timelines: Delivering projects on schedule is critical to maintaining a good reputation and securing future contracts.

- Technical Expertise: Specialized skills and innovative technologies are increasingly important for complex projects.

- Financial Stability: Strong financial health allows companies to undertake large projects and weather economic downturns.

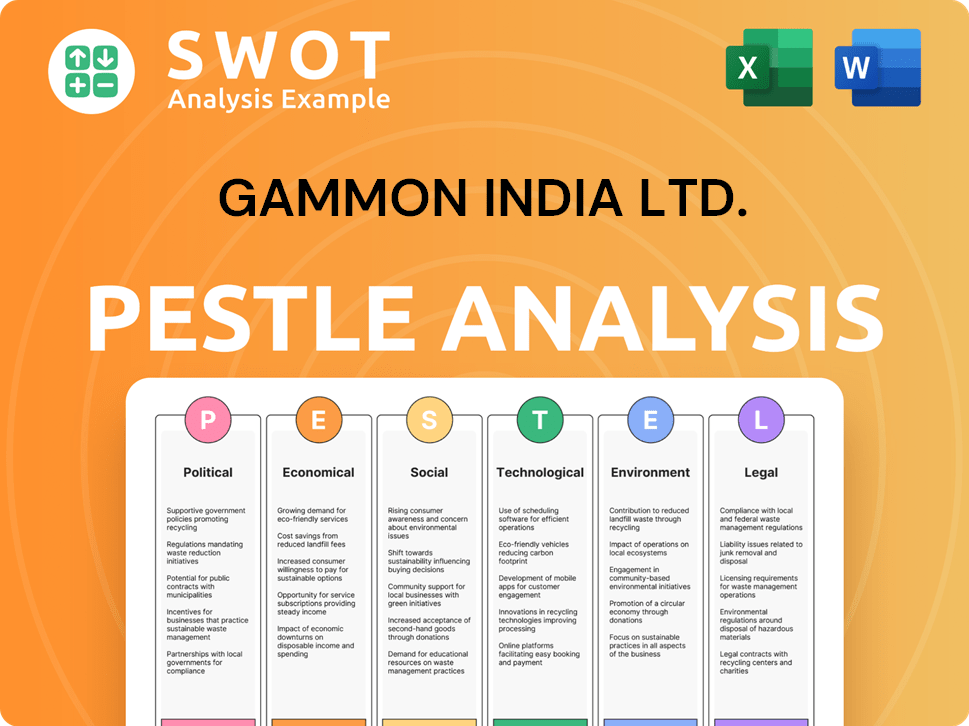

Gammon India Ltd. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Gammon India Ltd. a Competitive Edge Over Its Rivals?

Analyzing the Growth Strategy of Gammon India Ltd. requires understanding its competitive advantages, which have evolved over time. Historically, Gammon India Ltd. held several key advantages in the Indian infrastructure sector. These advantages, however, have been significantly impacted by the company's financial difficulties and operational challenges in recent years.

One of Gammon India Ltd.'s primary strengths was its extensive experience and expertise in executing complex civil engineering projects. This included a strong legacy of technical know-how and a skilled workforce, particularly in bridge construction. The company's established relationships with government agencies and public sector undertakings also provided a pipeline of opportunities, crucial in a sector heavily reliant on public funding.

Gammon India also benefited from its established operational capabilities and a network of resources, enabling it to manage large-scale projects. However, the sustainability of these advantages has been tested. The company is currently focused on restructuring and regaining its operational footing rather than leveraging these past strengths in the current competitive environment.

Gammon India Ltd. historically possessed deep expertise in complex civil engineering projects, especially bridge construction. This specialization allowed the company to secure projects requiring advanced engineering solutions. The company's long-standing relationships with government agencies were also a key advantage.

Financial distress and operational setbacks have significantly eroded many of Gammon India Ltd.'s historical competitive advantages. The company's focus has shifted towards restructuring and regaining operational stability. The current competitive environment presents new challenges.

Gammon India Ltd. is currently prioritizing restructuring efforts to address its financial and operational challenges. This involves streamlining operations and seeking new avenues for growth. The company is aiming to re-establish its position in the market.

