Hinduja Global Solutions Bundle

Can Hinduja Global Solutions Maintain Its Competitive Edge in the Booming BPM Market?

The Business Process Management (BPM) sector is on a meteoric rise, with projections exceeding $70 billion by 2032. Within this dynamic environment, understanding the Hinduja Global Solutions SWOT Analysis and its position is crucial. This analysis delves into the HGS competitive landscape, exploring its strengths, weaknesses, and opportunities in the global outsourcing market.

This deep dive into the HGS competitive landscape will dissect the company's standing among its HGS competitors, providing a detailed BPO industry analysis. We'll examine Hinduja Global Solutions market share analysis, key services, and strategic moves. Furthermore, we'll compare Hinduja Global Solutions to its rivals, highlighting its Competitive advantages of Hinduja Global Solutions and the challenges faced by its competitors, offering actionable insights for investors and stakeholders.

Where Does Hinduja Global Solutions’ Stand in the Current Market?

Hinduja Global Solutions (HGS) holds a significant position in the global Business Process Management (BPM) industry. As of December 31, 2024, HGS operated across 33 delivery centers in ten countries, employing over 18,000 people. This extensive presence allows HGS to serve a diverse range of sectors, contributing to its robust market position.

The company's value proposition lies in its diversified geographic and segmental reach. HGS provides services across various sectors, including technology and telecom, consumer and retail, banking and financial services, and the public sector. This diversification, coupled with its expanding presence in India, particularly in lower-tier cities, strengthens its market position and business risk profile.

HGS's market position has been enhanced by its digital media business, NXTDIGITAL. This segment contributed approximately 32% of the revenue in fiscal year 2024, serving over 6 million customers across India. The company's financial performance, with a consolidated total income of ₹4,958.8 crore (US$ 586.1 million) for the full year ended March 31, 2025, and revenue from operations at ₹4,404.2 crore, reflects its strong market standing.

HGS's revenue from operations for fiscal year 2025 was ₹4,404.2 crore. India accounted for about 31% of HGS's revenue in fiscal 2024. The digital media business, NXTDIGITAL, contributed approximately 32% of the revenue in fiscal 2024.

As of December 31, 2024, HGS operated 33 delivery centers across ten countries. India's revenue contribution significantly increased, showing HGS's expanded presence, especially in lower-tier cities.

HGS reported a consolidated total income of ₹4,958.8 crore (US$ 586.1 million) for the full year ended March 31, 2025. The net cash and treasury surplus stood at ₹5,167.8 crore as of March 31, 2025.

HGS serves various sectors, including technology and telecom (13%), consumer and retail (20%), and banking and financial services (14%) in fiscal 2024. The digital media business, NXTDIGITAL, serves over 6 million customers.

HGS's competitive advantages include its diversified service offerings and geographic reach. The company is focusing on customer acquisition, particularly in the broadband business, and leveraging the HITS platform for rural markets. These strategies are key to driving future growth within the Brief History of Hinduja Global Solutions.

- Diversified service offerings across various sectors.

- Expanded presence in India, especially in lower-tier cities.

- Focus on customer acquisition in the broadband business.

- Leveraging the HITS platform for rural markets.

