Knowles Bundle

Can Knowles Corporation Maintain Its Competitive Edge?

Knowles Corporation, a pioneer in advanced electronic components, is navigating a dynamic market landscape. Its strategic shift towards high-value industrial technology markets has positioned it for significant growth. But how does Knowles stack up against its rivals, and what are the key factors driving its success?

This analysis of the Knowles SWOT Analysis will examine Knowles's market position, detailing its competitive advantages and challenges within the Knowles industry. We'll dissect Knowles's business strategy, exploring its recent developments and growth opportunities. This comprehensive Knowles Corporation analysis will also cover its key competitors and provide insights into the future outlook of this innovative company, including its market share analysis and financial performance.

Where Does Knowles’ Stand in the Current Market?

Knowles Corporation is strategically repositioning itself, moving away from consumer electronics to focus on higher-value markets. This shift includes targeting sectors like medtech, defense, and industrial applications. The company's focus is on leveraging its core competencies in audio and advanced components to drive growth in these specialized areas, as detailed in a recent analysis of Owners & Shareholders of Knowles.

As of Q1 2025, Knowles reported revenues from continuing operations of $132 million, demonstrating solid performance. The company's full-year 2024 revenue from continuing operations reached $553.5 million, marking a substantial 21% increase from the previous year. This growth reflects the success of its strategic pivot and the increasing demand for its products in key target markets.

Knowles' core offerings include high-performance capacitors, RF and microwave filters, advanced medtech microphones, and balanced armature speakers. These products are essential components in various applications, including hearing aids, medical devices, and specialized audio equipment. The company's focus on these high-value products supports its strategic shift and strengthens its market position.

The Knowles competitive landscape is shaped by its focus on specialized industrial technology markets. Key competitors vary depending on the specific product segment, including companies in the audio, medical, and industrial components sectors. The company's strategy is to differentiate itself through innovation and high-performance products.

Knowles' market position is strengthened by its focus on high-value markets and a diverse product portfolio. The company's financial health is robust, with a current ratio of 2.35 as of Q4 2024, indicating strong liquidity. Knowles' ability to innovate and adapt to changing market demands is crucial for maintaining its competitive edge.

Knowles generates revenue from several key product segments, including MedTech & Specialty Audio and Precision Devices. The MedTech & Specialty Audio segment saw a 1.2% year-over-year revenue increase to $59.7 million in Q1 2025. The Precision Devices segment reported Q1 2025 revenue of $73 million, contributing significantly to overall revenue.

Knowles' financial performance reflects its strategic repositioning and operational efficiency. The company generated $35 million in net cash from operations in Q4 2024 and $130 million for the full year 2024. The company authorized an additional $150 million for its share repurchase program in February 2025, indicating confidence in its financial outlook.

Knowles' global presence, with manufacturing facilities in the United States, China, the Philippines, and Malaysia, supports its ability to serve a diverse customer base. The company anticipates revenue growth to resume in Q2 2025, with an expected range of $135 million to $145 million. This outlook suggests continued positive momentum and successful execution of its business strategy.

Knowles Corporation's competitive advantages include its strong focus on high-value markets and a diverse product portfolio. The company's ability to innovate and adapt to changing market demands is also a key strength. Its global manufacturing presence supports efficient operations and customer service.

- Focus on high-growth markets like medtech and industrial sectors.

- Diverse product portfolio including capacitors, filters, and audio components.

- Strong financial health with a current ratio of 2.35 as of Q4 2024.

- Global manufacturing footprint in the United States, China, the Philippines, and Malaysia.