The construction industry in India is highly competitive, with numerous players vying for projects. Market share is influenced by factors such as project financing, technical expertise, and regulatory compliance. Understanding these dynamics is crucial.

Gammon India Ltd.'s competitive landscape is shaped by its past strengths and current challenges. The company faces competition from both domestic and international players in the infrastructure sector. Key factors influencing its future include its ability to secure new projects and manage its financial health.

- Market Share: The company's market share has fluctuated due to financial constraints.

- Financial Performance: Recent financial performance has been impacted by project delays and cost overruns.

- Industry Overview: The infrastructure industry in India is experiencing growth, with opportunities in various sectors.

- Challenges Faced: The company is dealing with debt restructuring and operational inefficiencies.

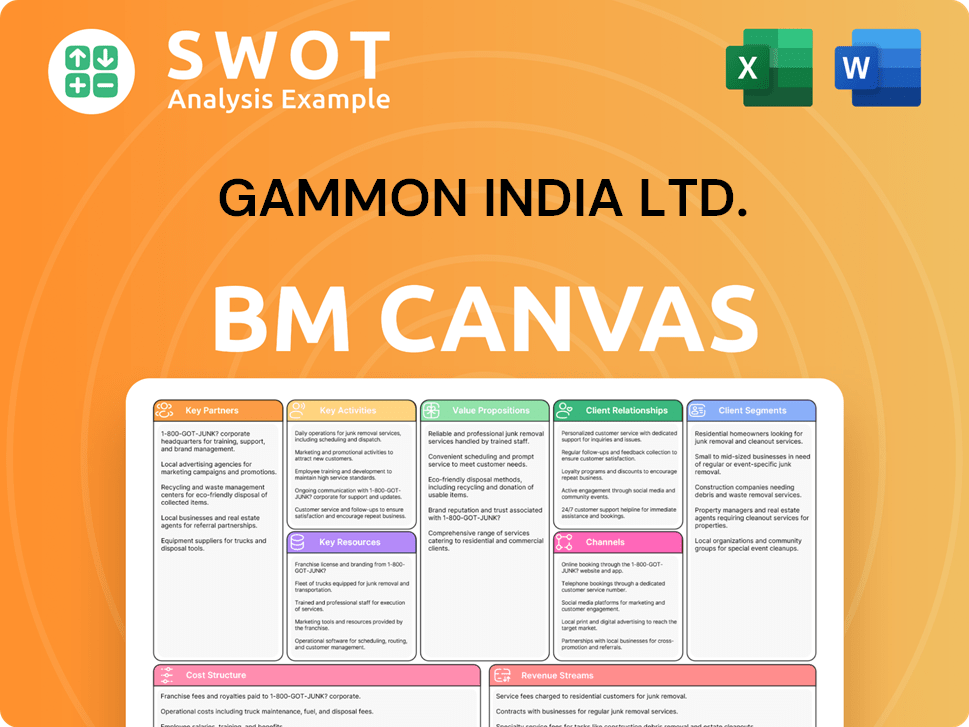

Gammon India Ltd. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Gammon India Ltd.’s Competitive Landscape?

The Indian infrastructure sector is currently experiencing significant growth, driven by substantial government investments and technological advancements. This creates a dynamic environment for companies like Gammon India Ltd. to navigate. Understanding the competitive landscape and industry trends is crucial for assessing the company's position and future prospects. A thorough Company Analysis reveals that the firm faces both internal and external challenges.

The Competitive Landscape for Gammon India Ltd. is shaped by its financial health and the strategic initiatives of its rivals. The company’s ability to secure new projects and maintain Market Share depends on its capacity to overcome its financial constraints and compete effectively. The infrastructure sector's future outlook is positive, but Gammon India's success hinges on its ability to adapt and capitalize on emerging opportunities.

The Indian infrastructure sector is witnessing a surge in government spending, particularly through initiatives like the National Infrastructure Pipeline (NIP), which aims to invest significantly in infrastructure projects. Technological advancements, such as the adoption of Building Information Modeling (BIM) and prefabricated construction, are reshaping project execution. Regulatory changes aimed at streamlining project clearances are also accelerating project timelines, creating a more dynamic environment.