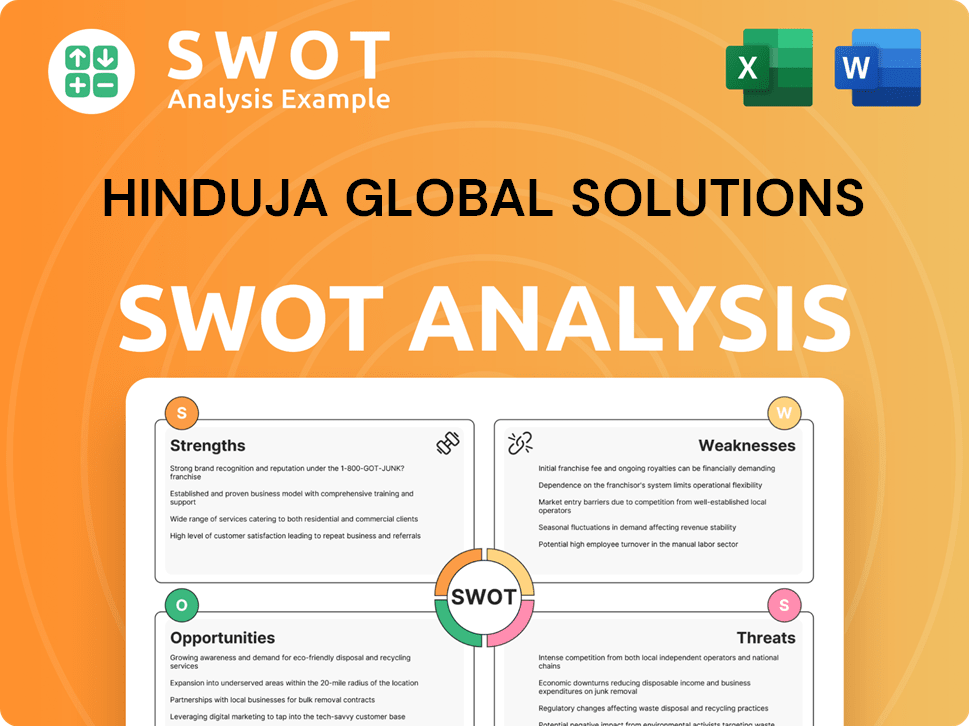

Hinduja Global Solutions SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Hinduja Global Solutions?

The competitive landscape for Hinduja Global Solutions (HGS) is intense, encompassing both direct and indirect rivals in the business process management (BPM) and IT-enabled services (ITeS) sectors. This environment is shaped by global market dynamics and specific regional competition, particularly within India. Understanding the HGS competitive landscape is crucial for assessing its market position and strategic direction. The BPO industry analysis reveals a sector driven by operational efficiency and technological advancements, influencing the strategies of all players, including HGS.

HGS faces competition across various service lines and geographies. The need for operational agility and cost-effectiveness is a constant driver in the BPM market. Competitors are continually investing in digital transformation and AI-powered solutions, mirroring HGS's own strategic initiatives. This dynamic environment requires continuous adaptation and innovation to maintain a competitive edge. For a deeper dive into HGS's strategic approach, consider exploring the Growth Strategy of Hinduja Global Solutions.

The competitive pressures impact pricing, service offerings, and the ability to attract and retain clients. The outsourcing market is vast, with numerous players vying for market share. HGS's ability to differentiate itself through specialized services, technological integration, and customer relationships is critical to its success.

Direct competitors of HGS include Transcom WorldWide, Atento, Firstsource Solutions, and Startek. These companies offer similar services, competing for the same client base.

Teleperformance and Iguane Solutions are also significant international competitors. They bring global scale and diverse service offerings to the market.

Within India, HGS competes with companies such as Airan Ltd., Allsec Technologies Ltd., AXISCADES Technologies Ltd., eClerx Services Ltd., and Vakrangee. These firms often focus on specific regional markets or service niches.

The IT and telecom segments, where HGS has a presence, are highly competitive, affecting pricing and cost management. Competitors are actively investing in digital transformation and AI-powered solutions, similar to HGS's own strategic moves.

The broader BPM market is driven by the need for operational efficiency and agility. New market entrants and evolving business models continually shape the landscape.

Industry trends, including the adoption of AI and machine learning, influence the competitive dynamics. These technologies are used to automate tasks and enhance decision-making.

Several factors contribute to the competitive landscape. These factors shape the strategies of HGS and its rivals. Understanding these elements is essential for a competitive analysis.

- Pricing Strategies: Competitors often use aggressive pricing to gain market share, putting pressure on profit margins.

- Service Offerings: The breadth and depth of services offered, including specialized solutions, are critical.

- Technological Innovation: Adoption of AI, automation, and digital transformation initiatives.

- Customer Relationships: Strong client relationships and customer satisfaction are essential for retention and growth.

- Geographic Presence: Global presence and regional focus are important for serving diverse markets.