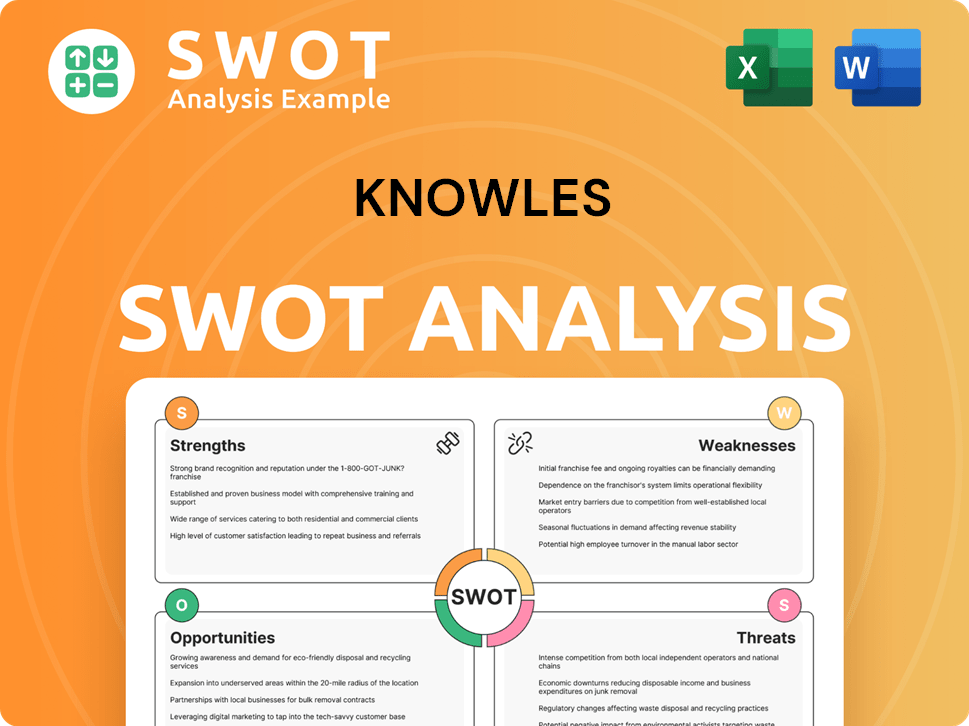

Knowles SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Knowles?

The Knowles competitive landscape is shaped by a mix of direct and indirect competitors within the specialized electronic components market. This analysis considers the broader industry, including companies that offer similar products or compete for market share in related areas. Understanding these competitors is crucial for assessing Knowles' market position and formulating effective business strategies.

Knowles Corporation's strategic focus has evolved, particularly with the divestiture of its consumer MEMS microphone business in late 2024. This shift highlights a move towards higher-value industrial technology segments. This strategic realignment impacts how the company competes and positions itself against rivals in the market.

The competitive dynamics involve companies challenging Knowles through product innovation, technological advancements, and market focus. For instance, companies like Microchip Technology and STMicroelectronics offer a range of audio components and MEMS microphones, respectively. The impact of mergers or alliances, such as Knowles' acquisition of Cornell Dubilier in 2024, also shapes the competitive landscape by expanding Knowles' product portfolio, particularly in high-quality film, electrolytic, and mica capacitors for demanding applications.

Key competitors in the broader market include Microchip Technology, STMicroelectronics, Qualcomm Technologies, and Analog Devices. These companies offer a range of electronic components, competing directly or indirectly with Knowles.

Direct competitors include companies that offer similar products, such as MEMS microphones and audio components. These companies directly compete for market share in the same product categories.

Indirect competitors may offer alternative solutions or compete in adjacent markets. These companies may not directly offer the same products but can still impact Knowles' market position.

Knowles' recent shift in focus towards industrial technology segments allows it to differentiate itself from more broadly diversified semiconductor or consumer electronics companies. This strategic move impacts the company's competitive positioning.

Competitive dynamics are also driven by technological advancements. Companies are constantly innovating to improve product performance, efficiency, and features, influencing their market share.

Mergers and acquisitions, such as Knowles' acquisition of Cornell Dubilier in 2024, can significantly alter the competitive landscape. These actions can expand product portfolios and increase market reach.

The competitive landscape includes companies like Microchip Technology, STMicroelectronics, Murata Manufacturing Company, Kyocera, and Yageo. These companies offer various products that compete with Knowles' offerings. The Knowles Corporation analysis reveals how these competitors influence the company's market position and strategic decisions.

- Microchip Technology: Offers a range of audio components, competing with Knowles in certain market segments.

- STMicroelectronics: Provides MEMS microphones and other components, directly competing with Knowles' product offerings.

- Murata Manufacturing Company: A key player in electronic components, potentially competing with Knowles in specific product categories.