Gammon India Ltd. faces the challenge of financial restructuring and resolving legacy issues, which limits its ability to bid for new projects. Intense competition from well-capitalized domestic and international players poses another significant hurdle. The company must also navigate the complexities of project execution, including securing timely approvals and managing cost overruns. These factors can impact the Financial Performance.

If Gammon India can successfully address its challenges, it has the potential to leverage its expertise in niche areas, possibly through partnerships or by focusing on smaller projects. The overall growth in the infrastructure sector offers opportunities for the company to rebuild its financial and operational capabilities. Strategic alliances and focused project selection could enhance the company's competitive position.

The Indian construction industry is expected to grow, with the government investing heavily in infrastructure projects. This includes roads, railways, ports, and urban infrastructure. The adoption of new technologies and the streamlining of regulations are also expected to boost project efficiency and attract more investments. The Industry Overview indicates a positive trajectory.

To improve its Market Position, Gammon India Ltd. needs to focus on several key areas. These include resolving financial issues, strategically bidding for projects, and exploring partnerships. The company should also invest in technological upgrades and enhance its project management capabilities. For a deeper look at how the company might approach its marketing, see the Marketing Strategy of Gammon India Ltd..

- Financial Restructuring: Prioritize resolving outstanding financial obligations to improve its creditworthiness.

- Strategic Project Selection: Focus on projects where it has a competitive advantage or specialized expertise.

- Partnerships and Alliances: Collaborate with stronger companies to bid for larger projects and share risks.

- Technological Adoption: Implement advanced construction technologies to improve efficiency and reduce costs.

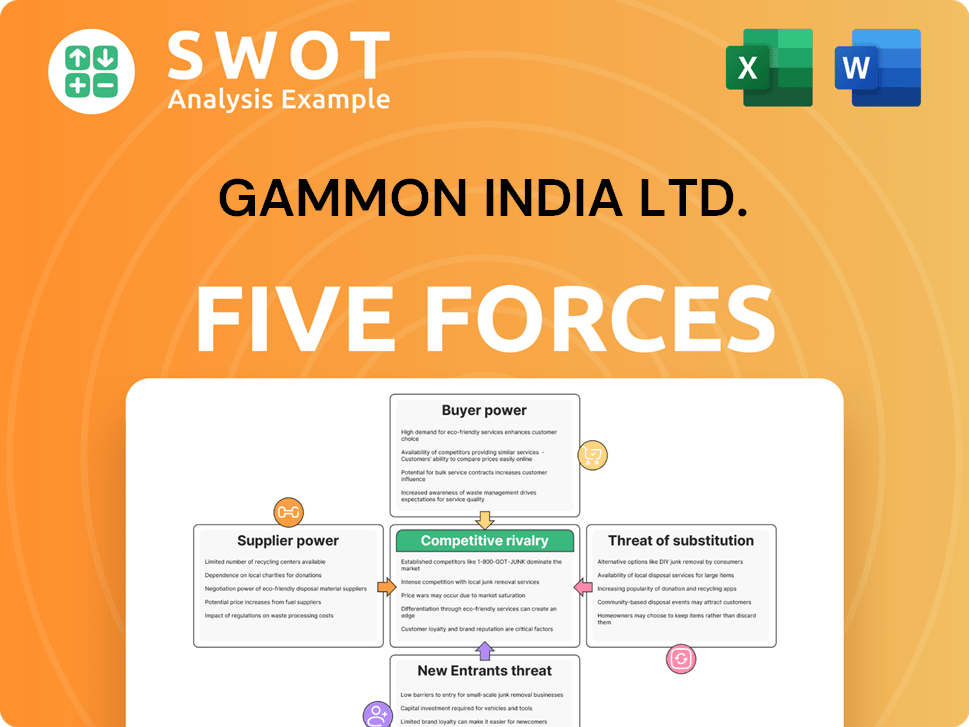

Gammon India Ltd. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Gammon India Ltd. Company?

- What is Growth Strategy and Future Prospects of Gammon India Ltd. Company?

- How Does Gammon India Ltd. Company Work?

- What is Sales and Marketing Strategy of Gammon India Ltd. Company?

- What is Brief History of Gammon India Ltd. Company?

- Who Owns Gammon India Ltd. Company?

- What is Customer Demographics and Target Market of Gammon India Ltd. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.