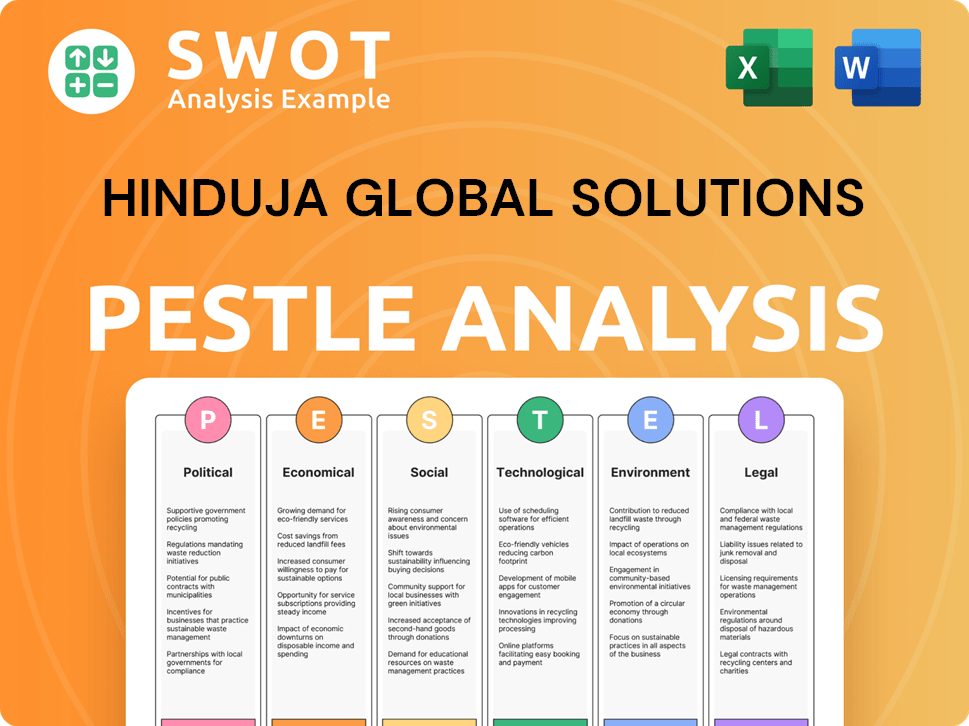

Hinduja Global Solutions PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Hinduja Global Solutions a Competitive Edge Over Its Rivals?

Examining the HGS competitive landscape reveals several key strengths that position the company favorably within the BPO industry. HGS distinguishes itself through its strategic investments in technology, particularly in AI-led solutions, and its broad geographic reach, enabling it to serve diverse clients across multiple sectors. These factors contribute significantly to its ability to compete effectively in the outsourcing market.

The company's focus on innovation, such as the development of HGS Agent X™ and HGS AI Ignite, highlights its commitment to providing advanced, AI-driven services. Furthermore, HGS's robust financial health, with a net cash and treasury surplus of ₹5,167.8 crore as of March 31, 2025, offers it a competitive edge in terms of financial flexibility and strategic growth opportunities. This financial stability supports its ability to expand operations and invest in emerging technologies.

The competitive advantages of Hinduja Global Solutions are multifaceted, encompassing technological prowess, global presence, and financial strength. These elements collectively enhance its ability to attract and retain clients, adapt to market changes, and maintain a strong position in the BPO industry. To understand more about the company's ownership and structure, you can read about the Owners & Shareholders of Hinduja Global Solutions.

HGS leverages AI-led technology services, including HGS Agent X™ and HGS AI Ignite, to enhance service delivery and accelerate AI adoption for clients. These solutions are designed to provide tailored, secure, and responsible AI-driven services. The company's focus on digital transformation helps clients improve operational efficiency and customer experience.

HGS operates 33 delivery centers across ten countries, serving diverse industries such as technology and telecom, and banking and financial services. The inclusion of NXTDIGITAL Ltd. has expanded its geographic reach, particularly in India. This 'globally local' approach allows HGS to cater to diverse client needs across various platforms.