- Kyocera: Known for its electronic components, including those that may overlap with Knowles' product lines.

- Yageo: Offers a variety of passive components, which could compete with Knowles' offerings in certain applications.

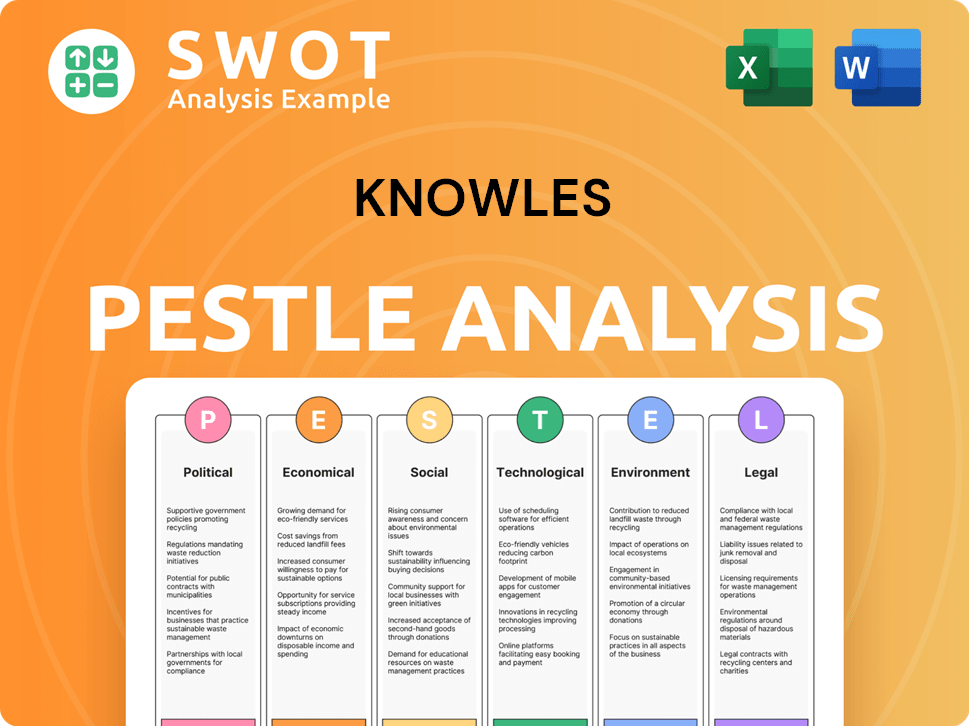

Knowles PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Knowles a Competitive Edge Over Its Rivals?

The competitive landscape of Knowles Corporation is shaped by its focus on advanced micro-acoustic, audio processing, and precision device solutions, particularly in the medtech, defense, and industrial sectors. Knowles' strategic moves and technological advancements have established a strong market position. The company's commitment to innovation and strategic partnerships, such as collaborations with JLab and others, enhances its competitive edge. A detailed Growth Strategy of Knowles can provide further insights into their market approach.

Knowles Corporation analysis reveals a company distinguished by proprietary technologies and a robust intellectual property portfolio. The company's competitive advantages are rooted in its strong patent portfolio, which includes U.S. patents expiring between 2024 and 2043. Ongoing R&D efforts have led to recent patent applications in 2024 and 2025, covering innovations in MEMS die and sensor technologies, strengthening its market position.

Knowles' balanced armature (BA) drivers, designed for superior sound quality, are integral to premium audio experiences. The acquisition of Cornell Dubilier in 2024 expanded its offerings in high-performance capacitors, critical for defense, medical, and industrial applications. This strategic move, coupled with a focus on high-value markets, positions Knowles for sustained growth, supported by continuous investment in R&D and a commitment to niche, high-performance applications.

Knowles holds a significant number of patents, with U.S. patents expiring between 2024 and 2043. This extensive patent portfolio covers critical areas such as MEMS microphones, audio processors, and balanced armature receivers. Recent patent applications in 2024 and 2025 include innovations in MEMS die and MEMS-based sensors, showcasing continuous investment in R&D.

Knowles leverages strategic partnerships to enhance its market reach and product offerings. Collaborations with companies like JLab for the Epic Sport ANC 3 True Wireless Earbuds and with Mimi Technologies and Audiodo for sound personalization algorithms. These partnerships enhance personalized listening experiences and expand market presence.

Knowles concentrates on high-value markets, including medtech, defense, and industrial applications. The acquisition of Cornell Dubilier in 2024 expanded its offerings in high-performance capacitors, essential for these sectors. This strategic focus enables Knowles to meet stringent demands and drive sustained growth.

Knowles is committed to reliability, custom engineering, and scalable manufacturing. These operational strengths are crucial for meeting the specific needs of its target industries. Continuous investment in R&D and a focus on niche, high-performance applications further reinforce its ability to compete effectively.

Knowles Corporation's competitive advantages are multifaceted, encompassing technological leadership, strategic partnerships, and a targeted market focus. These elements contribute to its strong market position and potential for growth. The company's ability to innovate and adapt to evolving market demands is a key factor.

- Proprietary Technologies: Advanced micro-acoustic, audio processing, and precision device solutions.

- Strong Patent Portfolio: U.S. patents expiring between 2024 and 2043, covering key technologies.

- Strategic Acquisitions: The acquisition of Cornell Dubilier in 2024 expanded its product offerings.

- Market Focus: Concentration on high-value markets such as medtech, defense, and industrial applications.

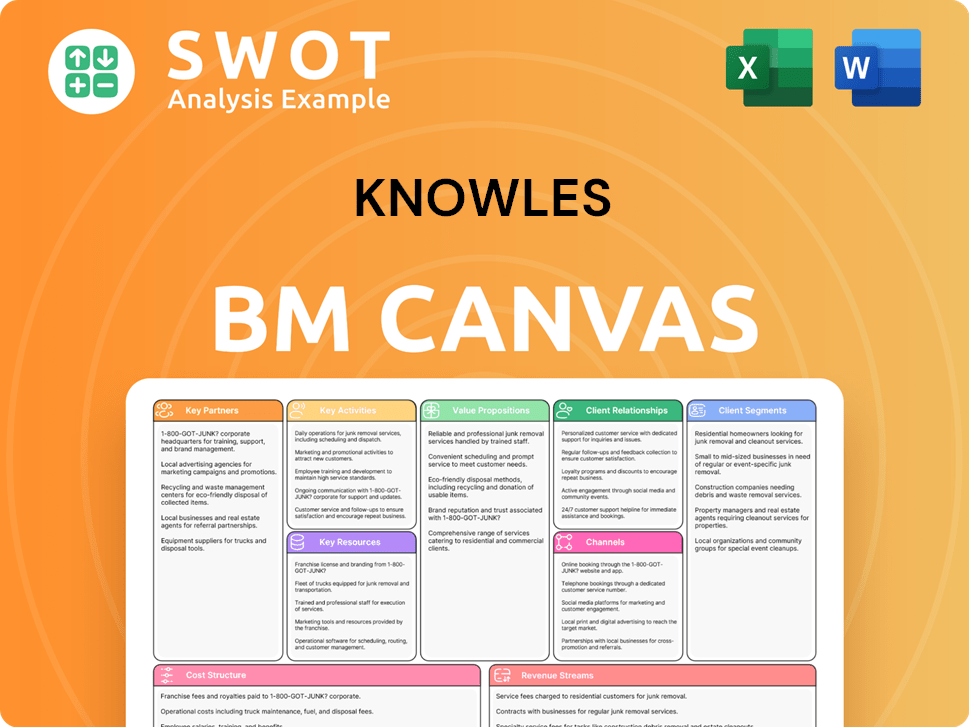

Knowles Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Knowles’s Competitive Landscape?

The Knowles competitive landscape is significantly influenced by technological advancements, shifting consumer preferences, and the integration of AI. This analysis explores Knowles Corporation's market position, highlighting industry trends, challenges, and opportunities. The company's strategic direction involves navigating the complexities of a dynamic market while capitalizing on emerging growth areas.

Knowles' industry position faces challenges from market oversaturation due to AI-generated content, but it also benefits from the demand for high-quality audio capture and processing. The company's focus on high-margin industrial technology markets, such as medtech and automotive, mitigates some risks. The future outlook includes continued investment in R&D, strategic partnerships, and potential acquisitions.