HGS maintains a strong financial position, with a net cash and treasury surplus of ₹5,167.8 crore as of March 31, 2025. This financial strength provides the company with flexibility for strategic investments, acquisitions, and expansion. It supports the company's ability to invest in new technologies and expand delivery capabilities.

HGS excels in customer experience management, digital enablement, and digital marketing services. These services help clients expand their businesses and build trust and loyalty. The company's expertise in these areas is crucial for providing comprehensive solutions to its clients.

HGS's competitive edge is built on its technological innovations, global presence, and financial stability. These advantages enable HGS to offer comprehensive BPO solutions and maintain a strong market position.

- AI-driven solutions like HGS Agent X™ and HGS AI Ignite enhance service delivery.

- A global footprint with 33 delivery centers across ten countries.

- Strong financial health with a net cash and treasury surplus of ₹5,167.8 crore.

- Expertise in customer experience management and digital marketing.

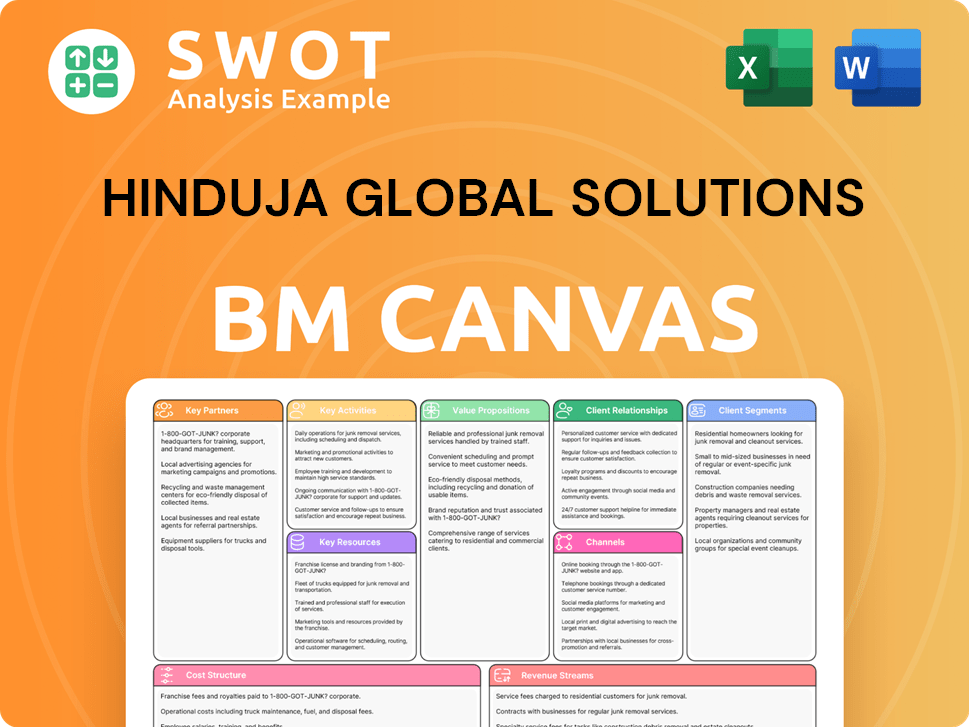

Hinduja Global Solutions Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Hinduja Global Solutions’s Competitive Landscape?

The competitive landscape of Hinduja Global Solutions (HGS) is shaped by dynamic industry trends and evolving market demands. The Business Process Management (BPM) sector is undergoing significant transformation, driven by technological advancements and shifts in client expectations. HGS faces both challenges and opportunities in this environment, navigating intense competition while leveraging emerging technologies and expanding its global presence. Understanding these factors is crucial for assessing HGS's position and future prospects.

The outsourcing market and the BPO industry analysis reveal intense competition, particularly in the ITES and broadband segments. This competitive pressure can impact HGS's pricing flexibility and cost management. In fiscal 2025, subdued demand in key markets and the transition from onshore to offshore models have influenced the company's revenue and operating margins. The media business, although offering growth potential, operates on low margins and requires significant capital investment.

The BPM industry is experiencing rapid growth, fueled by digital transformation and automation. AI, machine learning, and cloud-based solutions are becoming increasingly prevalent. The global BPM market is projected to reach USD 70.93 billion by 2032, with a CAGR of 18.6%. North America currently dominates the market.

Intense competition in ITES and broadband segments impacts price flexibility and cost management. Subdued demand in key markets like the USA and UK affects revenue and margins. The media business faces low margins and requires significant capital to sustain subscriber growth. The outsourcing market is highly competitive.

Investment in AI-led technology services and digital solutions like HGS Agent X. Expansion of the global delivery network, including new centers in Bengaluru and Cape Town. Government initiatives to expand broadband connectivity in India provide opportunities. Focus on digital transformation, geographic expansion, and service diversification.

HGS aims to leverage technology for operational efficiency and revenue growth. The company is focused on digital transformation, geographic expansion, and service diversification. Strong cash reserves support strategic investments and potential acquisitions. The company's strategy includes growth in digital transformation.

HGS's competitive advantages include its focus on digital transformation and expansion of its global delivery network. The company's strategy centers around leveraging technology for operational efficiency. HGS is actively investing in AI-led technology services.

- Digital Transformation: Investment in AI and automation to enhance customer experiences.

- Global Expansion: Expanding delivery centers to cater to growing demand for offshore services.

- Service Diversification: Offering a wide range of services to meet diverse client needs.

- Financial Strength: Strong cash reserves to support strategic investments and acquisitions.

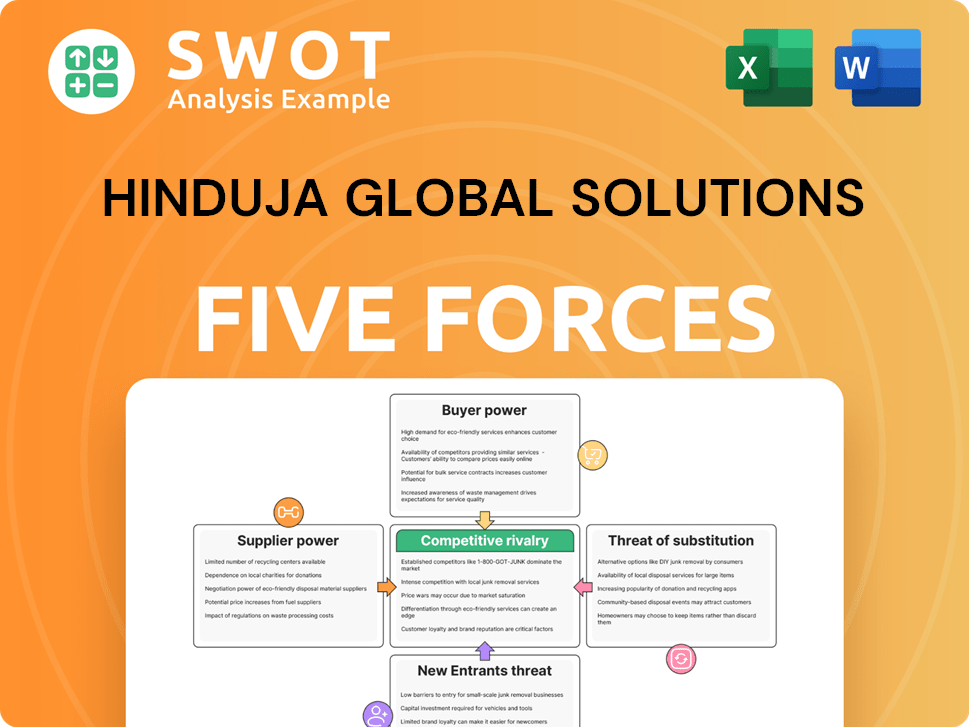

Hinduja Global Solutions Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hinduja Global Solutions Company?

- What is Growth Strategy and Future Prospects of Hinduja Global Solutions Company?

- How Does Hinduja Global Solutions Company Work?

- What is Sales and Marketing Strategy of Hinduja Global Solutions Company?

- What is Brief History of Hinduja Global Solutions Company?

- Who Owns Hinduja Global Solutions Company?

- What is Customer Demographics and Target Market of Hinduja Global Solutions Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.