The global audio AI market was valued at $2.9 billion in 2024 and is projected to reach $14.07 billion by 2030. AI-generated music is expected to boost overall music industry revenue by 17.2% by 2025. This growth presents both opportunities and challenges for Knowles competitors and the company itself.

Potential disruptions from new market entrants focusing on AI-driven audio solutions pose a threat. Managing the complexities of global supply chains is also a significant challenge. These factors require a robust Knowles business strategy to maintain a competitive edge.

Growing demand for advanced audio solutions in specialized markets, such as over-the-counter (OTC) hearing aids and premium true wireless stereo (TWS) devices, presents significant opportunities. The company is actively showcasing innovations at events like CES 2025. This includes exploring opportunities in gaming and other emerging sectors.

Knowles is pivoting towards high-margin industrial technology markets, including medtech, defense, and automotive. A recent $75 million+ multi-year order for high-performance capacitors in the energy market highlights a growth avenue. Increased order activity and a robust backlog in medical and defense markets are anticipated.

Knowles Corporation's strategy includes continued investment in research and development, strategic partnerships, and potential acquisitions to maintain its competitive edge. Anticipated revenue and earnings growth in Q2 2025 and beyond is expected. For more information on their target market, consider reading about the Target Market of Knowles.

- Focus on high-margin markets.

- Invest in R&D and strategic partnerships.

- Capitalize on the demand for advanced audio solutions.

- Manage potential disruptions from new market entrants.

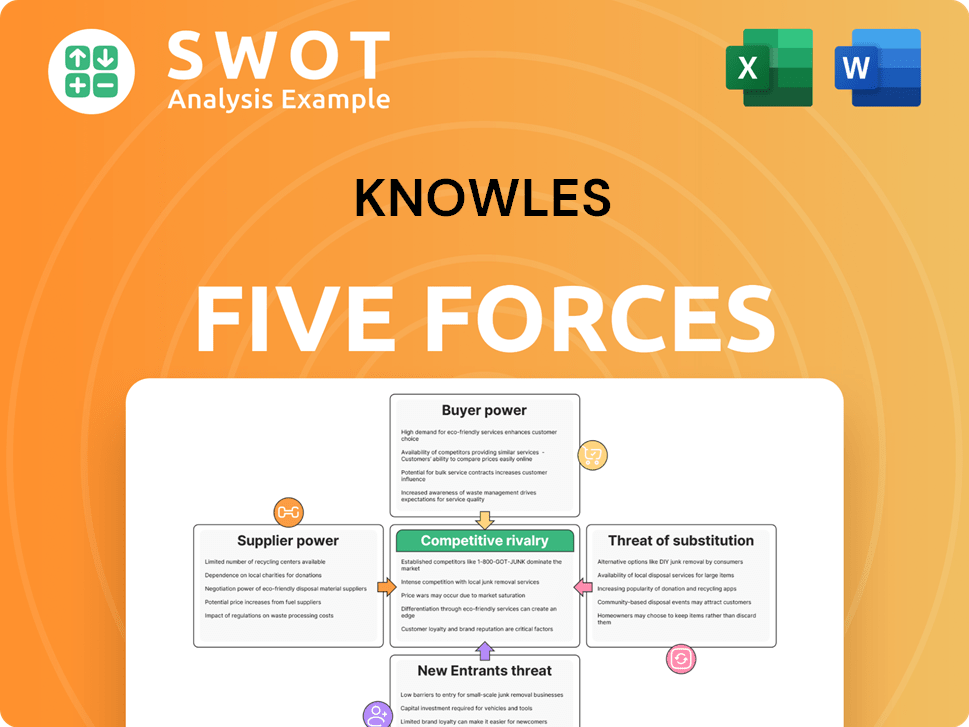

Knowles Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Knowles Company?

- What is Growth Strategy and Future Prospects of Knowles Company?

- How Does Knowles Company Work?

- What is Sales and Marketing Strategy of Knowles Company?

- What is Brief History of Knowles Company?

- Who Owns Knowles Company?

- What is Customer Demographics and Target Market of Knowles Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.